Reduce costs and drive growth with health system sustainability incentives

Many health care organizations recognize the potential benefits of sustainability tax incentives, but the incentives’ complexity and their own limited organizational resources often stand in the way

Alicia Janisch

Christine Brynaert

Dr. Jay Bhatt

Wendy Gerhardt

Jessica Overman

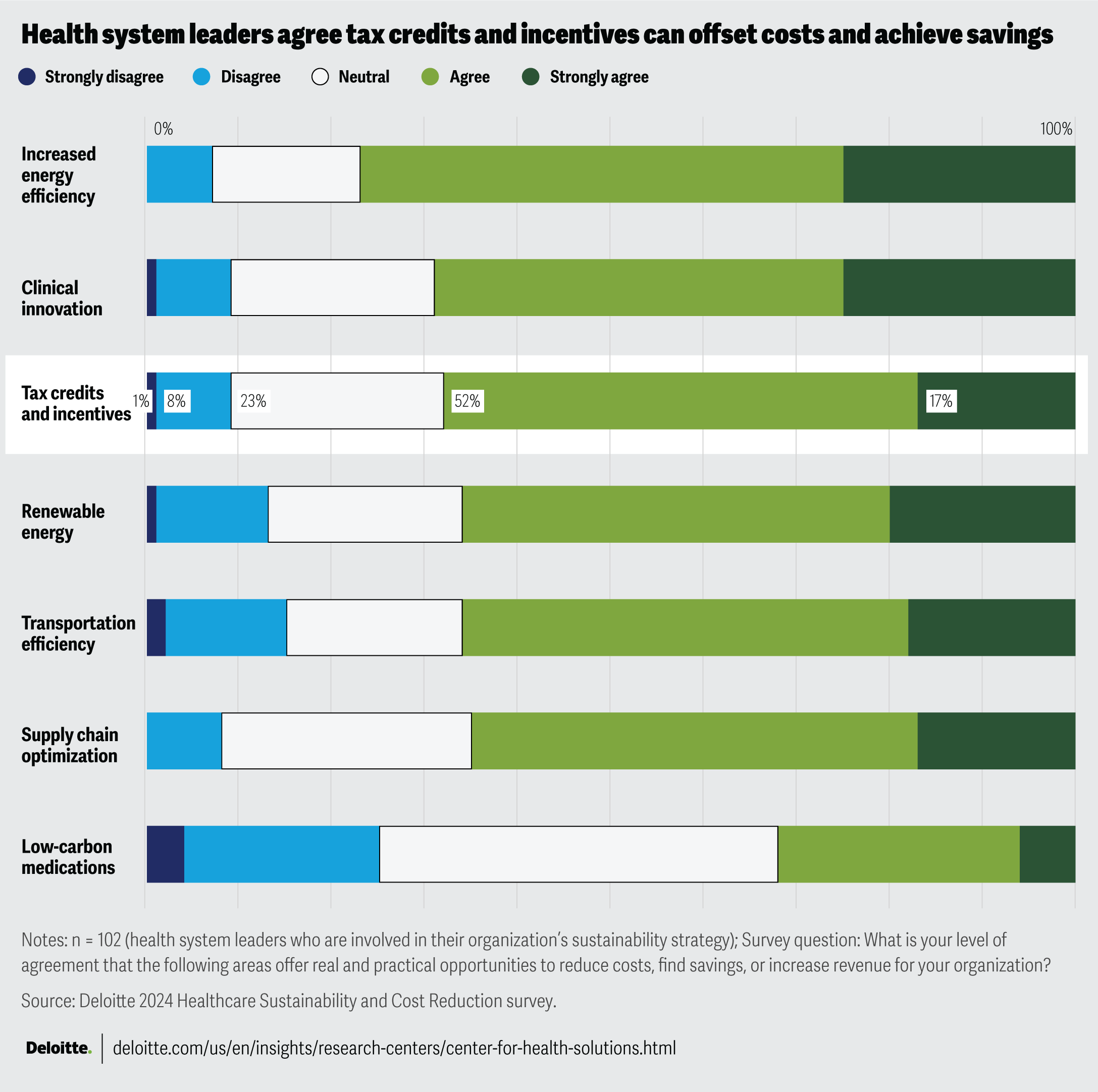

Sustainability tax credits and incentives present health systems with a potential avenue to offset costs and achieve growth. According to Deloitte’s Health Care Sustainability and Cost Reduction Survey, which was conducted in June 2024, 69% of respondents agreed or strongly agreed that these tax credits and incentives offer opportunities for cost reduction and revenue growth. However, the survey findings also highlighted challenges in effectively using these incentives due to complex tax regulations and the limited resources organizations have to address them. In an era where health systems may be facing mounting pressures, the importance of reducing costs while addressing organizational priorities appears to be growing. Maximizing the benefits of sustainability tax incentives could be a compelling opportunity to alleviate margin pressure and position organizations for long-term growth.

Tax incentives are available for various initiatives at health systems, including those that minimize waste and reduce energy consumption. For instance, a hospital investing US$6 million in a battery storage project could qualify for up to US$4.2 million in tax credits through the Section 48E Investment Tax Credit.1 Similarly, a nonprofit health center could partner with its building designer to save between US$0.50 and US$5.00 per square foot on energy efficiency upgrades to heating, ventilation, and air conditioning, water heating, or interior lighting systems by utilizing the Section 179D deduction.2 These financial benefits can free up capital for other important investments, such as advanced medical equipment or patient care programs.

Moreover, using these credits and incentives can strengthen the organization’s overall financial health, helping it become more resilient to economic fluctuations and better prepared for long-term growth. The strategic use of tax incentives can also demonstrate an organization’s commitment to innovation and efficiency.

In June 2024, the Deloitte Center for Health Solutions surveyed 102 US health system leaders, including C-suite officers, directors, and vice presidents to assess the potential costs and value of investing in sustainability strategies. While many health systems recognize the opportunities presented by sustainability initiatives (see figure), leaders may be overlooking broader systemic benefits and opportunities, focusing instead on well-established areas like energy efficiency and clinical innovation.3

Challenges to tax incentives and credits in health care

Investing in initiatives to improve the sustainability of health system operations is important for not only mitigating climate impacts on health but also as a strategic approach to achieving financial stability. Such investments in sustainability initiatives can position an organization for growth and enhance overall outcomes. Minimizing waste and reducing energy consumption can contribute to cleaner air and water, both of which contribute to better health outcomes.4 Health care organizations, which may already be under pressure to increase profit margins, could face financial challenges that limit their capital and investments. Sustainability tax incentives, available at local, state, and federal levels, can help alleviate financial challenges, in making these investments, for many organizations, including nonprofits.

By leveraging incentives and credits, health care organizations can reduce expenses, improve margins, and invest in sustainability initiatives. However, not all health systems are taking full advantage of these tax credits and incentives. The survey findings highlighted three constraints that appear to be preventing some organizations from fully capitalizing on these opportunities:

- Complexity of tax credits and incentives: Sixty-nine percent of the surveyed leaders agree or strongly agree that there is complexity in benefitting from or complying with tax incentives for sustainability initiatives. This is the same percentage of leaders who acknowledge the opportunities these incentives provide. The landscape of tax credits and incentives, particularly those related to sustainability, is complex due to regulatory nuances, detailed eligibility criteria, and intricate application processes, among other factors.5 Both at the state and local levels, a variety of property and sales tax exemptions, abatements, and credits are available, and the specifics vary by jurisdiction. Organizations should identify, understand, and assess the specific requirements and opportunities for each incentive, which can be a complicated and resource-intensive task.

- Inadequate structure and resources: Just 38% of organizations have a designated position or office responsible for identifying these credits and incentives. This lack of specialization, particularly in nonprofit health systems with limited tax-related knowledge and resources, can hinder their ability to identify, assess, apply, and manage opportunities effectively.

- Lack of dedicated leadership: Of the 38% of organizations with a designated leader responsible for identifying credits and incentives, roles vary widely: One-third (33%) have a chief sustainability officer, 31% have a chief operating officer, and 15% are unsure who is responsible within their organizations. The lack of dedicated leadership could result in fewer organizations taking advantage of opportunities.

Maximizing the benefits of sustainability initiatives

By prioritizing and investing in efforts to improve the sustainability of its facilities and communities, health systems can improve the health outcomes of the populations they serve.6 These initiatives to improve their organizational sustainability can also offer substantial financial benefits through tax incentives. To help fully realize these financial benefits, health systems should consider:

- Identifying appropriate resources: Having dedicated resources is important for health systems to effectively take advantage of relevant tax incentives. Some organizations may look to establish a dedicated leader or create an office with staff and budget resources. These dedicated resources can help identify, assess, apply for, and manage tax incentives offered by various federal, state, and local programs. Given the complexity of this task, specialized knowledge and skills are needed, which may involve external professionals to provide expertise, insights, and solutions tailored to identifying and applying for applicable credits. Another resource to consider is leveraging technology, such as AI, to assist organizations with identifying opportunities and reporting.

- Gaining organizational buy-in: To gain buy-in across an organization for sustainability tax initiatives, the vision and benefits should be clearly communicated, all appropriate stakeholders should be involved in its design and execution, and its goals should be aligned with broader organization goals. Health systems should consider shifting their mindset to view sustainability tax credits and incentives as a strategic avenue to not only offset the costs associated with implementing sustainability efforts but also drive financial savings and reduce costs across the entire health system.

- Developing processes to coordinate across functions: Implementing processes to coordinate multiple functions across the organization and with external resources can help ensure necessary information and requirements for securing tax benefits are gathered. Given the complexity of tax credits and incentives, health systems should consider developing processes that facilitate cross-business coordination with key internal stakeholders, external advisors, and tax experts. This coordination should help navigate and gather the required information. A dedicated leader or office could play an important role in driving this coordination effort.

Strategies to improve the sustainability of a health system’s facilities and operations can benefit both human well-being and business success. Health systems that prioritize and capitalize on these opportunities, including available tax credits and incentives, can enhance their financial viability. This can position them to continue investing in sustainability efforts for their facilities and operations, thereby helping to increase their overall impact.