The AI-amplified future of work in public sector regulation

From real-time risk detection to decoding jargon, AI can make public sector regulatory work faster, clearer, and more effective, without compromising compliance

Artificial intelligence, generative AI, and AI agents are revolutionizing government regulatory processes and compliance activities, making them faster, smarter, and more effective. AI-driven analytics enable real-time monitoring and analysis of vast data sets, allowing regulatory bodies to detect anomalies, predict compliance risks, and identify potential violations with greater speed and accuracy. Gen AI takes it a step further by decoding complex regulations, automating time-consuming report writing, and translating jargon into clear, actionable steps. This technology not only speeds up processes but also helps regulators enforce rules consistently and fairly. The result? Less time, more transparency, and a government better equipped to tackle the challenges of tomorrow.

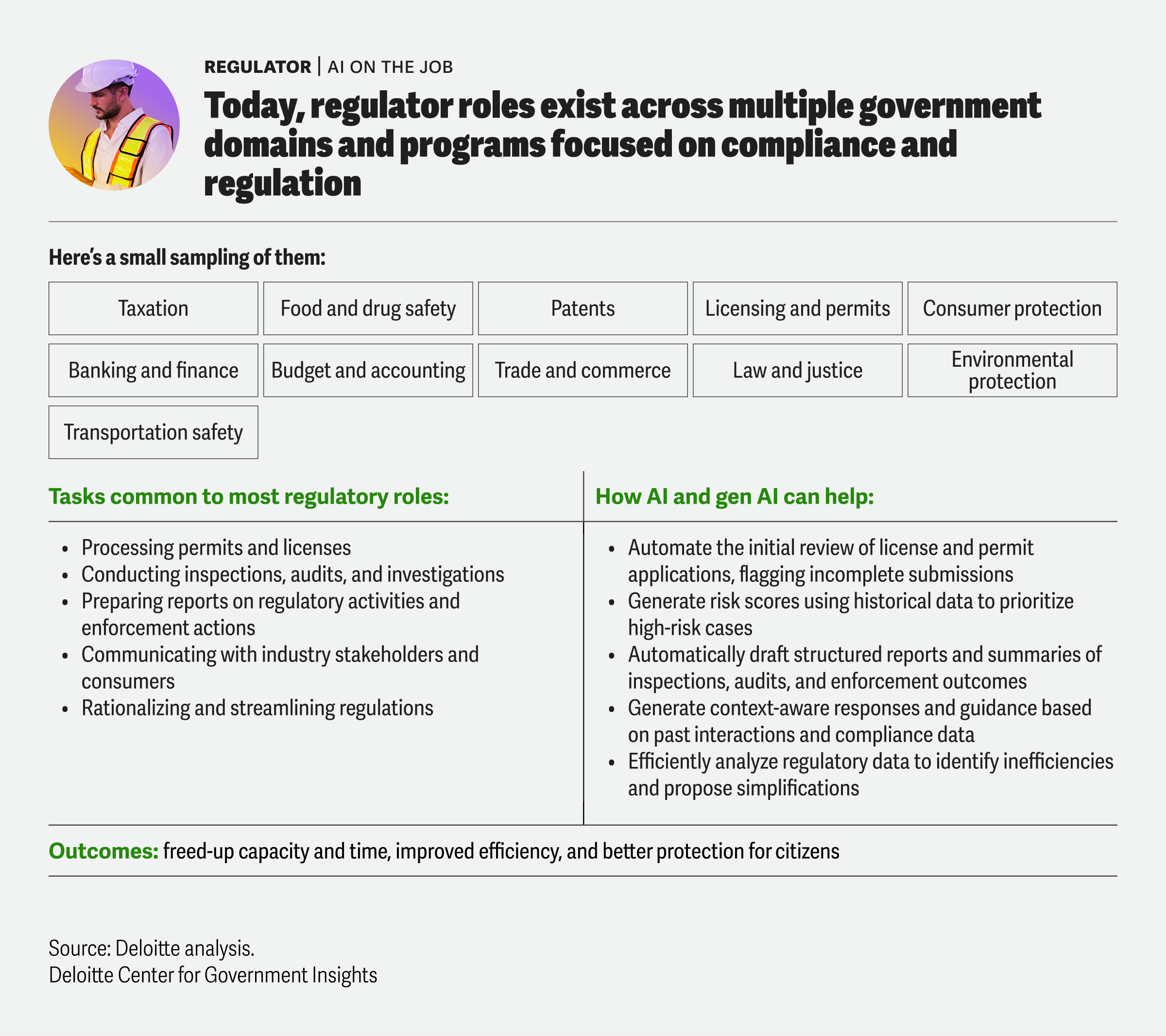

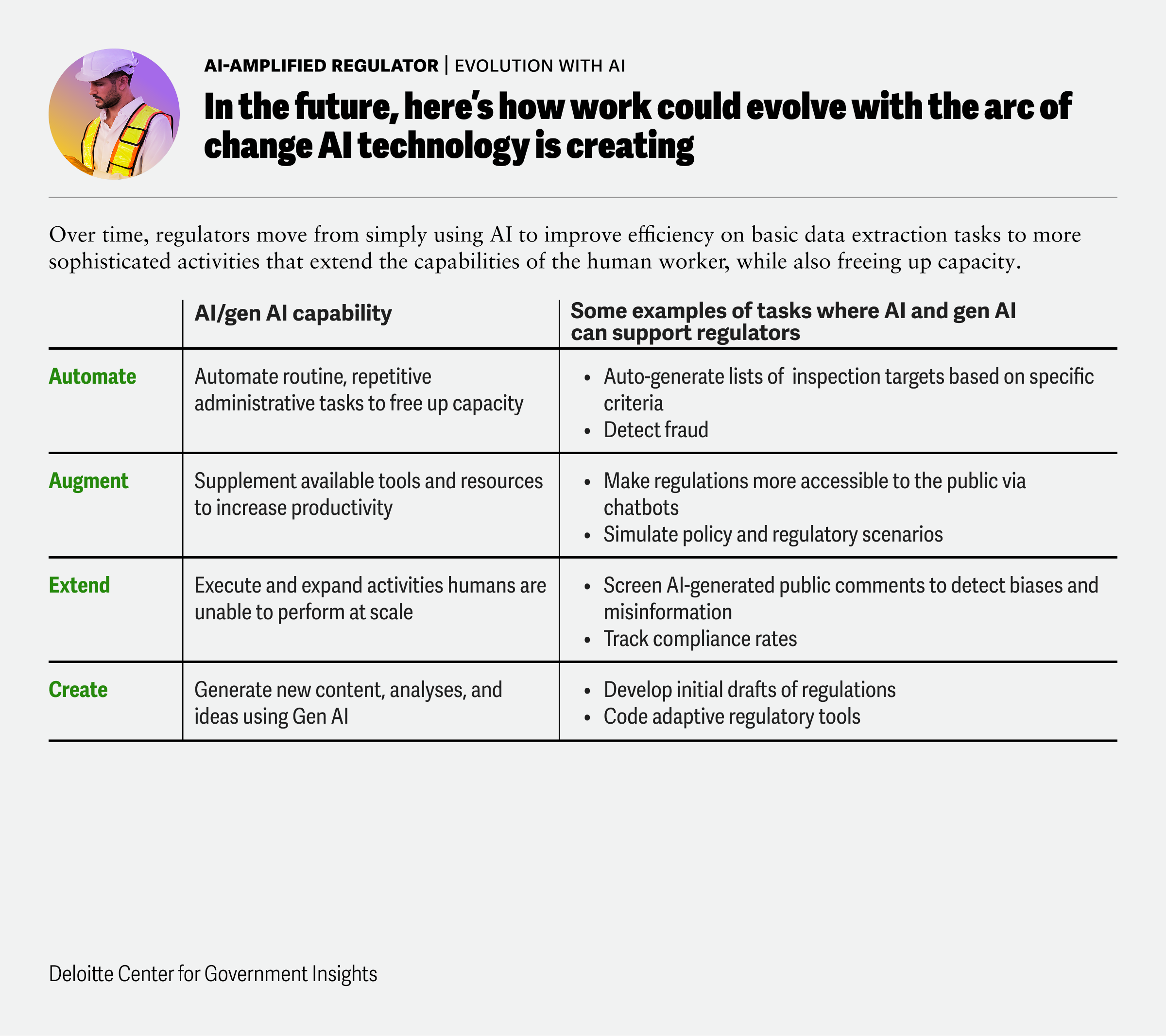

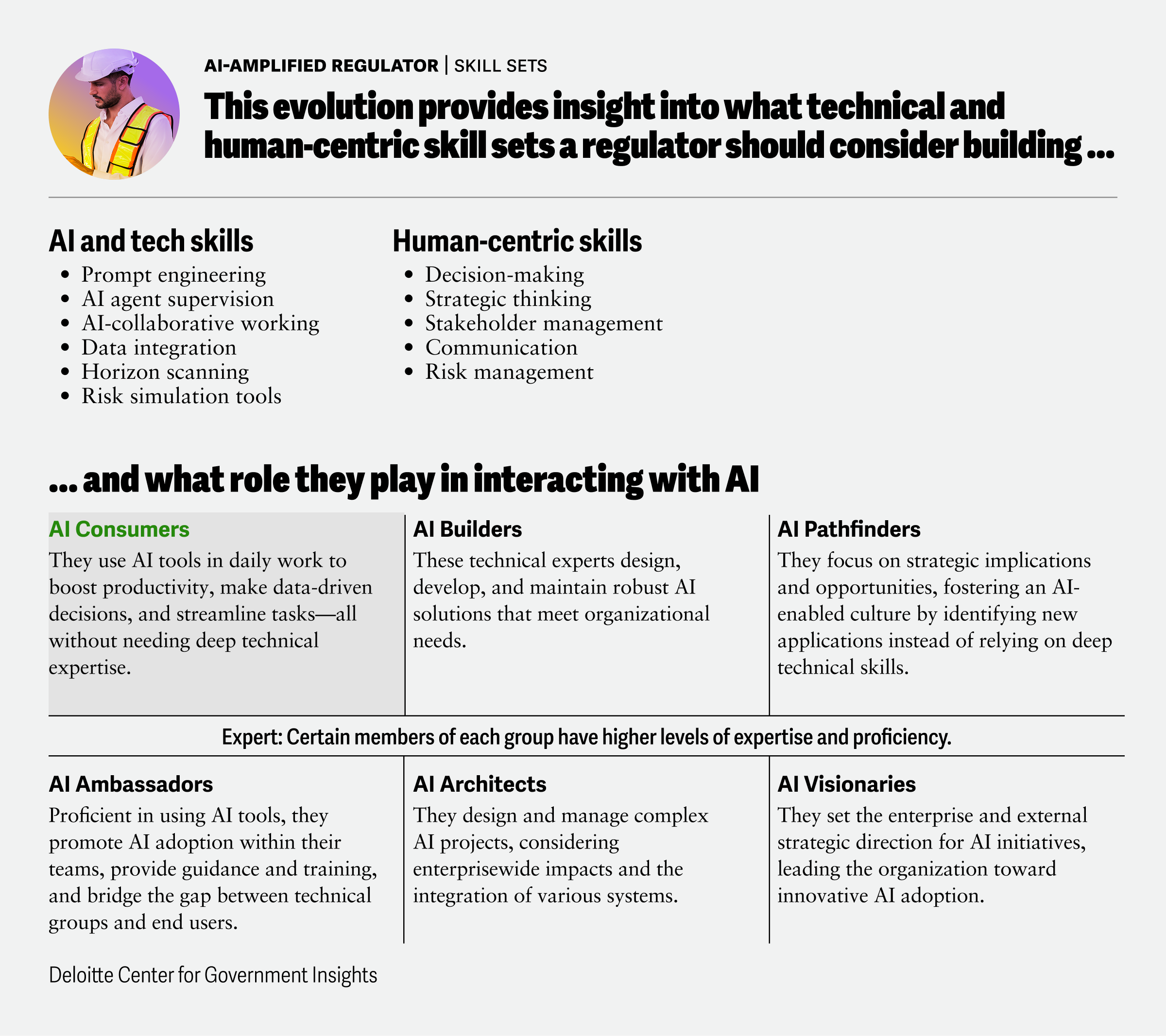

What does this mean for government workers in regulatory roles? This progression signifies a shift toward an “AI-augmented worker” and even an “AI super user” within regulatory bodies, requiring new skill sets like prompt engineering and AI supervision, alongside traditional skills like policy expertise and strategic thinking. From tax auditors and building inspectors to financial regulators and licensing and permitting professionals, a wide range of jobs are a part of the government’s regulatory and compliance activities. And while there are bound to be some unique job-specific benefits from using AI, there are several that are role-agnostic.

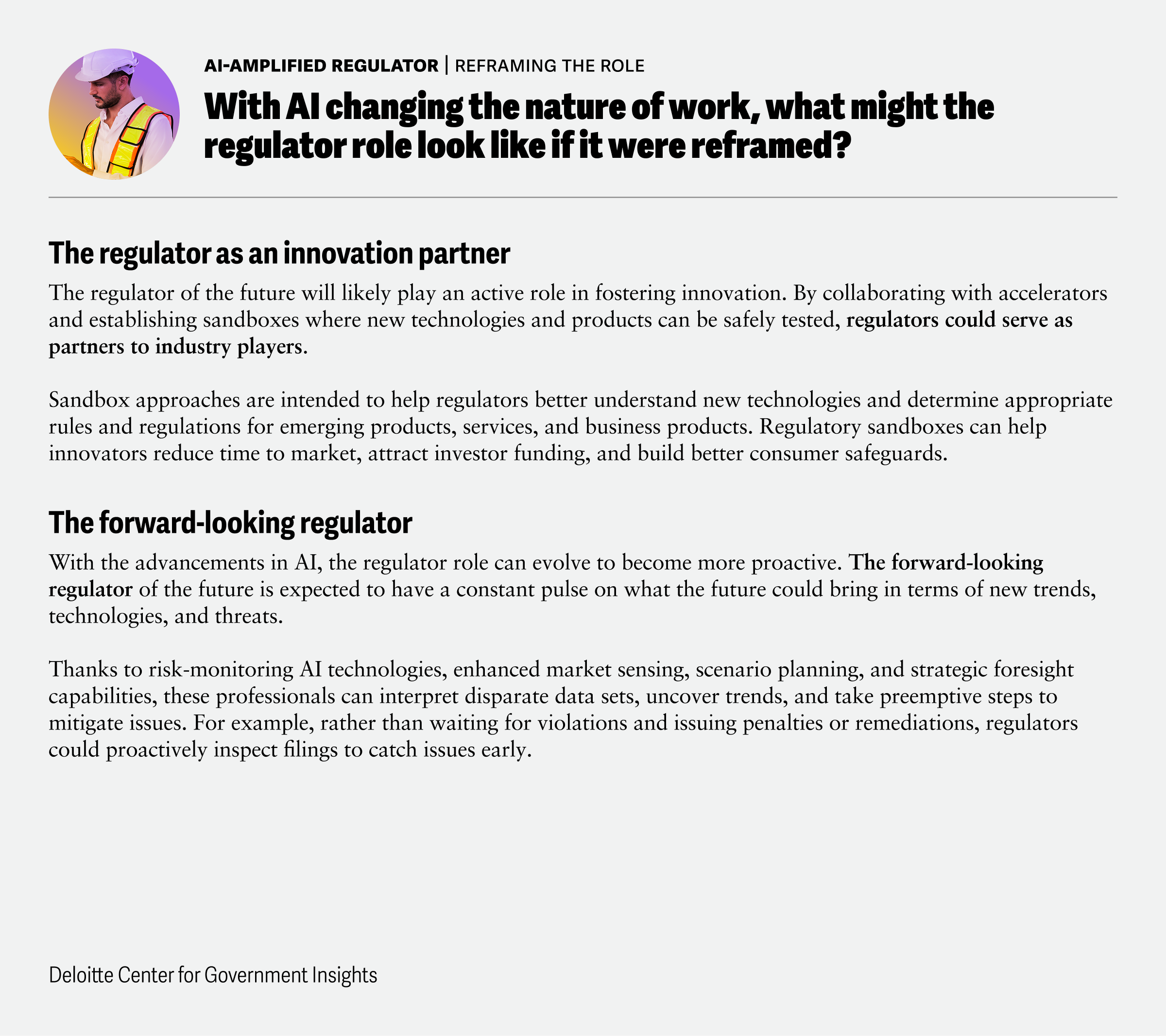

How can AI change the government regulator role?

Let’s take a closer look at how AI technologies might change the government regulator role and what it means for the worker doing the job. Click through the slides below or download the complete PDF.

What’s next?

As AI continues to drive efficiency in regulatory functions, new roles are expected to emerge that focus on improving processes and reducing unnecessary complexity. One such future role is the organizational debt auditor, a professional who is dedicated to identifying process improvements and reducing organizational debt. What might this new public sector job look like?

The organizational debt auditor: A possible future role in regulation and compliance

- Mission: Organizational debt auditors help assess and minimize organizational debt–misaligned structures, administrative redundancies, and outdated processes that may have built up over time. Similar to technical debt, organizational debt, if left unchecked, can slow down government processes, hinder operations, and create undue burdens for government workers and the people they serve.

- Key responsibilities may include:

- Conducting internal audits to identify if there are any internal bottlenecks or onerous regulatory and compliance processes in workflows.

- Using AI-powered analytics to assess process inefficiencies and their impact on time, cost, and workforce productivity.

- Developing recommendations to intentionally retire outdated processes and duplicative steps, simplify documentation, and reduce unnecessary complexity and confusion.

- Collaborating with other agencies to implement changes that enhance agility and effectiveness while maintaining compliance integrity.

On the job impact

Jennifer, an organizational debt auditor, has just completed an AI-powered audit of the new-hire onboarding process for a back-office government department. She discovers that the current onboarding process has 29 steps, many of which are confusing and duplicative and impose additional processes on both new hires and managers. Using a gen AI–powered “friction finder” tool, Jennifer is able to identify bottlenecks, duplication, points of friction, and delays, and quantify their impact on cost and efficiency. With insights from the tool and consultations with stakeholders, Jennifer creates a plan to cut the process in half and improve efficiency for all parties.