Reimagining US energy independence: How states can harness advanced nuclear power

By building public trust, anticipating future energy needs, and investing in the supply chain and workforce, states can harness advanced nuclear power to drive economic growth

America stands at a crossroads: Our increasingly technology-driven modern lifestyles are likely to drive a surge in electricity demand by 2030, fueling a need for stable, cost-effective power generation that goes beyond any one source of energy.1 At the same time, nuclear energy has re-emerged as a powerful solution. Small modular reactors and other advanced nuclear technologies are quickly developing to provide affordable, scalable, clean and safe alternatives to generate power.2

Decades ago, the United States pioneered nuclear energy but competition with other energy sources, escalating costs, a complex regulatory environment, and high-profile incidents weakening public trust combined to slow further development. While the United States still has the largest installed nuclear capacity, other nations such as China and Russia have been moving forward rapidly in advanced nuclear energy licensing and construction.3 The International Energy Agency estimates investments in small modular reactors (SMRs) alone could reach $670 billion, globally and cumulatively, by 2050.4

Recently, the US administration has issued several executive orders aimed at reasserting the country’s leadership in nuclear innovation by promoting advanced nuclear technologies and strengthening domestic energy independence and grid resiliency.5 This renewed focus on nuclear includes other federal policies such as the bipartisan Accelerating Deployment of Versatile, Advanced Nuclear for Clean Energy (ADVANCE) Act signed into law in 2024, which aims to streamline licensing for advanced reactors and unlock deployment through existing tax credits and loan guarantees.6 And a May 2025 presidential executive order set a target to quadruple US nuclear capacity from 100 GW to 400 GW by 2050.7

According to the Nuclear Energy Institute, last year alone, 25 states have advanced nuclear activities through legislation and targeted programs, while seven state public utility commissions have approved orders or acted in support of nuclear power.8 The NARUC-NASEO Advanced Nuclear State Action Tracker identified more than 170 state activities that may impact states’ advanced nuclear efforts as of September 2025.9

Advanced nuclear power provides an opportunity for states to advance their economy, creating high-quality jobs, offering stable power for new types of industries, and decarbonizing their grid.10 It has the potential to revitalize communities, strengthen energy independence and security, and help position the United States at the forefront of global innovation. In this article, Deloitte identified some of the steps states can take to explore the potential for advanced nuclear energy development, drawing from Deloitte’s hands-on experience developing utility-scale projects and helping navigate policy and regulatory guidance for novel energy technologies.

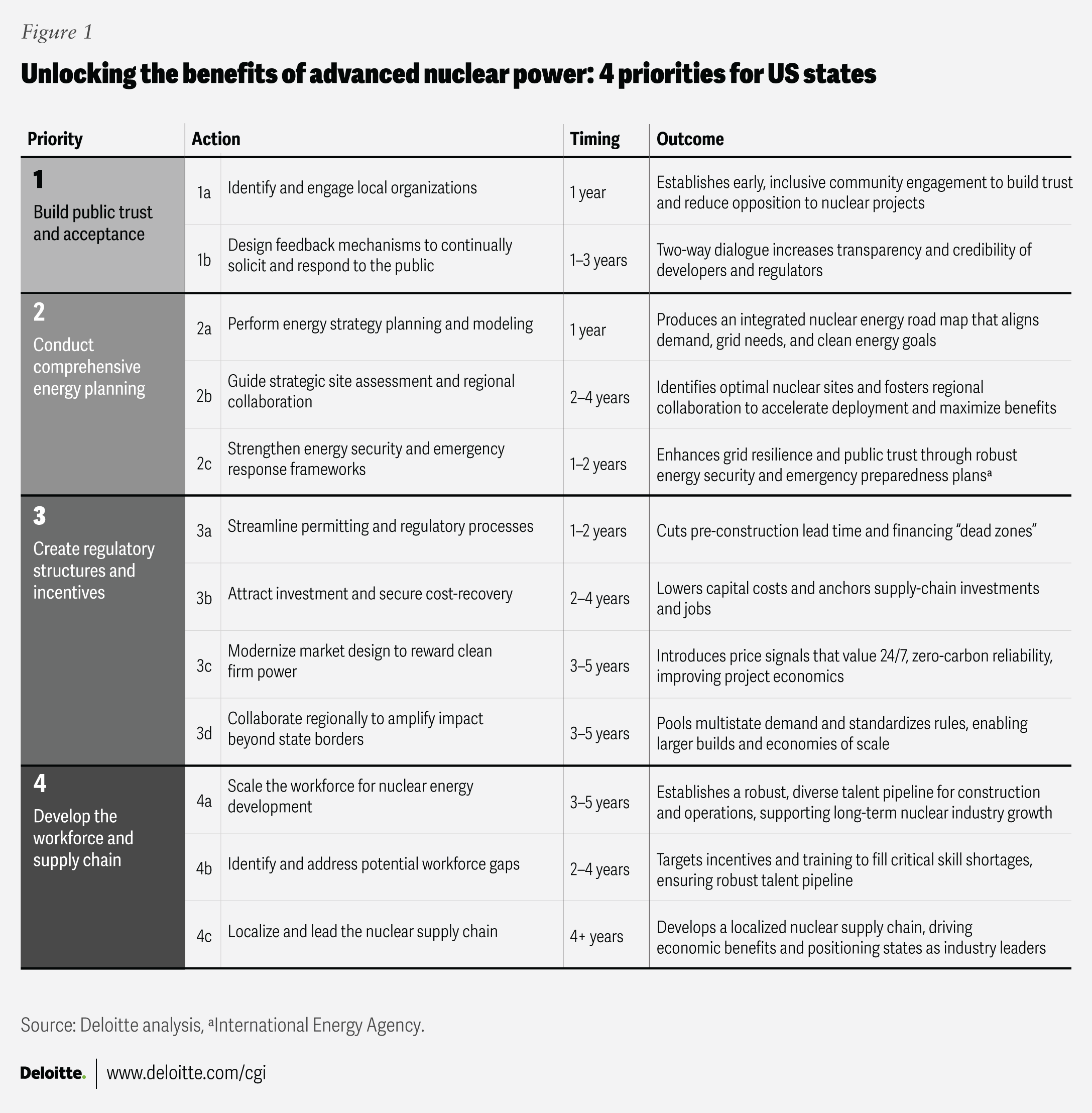

To capitalize on this moment, states should consider these four strategies:

- Build public trust and acceptance: Form alliances with local organizations and build dialogue to secure community support for nuclear projects.

- Conduct comprehensive energy planning: Establish robust energy frameworks and studies to enable grid reliability, security, and resilience.

- Create regulatory structures and incentives: Design supportive regulatory structures and incentives and collaborate regionally to streamline projects and attract investment.

- Develop the workforce and supply chain: Maximize economic benefits with a system that supports a local nuclear industry and understand where your state fits into the industry.

States acting decisively today have an opportunity to power their economies for decades to come and could help set a new standard for long-term growth and resilience. The actions outlined in figure 1 offer a strategic road map for states to accelerate nuclear deployment and unlock the full benefits of this transformative era.

How states can secure a resilient energy future

To accelerate nuclear development and enable lasting community benefits, states can focus on a set of strategic priorities ranging from community engagement to structural frameworks. By aligning efforts across these key areas, states can fast-track nuclear deployment, strengthen local economies, and build public trust, paving the way for a secure energy future.

Strategy 1: Build public trust and acceptance

Public acceptance and community support are critical aspects of nuclear energy projects. Some residents may be nervous about living near nuclear energy sites because of historical concerns surrounding safety and waste disposal.11 Rather than dismissing risk perception, addressing uncertainties proactively and communicating risks appropriately, while building public trust in regulators and organizations involved in nuclear energy development, can lead to a better understanding of the risks and merits of nuclear energy.12 State regulators, nuclear energy developers, and technical experts can help earn trust through proactive, authentic, and continuous community engagement throughout the project life cycle.

Reflecting Deloitte’s “Infrastructure for Good” approach, building public trust requires more than outreach—it demands authentic, ongoing engagement that puts people and communities at the center. As highlighted in Deloitte’s “Community Engagement for Good” framework, “putting people at the center of infrastructure decision-making” is essential. By identifying, engaging, and collaborating with local organizations early and creating joint solutions, project leaders can ensure that nuclear initiatives are designed not just for energy needs but for lasting community prosperity.

Action 1a: Identify and engage local organizations

Community organizations, environmental groups, and interested public influencers could be engaged early and visibly on substantive issues. Illinois’ Climate and Equitable Jobs Act13 requires community-benefit considerations and workforce-transition plans for the relevant areas before permits are issued. Every proposed nuclear site would convene a local stakeholder committee empowered to monitor environmental baselines and negotiate benefit packages (for example, tax stabilization, job training, air-quality monitoring). Measures such as regular town hall meetings and an online document portal—tactics used effectively by the Washington State Department of Ecology to involve residents in decisions regarding nuclear waste cleanup at the Hanford Site14—can give residents a meaningful voice and surface potential issues early, enabling developers to address issues, increasing the probability that well-designed nuclear projects proceed on time and on budget. In Kentucky, communities can self-identify as nuclear-ready communities, signaling that they have undertaken formal consultations with their citizens regarding hosting part of the nuclear supply chain and its citizens have agreed to engage industry.15 This streamlines the community engagement process, creates an initial down-selected list of viable sites for nuclear development, and starts the process from a mutually agreeable position.

Identifying and engaging local communities depends on a well-developed outreach strategy. Any project outreach can include a variety of community members in feedback solicitation and enable the accessibility of engagement meetings. As described in Deloitte’s framework for trusted communication,16 an effective outreach strategy taps into the three elements of trust: competency, humanity, and integrity. In the context of nuclear energy projects, an effective communication strategy, designed to build trust with communities, could include these key elements:

- Competency: Developers and regulators can show that they fully understand all aspects of nuclear energy and how to mitigate risks in its use.

- Humanity: State governments can show community members that they make decisions with genuine empathy and care for their constituents, and that they acknowledge and take into account residents’ concerns into the decision-making process.

- Integrity: States and nuclear energy industry players can be transparent with local communities, providing clear insight into challenges and the development process.

Action 1b: Design feedback mechanisms to continually solicit and respond to the public

Community trust cannot be built without state representatives, legislators, regulators, energy developers, and utilities actively responding to community concerns, feedback, and desires. Mechanisms to solicit community feedback can exist throughout the nuclear energy project life cycle and result in tangible changes that community members recognize. Industry players involved in the siting and design processes of nuclear energy development can use public input gained early in the project to see that these designs and the location of sites are aligned with public values to minimize opposition to licensing processes. Community concerns can be addressed and reflected in the iterative design review process, thereby building public trust in regulators, developers, and other industry players.17 Additionally, mechanisms such as advisory boards, town halls, door-to-door campaigns, and other continual feedback mechanisms can enable these players to continually receive and respond to feedback.

Project leaders should consider being willing to dedicate the resources needed to both listen and respond to local communities, for example, with an agile, specialized team. States can create a “rapid response” team that anticipates communication needs and forms proactive plans at each step of the decision-making process. Assigning a proactive team to address nuclear energy communications would enable continual responses to the public throughout the licensing, siting, construction, and operation of the project, further building trust for nuclear energy advancement.

Strategy 2: Conduct comprehensive energy planning

Small modular reactors and advanced nuclear plants can deliver consistent, around-the-clock baseload electricity. For example, a single SMR can power approximately 300,000 homes, providing the grid stability needed to support both residential and industrial growth.18 Reliability is essential for energy-intensive sectors, such as advanced manufacturing, critical infrastructure and data centers, whose energy usage could triple by 2028.19 In these sectors, even brief power disruptions can have significant economic or social consequences. States can estimate where sufficient demand will exist to site possible nuclear energy assets and enable interconnection with the grid. By integrating advanced nuclear into their energy mix, states can help safeguard against fuel price volatility, reduce dependence on imported commodities, and enable a stable supply of electricity in the face of rising demand.

For instance, France's power supply is more reliable than many European countries due to its heavy reliance on nuclear power, which provides a stable, clean baseload, generating about 70% of its electricity with a fleet of 56 reactors.20 Thanks to its nuclear fleet, France’s electricity grid maintains a legal standard limiting supply interruptions to less than three hours per year—one of the most reliable levels in Europe.21 Nuclear energy enables consistent output, enabling France to maintain energy security and export surplus electricity, earning the country more than €3 billion per year from export activity.22

Action 2a: Perform energy strategy planning and modeling

To effectively integrate advanced nuclear technologies into their energy mix, states can develop a comprehensive energy strategy plan that aligns nuclear deployment with long-term energy goals, grid reliability needs, and decarbonization targets. This plan can begin with a holistic assessment of current and projected electricity demand, identifying high-demand regions like data centers or industrial hubs where SMRs’ consistent baseload power can provide maximum value. States can consider incorporating stakeholder input from utilities, industry, universities, and communities to prioritize energy security, and cost-effectiveness. By mapping existing infrastructure, such as transmission lines and retired generation sites, and forecasting future grid needs, the plan can pinpoint optimal advanced nuclear plants locations and integration strategies.

This strategic framework can set the stage for advanced modeling studies to demonstrate how nuclear energy can strengthen grid resilience, complement renewables, and support economic growth while minimizing risks and costs. States can leverage three key types of modeling studies to inform advanced nuclear buildout and deployment:

- Strategic demand forecast modeling employs sophisticated forecasting tools to analyze future electricity demand, informing the optimal integration of nuclear energy into the grid to enable sufficient capacity, reliability, and alignment with long-term energy goals.

- Economic viability and dispatch optimization modeling assesses the economic competitiveness of advanced nuclear plants by analyzing operational costs, fuel expenses, and maintenance alongside their integration with other grid-connected assets like solar and wind. This analysis optimizes dispatch strategies to minimize costs, maximize efficiency, and enable cost-effective energy delivery to consumers.

- Transmission grid integration assesses the grid's physical limitations and identifies optimal locations. This analysis determines necessary transmission upgrades, enables efficient power delivery, enhances grid stability, and quantifies the impact of nuclear power on load balancing, decarbonization, and overall infrastructure needs, guiding strategic deployment decisions.

Action 2b: Guide strategic site assessment and regional collaboration

Comprehensive due diligence studies can help to evaluate the technical, economic, and environmental viability of advanced nuclear energy deployment. These studies could consider site-specific factors, such as seismic risks, water resources, and proximity to high-demand sectors, while leveraging opportunities to repurpose retired power generation sites with existing infrastructure and a skilled workforce. Rigorous cost-benefit analyses, including decarbonization impacts, operational costs, and community support, are essential for informed decision-making and expedited project timelines. Wyoming's TerraPower project in Kemmerer exemplifies the benefits of this approach. The project team evaluated factors such as local community support, the physical characteristics of the site, the ability to obtain a license from the US Nuclear Regulatory Commission, and access to existing infrastructure and the needs of the grid.23 By combining rigorous site evaluations, technology assessments, and regional cooperation, states can accelerate advanced nuclear energy deployment, minimize disruptions, and maximize economic and environmental benefits.

Action 2c: Strengthen energy security and emergency response frameworks

Nuclear power can maintain electricity supply during most extreme weather events, including hurricanes, extreme heat or cold, at times when other energy sources may experience disruptions.24 Between 2010 and 2020, lost generation due to weather-related events in the US nuclear fleet was less than 0.1%. Nuclear plants can deliver steady baseload power even when fuel supplies, supply chains, or portions of the grid are compromised, helping maintain critical services during disasters.25 Building on this strength, states can leverage tools and resources from the US Department of Energy’s Office of Cybersecurity, Energy Security, and Emergency Response (CESER), and the National Association of State Energy Officials (NASEO) to prepare or strengthen energy security plans.26 These plans can incorporate the advanced tools CESER has developed in collaboration with industry and the national laboratories to address a spectrum of threats, including natural disasters like floods and earthquakes, operational incidents, and cybersecurity vulnerabilities that could have an impact on nuclear operations or grid stability. The Council of State Governments and the National Emergency Management Association can also contribute to sharing effective strategies across states, ensuring alignment with national standards like those set by the North American Electric Reliability Corporation.27 For example, North Carolina developed an Energy Security Plan in alignment with CESER’s frameworks, and provided a strategic roadmap to assess energy supply risks, strengthen security, and enable rapid recovery, offering a model for states to safeguard nuclear energy deployments, and deliver reliable, affordable energy.28

With the growing digitalization of energy infrastructure, cybersecurity has become a critical pillar of emergency preparedness for nuclear deployments. Advanced nuclear plants rely on advanced control systems and grid interconnections that are vulnerable to cyber threats, including ransomware or targeted attacks on critical infrastructure. States can work with CESER’s Cybersecurity for the Operational Technology Environment program to implement robust cybersecurity standards, conduct regular threat assessments, and develop incident response protocols tailored to advanced nuclear facilities.29

In addition to providing resilient power, advanced nuclear plants incorporate safety enhancements that further reinforce emergency preparedness. Advanced nuclear designs include passive safety systems, like passive cooling, that do not require operator action or external electricity to prevent overheating, even in the most severe scenarios.30 By integrating these advanced nuclear energy innovations into emergency planning, while proactively managing physical and cyber risks, states can safeguard nuclear operations, maintain grid stability, and build lasting public trust in nuclear energy’s role as an anchor of energy security and resilience.

Strategy 3: Create regulatory structures and incentives

The technology behind small modular and other advanced reactors is progressing rapidly, creating potential economic opportunities for states. For states that plan to incorporate nuclear power into their future energy portfolio, the real test in the coming years is whether policy frameworks can keep pace. Long, sequential reviews and permitting processes, uncertain cost-recovery rules, and weak price signals can add years and billions of dollars to a project’s timeline, while every gigawatt that does reach the finish line can support thousands of well-paid, qualified jobs and sustained economic growth. Early state-level initiatives, from Illinois’s Zero Emission Credit program31 to the fast-tracked permits in Tennessee,32 Wyoming,33 and Virginia,34 illustrate how legislatures, utility commissions, and economic-development agencies can coordinate their levers to create a more favorable environment for future nuclear projects and pave the way for a markedly more profitable industry, aligned with long-term energy goals.

The following policy actions—drawn from emerging state experience—offer a practical playbook for turning nuclear ambition into investible reality:

Action 3a: Streamline permitting and regulatory processes

Long, fragmented approval timelines are one of the biggest cost drivers in nuclear development. Even after a company secures a federal license from the Nuclear Regulatory Commission, it often still needs separate state and local signoffs for land use, water rights, transmission interconnection, tax treatment, and environmental reviews.35 Because these processes typically run in sequence and vary from county to county, developers could finance multiyear “dead zones” with no revenue in sight, which can add hundreds of millions of dollars in interest expense and deter would-be investors. States control virtually every other permit on the critical path, so their ability to synchronize and accelerate those reviews is central to making projects viable.

A traditional reactor can spend almost a decade in preconstruction limbo. One-stop approaches in Idaho36 and Wyoming37 for mining and carbon-capture projects demonstrate that faster does not have to mean looser; there can be concurrent reviews, clear timetables and direction on the steps, and early engagement with local communities.

Action 3b: Attract investment and secure cost recovery

Securing investment for a new reactor begins well before concrete is poured and most of the bill comes due long before a single kilowatt-hour is sold. The first hurdle is therefore to de-risk the up-front phase so developers can raise the billions required to break ground; the second is to assure investors that their initial investment will be repaid while the plant is still under construction.

States are tackling the front-end challenge by pairing predictable, guaranteed minimum revenue with public-sector credit enhancements. For example, Illinois established a pioneer Zero Emission Credit (ZEC) program in 2016 to provide financial support to at-risk nuclear power plants.38 Under this program, utilities are required to purchase ZECs at a fixed price, creating a stable revenue stream for nuclear operators. This mechanism helped ensure the continued operation of the Clinton and Quad Cities nuclear plants, demonstrating how guaranteed revenue can de-risk investment and attract the necessary capital for nuclear energy projects.39 Some banks in Connecticut and New York have gone a step further, layering in subordinated loans and loan guarantees that cover roughly 15% of the total cost. By absorbing first losses, they crowd in senior lenders who may otherwise price the risk too high.40 Indiana now authorizes 40-year securitized bonds whose maturities match a reactor’s economic life,41 while the Utah Associated Municipal Power Systems consortium in the Mountain West uses take-or-pay contracts in which each of its dozens of city-owned utilities agrees to pay for its share of the plant’s output whether it ends up taking the power or not, so all participants share the risks and rewards together.42 Together, these tools could narrow or eliminate the equity gap that typically stops first-of-a-kind builds at the drawing board.

Because first-of-a-kind advanced nuclear projects lack a proven cost track record, several states have adopted conditional financial incentives to help manage project risk, while aiming to limit the effects on ratepayers. These include grants or tax credits that are contingent on qualifying activities, such as research, development, or construction, as well as cost-recovery provisions that allow utilities to recoup development expenses during the early stages of a project. For example, Virginia enacted legislation that allows utilities to recover up to 80% of their advanced nuclear development costs—such as engineering, licensing, and site permitting—on a current basis from ratepayers, providing early-stage financial certainty and helping to de-risk investment in first-of-a-kind nuclear projects.43 Similarly, Indiana enacted a tax credit equal to 20% of qualified investments made in manufacturing small modular nuclear reactors in the state and specified that tax credits can be carried forward.44 At the federal level, the Department of Energy’s Advanced Reactor Demonstration Program (ARDP) has utilized a milestone-based funding approach, releasing funds in phases as projects achieve specific technical and regulatory milestones.45 States could potentially implement similar milestone-based support mechanisms, which would encourage innovation and promote the investment of public funds in projects that demonstrate measurable progress and risk reduction.

Once the funding is in place, the focus can move to bridging the period between breaking ground and the moment the plant starts producing electricity and earning revenue. Construction-work-in-progress accounting (CWIP) enables utilities to place verified expenditures into the rate base as they occur, turning sunk costs into billable assets and preserving investment-grade credit.46 Florida employs a similar statute,47 and more than 10 other states now authorize some form of advanced-nuclear cost recovery, typically reinforced by prudency audits and performance-based true-up accounting that align shareholder returns with on-time, on-budget delivery.48

When revenue certainty, first-of-a-kind risk mitigations, subordinated public capital, long-term bonds, and balanced cost-recovery mechanisms operate in concert, they can help turn nuclear energy from a speculative gamble into a financeable infrastructure play, attracting cheaper capital, anchoring local supply chains, and accelerating the clean-energy transition.

Action 3c: Modernize market design to reward clean firm power

Most wholesale markets pay primarily for the next kilowatt-hour of energy, not for its multiple attributes, such as zero carbon, on-demand availability, and voltage support, that keep the lights on when solar production fades and gas prices spike. This focus can discourage investment in resources like advanced nuclear that, despite operating 24/7 with minimal emissions, requires long-term revenue certainty to secure financing. Because states set integrated-resource planning rules, oversee utility cost recovery, and influence regional market tariffs, they hold some of the levers to broaden compensation from the cheapest electrons now to the highest system value in the long run.

In multiple states, policy shifts are beginning to reflect that broader view. Washington State’s Clean Energy Transformation Act explicitly designates nuclear as a clean-firm asset that can satisfy utilities’ decarbonization mandates, providing a profitable compliance pathway.49 Illinois50 and New Jersey51 have extended their Zero-Emission Credit programs to prospective builds, turning avoided carbon into a predictable revenue stream rather than a retrospective subsidy. The California Public Utilities Commission is currently considering a staff proposal for technology-neutral, round-the-clock capacity solicitations that would enable nuclear to compete directly against combinations of renewables, storage, and demand response on the basis of reliability-adjusted cost.52 Industry analyses help back the economic case: Electricity markets with remuneration mechanisms such as capacity markets or contracts for difference, which recognize the contribution of nuclear energy to system reliability and resilience, are essential for supporting new nuclear investments, especially as grids incorporate higher shares of variable renewable energy.53

Action 3d: Collaborate regionally to amplify impact beyond state borders

Advanced reactors are capital-intensive assets designed to serve regional rather than strictly local demand. Stand-alone utility load forecasts and competitive market structures may not provide sufficient market signals to incentivize the development of a large nuclear reactor, especially in mid- and smaller sized markets, indicating the need for collaboration or shared investment approaches among utilities. Fragmented state rules on siting, cost recovery, and transmission planning often compound the problem by forcing every project to negotiate a unique regulatory maze. The result is chronic under-subscription: Developers struggle to line up enough credit-worthy offtakers, while states pursuing go-it-alone strategies miss out on economies of scale and may leave federal incentives on the table. Because states control zoning, resource-planning mandates, and most retail-rate design, they are uniquely positioned to convene multi-jurisdictional coalitions that pool demand, standardize criteria, and unlock shared infrastructure.

For example, the Midcontinent Independent System Operator’s study of multistate cost allocation for new transmission54 illustrates how coordinated planning can lower unit costs and shorten schedules. By agreeing on common siting parameters and synchronized procurement, member states create a single, reliable market rather than a patchwork of small bets. In April 2025, the governors of Utah, Idaho, and Wyoming signed a Memorandum of Understanding to collaborate on nuclear energy development.55 This tri-state agreement focuses on multiple topics, including aligning energy policies to support innovation and private investment, jointly navigating regulatory and environmental, and coordinating infrastructure development. A report published by the Southeast Nuclear Advisory Council shows the potential payoff for regional collaboration. In the Southeastern US region alone, the nuclear industry generates nearly $43 billion in annual economic impact, supports more than 152,000 jobs, and contributes $13.7 billion in labor income and $3.7 billion in annual tax revenues across five states. Interstate collaboration is key to achieving these outcomes, as it enables states to pool resources, harmonize workforce development initiatives, and coordinate supply chains—ensuring a steady pipeline of skilled talent and robust technical support for advanced nuclear projects.56 By working together, states can streamline regulatory processes, accelerate technology deployment, and may attract greater private investment, ultimately maximizing the economic and innovation benefits of advanced nuclear energy for the entire region.

Together, these four actions form a practical playbook that moves from siting and licensing through financing, revenue certainty and regional collaboration can help convert nuclear energy from a perceived high-risk gamble into a competitive advantage for economic development.

Strategy 4: Develop the workforce and supply chain

Advanced nuclear energy presents a significant opportunity for states to develop a new skilled and diverse workforce. The deployment of advanced nuclear energy and exploration of fusion technologies will increase the demand for talent in areas like construction, operations, manufacturing, and supply chain management. Achieving the US target to quadruple US nuclear capacity from 100 GW to 400 GW by 2050 will require a dramatic workforce expansion.57 According to the US Department of Energy, in 2024, approximately 100,000 workers supported the operation of nearly 100 GW of nuclear capacity.58 By 2050, an estimated 375,000 additional workers will be needed—100,000 for ongoing operations and 275,000 for construction and manufacturing.59 This potential surge in demand spans a wide range of skill sets, from engineers and reactor operators to welders, electricians, project managers, and supply chain specialists. States can position themselves as leaders in nuclear innovation by ensuring they have a workforce trained in advanced technologies and supported by local supply chains. By focusing on localizing the nuclear supply chain and using state-level incentives, states can meet the demand for nuclear energy while also promoting economic growth and creating career opportunities for their residents.

Action 4a: Scale the workforce for nuclear energy development

The potential rapid expansion of advanced nuclear power could create workforce opportunities for states. To realize the full potential of this sector, states can take a proactive approach to developing a robust, skilled, and varied talent pipeline—one that spans technical and nontechnical roles across construction, operations, manufacturing, engineering, and supply chain management.

Advanced nuclear energy projects may face significant workforce challenges, particularly because of shortages in critical skilled trades and specialized expertise required for building, operating, and maintaining advanced nuclear technology. To address these gaps, states can take proactive steps such as identifying and tracking constrained trades and critical skill shortages, offering financial incentives to attract and upskill workers, and establishing regional education and training programs in partnership with industry, labor unions, and educational institutions. Additionally, broadening recruitment and outreach initiatives to include non-traditional talent such as local unions, technical schools, high schools, adjacent industries, veterans, and former industry workers can be beneficial to building a robust nuclear workforce.

Action 4b: Identify and address potential workforce gaps

States can move beyond general workforce expansion and directly address specific gaps in skills and labor availability. This requires a data-driven, collaborative approach to workforce planning and development.

States could proactively:

- Map current and future needs: Conduct comprehensive assessments to identify critical skill shortages and forecast future workforce requirements for advanced nuclear energy projects. Evaluate whether robust, granular data systems and tracking capabilities exist to identify workforce-related gaps. Additionally, assess whether existing workforce development institutions have the expertise and resources to address the unique labor demands of nuclear energy.

- Leverage data and partnerships: Use labor market analytics and collaborate with industry, labor unions, and educational institutions to align training programs with real-time needs. Facilitate coordination among workforce development agencies, economic development authorities, and industry partners to maintain an up-to-date understanding of evolving skill requirements and respond quickly to changing market signals.

- Targeted upskilling and reskilling: Develop and fund specialized training, apprenticeships, and certification programs for high-demand roles in nuclear construction, operations, and supply chain.

- Expand talent pools: Launch outreach initiatives to attract workers from adjacent industries, Navy veterans with nuclear training, and local communities.

- Monitor and adapt: Establish mechanisms to track progress, measure outcomes, and adjust strategies as workforce needs evolve.

Pennsylvania has leveraged its existing nuclear infrastructure to attract major private-sector investment. In partnership with Amazon, the state facilitated the development of data centers adjacent to Talen Energy’s Susquehanna nuclear facility. Amazon has committed to investing at least $20 billion in Pennsylvania to build multiple high-tech cloud computing and AI campuses, creating at least 1,250 high-paying tech jobs and thousands of construction roles, the largest private investment in Pennsylvania history.60 The initiative includes partnerships with local schools and workforce organizations for training and STEM education, while the state will invest $10 million in workforce development to support the further growth of that industry in the state.61

States can work to develop a skilled and diverse workforce for the nuclear sector through input and output economic modeling, strategic workforce development, and advising effective incentives and recruitment. By fostering collaboration and creating nuclear-specific technical education pathways and apprenticeships, states can attract the talent needed for successful nuclear energy deployment and operation.

Action 4c: Localize and lead the nuclear supply chain

Deploying advanced nuclear energy plants, as well as fusion technologies hinges on establishing robust, localized supply chains, robust inventories, and component redundancies for critical components such as reactor vessels, cooling systems, specialized valves, advanced fuels, and unique control systems. This positions states to become first-movers in a competitive global market. States can achieve this by investing strategically in nuclear manufacturing capabilities, fostering innovation through state-funded research and development grants, and creating economic zones to attract different types of manufacturers with tax incentives, infrastructure support, and streamlined permitting processes. Key actions include launching specialized training programs at community colleges and vocational schools to build a skilled manufacturing workforce, forging strong partnerships with domestic and international suppliers to enable a resilient supply network, and coordinating regional efforts to establish advanced manufacturing hubs that align supply chain strategies with national energy goals. States can also collaborate with industry stakeholders to share information and analyze supply chain vulnerabilities, with a special focus on identifying risks and gaps related to the most critical components in the nuclear value chain. This localized approach not only supports nuclear energy deployment but also drives economic diversification, generates high-skill jobs, and reduces potential reliance on foreign supply chains.

Virginia’s 2023 nuclear innovation package demonstrates the power that state-level incentives can have in driving workforce and economic development.62 By awarding competitive grants to support workforce development, research, and education, they established partnerships between the state’s universities, community colleges, and industry leaders. These efforts are designed to build a robust talent pipeline and attract advanced nuclear supply chain investments, reinforcing Virginia’s role as a regional hub for nuclear innovation.63

An action plan for states to lead the advanced nuclear energy adoption

Advanced nuclear power is no longer a distant prospect, but a practical, proven technology already attracting private capital, and inspiring a new generation of engineers and tradespeople. States that act decisively now by planning their energy future, modernizing regulation, investing in people and local businesses, and earning the confidence of their communities have an opportunity to secure reliable, clean power for decades, spark new industries, and anchor well-paid jobs, with an average pay of up to 50% higher than other electricity-generating sources.64 This is not only a technical choice, but also it can be a way to advance energy independence and grid resilience, environmental leadership, and community prosperity.

Data center developers, manufacturing centers, and high-technology industries, among others, are making decisions now about where they will build their infrastructure and locate their facilities. More than ever before, the availability of reliable, low-cost power will be a central part of their decision-making process. In this context, states have an opportunity to move forward now to support the industry and facilitate the development of reliable, low-cost power. Enabling the deployment of advanced nuclear technologies could be a central component of that plan.

Following a targeted, phased approach, states that plan to incorporate nuclear power into their future energy portfolio may achieve significant progress in the coming years, aligning actions across public trust, energy planning, regulatory structures, and workforce development to maximize impact. An effective accountability framework, leveraging state task forces, public reporting, and regional collaboration can help enable measurable progress. Outcomes can include:

- Widespread public support: Attain social acceptance for advanced nuclear energy projects through transparent engagement and community-focused benefit programs, minimizing opposition and fostering trust.

- Accelerated project deployment: Reduce permitting timelines for advanced nuclear energy technologies, preidentifying viable sites for developers, and streamlining regulatory processes to enable faster, cost-effective project implementation.

- Enhanced energy security: Establish nuclear energy as a cornerstone of baseload power to meet growing industrial and residential demand, reducing dependence on volatile fuel markets.

- Robust workforce: Train thousands of workers to support the construction and operations of advanced nuclear energy plants, building a skilled talent pipeline to meet long-term industry needs. Coordinating with other states to understand how they are building out their supply chain and nuclear industry promotes efficiencies in a capital-intensive industry.

- Economic competitiveness: Develop localized nuclear supply chains and coordinate to create strategic component inventories that make states attractive locations for nuclear development, create high-skill jobs and establish states as key players in the global nuclear industry.

- Resilient infrastructure: Implement comprehensive energy security plans to protect nuclear energy plants against natural disasters and cyber threats, ensuring reliable and safe operations.

By executing this plan with clear accountability through governor-level oversight, public reporting, and agreements with organizations like the Nuclear Regulatory Commission, states aiming to integrate advanced nuclear power into their future energy mix can shift from reactive energy policies to proactive leadership.65 This strategy can deliver cleaner energy, local jobs and stronger economies, providing states with opportunities to lead the advanced nuclear energy transition with confidence and impact.