2023 sports fan insights: The beginning of the immersive sports era

The future of sports fandom could hinge on captivating younger fans with personalized and interconnected digital experiences.

Pete Giorgio

David Jarvis

Brooke Auxier

Hannah Bobich

Kat Harwood

Shifts in technology and consumer behavior are seemingly redefining the way fans enjoy sports, both at home and in person. Fans play a significant role in driving the enormous popularity and unique role of professional sports in our society. That’s why it’s important for sports leagues, teams, organizations, and media and entertainment companies to truly understand these shifts and fans’ complex passions and proclivities.

Fans have access to a mind-boggling amount of sports content across multiple platforms, but this increasingly complex media environment could impact the engagement and passion of the next generation of fans. These shifts could also present monumental opportunities to connect with fans and forge deeper connections. To help better understand what the broad sports ecosystem may need to do to shape this emerging future, there are some critical questions that should be investigated.

What is the current state of sports fandom? Are young fans engaged? How are their behaviors different from fans in older generations? How much are fans using streaming services and what do they want from their streaming providers? How fully are fans engaging across the digital channels they have access to? How are social media and sports betting impacting a fan’s experience and expectations? Will virtual reality (VR) ever become a mainstream way to engage with sports? Can digital assets, like NFTs, become a sustainable market for sports?

To help answer these questions and more, Deloitte surveyed more than 3,000 US sports fans ages 14 and older.

The current state of sports fandom is strong … for now

Despite the shifting landscape, sports fans still seem to be very enthusiastic. Data from Deloitte’s Sports Fan Insights survey shows that current sports fans are quite passionate and willing to invest their time and money into their fandom. Over three-quarters of those we surveyed rated their sports fandom a seven or higher (on a scale of one to ten).1 Additionally, nearly 90% of fans say that their fanhood has grown (37%) or stayed relatively the same (52%) over the past three years. Coming out of the COVID-19 pandemic, where sports suffered significantly, this is an improvement.2

The reason why fans say they’re fans? It may seem simple, but almost 70% of fans say it’s because sports are entertaining. Of course, sports can be more than just fun and games. Fans surveyed also like sports because of their friends’ or family’s influence, sports give them something to look forward to, and they are a source of tradition. What creates these passionate fans? Participation in sports is a common thread. Sixty-eight percent of fans surveyed said that they currently participate in sports or have in the past. When asked to pick a single reason for the genesis of their fanhood, around a third of fans attribute it to their participation in youth sports—the top overall reason.

When asked to pick a single reason for the genesis of their fanhood, around a third of fans attribute it to their participation in youth sports—the top overall reason.

With concerns over the state of youth sports and participation rates, this could signal trouble for the fan base of the future.3 Add to that the myriad of entertainment options available to younger people today—including video games, social media, user-generated content, and streaming services—and it could become easy to worry that sports won’t be able to maintain the same historical level of interest.

However, current sports fans age forty and under are just as engaged as those over forty. Seventy-two percent of Generation Z fans and 82% of Millennial fans rate their fandom a seven or higher (on a scale of one to ten). The passion of Gen Z fans is growing as well—60% said that they were more of a fan today than they were three years ago. This suggests that they are still growing into, and establishing, their sports fanhood.

Going forward, to keep the state of sports fandom strong and attract new fans, who may not have participated in youth sports, the sports ecosystem may have to evolve. This includes focusing on entertainment value and providing a more interconnected and interdependent digital tapestry of experiences for younger fans.

Enter the era of immersive sports

Emerging technologies and ways to consume entertainment are creating new possibilities for the sports industry and advancing the era of immersive sports. In this era, fans could expect to be able to craft their own unique, personalized, digital sports reality. Every fan won’t have the same experience, even if they’re watching the same live sporting event. Fans could be able to dictate:

- What they want (content)

- When they want it (timing)

- Where they want it (channel)

- Who they want to experience it with (community)

- How they want to consume it (delivery)

This might look like placing real-time bets through mobile devices at home or in-venue, watching a game from a player’s point of view in VR, instantly buying unique merchandise from an event through a streaming video service, or sharing custom, real-time statistics with friends via social media. Fans will be able to seamlessly pick and choose what capabilities they want to meet their needs at any given moment. Immersive sports will integrate digital channels to fulfill the desires of fans—providing as much, or as little, enhancement to the live event as possible.

Creating personalized

sports realities

This future is just starting to emerge and how it evolves will depend on a variety of factors. Through our survey of sport fans, we uncovered six key insights around how this is happening and what it may mean for the evolution of fanhood and the arrival of the immersive sports era. Whether it will be a gradual evolution, or a more profound revolution, remains to be seen.

Insight No. 1: Gen Z fans crave a social sports experience

Community, socialization, and connection are important aspects of entertainment experiences for Gen Z consumers.4 And Gen Z sports fans are no different when it comes to how—and with whom—they consume live sports and sports content. Whether they’re watching from home or attending an event live in-venue, Gen Z sports fans crave interaction as part of the experience, and it may be crucial to developing their sports fandom.

Most of the time (61%) when watching live sporting events from home, Gen Z fans say they’re watching with other people (compared to 53% of Generation X and 48% of Boomer fans). This communal experience is a substantial draw for many—nearly 40% of Gen Z fans say they’d be more likely to watch an event from home if they were watching with friends or family. These in-person interactions are important, but Gen Z fans’ social connections go far beyond the people in their living rooms.

As digital natives, Gen Z fans are tapping into technology to expand their communities and their sports fandom. Around half of Gen Z fans say they have used social media—either to read comments and opinions from others or to interact with others—while watching live events from home. They’re also more likely than those in some older generations to say they’d welcome streaming video on-demand (SVOD) features that allow for more integrated social capabilities, like co-viewing with family and friends while watching live sports and a live social feed right on the screen. Around a third of Gen Z fans would also like the ability to watch the game from an athlete’s point of view and to have access to behind-the-scenes content from athletes as part of the SVOD sports viewing experience.

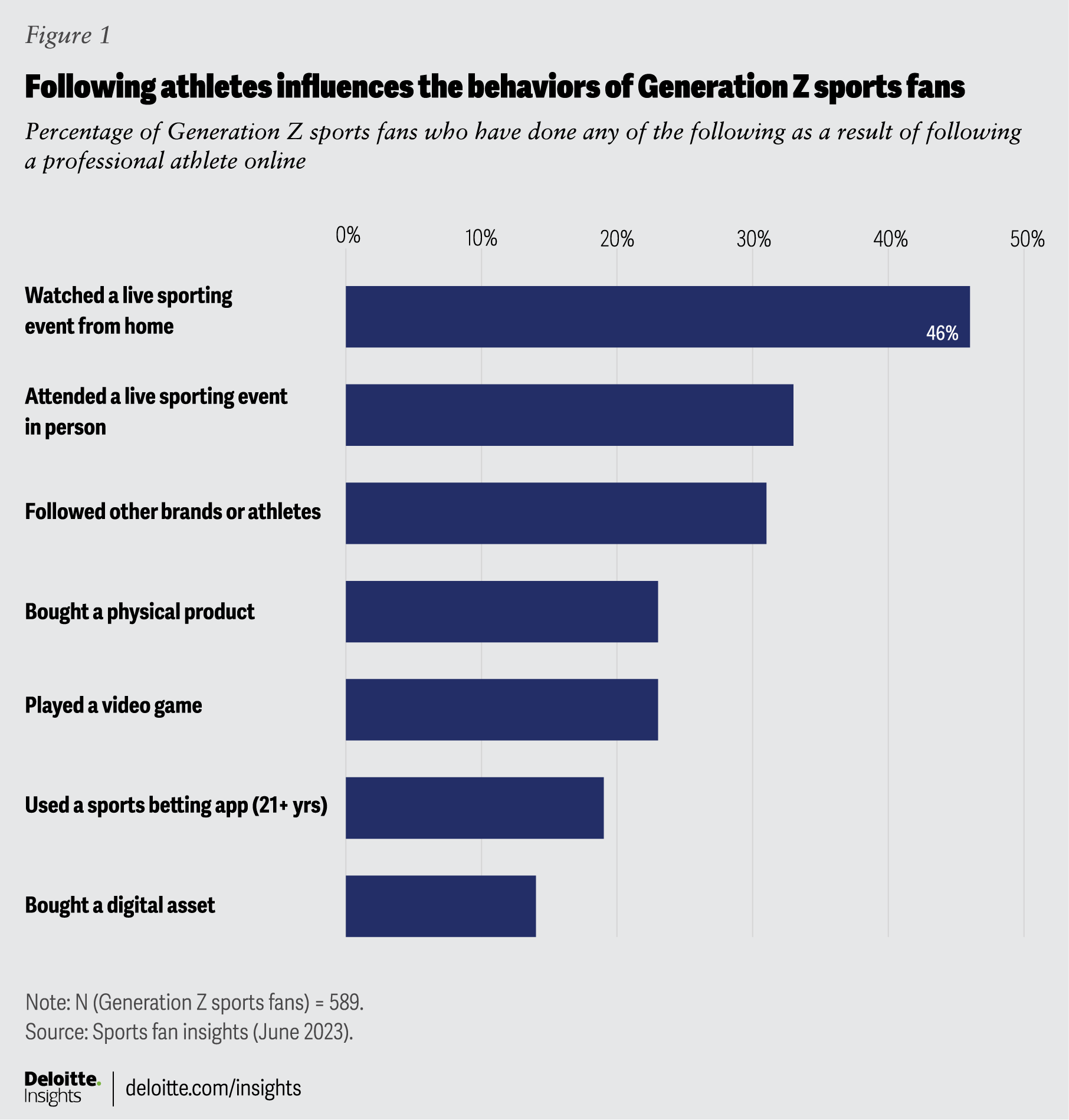

For this youngest cohort of sports fans surveyed, creating connections with their favorite athletes on social media proves important to their fanhood. Nearly all Gen Z fans are using social media to consume sports-related content, and they are more likely than those in older cohorts to prefer consuming interviews with athletes, posts from athletes, and posts from the athletes’ families on social media. Similarly, around 80% of Gen Z fans follow a professional athlete online, which leads them to watch and attend sporting events the athlete participates in, follow brands or other athletes they interact with, and buy products they promote.

Even when attending live sporting events in person, Gen Z fans are still focused on connecting with others and are often using social media services to facilitate those interactions. A quarter of Gen Z fans say the main reason they enjoy attending live professional sports events in person is to experience the event with friends and family. While attending, many Gen Z fans say they’re texting with friends and family about the event or are posting to social media during the game.

Questions to consider

- How can leagues and teams further capitalize on the star power of their own athletes—and their social media followings—to draw in younger audiences and influence their behaviors?

- In what ways can the broader sports ecosystem foster more community building and enable opportunities to connect for fans, both in person and through digital channels?

Insight No. 2: Fans want SVOD features that enhance, but don’t overshadow, the game

Streaming video on-demand (SVOD) services are a staple in most US households.5 And while cable and broadcast television still host most live sporting events, streaming video services are pushing further into the sports broadcasting space.6 There has been significant growth in the expenditures by streamers for live sports rights around the world over the last few years.7 Streaming providers want to use live sports as a differentiator to help attract and retain subscribers. Sports organizations want to further monetize their rights, expand reach, and pursue younger consumers. This market expansion presents exciting opportunities for fans, but before these services can reach their potential, there are points of friction to consider.

We found that 30% of all fans have paid for a subscription to a streaming video service to watch sports over the past 12 months. For Millennials, it increases to 46%. Additionally, for sports fans who are watching sports from home, they estimate that 22% of their time is spent on a streaming video service, compared with roughly 60% of their time watching through traditional providers (cable, broadcast, and satellite). In a market crowded with so many options, how can streamers differentiate themselves?

When fans were asked about watching a sporting event on a specific SVOD service, around half of them said the experience was more interactive and personalized than watching the same event on cable or broadcast TV. Additionally, 56% of fans said they had a better viewing experience when watching this event on a streaming video service than on cable or broadcast TV. Some of the reasons they liked watching this particular streaming event was because it was easy to find (42%), the video quality (17%), and the ability to watch on a wide range of devices (15%).

Fans also indicated that they want more features as part of their SVOD services to enhance their sports-watching experience. For all fans, whether they currently subscribe to a video streaming service or not, about a third want real-time stats and analytics (35%) and different camera angles (34%) included as part of their SVOD service. Other appealing features include watching the game from an athlete’s POV, coviewing with friends and family, and behind-the-scenes content from athletes. Things like integrated social feeds, betting capabilities, and shopping experiences aren’t as highly desired now. As streaming providers look to increase differentiation, retain subscribers, and meet the consumption patterns of younger fans, they should work to provide personalized features for the fans that want them.

If streamers want to continue to attract and delight sports fans, there are some basic frustrations with services that should be overcome. Fragmentation is a significant issue. Almost half of fans say they often miss games they want to watch because they don’t have the right streaming video service and 44% say they have to subscribe to too many services to watch their sports. Simplicity is also a wish for fans: A majority of fans (59%) say they would pay extra for a streaming video service that had all the sports they want to watch in one place (80% of Millennials would pay extra).

Questions to consider

- How can streaming video providers concurrently meet the needs of fans who want a more immersive experience and those who want to focus solely on the game?

- With sports rights being so expensive and fragmented can providers offer the simplicity and accessibility that fans crave?

Insight No. 3: Fans are crafting their own perfect experience at home

It’s hard to compare to the experience of watching professional sports in a venue with thousands of other energized fans, but the reality is most fans spend their time watching sports at home. There are fewer distractions, fewer expenses, and more control over how you view the game. On average, a vast majority of sports fans (88%) surveyed watch live sporting events from home at least weekly. If they miss the crowds, fans can still get a social experience at home if they want. In fact, fans spend about half of their time watching live sporting events from home with others.

A majority of fans (59%) say they would pay extra for a streaming video service that had all the sports they want to watch in one place (80% of Millennials would pay extra).

To further improve the home experience, some sports providers are experimenting with ways to give fans a more interactive and personalized home viewing experience. Some streaming video providers are offering advanced statistics and analytics in real time, interactive replay, and alternate streams with different broadcasting talent.8 Other sports broadcasters, through their apps, are giving fans the option of integrating prediction games into their viewing experience or adding a layer of social interaction by offering cowatching capabilities.9 How widespread the adoption of these features could become in the near future remains to be seen.

What does the ideal sports content experience at home mean for fans? The live event is still central for most—71% of all fans say that live sporting events are their favorite type of sports content. However, this drops to only 58% for Gen Z and Millennial fans. They have a more diverse set of favorites, which include highlights and clips, documentaries, and sports-related social media videos. What are fans watching live sporting events on? Televisions are still the primary device fans use, less so for younger fans. Fans use a television to watch live sporting events from home 74% of the time, on average. That percentage of time is 58% for Gen Z fans and 61% for Millennial fans. They are leveraging their mobile devices, laptops, and tablets the rest of the time.

The live event is still central for most—71% of all fans say that live sporting events are their favorite type of sports content. However, this drops to only 58% for Gen Z and Millennial fans.

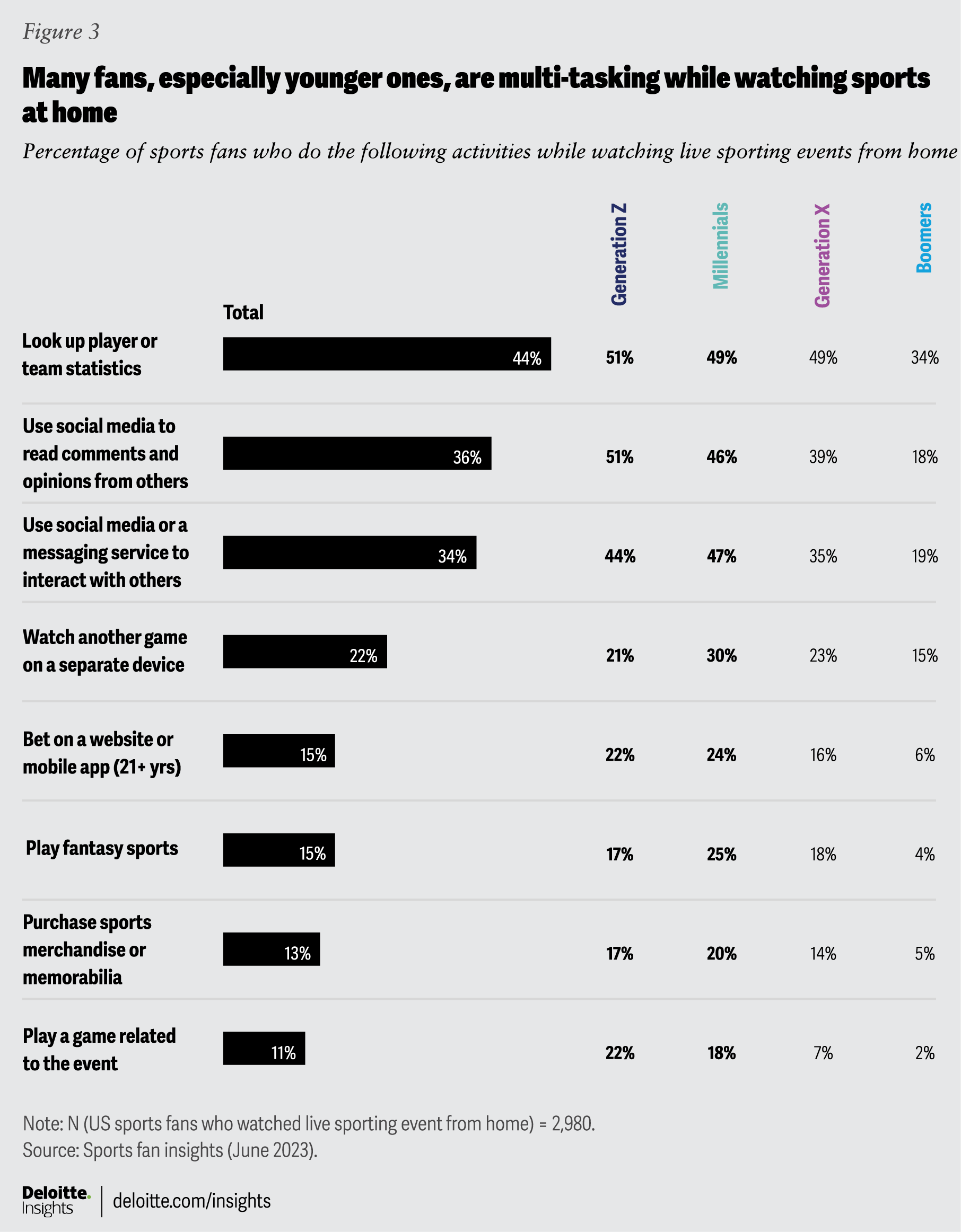

Additionally, many fans, especially younger ones, are multitasking while watching sports at home. In fact, 77% of sports fans say they’ve done at least one additional activity related to a game while watching a sporting event from home. More popular activities include looking up stats, using social media, watching another game on a separate device, betting, and playing fantasy sports. Those in older generations are more likely to say they aren’t doing any of these activities and are focusing simply on the event itself.

Questions to consider

- How can sports broadcasters and streamers best integrate capabilities, such as real-time data and analytics, social feeds, and betting, directly into the sports viewing experience to make sure younger fans are continuously engaged?

- How can sports providers continue to evolve their technical capabilities to enable more seamless multitasking and give fans more options for personalization while watching sports?

Insight No. 4: Bettors invest more in their fandom; nonbettors are more wary

In the pursuit of new revenue and deeper personal connection, many teams, leagues, organizations, and media companies have started to explore integrating sports betting into the fan experience. There are increasing numbers of sportsbooks located in venues and there have been some early experiments by streamers to incorporate betting functionality into their services.10 To capture and grow this market, sports betting operators have pushed hard over the last few years with aggressive advertising and incentives.11 Despite the opportunity, there are questions around how to blend sports betting into the overall fan experience, and how to cater to bettors without alienating other fans.

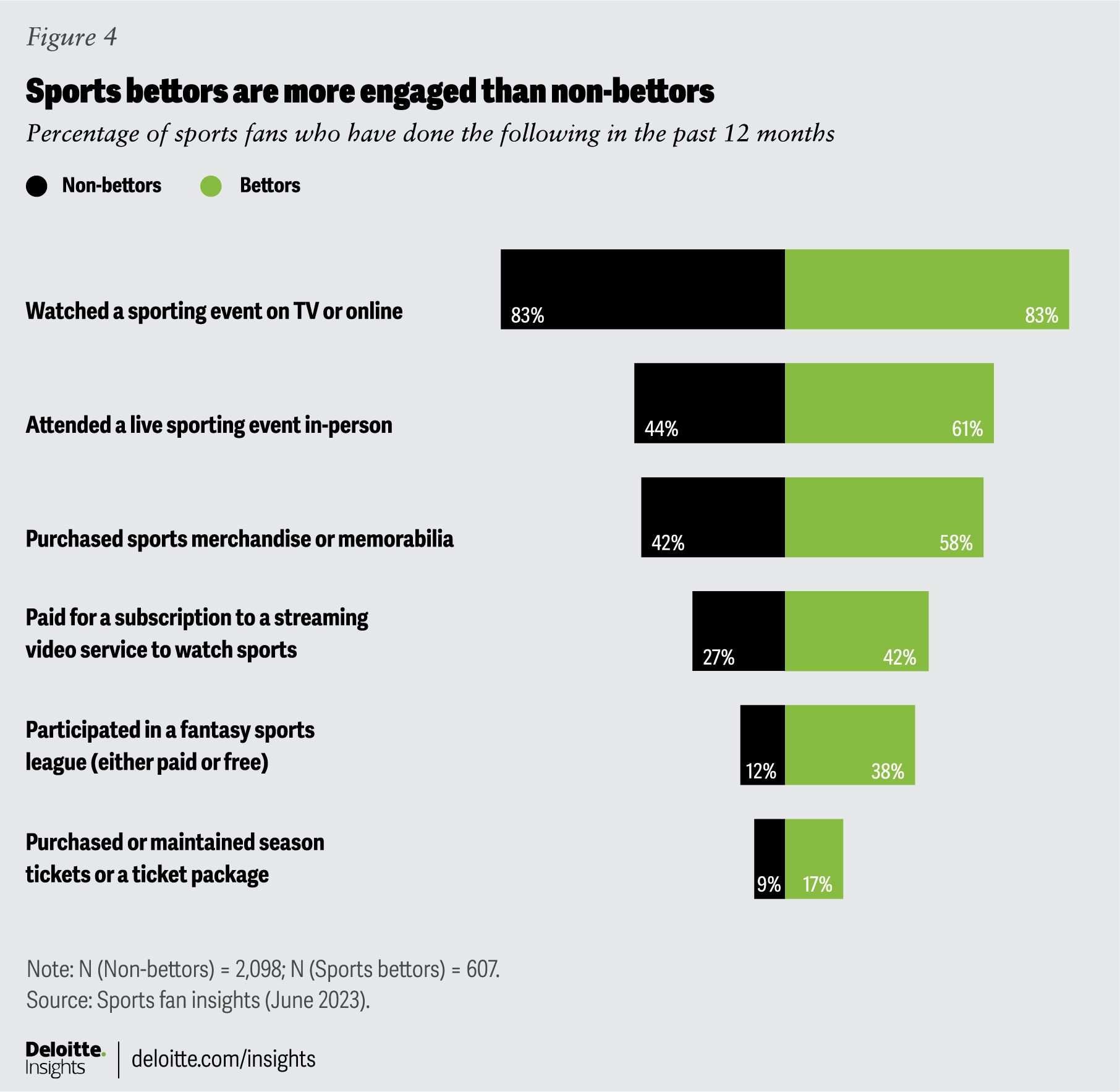

Of those we surveyed, bettors are more likely to have attended a game in person, bought sports merchandise, paid for a streaming video service to watch sports, and participated in fantasy sports over the past 12 months.

Even though it isn’t legal across the entire United States yet, sports betting is already quite popular with fans and even more so with younger ones. Twenty-two percent of sports fans (over age 21) say that they’ve bet on a professional sporting event in the last 12 months. For Millennial and Gen Z sports fans, this increases to 30%. In general, sports bettors tend to be more active fans across the board. Of those we surveyed, bettors are more likely to have attended a game in person, bought sports merchandise, paid for a streaming video service to watch sports, and participated in fantasy sports over the past 12 months. What drives this engagement? Eighty percent of sports bettors agree that betting increases the entertainment value of live sports.

We found that bettors are already including betting into their fan behaviors, with a desire to potentially integrate even further. While at home, 58% of sports bettors say they have bet through a website or mobile app while they watched live sports. In venues, 23% of sports bettors say they use their mobile device to place sports bets while attending a live sporting event. Looking into the future, 66% of sports bettors say they want the capability to bet on different aspects of a game in real-time on their mobile device while they attend an event in person.

When looking to integrate betting into the fan experience, it’s important to address the sentiments of non-bettors as well. They’re more concerned than bettors about several issues. Looking at the issue of advertising, 66% of non-betting fans say they’re tired of seeing so much advertising around sports betting (compared to 48% of bettors). Could the United States follow the UK and some European countries where sports betting has been legal for a long time and there are an increasing number of advertising and sponsorship restrictions?12 Looking more broadly, 59% of non-bettors say they worry about the long-term impacts of sports betting on professional sports—compared to only 42% of bettors. This reflects the feeling that the more prevalent sports betting becomes in the United States, the chances for mistakes and abuse could grow.13

Questions to consider

- How can the passion of sports bettors be harnessed while keeping them safe?

- As the capability to bet on games in real-time (via microbetting) at home and in person becomes more widespread, what will be the unanticipated consequences to the broader fan experience?

- How can the inclusion of betting be better personalized, so fans who find it objectionable or uninteresting don’t become estranged?

Insight No. 5: VR is still on the undercard. What will it take to make it the main event?

There are a variety of emerging digital engagement channels seeking the attention of sports fans; one of those is virtual reality (VR). Sports and VR seem like the perfect pairing. VR could be the ultimate way to make fans feel like they’re a part of the game. Deloitte estimates that there will be an install base of about 22M VR headsets worldwide in 2023.14 And the capabilities of headsets are getting better and better—more processing power, better resolution, longer battery life, and a more comfortable experience. Early options to consume sports content in VR already exist for fans. During the most recent NBA season, Meta provided access to over 50 live NBA games, however, only 5 of them provided 180-degree monoscopic views.15

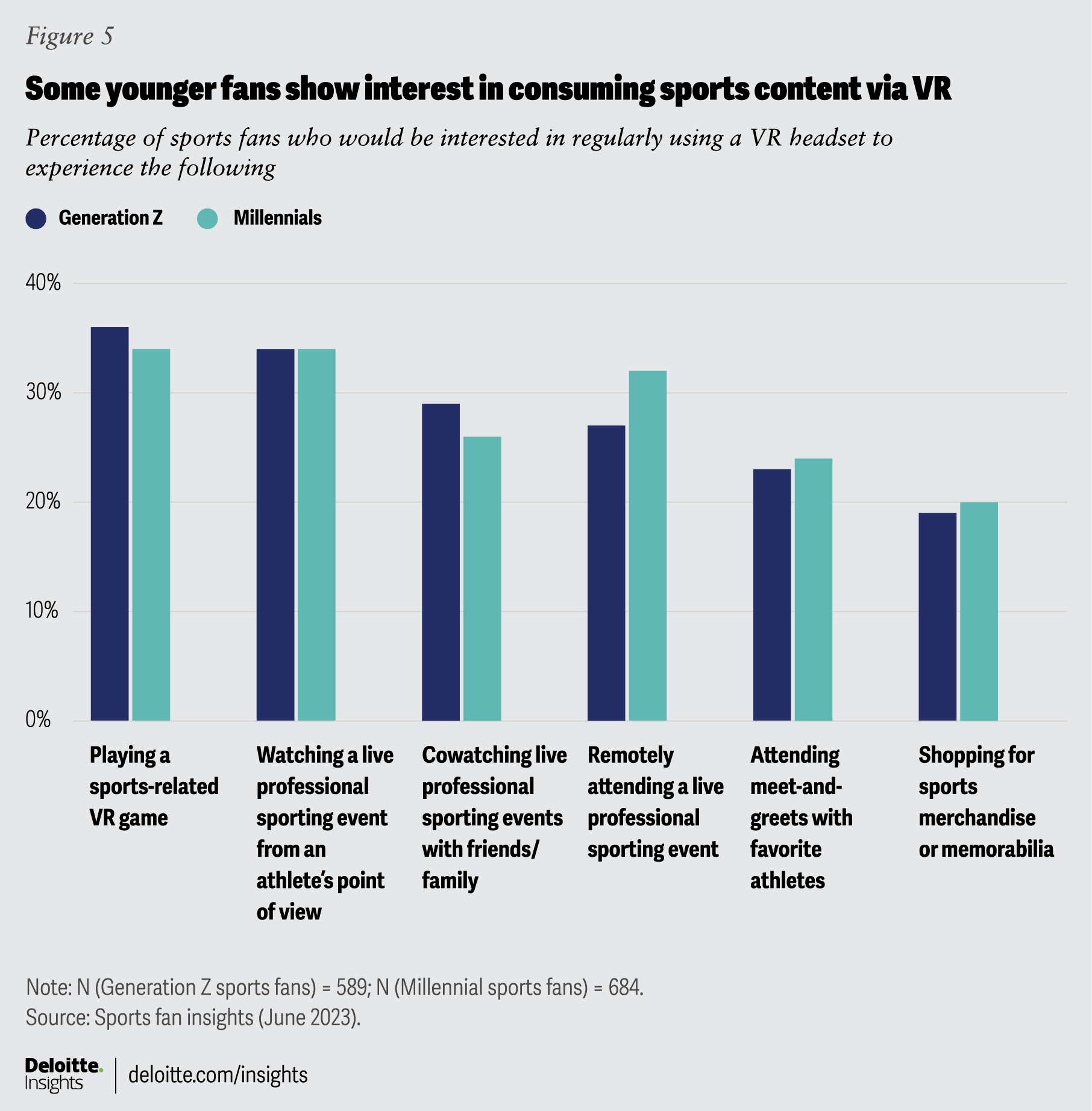

When given a list of six different sports-related VR experiences, roughly 70% of Gen Z and Millennial fans were interested in at least one of them.

The market is still niche for now. Only 5% of all sports fans surveyed said that they have used VR to consume some type of sports content in the last 12 months (for Gen Z fans, it’s 9%, for Millennials, 7%). However, there is definite interest. When given a list of six different sports-related VR experiences, roughly 70% of Gen Z and Millennial fans were interested in at least one of them. The top activities of interest for Gen Z and Millennials included playing sports-related VR games, watching live sporting events from an athlete’s POV, remotely attending a live sporting event, and cowatching an event with friends and family.

If VR becomes more widespread for watching sports, can the experience be monetized? When fans were asked if they would pay for a sports experience using VR (assuming they already had the right equipment), many Gen Z and Millennial sports fans were willing. Sixty-two percent of Gen Z and 66% of Millennial sports fans said they would pay to watch a sporting event in real-time from an athlete’s point of view in VR. In addition, 59% of Gen Z and 65% of Millennial sports fans said they would pay to watch a sporting event in VR from the seat of their choice at a venue.

Could live sports be the “magic” content that drives broad adoption of VR? It could hinge on overcoming the innate barriers to using VR, such as, expense, comfort, and isolation, and making it compelling for sports fans with unique content that they can’t get anywhere else. Fans seem to want things that can make them feel truly part of the action, like player POV, 180-degree field or court-level views, and integrated social connection.

Questions to consider

- How can teams, leagues, and sports organizations better collaborate with their technology partners to codevelop unique and compelling VR experiences to drive greater adoption?

- How can sports-related VR gaming be used as a bridge to increase broader interest in sports for younger people who may not be fans yet?

Insight No. 6: Fans prefer digital assets with real world benefits

Over the last few years, digital assets, like non-fungible tokens (NFTs) and fan tokens, have entered as a new way for sports fans to connect with their favorite leagues, teams, and players. Commemorative NFTs have been provided to ticket buyers, marketplaces for digital assets have been established, and NFTs are increasingly being integrated into fantasy sports.16 The broader market for digital assets has softened significantly from its peak, with overall sales, activity, and market value for assets seeing declines.17 The question is, can these channels remain a viable long-term way to connect with fans and improve fan engagement and loyalty? How can digital assets contribute to an immersive sports experience?

Familiarity with these digital assets doesn’t seem to be too much of a problem, especially with younger fans. Around 40% of Gen Z and Millennial sports fans said that they were very or somewhat familiar with the use of NFTs and fan tokens in sports. However, it’s still a niche market, with just around 5% of sports fans surveyed saying that they have purchased or received a sports- or athlete-related NFT or received a team fan token in the last 12 months. For those that are familiar with NFTs, what value do they see? There’s currently no clear consensus, with 37% of fans familiar with them seeing NFTs in sports as a fad, 32% as an investment, and 24% as something fun to express fandom.

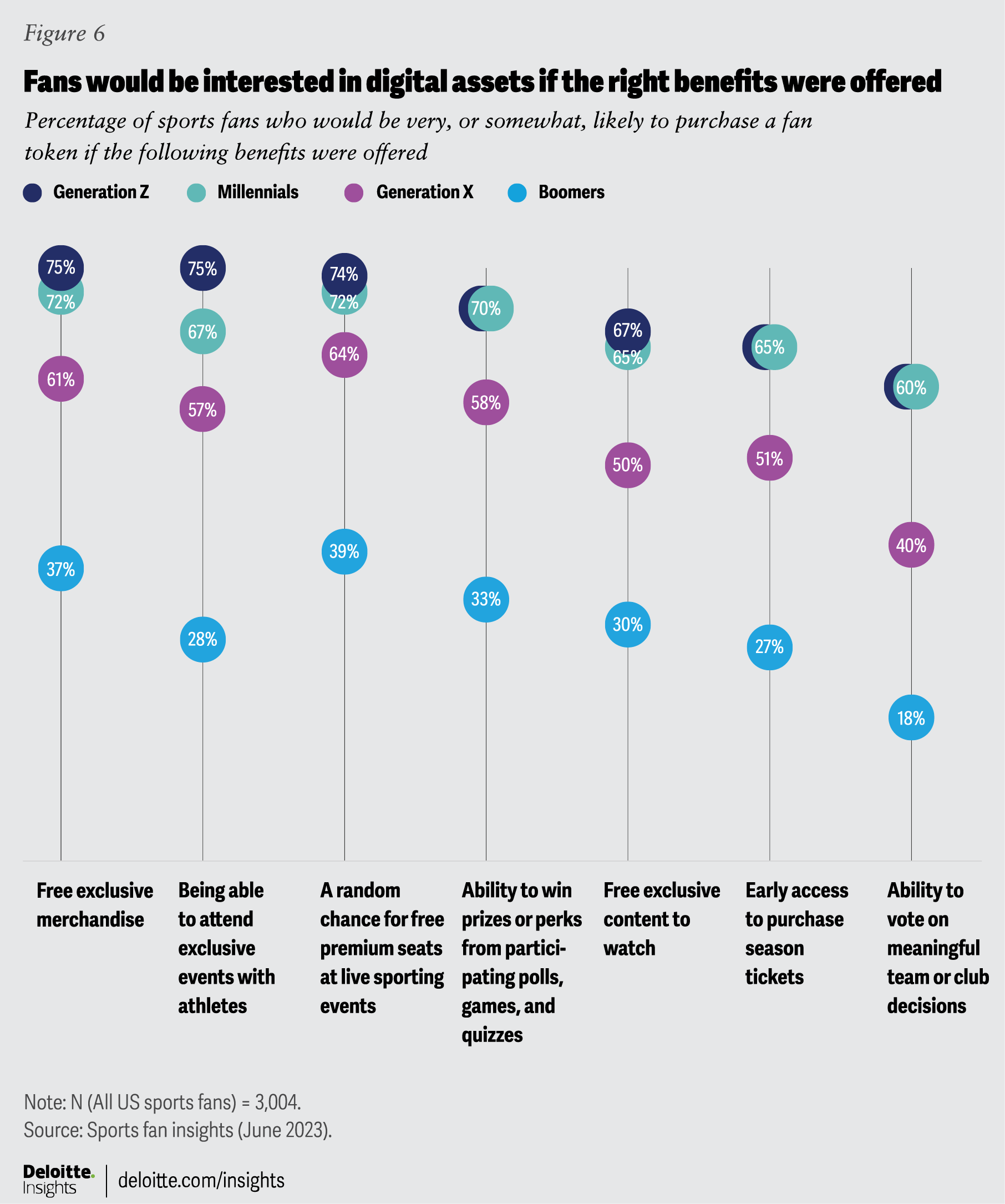

When given the definition of a fan token and asked how likely they would be to purchase a token if a specific benefit were offered, there was overall enthusiasm from fans.

What may help is a clear connection between digital assets and well-defined benefits for the fan. They should provide additional utility, functionality, or redeemability to the owner. When given the definition of a fan token and asked how likely they would be to purchase a token if a specific benefit were offered, there was overall enthusiasm from fans.18 A random chance for free premium seats at live sporting events ranked highly, with 60% of sports fans saying they would likely purchase a fan token if that benefit were offered—almost three quarters of Gen Z and Millennial sports fans would. Other benefits of interest included free exclusive merchandise, the ability to win prizes or perks from participating in team polls, games, and quizzes, and attending exclusive events with athletes.

The question arises, do fans really need a blockchain-based digital asset to get access to these types of perks? Could a simpler loyalty program work? One theory is that by digitally formalizing the relationship between fans and their favorite sports leagues, teams, and players, a more concrete sense of ownership can be established—one that accurately reflects the true value of the relationship.

Questions to consider

- How can digital assets be more effectively integrated into traditional fan loyalty programs, bridging the physical and digital worlds?

- How can leagues and teams increase awareness and reduce barriers to entry by integrating digital assets into existing fan engagement channels (e.g., mobile apps, gaming, social media)?

Game planning for the era of immersive sports

Today, the overall state of sports fandom is strong, and the live sporting event is still at the heart of the fan experience. How those events are enjoyed—both at home and in person—is shifting, driven mainly by younger fans. They are:

- Interested in a wider variety of sports and consume sports content across a wider variety of channels.

- Using streaming services more and want new features to enhance their experience.

- Engaging in multiple sports-related activities concurrently while watching at home.

- Socializing online and increasingly integrating betting into their behaviors.

- Experimenting with new ways to engage with sports and express their fandom through things like VR and digital assets.

These new ways to revel in live sporting events could continue to grow only if fans feel like they enhance the core event and don’t get in the way of their entertainment experience.

How might this play out in the future? When asked how professional sports consumption at home will be different in 2030, 67% of fans said it would be more interactive, 57% said easier to access, and 54% said more immersive than today. They also feel that access to coveted content and these new capabilities may come at a cost. Seventy-two percent of fans thought that the future would be more expensive.

The emerging era of immersive sports is expected to require a more unified and personalized sports experience for fans. This could mean paying extra attention to foundational technology infrastructure and data management capabilities, as well as new approaches to producing, managing, and distributing content. Can the disparate pieces of the digital jigsaw puzzle come together to fulfill the needs and passions of fans, or will they be left to wander a fragmented and confusing landscape of sports content? For this evolution to succeed, leagues, teams, organizations, and media and entertainment companies should come together to address this considerable challenge.

Research methodology

The Sport Fan Insights Survey was conducted by Deloitte’s Technology, Media & Telecommunications practice. The survey provides insight into the attitudes and behaviors of sports fans in the United States ages 14 and older. Topics included the nature of fandom, sports streaming, mobile devices and sports, in-venue experiences, fantasy and sports betting, social media, and additional emerging digital engagement channels.

The survey was fielded by an independent research firm in March 2023 and employed an online methodology among 3,004 US sports fans. All data is weighted based on the most recent census data to give a representative view of fan sentiment and behaviors.

Throughout this report, we reference generations. Our generational definitions are as follows: Gen Z (born 1997–2009), Millennials (born 1983–1996), Generation X (born 1966–1982), Boomers (born 1947–1965), and Matures (born 1946 and prior).