Differentiating distribution to boost middle-market commercial insurance partnerships and production

Deloitte survey reveals preferences and priorities of agents and brokers based on insurer relationships

Key takeaway

- As more middle-market agents and brokers consolidate into bigger, service-driven risk managers adding value beyond the sale of an insurance policy, carriers should consider reexamining their distribution approach to align relationship management practices, service offerings, and investment decisions with the priorities of like-minded producers—depending upon whether the preferred relationship is primarily transactional, collaborative, or strategic.

What might it take to attract and retain the most productive and profitable commercial insurance agents and brokers (ABs) serving the middle market—a segment which accounts for about 200,000 private businesses, generates one-third of US gross domestic product, and employs some 48 million people?1 Competition for middle-market business is becoming fierce, thanks in part to rapid consolidation of the distribution force over the past few years,2 which threatens to undermine longstanding relationships with carriers.

Many small to midsize ABs have been combining forces seeking greater scale and enhanced capabilities to reach larger accounts. At the same time, some of the biggest national and regional brokerages have been actively acquiring middle-market ABs to expand their presence in this wide-ranging customer segment3 (which we define as companies generating annual revenue from US$20 million to US$1 billion4). Indeed, over the past five years alone, there have been 3,146 AB mergers and acquisitions (M&A), with a peak of 802 in 2021.5 Such consolidation has begun tipping the scale in favor of leading ABs, who are commanding greater market share and leverage in placing business. In addition, each time ABs combine in a merger or acquisition, the relationship and business volume commitments to their respective insurers may be subject to change.

This could be a game-changing moment for many middle-market carriers as the competitive ground shifts beneath their feet. While small-business policies are largely commoditized and sold off the shelf by Main Street agencies,6 and jumbo accounts are predominantly handled by the largest national and global brokerages, the middle-market segment remains very much in play and could hold great potential for profitable growth through innovation and differentiation beyond the price of insurance. Customers’ coverage needs in this segment are usually higher- level and more diverse than for smaller businesses, which means many middle-market companies still depend on ABs to serve not just as insurance shoppers but as their risk managers. This could make the availability of value-added service options potential competitive advantages for carriers and their distributors.7

The challenge facing many insurers in this rapidly evolving environment is how to differentiate beyond price and coverage to maintain and grow their middle-market business. This should prompt many insurers to rethink their distribution relationships and consider new strategies to not only lock down their most reliable producers, but also to target and develop those with the potential to become longer-term partners.

The Deloitte Center for Financial Services surveyed 150 middle-market ABs in January 2023, supplemented by in-depth interviews with select ABs and leading carriers, to better understand how producers view their carrier relationships, as well as what motivates them to go to and/or stick with a particular insurance company. We looked at their preferences and priorities, what kinds of information and help they seek from carriers to bolster efficiency and growth (such as data-sharing and tech support), as well as the availability and importance of insurance-adjacent and noninsurance services.

Our goal was three-fold. This research should help middle-market insurers:

- Assess the types of ABs selling their products and ascertain whether they have the right mix to match their business model and execute their distribution strategy;

- Determine what incentives they might consider to develop and attract more like-minded producers while enhancing ties with their current, most coveted distributors; and

- Drive greater synergy with their most productive and profitable ABs while encouraging more of a holistic, longer-term partnership that goes beyond transitory pricing considerations.

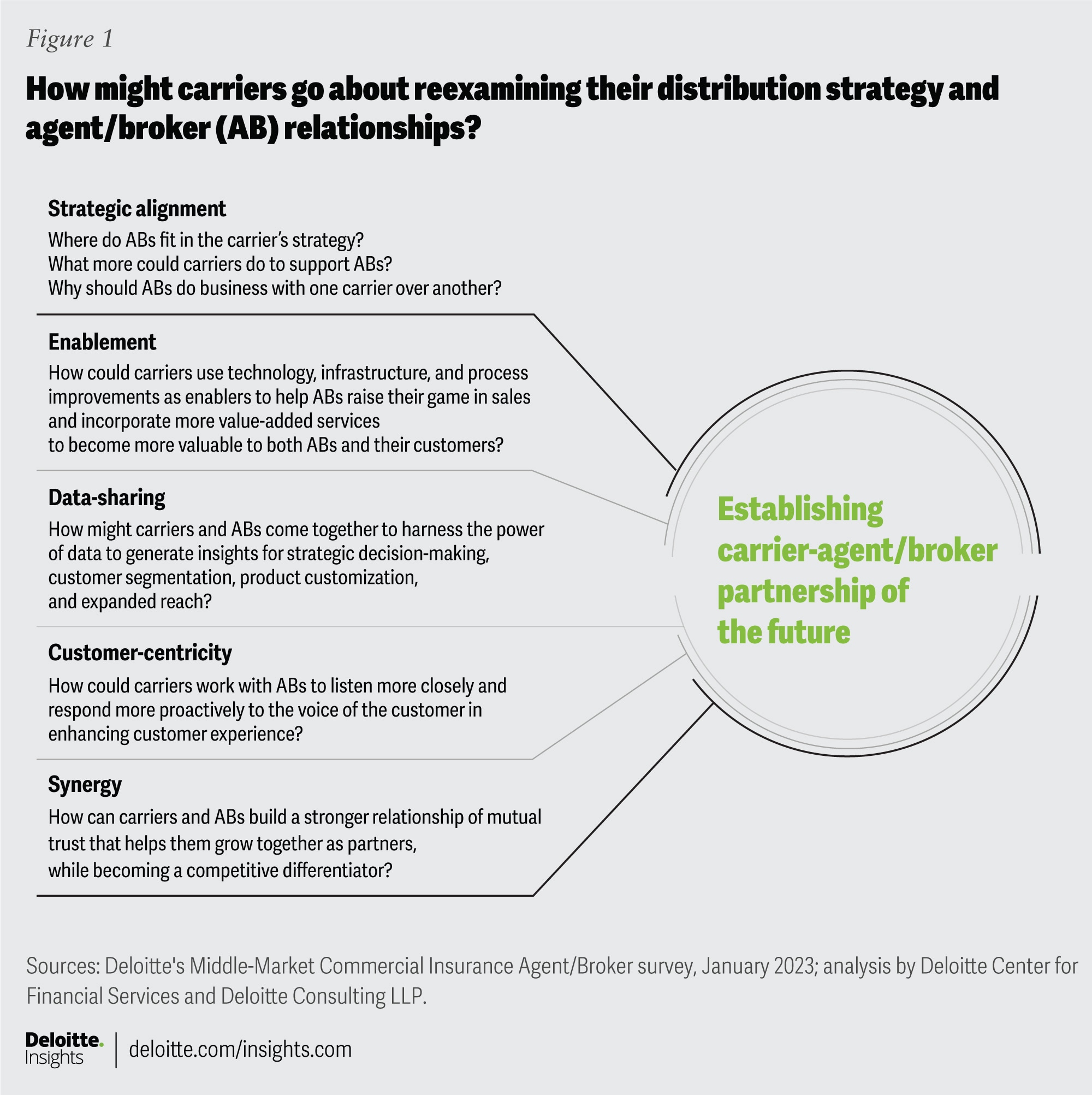

Factors for insurers to consider when reexamining distribution strategies

To secure steady growth and profitability in middle-market commercial insurance, many carriers may have to rethink how they engage with various types of ABs. In analyzing our survey data, we have crafted a five-point actionable framework designed to guide discussions among leaders of distribution, lines of business, marketing, product design, and information technology (IT) (figure 1).

Insurers should consider whether they have established a strategic alignment of their go-to-market plans—whether focused on new market entry, retention improvement in specific product lines or geographies, or market share growth—with the preferences and priorities of their current distributors (whether they are mostly competing on price alone or seeking more services to secure accounts long term). Clear communication and commitment could help get carriers and their ABs on the same page while enhancing trust, boosting production, and improving profitability.

This exercise can provide a fresh look at options to bolster enablement—improving how a carrier engages with distributors in terms of technology infrastructure, staff support, and overall ease of doing business, while better positioning both parties to achieve their strategic goals.

Next, insurers must consider a review of data-sharing protocols to help improve hit ratios, retention rates, and overall profitability by exchanging insights on target market needs and potential coverage gaps among current and prospective customers. Improved connectivity and exchange of data between carriers and their ABs could spur more profitable growth, such as by enhancing risk selection, streamlining submissions, and expanding opportunities for cross-selling and upselling to existing clients.

Establishing customer-centricity as a common priority should also be an important goal, particularly when it comes to helping more ABs deliver strategic advice and risk management support to clients above and beyond the transactional placement of insurance policies. The more value-added services a carrier can offer through their AB partners to better manage client risk, the stronger the relationship with a policyholder (and distributor) is likely to be. This could also help both the carrier and AB differentiate beyond price for policyholders and boost retention rates.

Last but not least, taking these steps should produce greater synergy between carriers and their distribution force, as the two sides work more closely together to build mutual trust and stronger, longer-term relationships that have the potential to become competitive differentiators. Such synergy should contribute to improved top- and bottom-line performance through greater production from distribution partners as well as stronger retention of clients they serve.

Not all ABs may have equal value or potential for carriers

This is not to suggest a one-size-fits-all approach. Indeed, a large part of achieving strategic alignment with distribution partners should involve gaining an understanding of the specific capabilities that insurers might offer to attract and retain their most desirable distribution outlets, depending on the attributes and strategic goals of different types of AB relationships.

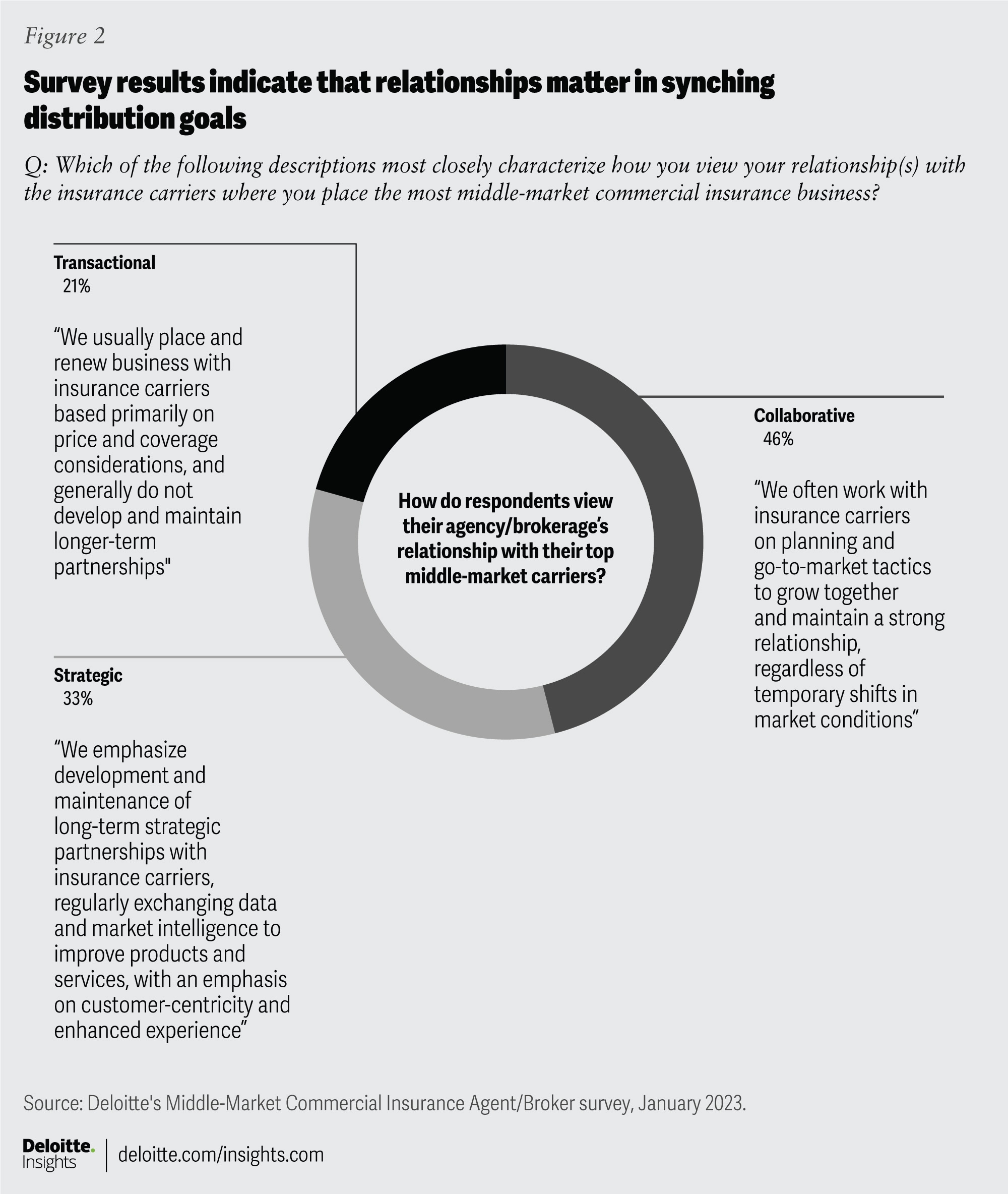

To help facilitate such an analysis, we asked survey respondents to categorize their relationships with carriers writing the most middle-market business for them (figure 2). Among our sample, approximately one in five classified their relationships with carriers as transactional—selling mostly on price with little or no concern about developing long-term partnerships. Nearly half of respondents classified their relationships with carriers as collaborative—marking the beginning of a partnership, with the two sides more frequently working together on elements beyond temporary shifts in the market. Lastly, one-third classified their relationships with carriers as strategic—indicating they were much more focused on broader relationships and working closely together to develop, launch, and distribute products and services.

This survey sample’s relationship breakdown does not necessarily reflect the desired or ideal split for all middle-market insurers. That should depend on what each individual insurer is trying to accomplish and how they intend to reach their target segments. Therefore, determining this breakdown should likely be the starting point when insurers consider whether they have the correct distribution relationship mix to fulfill their goals, and if not, how they might reinvent their distribution strategy to attract and retain the necessary types of ABs.

Those seeking entry into the middle market as a new or returning player, for example, might be more interested in cultivating transactionals and competing mostly on price, at least at first. However, established players may be more interested in limiting transactional relationships, seeking to bolster longer-term partnerships with more committed, collaborative, and strategic ABs looking for carriers offering a wider array of services besides risk transfer.

Setting these objectives could serve as guiding principles, whether dealing with ABs directly or through wholesalers.

AB preferences and priorities differ depending on their relationship profile

Respondents from all three relationship types included in our survey (transactional, collaborative, and strategic) place a high priority on price and growth potential when deciding where to place or keep an account. Even strategic respondents indicated they would be unlikely to keep renewing policies for a customer with a specific carrier if that provider is consistently pricing coverage much higher than the market average for similar risks.

However, our survey also found that the more engaged the relationship, the more likely an AB will be to value other factors as well—such as the availability of insurance and noninsurance services. These value-added options could prove to be differentiators in an AB’s placement and retention decisions, depending on their preferred relationship with carriers.

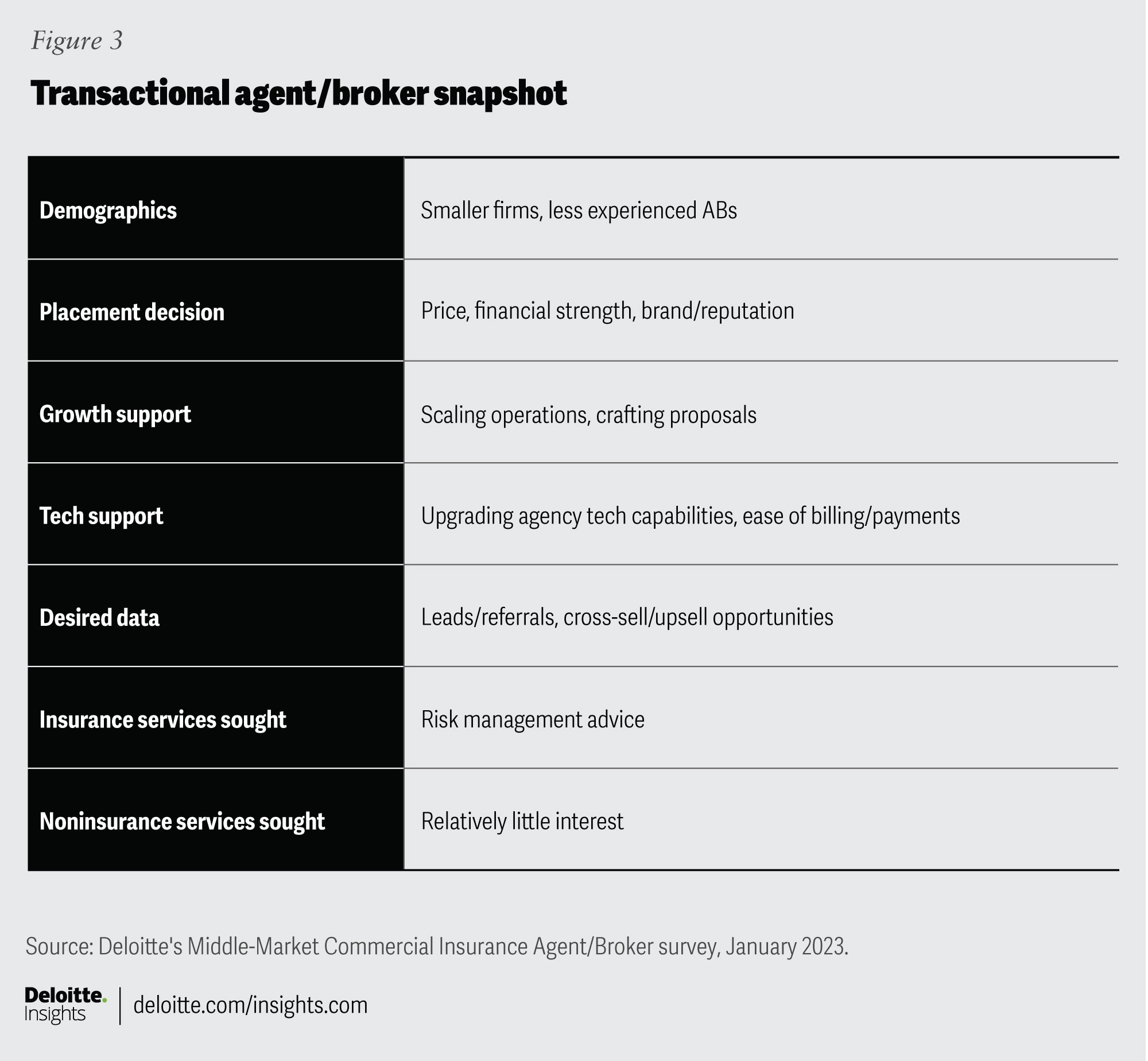

Survey respondents self-identifying as transactionals (figure 3) are likely to be the most volatile, owing to their higher focus on selling policies based mostly on price. Indeed, only one in four transactional respondents cited retention rates as a preferred compensation factor, the lowest of the three segments by far. Long-term partnership does not appear to be a priority for them, while personal relationships with carrier personnel ranked near the bottom of 17 potential decision points when placing business.

Transactional respondents tended to value scale and efficiency, looking for speed and ease of doing business from quoting to billing. Many would welcome carrier support to upgrade their own agency’s tech capabilities. However, most surveyed did not indicate a preference for automated renewal support, as this would likely shift control over customers to the carrier and could inhibit their ability to shop accounts annually for lower premiums, higher coverage, or greater compensation.

Since transactional AB respondents tended to show little interest in providing services beyond risk transfer, getting new business leads and referrals as well as data on cross-selling and upselling opportunities were their top two data-sharing priorities. “Curate cutting-edge AI-based pricing models that help us understand the needs of the customer and provide a plan that best suits them,” suggested one transactional AB surveyed. Getting regular updates on progress towards producer incentives and quota bonuses also ranked much higher for this AB group than for the other two relationship types.

One area where carriers might consider playing a more active role is in M&A facilitation. Since transactional respondents tended to come from smaller agencies, many such ABs may lack the resources to be more than insurance distributors. To become full-fledged risk managers and upsell into higher middle-market realms, acquiring other agencies (or selling their agency to other firms) could add the desired size and scale, as well as bring in new markets and capabilities.

Helping ABs identify potential acquisition targets (or facilitating contacts with agencies possibly interested in acquiring their firm) could solidify relationships with matchmaking carriers for combined ABs. While such M&A support isn’t commonly provided today, 58% of transactional respondents rated carrier help in this area as very desirable, trailing aid only in scaling and growing their business, both of which could be accomplished more quickly with M&As.

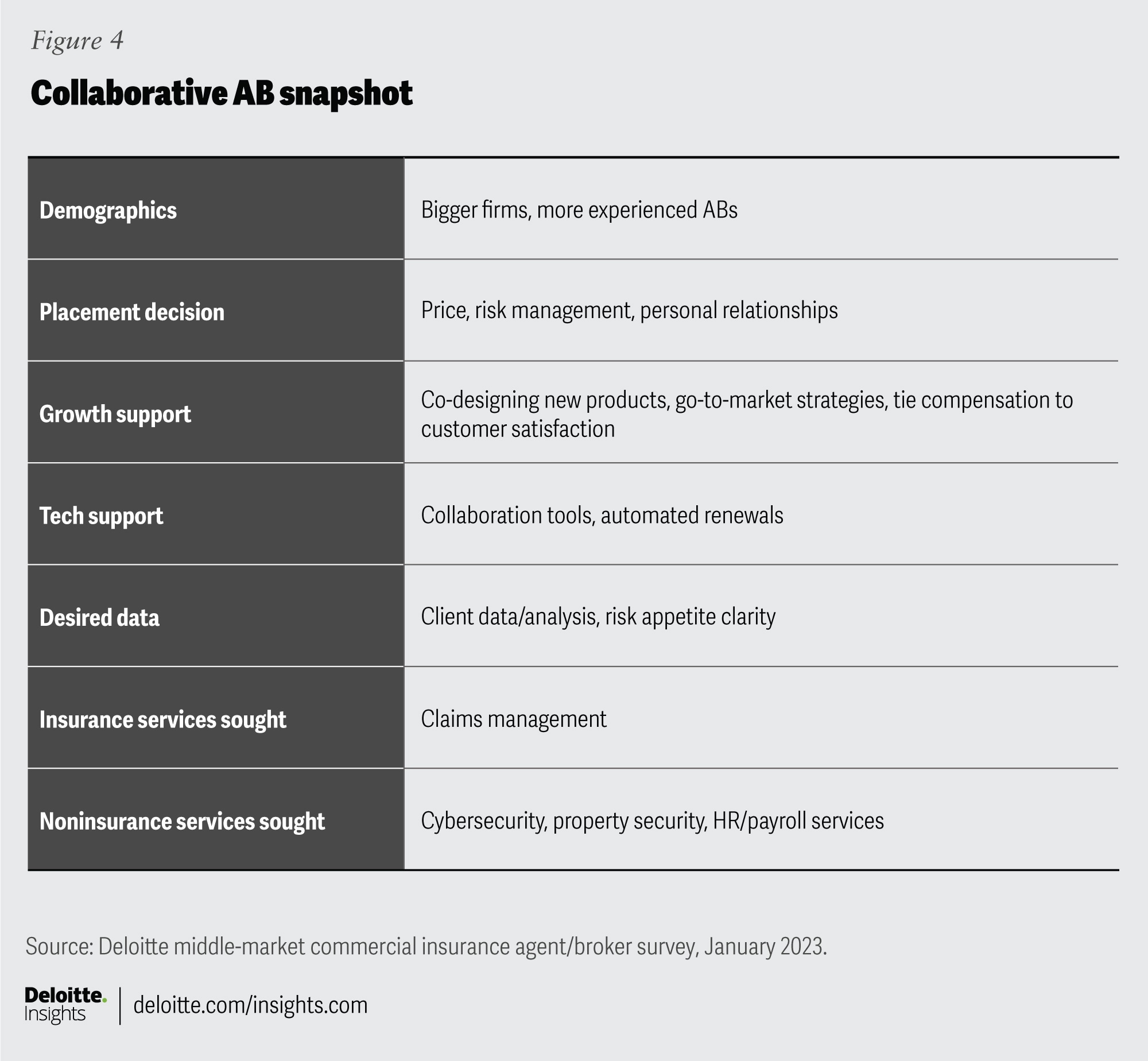

Collaborative respondents define the beginning of a true partnership. They are likely to be more stable producers, turning over their accounts to new carriers less frequently, which should lower acquisition and retention costs. Indeed, nearly twice as high a percentage of collaborative versus transactional respondents said compensation should be based on retention rates.

While price continues to rule as a decision point, they also tend to place high priority on client service in risk management (ranked second) and claims management (ranked third), providing opportunities for carrier differentiation beyond the price of a policy.

Collaborative respondents also tended to place a higher value on personal relationships with carrier personnel, while seeking involvement in codesigning new products and go-to-market strategies. Indeed, one collaborative respondent said they preferred carriers that would “engage with agents to hear ideas.”

Their emphasis on customer-centricity is reflected by a strong desire to see client satisfaction levels be included as a significant compensation factor. Collaborative respondents also indicated they would appreciate more carrier support in providing enabling technology to improve customer service—such as collaboration tools to negotiate coverage and pricing. Automating the policy renewal process was also cited as a top-five priority, which indicates collaborative ABs are less likely to shop their accounts annually and are seeking to reduce cycle time. “Provide a better-equipped management system that incorporates technically advanced data, swift claims processing, and a simple renewal application procedure,” suggested one respondent.

An example of this approach in action is AXA, which looked to strengthen relationships with middle-market ABs by establishing AXA Vantage, offering access to “business resilience managers” for risk management advice, claims support, and value-added services via “AXA-approved partners” and digital tools.8

Collaborative ABs will likely exhibit a different mindset from transactional competitors by tending to view placement of insurance as one part of a comprehensive risk management service rather than just a commoditized transaction. Risk management services provide more client touchpoints and bolster overall account value, making a transactional AB more of a holistic risk manager than pure policy peddler. Offering or helping to arrange loss control services—such as preventative cybersecurity and crisis management support after a hacker attack, or business continuity planning and aid to get a customer back up and running following a fire or natural disaster—could be game changers for carrier-AB collaboration in competing beyond the price of a policy.

Carriers seeking collaborative relationships should therefore look to offer more overarching loss control and recovery propositions, with insurance merely one part of a comprehensive risk management package.

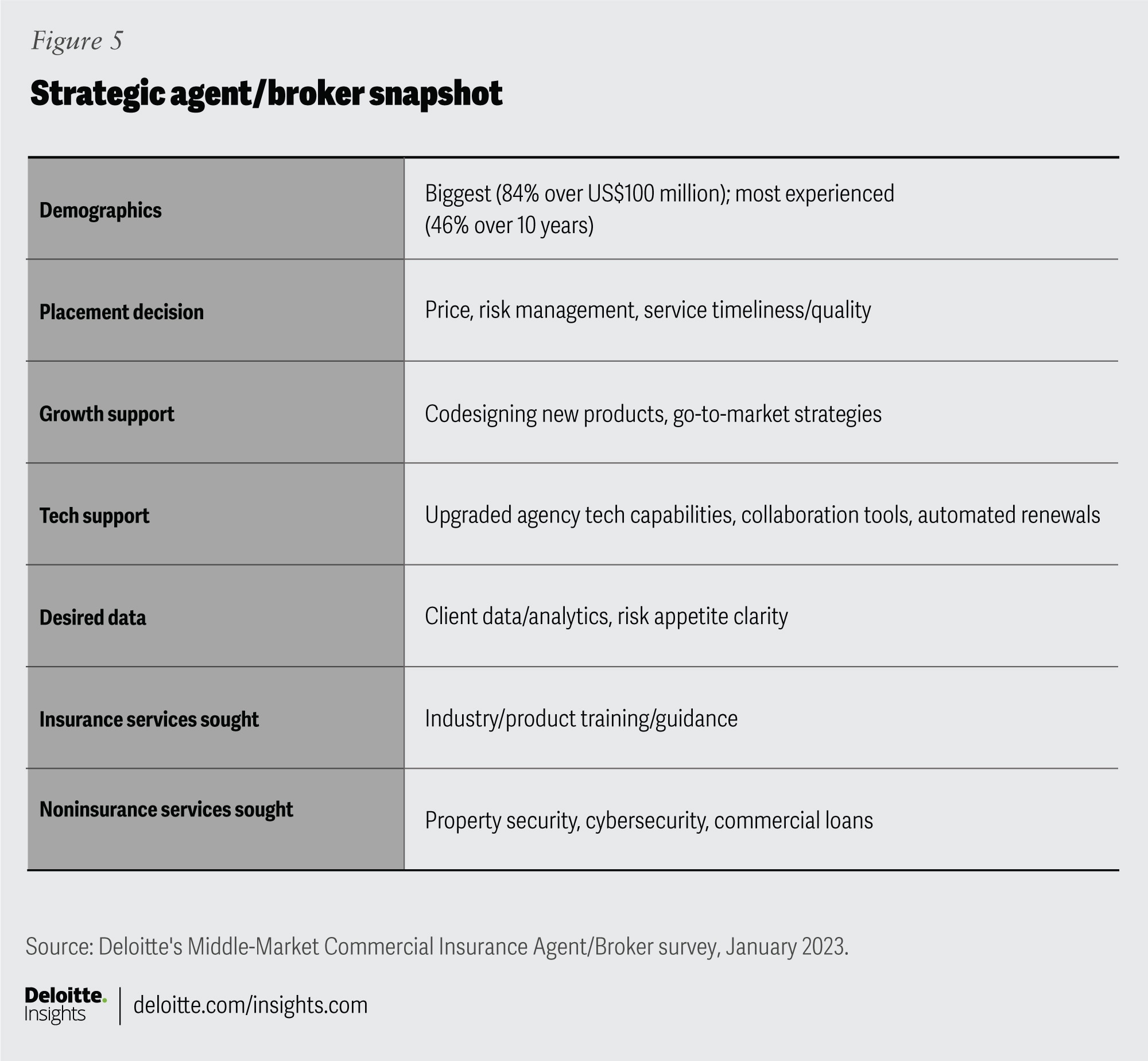

Strategic respondents represent the apex of the carrier-AB relationship for those seeking longer-term, wider-ranging engagements. “We are in the business of partnerships and not in the business of transactions,” noted one respondent. Strategic ABs are generally aligned with their main carriers in seeking mutually beneficial partnerships that can grow and remain sustainable over multiple years, bringing positive outcomes to the policyholders and communities they serve.

Our survey showed that strategic ABs and their insurers are more likely to put a premium on customer-centricity. The pair therefore tend to develop deeper ties to one another to jointly support target client segments. Ideally, this alignment in goals and approach should create stronger incentives and lay the foundation for innovation in risk management and other adjacent, value-added services. Not every AB has the strategic vision, appetite, or resources to achieve these goals, but those who do could yield sustained production, growth, and retention benefits for a carrier partner looking to coinvest in the strategic relationship.

Strategic respondents tended to be hungrier for information from carriers about the latest industry developments, outlook, and product offerings. One example of how carriers might meet this demand is Nationwide’s “Agency Forward®” website, which provides insights on a wide range of topics concerning commercial lines risks and trends.9

Strategic ABs surveyed were generally keen to bundle noninsurance services as part of their value proposition to customers—such as support in cybersecurity, business continuity, and even helping to arrange financing of loans.

Strategic respondents sought more transparency from carriers, especially about their risk appetite (which ranked No.1 as an information priority), while prioritizing online-collaboration tools to facilitate negotiations with carriers (which ranked second as a preferred functionality). They also placed a high value on personal relationships with carriers and seek concierge-level service to support them. As one respondent highlighted, “Carriers should have a team of professionals headed by a relationship manager to ensure proper communication with agents and brokers on changes in coverages, market shifts, and new business models/strategies.”

Chubb, for example, provides several digital-service options, including sales support (such as a commercial business-valuation tool and an online learning center) as well as the ability to interface with an AB’s agency management system to handle information across different carriers in one central location.10 This latter point on interoperability should resonate with most ABs—since while the vast majority of respondents across relationship segments were generally satisfied with their carrier portals, half cited the lack of standardization in interfacing with multiple carriers to be a major problem.

Steps to consider in reinventing middle-market distribution strategies

Taking into account the differing preferences and priorities of the three types of AB-carrier relationships outlined here, how might an insurer’s leadership assess the adequacy of their distribution force in meeting their goals, and determine what changes should be made to maximize growth, retention, and profitability in the volatile middle market? Figure 6 outlines steps carriers could consider in revamping how it gets products to market.

Reassess distribution makeup: Carriers should evaluate the current state of their distribution force, in terms of what percentage of production is generated from transactional ABs, versus collaborative and strategic. Does this mix align with their short- and long-term sales and market share goals in specific lines and geographic regions? If not, where might adjustments be made? For instance, carriers looking to lessen price-driven turnover should avoid having their distribution mix lopsided toward transactional distributors. Yet, transactional ABs may be far more valuable to newcomers seeking to buy their way into a particular market by underpricing the competition, at least in the short term. Rationalizing a carrier’s distribution portfolio can also yield savings on licensing and administrative expenses for low-producing transactional agencies.

Reset relationship mix: Once a preferred distribution-force ratio is determined, carriers should be looking to nurture relationships with the types of ABs with whom they wish to develop long-term partnerships. Carriers seeking to optimize their relationship mix should identify which transactional ABs might have the potential to become collaboratives, and which collaboratives could be upgraded to strategics.

Determine differentiation levers: Whether a carrier is trying to maintain or alter its producer mix, tailored approaches to establish and sustain longer-term partnerships may be called for, since each relationship type has its own set of preferences and priorities. Retention incentives could be raised, for example, to convince transactional ABs to keep more business in place. Greater data-sharing along with value-added risk management services could attract and retain more collaborative ABs. Providing leading ABs with a seat at the table to discuss product development and go-to-market plans could help impress strategic distributors.

Alter processes, while demonstrating commitment: To become more committed partners with their preferred ABs, carriers could consider altering how they deal with distributors in both day-to-day interactions and long-term planning. A logical starting place might be to appoint relationship managers for collaborative ABs, with concierge-level attention provided to current and potential strategic partners. If transactional ABs are the prime target of a carrier’s distribution strategy, more data-driven insights on leads and referrals for prospecting, cross-selling, and upselling could be a compelling value proposition.

Commitment can also be demonstrated by providing greater clarity to ABs on a carrier’s sales goals, target markets, and risk appetite—a point that ranked high among nearly all those surveyed regardless of their relationship segment. This resonated with one carrier-distribution leader we interviewed, who said the lack of such clarity has resulted in “tremendous submission inefficiency,” with thousands of coverage applications rejected out of hand because they were not among the carrier’s preferred targets. “Our cost of acquisition is too high, and one way to lower it is being better at communicating what kinds of business we actually want to write and at what price range,” this interviewee noted.

Establish ongoing feedback loop: Finally, carriers could establish ongoing communication both internally (to make sure leaders of various business lines and operational functions are aware and on board with evolving distribution strategies) and externally (to get regular input from ABs and make them part of the decision-making process, emphasizing collaboration and partnership). Along those lines, carriers could consider establishing a distribution council, with key ABs and carrier leaders as members. Such feedback could help flag areas of concern—such as a problematic product or go-to-market initiative that should be tweaked or dropped.

While appointing relationship managers could help facilitate greater communication and quicken response time to any issues raised, strategic and higher-level collaborative ABs should have access to a wider range of carrier contacts. Munich Re, for instance, looks to offer a “holistic” broker-centric experience by connecting ABs with a broad range of individuals at the carrier involved with insurance and risk management services, or those with specialized product and industry expertise, rather than perpetuating a siloed approach with AB contact limited to assigned underwriters.11

The ultimate barometer of success for a carrier’s AB strategy should be influenced by return on investment. Not every insurer has access to investment funding to enable and cultivate the relationships targeted in their strategy. Carriers should take a pragmatic approach in understanding which types of relationships are worthy of limited investment budgets and set their strategy, enablement, and data-sharing agendas accordingly.

Depending on a carrier’s strategy, many may consider a balanced approach to near-term and long-term planning by cultivating long-standing relationships with strategic ABs that can yield significant distribution production over the course of many years, while attracting and optimizing the production results they can achieve from transactional ABs in markets where their product lines are competitive.

Forging the carrier-agent/broker partnership of the future

The insurance landscape is rapidly evolving, thanks to the development of alternative data sources (such as sensors in buildings, vehicles, and wearables) as well as emerging technology to help make new information streams actionable (such as segmentation algorithms). In increasingly commoditized small-business insurance, advancements in robotic process automation and artificial intelligence are making it easier to bypass purely transactional ABs, helping drive growth in direct-to-consumer sales by carriers and self-service options for policyholders.12

Middle-market commercial accounts, however, should remain impervious to widespread disintermediation for the foreseeable future, given the size and complexity of the risks facing companies generating up to US$1 billion in revenue. The challenge for carriers looking to enter, grow, or at least maintain market share in this increasingly competitive market will therefore likely be in finding ways to strengthen relationships with the ABs who often serve as full-service risk managers rather than simply placing insurance for such clients.

To accomplish this, many carriers will likely have to offer more than just a competitive price quote to attract and retain middle-market business—at least for those looking beyond any purely transactional business they conduct, which is often volatile and expensive to maintain. Having a wide range of risk management and noninsurance services in their repertoire could drive more business their way for collaborative and strategic ABs, while attracting more loss-control-oriented accounts that could translate into lower frequency and severity of claims.

A major differentiator for many carriers, however, is likely to be a better understanding of what motivates different kinds of ABs serving the middle market, and being prepared to fulfill the preferences and priorities of each relationship segment. Such points of distinction should become increasingly important as the middle-market distribution force continues to consolidate and evolve, prompting more carriers to be asked what they are doing to earn the business generated by the most productive and profitable ABs of all types.

Table of contents

- Key Takeaway

- Factors for insurers to consider when reexamine distribution strategies

- Not all ABs may have equal value or potential for carriers

- AB preferences and priorities differ depending on their relationship profile

- Steps to consider in reinventing middle-market distribution strategies

- Forging the carrier-agent/broker partnership of the future

- Deloitte services