2026 commercial real estate outlook

The opportunities are real—if you know where to look

To what extent could macroeconomic volatility and policy uncertainty impact the pace of the commercial real estate recovery?

Is now the moment to recommit to the property market comeback?

Where does upside exist within a bifurcated CRE loan market?

How can strategic partnerships expand access to CRE capital and diversify investment channels?

Are CRE organizations investing in AI progress, or just paying for promise?

Read on to find out.

Macroeconomic volatility and policy uncertainty may put the CRE industry recovery on pause, but not for good

In last year’s commercial real estate outlook, we anticipated that 2025 could mark a recovery for the global CRE industry—buoyed by an expected return of deal activity, more favorable lending terms, greater industry collaboration, and advances in artificial intelligence. As we write a year later, it hasn’t exactly played out that way, largely due to an unpredictable global macro environment, which may affect how soon, and to what degree, the industry could fully recover in the next 12 to 18 months.

Trade and regulatory uncertainties have complicated decision-making, prompting some leaders in the CRE industry to rethink their approach. We do not expect this to abate any time soon as trade negotiations and legal challenges continue. That said, opportunities for growth likely exist—for those who understand the industry’s geographic, asset, and macro-level nuances, and remain agile and forward-thinking.

Navigating a pause in the recovery

Results from Deloitte’s 2026 commercial real estate outlook survey help us confirm what macroeconomic conditions are likely of most concern to global owners, investors, and the CRE industry overall, as well as how they think their businesses, strategies, and technologies might be impacted. The survey collected input from over 850 global chief executives and their direct reports at major real estate owner and investor organizations across 13 countries (see methodology).

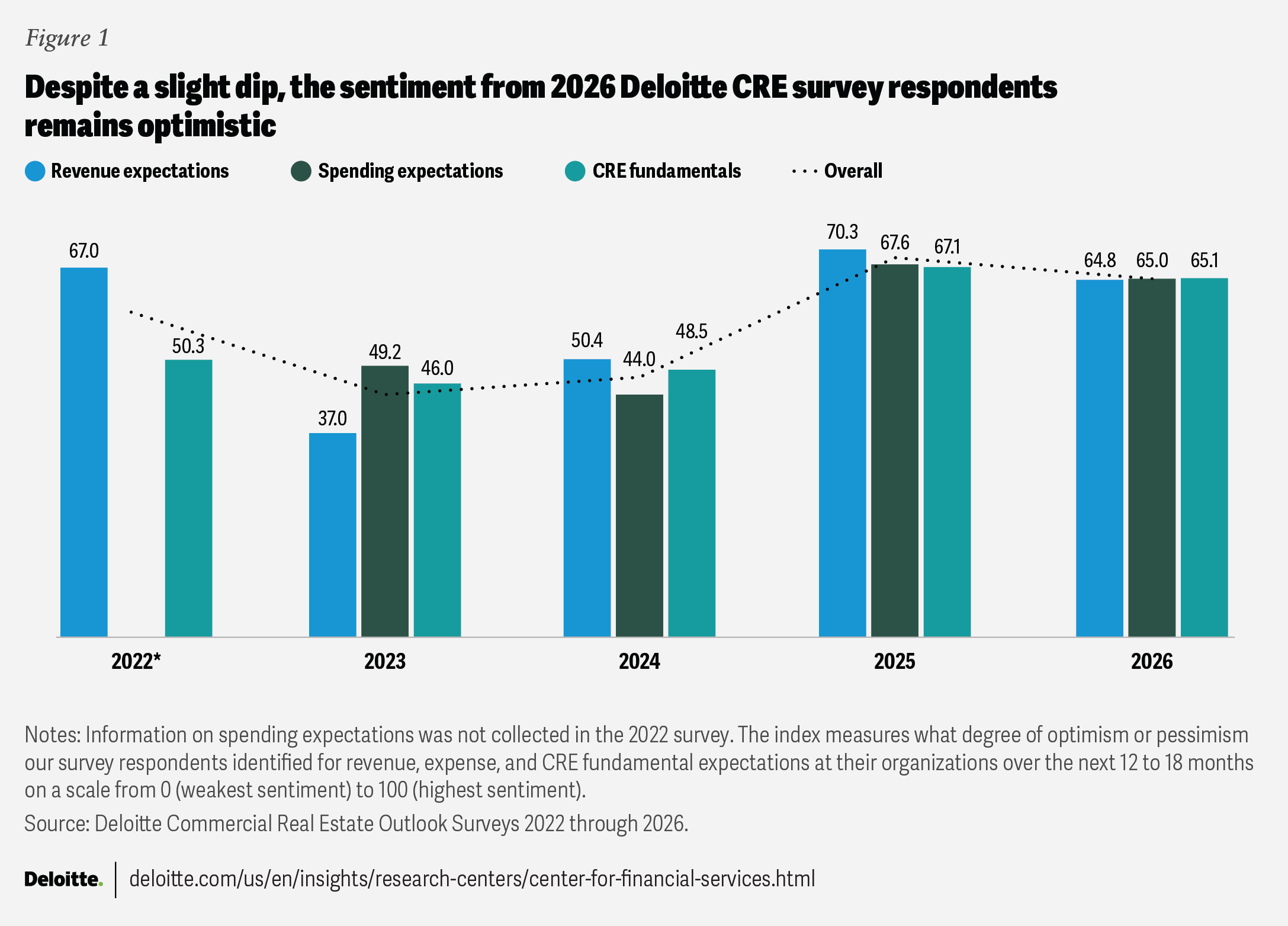

When asked how our survey respondents expect their revenues and expenses to change for the coming 12 to 18 months, there was a slight pullback in optimism from last year’s survey. Eighty-three percent of our respondents expect their revenues to improve by the end of the year compared with 88% last year. And across all surveyed spending areas, including operations, office space, and technology, fewer respondents plan to increase spending (down 5%), while more expect to keep spending flat (up 8%). Still, 68% anticipate higher expenses this year.

We noticed a similar pattern around expectations for CRE fundamentals. Many respondents still expect all conditions surveyed, like rental rates, leasing activity, vacancies, and cost of capital, to improve through 2026 (65%), compared with last year (68%). Despite macroeconomic uncertainties, CRE fundamentals don’t change overnight, and growth is still expected across most asset classes and most geographies.

Overall, for business and industry expectations, this year’s CRE outlook sentiment index (figure 1) scored 65—well above the 2023 trough (44), but just below last year’s high (68), indicating that optimism persists.

Table of contents

- Macroeconomic and policy uncertainty may pause CRE’s recovery, but not for good

- Selective, flexible capital commitments key as early-mover advantages wane

- Fresh capital and lender activity could boost CRE debt markets despite ongoing distress

- CRE investors turning to alliances to leverage partner know-how

- Turning AI promise into success likely requires reliable data and application readiness

- The opportunities are real

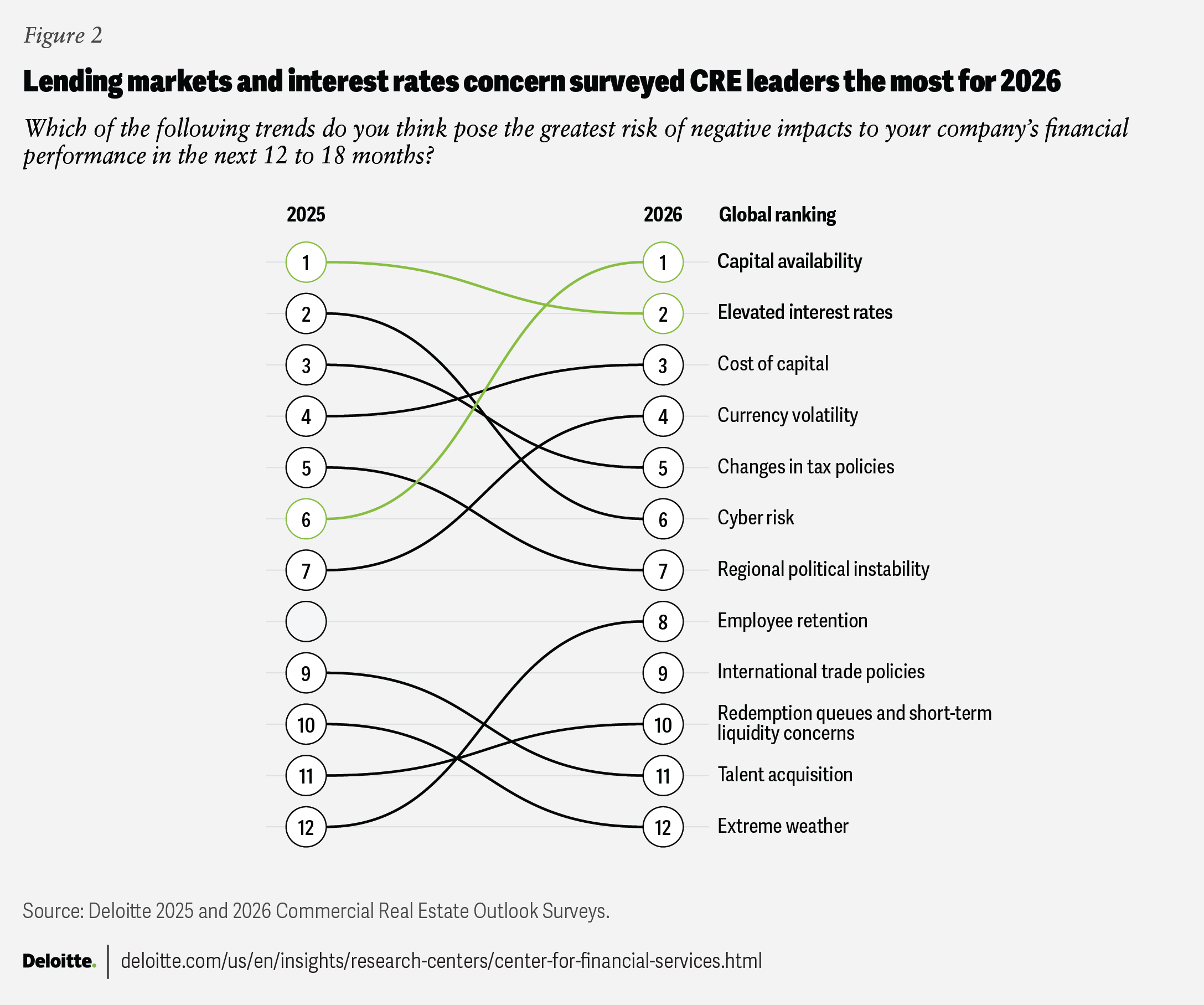

Sustained optimism is not without some hesitations, though. When asked about what macroeconomic trends could most negatively impact their financial performance for the next 12 to 18 months, respondents identified capital availability, elevated interest rates, cost of capital, currency volatility, and changes in tax policy most often (figure 2). Interestingly, cyber risk as a concern declined significantly among respondents from a score of two last year to six this year. It is also noteworthy that respondents’ worries increased about employee retention, which went up to score eight this year, from 12 last year.

The top three responses pull on common threads—capital availability, elevated interest rates, and cost of capital are all likely tied to concerns around accessing CRE debt markets, coupled with interest rates that are still perceived to be higher for longer—a recurring theme from last year’s survey. Though as of the September meeting of the US Federal Reserve, interest rates were cut for the first time in nine months by a quarter of a percentage point, with indications there could be two more rate cuts by the end of 2025.1

Changes in tax policy resurfaced as one of respondents’ top five concerns for the second consecutive year. We estimate this remained elevated again due to anticipation surrounding recent US tax proposals, such as Section 899, which—while ultimately not enacted when legislation was signed into law on July 4, during the time of survey fielding—would have increased rates on foreign investment into the United States.2 Uncertainty around the future of the Pillar Two regime could also be a factor.

Lower in the results was a new entry to this year’s response options—international trade policies—which ranked ninth globally but was the fifth-biggest concern for Asia-Pacific respondents. While international trade headlines have likely been a factor behind economic uncertainty, CRE leaders from our survey are seemingly less concerned with its potential impact to their financial conditions for 2026. This may be, in part, due to global owners and investors coming to expect a more volatile trade environment after initial discussions, as well as some regions and asset classes around the globe being relatively sheltered from international trade risk due to shifts in structural trends, such as European multifamily properties3 or the Japanese health care sector.4

Selective, flexible capital commitments could determine success in the property market comeback as early-mover advantages appear to wane

Increasing global investment returns and volumes may indicate the pendulum has swung

The commercial real estate property markets have seemingly turned a corner on recent performance downturns. Globally, investment volume declines reduced for six consecutive quarters, and in the first quarter of 2025, notched the first year-over-year increase since mid-2022.5 Through late June, the one-year total return for the S&P Global property index (14.1%), a measure of the global investable universe of publicly traded property companies, outpaced both the S&P 500 (11.7%) and the S&P World equities index (13.8%). And for private real estate, following two years of negative results, total returns have been positive for three consecutive quarters.6

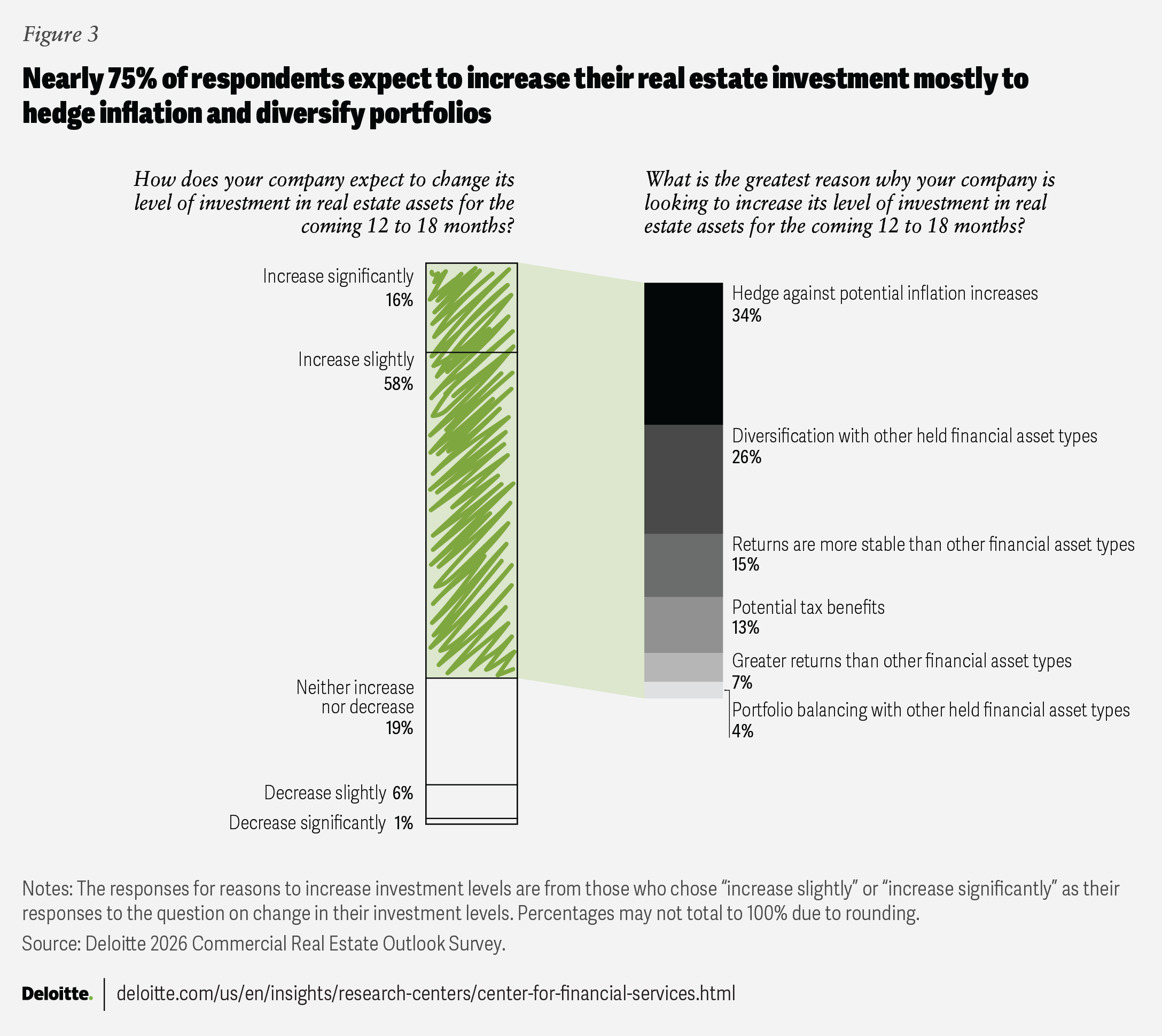

Our survey results indicate that many leaders still see CRE as a potential safe investment, given its performance during similar periods of uncertainty in the past. Nearly 75% of global respondents still plan to increase their investment levels in real estate assets over the next 12 to 18 months, with most doing so for benefits such as the investment acting as a potential hedge against inflation (34%), greater diversification with other financial asset types (26%), stability as an asset class (15%), and for potential tax benefits (14%) (figure 3).

The United States remains a top investment market for 2026, but investors are also looking elsewhere

Through the end of June 2025, property sales activity in the Americas remained on the recovery trajectory that began at the end of last year—up 12% year over year.7 European markets were likely more heavily impacted by shifts in bond rates and trade policy, dropping by 15% annually.8 Sales declines in Asia Pacific have been the largest year to date, dropping 27% compared to last year. The pipeline of potential deal closings in the region also shrank in the wake of increasing trade uncertainty.9

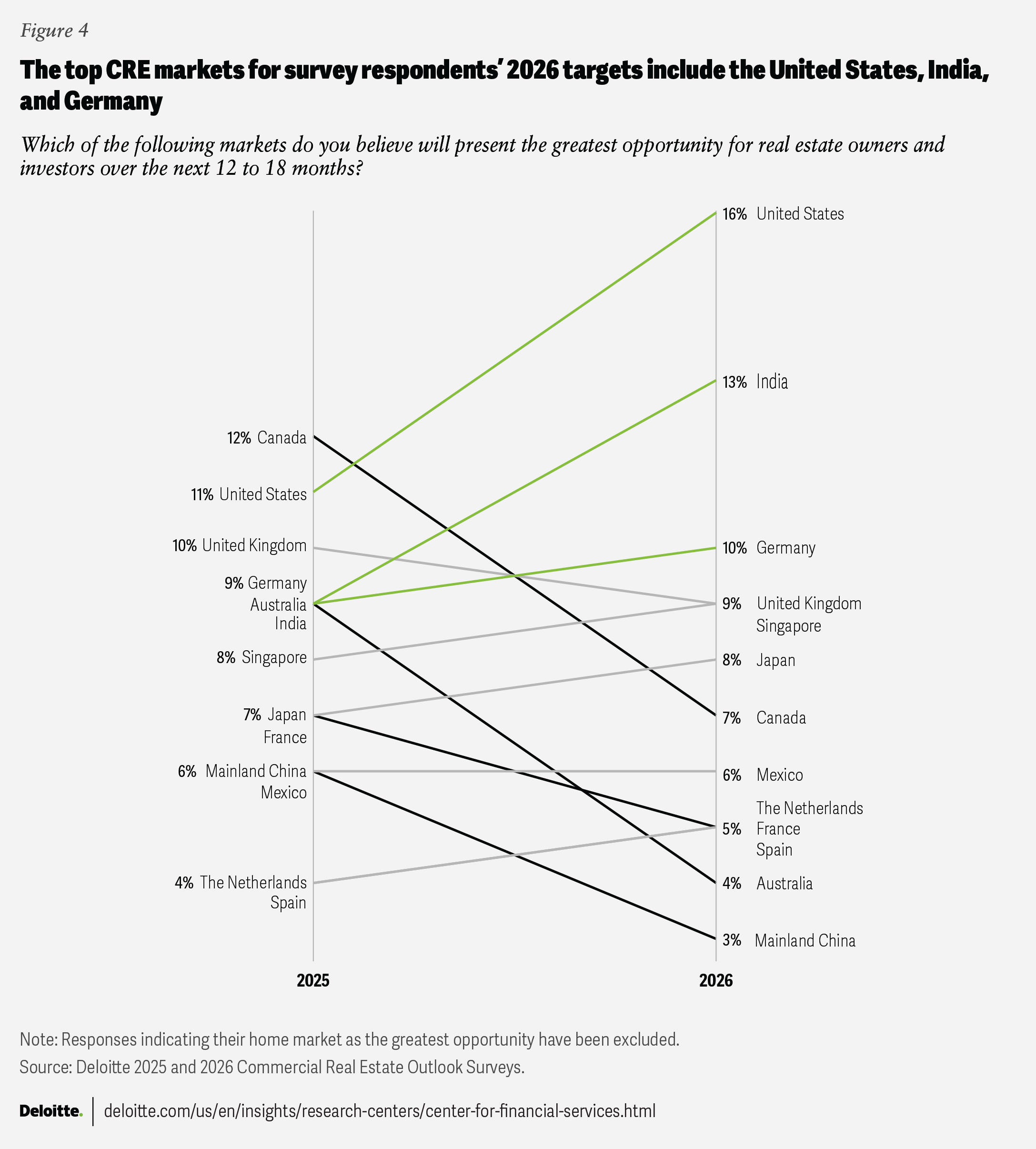

The top targets for our survey respondents (when excluding their own domestic region) include India, Germany, the United Kingdom, and Singapore (figure 4). However, the United States remains a preferred investment market for 16% of our respondents, up from 11% last year, at least in the near term.

Despite inbound capital dipping in recent quarters, the United States remains the top source of outbound global investment capital, with activity in the first quarter of 2025 returning numbers slightly ahead of the five-year average.10 This trend could strengthen in 2025 and 2026, as US asset managers have ample dry powder11—property sales are up year over year, and a new executive order could allow individual retirement accounts to invest in private markets, potentially unlocking US$12 trillion in capital.12 Globally, 75% of European and Asia-Pacific respondents expect to increase real estate investment in the next 18 months, especially in India (86%), Canada (80%), and France (78%).

Global fundraising through early 2025 is also on track to surpass totals in the previous two years.13 Notably, private credit strategies have drawn significant fundraising interest, accounting for a third of new capital raised.14 With relatively high interest rates and debt set to mature in the next few years, investors and asset managers may look to capitalize on emerging opportunities in the real estate debt markets.

Property fundamental expectations appear positive but nuanced

Respondents’ expectations for next year’s property sector fundamentals were wide-ranging. Most global respondents expect improvements in CRE leasing, transactions, and debt, though deeper analysis shows variation by geography and specialty.

European respondents expressed the most optimism, with about 70% expecting improvements in leasing, capital markets, and lending. In North America, 25% expect conditions like rent growth, vacancies, and cost of capital to remain flat year over year—reflecting a more neutral outlook. Asia-Pacific respondents appear more cautious this year: Sixty-three percent expect fundamentals to improve in 2026, but 19% and 20% foresee worsening cost of capital and capital availability, respectively.

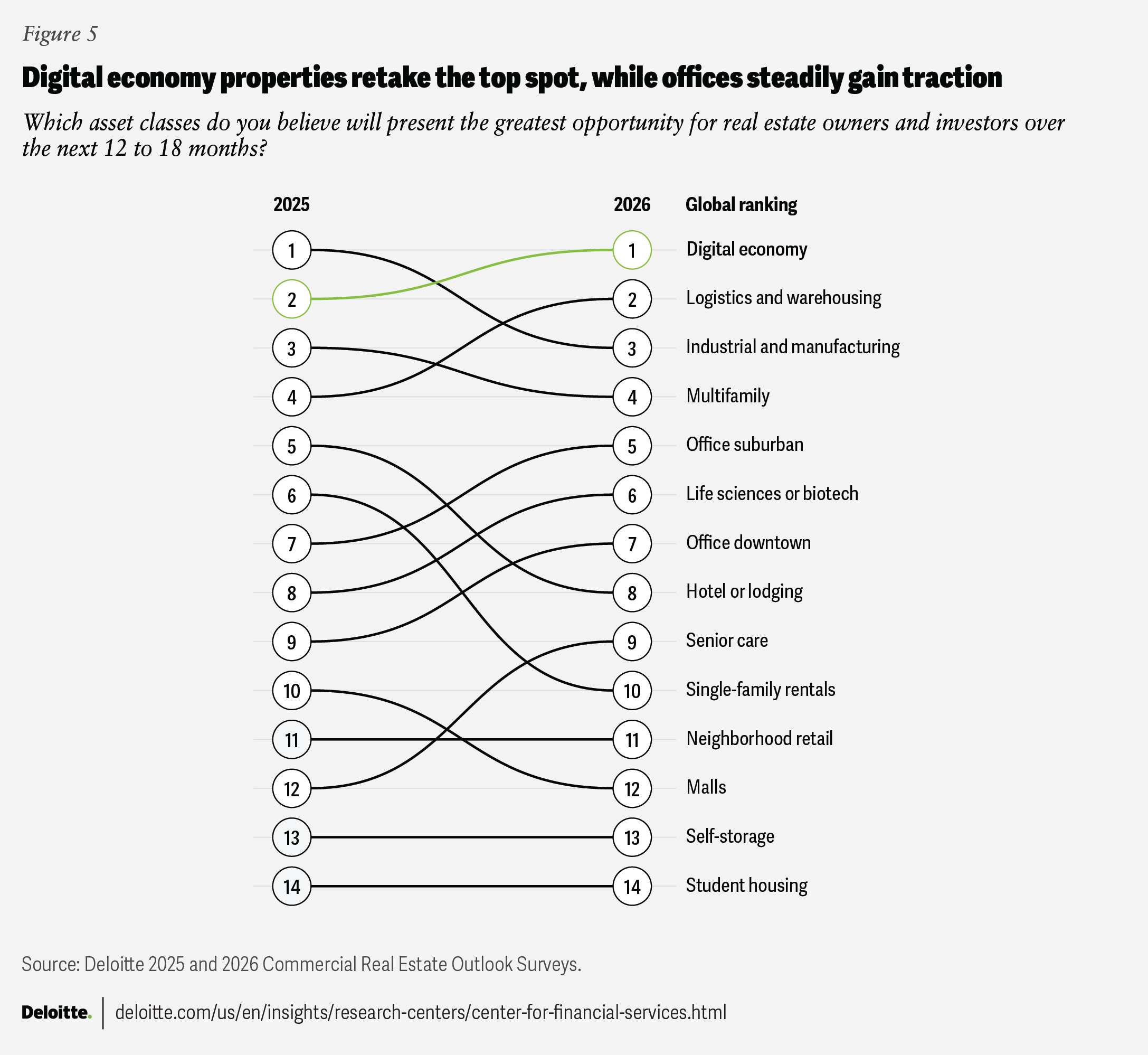

Asset class rankings for the next 12 to 18 months were stable, with no property type moving up or down more than four ranks year over year. Digital economy properties, which include data centers and cell towers, retook the top spot after yielding it to the logistics/warehousing sector last year (figure 5).

Both suburban and downtown offices regained some favor among survey respondents after falling to seventh and 10th positions two years ago (see “Select sector spotlight” for details).

Select sector spotlight

Data centers remain a top-two property type for opportunity in four of our past five annual outlooks. Demand for data center locations exceeds supply, with fierce competition for space, and are often leased before completion.15 In nine major global markets, 100% of the new construction pipeline is already pre-committed.16 As power constraints may limit growth in some key areas, new markets like Central Washington,17 Berlin,18 and Singapore are emerging owing to advantages such as favorable power costs (Central Washington), available land (Berlin), and established connectivity and infrastructure (Singapore).

Meanwhile, the industrial sector may be nearing an inflection point in the real estate market cycle. The pace of leasing activity has slowed slightly—potentially impacted in part by short-term trade uncertainties as users reassess global supply chain routes.19 However, structural demand patterns for industrial facilities should support measured long-term growth and users seeking specific needs have established a robust built-to-suit development pipeline.20 The continued trend of onshoring and nearshoring of high-value manufacturing is likely to continue and increase demand for specialized manufacturing facilities and advanced logistics.21 As organizations seek flexibility in their supply chains, short-term overspill space for rerouted shipments may shift traditional logistics facility demand patterns.

The office sector appears to be rebounding, with both suburban and downtown office types increasing in our property sector rankings for the second consecutive year. Owner and investor interest appears up, likely driven by progress in office-reentry programs and record-low new construction, which can help make prime office space more highly sought after.

Actionable guidance to consider

- The early-mover advantage may be nearing an end. CRE leaders should stay attuned to a potentially improving capital markets climate and be ready to act with conviction before the rest of the market is ready to come back to the table. After a seemingly sluggish 2024, there are indications that markets are stirring back to life. By late 2025, high-quality assets with stabilized income could attract more bidders than in recent years as financial conditions may gradually turn the corner on recent underperformance.

- Maintain agility, flexibility, and selectivity in capital allocation decisions. Leaders should avoid short-term reactions but instead act decisively based on medium- to long-term convictions. Practically, this could mean conducting regular portfolio reviews backed by data-driven insights and being prepared to rebalance holdings to property sectors or locations insulated from near-term headwinds—capturing upside in growing segments while cushioning for unforeseen downturns.

- Consider alternatives or sub-asset types that could be best positioned for a lower-growth environment. Outside of the core four (office, retail, industrial, and multifamily), sectors like health care, grocery-anchored retail, and housing stay in demand even in downturns, likely attracting tough competition.22 A shift toward alternative or nontraditional property types appears already underway, particularly for properties in the telecommunications, health care, and data center subtypes. The value of alternative property types in commercial portfolios has grown by 10% annually since 2000.23 We expect this shift to accelerate over the next decade.24

Upside may be on the horizon as renewed capital and the return of traditional lenders help breathe life into CRE debt markets, even as distress persists

Looking ahead, CRE lending seems to be a tale of two markets: existing loans are often stressed by refinancing and defaults, while new loans often come with better terms and valuations. For leaders, success will likely depend on how well they mitigate loan risk within their existing portfolios while also taking advantage of improved new-loan conditions.

Pressure on legacy loans

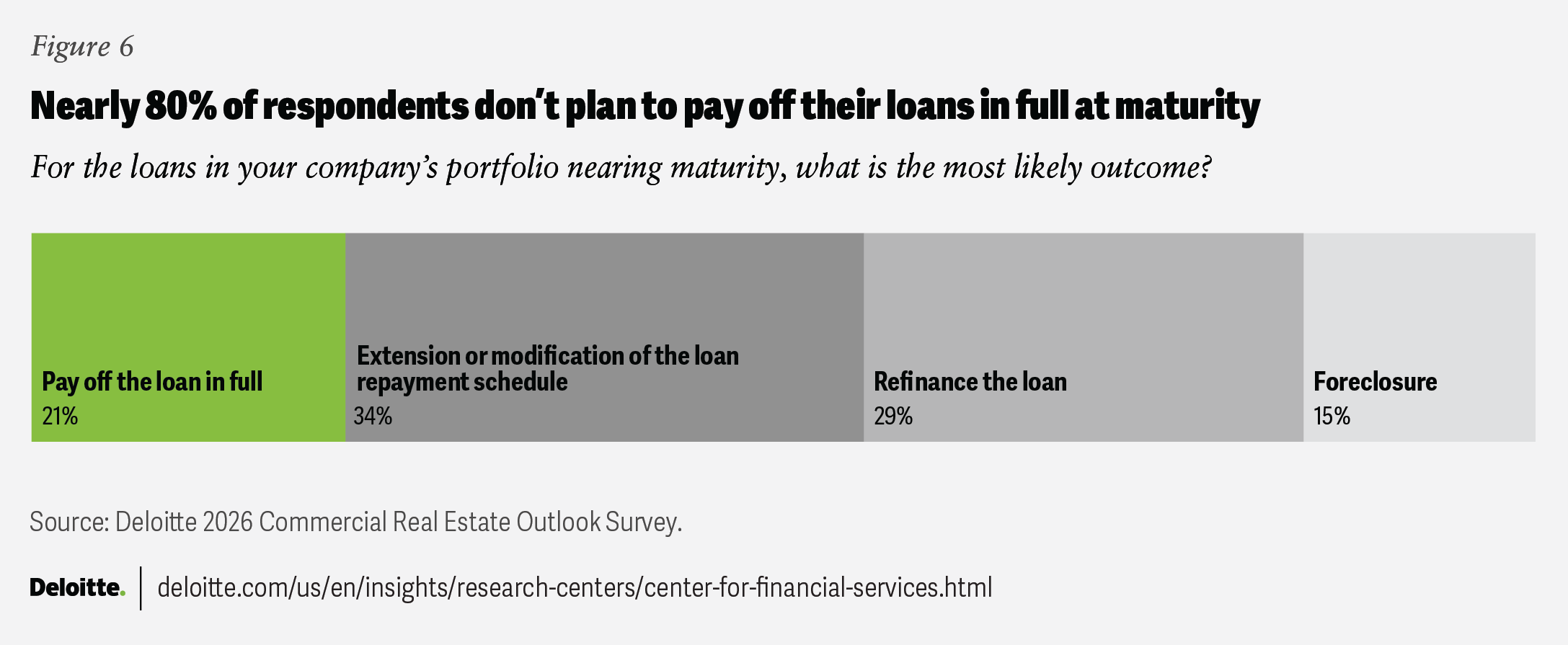

The commercial real estate industry has likely not yet reached the summit of the loan-maturity mountain. Over 50% of respondents report that their companies are facing property loan maturity in the coming year. In the United States, there are over US$1.7 trillion in commercial mortgages—many already delayed through “extend-and-pretend” deals that simply push out due dates.25 Whether those proceedings end with the property reverting to the lender is uncertain, as lenders have been as interested as their borrowers to seek out loan resolutions.26 Only 21% of respondents expect to be able to pay off their upcoming maturity in full—led by leaders at housing (26%) and retail-focused organizations (24%) (figure 6).

Shorter-term loans that were originated in 2022 comprise the largest portion of those set to mature over the next several years.27 And they were underwritten when the average commercial mortgage rate was as low as 3.9%, at nearly the lowest levels over the past two decades and 270 basis points under the 6.6% rate as of the first quarter of 2025.28 This surge in borrowing costs will likely put pressure on debt-service coverage for many borrowers, especially for loans with floating rates or upcoming resets.

Global CRE refinancing risk is typically concentrated, not widespread. Germany and France have the greatest share among European countries at almost 20% each. Only 6% of UK loans are estimated to face refinancing gaps due to early property-value corrections.29 In Asia Pacific, markets did not experience as extreme a debt-fueled boom as other parts of the world, with the trajectory of interest-rate movement varying by country—Japan’s ultra-low rates have eased refinancing, while Australia’s elevated rates have put lenders under pressure.30

New lending opportunities

Amid the legacy loans turmoil, a brighter story may be emerging for new CRE debt origination. With property values stabilizing and lenders demanding more robust deal structures, new loans are often originating on more manageable terms. Investors and lenders who have fresh capital, unburdened by yesterday’s troubled loans, could have an opportunity to strategically invest in CRE debt markets. Through the beginning of 2025, new loan volume increased by 13% from the end of 2024 and over 90% from the same time last year—a recovery in lending activity to levels not seen since early 2023.31 Commercial mortgage loans spreads also tightened by 183 basis points, enabling sponsors to potentially pursue early refinancings and debt for property purchases.32

Renewed availability of debt capital

Access to debt capital has improved and could become even more robust going forward.33 Property-value resets have helped unlock liquidity, prompting some lenders and borrowers to reengage. All property sectors have seen an increase in active lenders.

Alternative debt sources appear to have been the driving force behind this resurgence. Lenders such as private credit funds or high-net-worth individuals often add to the global pool of available debt capital as they target diversification through high-yielding real estate assets. These sources accounted for 24% of US CRE lending volume last year, exceeding the 10-year average of 14%.34 The global private credit market reached US$238 billion in 2024, and is expected to reach US$400 billion in assets under management (AUM) by the end of the decade.35 As of August 2025, US$585 billion in CRE dry powder is poised for deployment.36

Lenders of all types are often more selective than in previous cycles, targeting stable returns, net operating income growth, and sound property fundamentals for capital preservation. This has heightened competitiveness for high-quality, income-generating assets, likely fostering a more dynamic environment for price discovery.

Some traditional lenders are making a cautious return

Lenders like banks and commercial mortgage-backed securities (CMBS) lenders are cautiously reentering an evolved CRE debt market following a few years of inactivity. CMBS lending recorded a 110% year-over-year jump driven by single-borrower deals through early 2025.37

Banks are often caught between caution and opportunity, offsetting potential losses from legacy loans with yield opportunities from new loan growth.38 This is reflected in the latest Federal Reserve Senior Loan Officer Opinion Survey, with underwriting standards becoming more relaxed compared to the last few years.39 As of June 2025, just 9% of banks are tightening their lending standards as compared with 30.3% in April 2024, and 67.4% in April 2023.40 Reduced tightening of lending standards has been a reliable precursor to capital value improvements in commercial real estate.41 Bank loan loss provisions coming under previous estimates and lower-than-expected net charge-offs both also point toward the improving health of banks’ CRE loan portfolios.42

Lending activity in Europe is also set to grow through the remainder of 2025 and into 2026, with nearly 80% of surveyed lenders planning to boost their loan-origination volumes.43 Moreover, European insurance companies and investment banks are expecting stronger growth in originations, compared to traditional banks.44 About 25% of Asia-Pacific investors increasing their real estate allocation reported doing so to potentially lower debt costs. This measured resurgence appears to be driven by companies wanting to restructure balance sheets, replacing underperforming real estate loans with better-structured, lower-leverage opportunities.45

Actionable guidance to consider

- Proactively manage new financing (and refinancing) opportunities with alternative debt sources. Compared to traditional debt sourcing, commercial real estate owners and investors from our survey plan to work more with private debt (up 4%), private equity (up 2%), and banks (up 2%) for property transaction financing, while potentially dealing less with CMBS lenders (down 10%).

- Reset investment strategies and underwriting assumptions. CRE leaders should recalibrate how they evaluate deals, properties, and their debt strategies; factor in higher financing and exit cap rates in underwriting; and determine if selling and repurposing projects may be wiser than holding.

- Strengthen risk management and transparency. Leaders should stress-test property portfolios for adverse scenarios including interest-rate hikes or further dips in property values; identify which loans or assets would be at greatest risk and have contingency plans; focus on improving the underlying fundamentals of potentially distressed properties; and share plans with lenders and investors on how they plan to recover asset value.

Alliances appear to gain favor among CRE investors looking to tap partner expertise for new opportunities

Real estate asset management appears to be increasingly becoming a scale-driven business, with both asset size and product range likely driving competitiveness. Some leading asset managers are increasingly forging both cross-border and domestic partnerships that span public and private markets as well as active and passive investment strategies. These alliances appear to be broadening capital channels to help tap into a wider array of sources including wealth management platforms, insurance companies, and retail investors.

Partnership structures and joint ventures may be emerging as agile alternatives during this period of elevated interest rates and often challenging conditions for mergers and acquisitions, helping enable firms to pivot between strategies that can better address evolving client demands around liquidity, returns, and risk management. In April 2025, Blackstone, Wellington Management, and Vanguard announced a strategic alliance aimed at developing streamlined multi-asset investment solutions.46 The partnership seeks to seamlessly integrate public and private markets, as well as active and index strategies—an approach that helps underscore a growing appetite for diversification and innovation. While retail investments into private assets may remain in their infancy, such alliances can help democratize access to private market investments and offer new avenues for portfolio diversification.

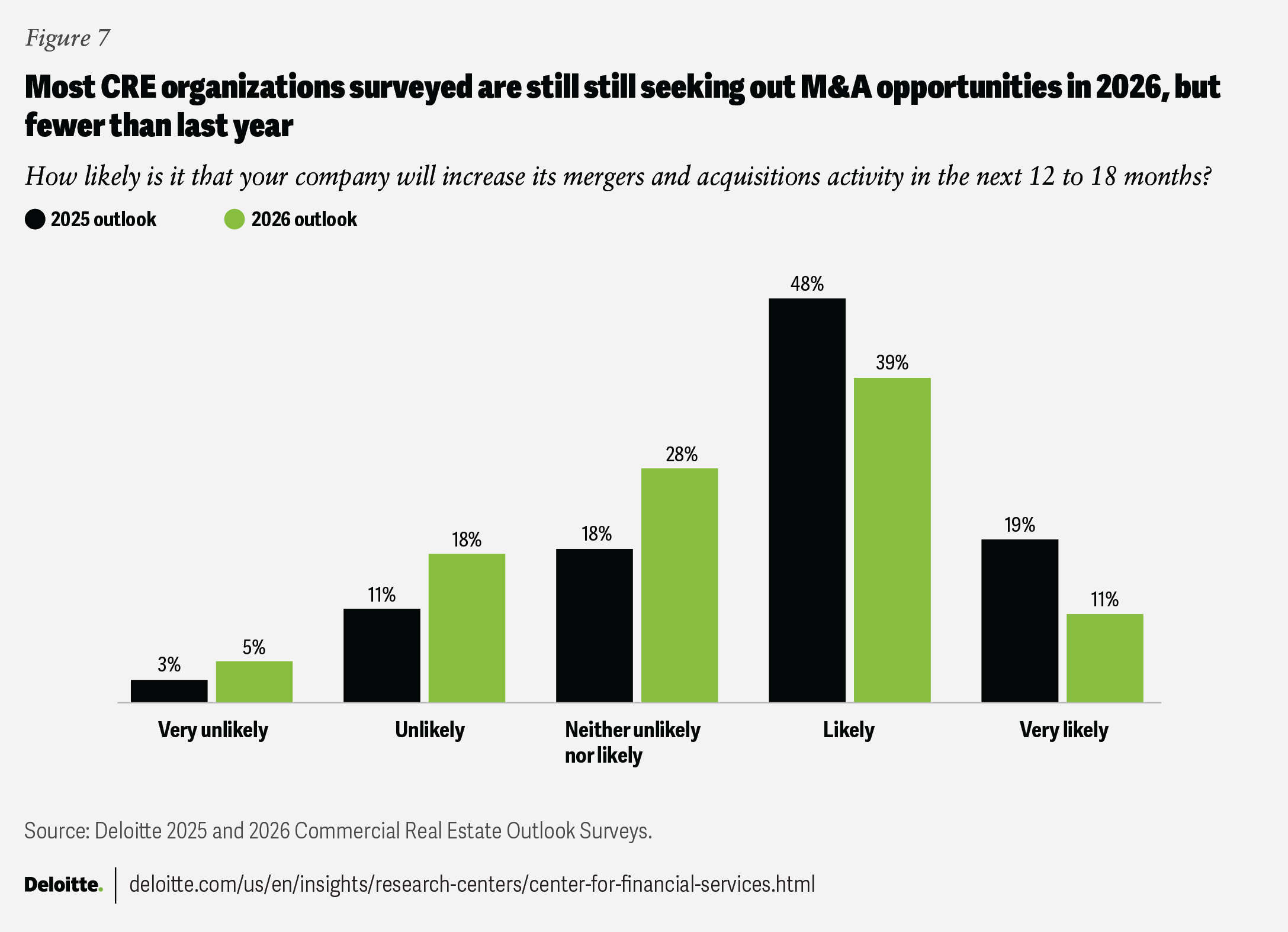

Some investors are increasingly seeking private markets for their growth potential and low correlation with public markets. Structural trends such as low supply in many property types could bolster real estate fundamentals.47 The quest for yield and diversification is likely propelling these partnerships, which can help position them as attractive alternatives to traditional M&A during this period of elevated interest rates. From our survey, 17% fewer respondents than last year plan to increase their M&A activity in 2026 (figure 7).

Some asset managers embrace one-stop solutions

Some lenders appear to be broadening their services across the capital stack and risk spectrum including senior and subordinated debt and preferred equity. While debt or equity specialists remain, the overall trend appears to be shifting toward accessing integrated capabilities and offering them under one, all-encompassing umbrella.

Recent deregulation and reform initiatives could mark a shift in housing policy, moving more toward market-based solutions such as public-private partnerships to help tackle affordability challenges in the housing sector. These reform initiatives often aim to cut construction costs, boost housing supply, and promote higher-density development.48 By streamlining approvals and encouraging private sector participation, local municipalities can potentially unlock opportunities for institutional capital to help finance affordable housing projects.

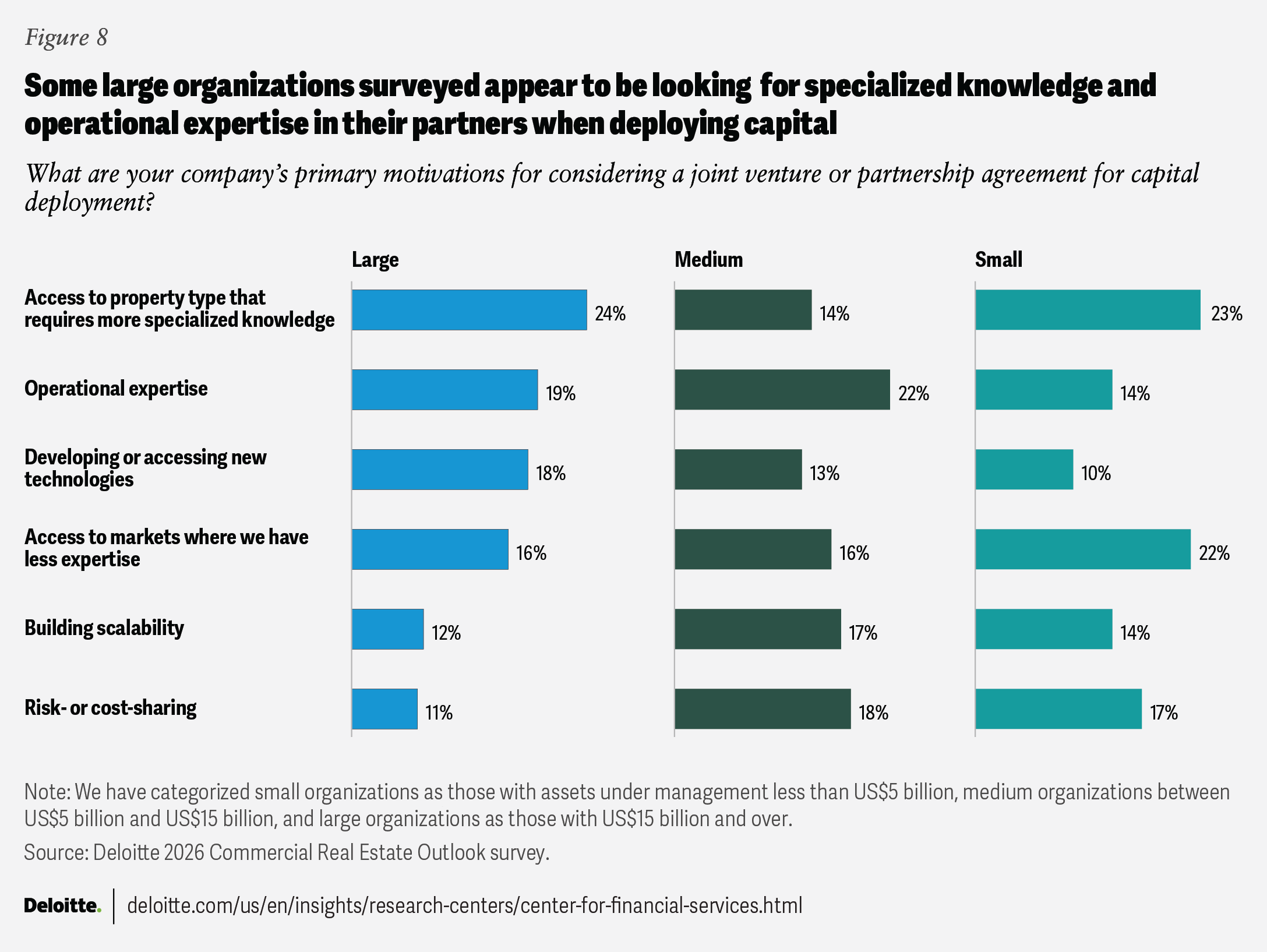

Leaning on operating partners

Some investors are increasingly focusing on operational real estate sectors such as specialized housing and data centers as income level and growth are driving returns.49 This may be especially true for larger organizations. According to our 2026 outlook survey results, for almost 24% of larger organizations with AUM worth over US$15 billion, gaining access to property types that require more specialized knowledge was the primary motivator for considering joint ventures or partnership agreements, while smaller organizations with AUM of less than US$5 billion are also looking for partners to help access new markets (figure 8).

Some investors are seeking equity ownership in local operating partners with specialized knowledge to help enhance execution and achieve greater returns from equity positions. For instance, Ontario Teachers’ Pension Plan partnered with two specialist real estate investment management companies both as a shareholder in the operating companies and as a capital partner for geographic expansion into Europe. Meanwhile, GIC, the Singaporean sovereign wealth fund and the world’s largest investor by capital deployed in real estate, is actively seeking to add to its existing 400 global partners to help deploy capital into new markets and sectors.50

As demand for digital infrastructure surges, some data center operators are forging deeper cross-industry partnerships with energy suppliers and technology firms to help secure reliable power and manage rising costs. Several data center real estate investment trusts (REITs) are actively partnering with energy suppliers to implement hybrid microgrid solutions and are exploring unconventional energy sources such as geothermal, parabolic solar, and on-premise natural gas production.51 Some hyperscalers are bundling microgrid maintenance costs into simplified energy supply agreements and are also looking at energy hedging costs and derivative contracts. For example, data center REIT Equinix has partnered with Bloom Energy for on-premises natural gas generation,52 and some data center developers are even engaging with microgrid developers such as Enchanted Rock and RPower to help accelerate power deployment.53

Some real estate funds are diversifying their limited partner base

Diverse sources of capital are often part of the new playbook for some fund managers, insurance firms, retirement accounts, and wealth management organizations, with private real estate serving as a key beneficiary. Thriving annuity markets,54 aging demographics across regions, and broader sectoral trends like convergence between retirement solutions providers and wealth management55 have led some organizations in private markets to seek out strategic partnerships.

The appetite for private assets appears to be growing globally. On average, 82% of wealth managers plan to increase allocations to private equity, venture capital, private credit, and private real estate over the next three years.56 The trend is especially pronounced in the Asia-Pacific region, where 92% of managers anticipate boosting their exposure.57 Interest in real estate among high-net-worth individuals is holding at 19%—a level not seen since 2006, when allocations peaked at 24%.58 Some alternative asset managers are capitalizing on this shift. Some new-age investors are diversifying their portfolios, compared to prior generations, turning to private market assets to help optimize returns and manage risk.59 The “Great Wealth Transfer” estimates suggest that about US$84 trillion will likely be transferred through 2045, and younger generations such as Generation X and millennials are expected to inherit US$72 trillion of that total.60

The relationship between alternative asset managers and the insurance sector could be shifting. In May 2025, a UK-based insurance organization acquired a 75% stake in real estate investor Proprium Capital Partners to expand its private market investments.61 Blackstone has four strategic relationships and 20 separately managed accounts with insurance companies.62 Asset managers are likely to continue to evaluate and commit capital across the financial services industry, and may seek investments not only in retirement-related balance sheets but may also invest or partner with non-retirement vehicles, such as life and non–life insurers, which could help broaden and diversify the investor base.

Some REITs are actively pursuing partnerships with private capital providers

In a market often defined by rising competition and evolving investor demands, some publicly traded REITs appear to be increasingly turning to partnerships with private capital providers, such as pension funds, sovereign wealth funds, and other institutional organizations, to help scale up, diversify income, and navigate a real estate market in flux. These collaborations often take the form of joint ventures and co-investment vehicles, with REITs serving as general partners. Ventas Investment Management (or VIM) is Ventas’ third-party institutional capital management platform which includes, among other activities, the open-ended Ventas Life Science & Healthcare Real Estate Fund (the "Ventas Fund") and their ongoing life science development partnership with GIC.63 Investments are focused on core and core-plus assets in life science, outpatient medical, and senior housing real estate assets across North America

Actionable guidance to consider

- CRE organizations should implement consistent data standards across all partnerships and joint ventures to help ensure accurate, timely, and comparable reporting. They should develop unified compliance frameworks and reporting standards that align with both domestic and international requirements for all strategic partners and retail investors, including anti-money laundering and know-your-customer regulations.

- They should also carefully evaluate where it makes sense to ally with strategic partners to help expand market share, capabilities, access to new markets or property types; weigh their options (M&A, joint ventures, and other partnership agreements); and review interest-rate expectations and central bank stance.

- Institutional investors should seek to actively engage with states and municipalities to help showcase public-private partnership models for specialized uses including media, entertainment, health care, energy-related infrastructure initiatives, and affordable or student housing.

The path to turning AI promise into success likely runs through reliable data and application readiness

Early days with measured progress

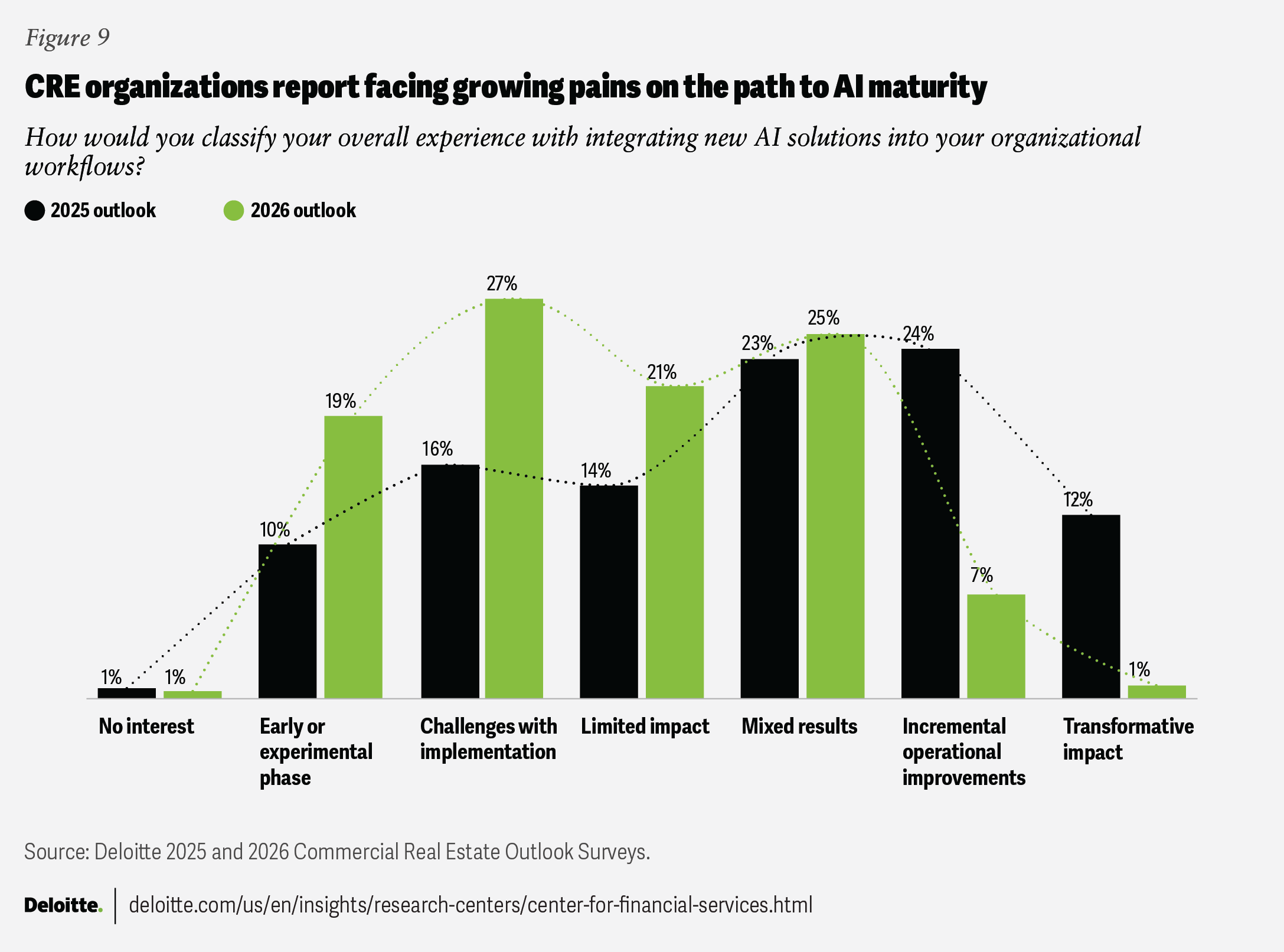

According to the 2026 CRE outlook survey results, 19% of respondents believe their organizations are still in the early stages of their AI journey. Interestingly, 27% are experiencing challenges with AI implementation, including technical issues, lack of expertise, or resistance to change (figure 9).

This notable shift in the AI integration curve has likely occurred because “transformative” AI means more than document summaries or email replies. Last year’s survey may have reflected hype, which could have led to overly high expectations for 2025. Achieving returns on AI investments can take time, sometimes due to gradual human adaptation rather than tech issues. Now, more survey respondents report challenges or mixed results, which could make successful initial AI implementation more critical than ever.

An AI revolution extends far beyond chatbots

Smaller, more efficient AI models, with increased sector-specific specializations, seem to be gaining traction across the industry. Most voice and chat assistants are not novelties; they’re often becoming common tools for engaging prospects and qualifying leads. Survey respondents appeared enthusiastic about different emerging AI technologies, such as multimodal capabilities, multi-agent systems, small language models, AI-powered digital twins, large action models, and agentic AI. No one option for AI technology development was selected by less than 40% of survey respondents. This wide-ranging interest suggests that many real estate leaders likely see AI as a transformative force, and could be poised to help reshape everything from property operations to client interactions and decision-making.

But do organizations have the right data—not just to train AI models, but to feed inputs for valuable outputs? Volume alone doesn’t guarantee utility for AI. The challenge is often finding usable, significant data without extensive extract, transform, load efforts. Generating synthetic data was highlighted as an area of most interest almost 50% of the time, in our survey. Real estate data often includes sensitive information, including bank account and social security numbers, tenant names, and mortgage loan payment statuses, which cannot be fed into the models for training and may require synthetic data creation. However, generating synthetic data is often tough, needing data science expertise and rigorous quality control to ensure artificial data is both realistic and useful.

Targeted deployments and early wins

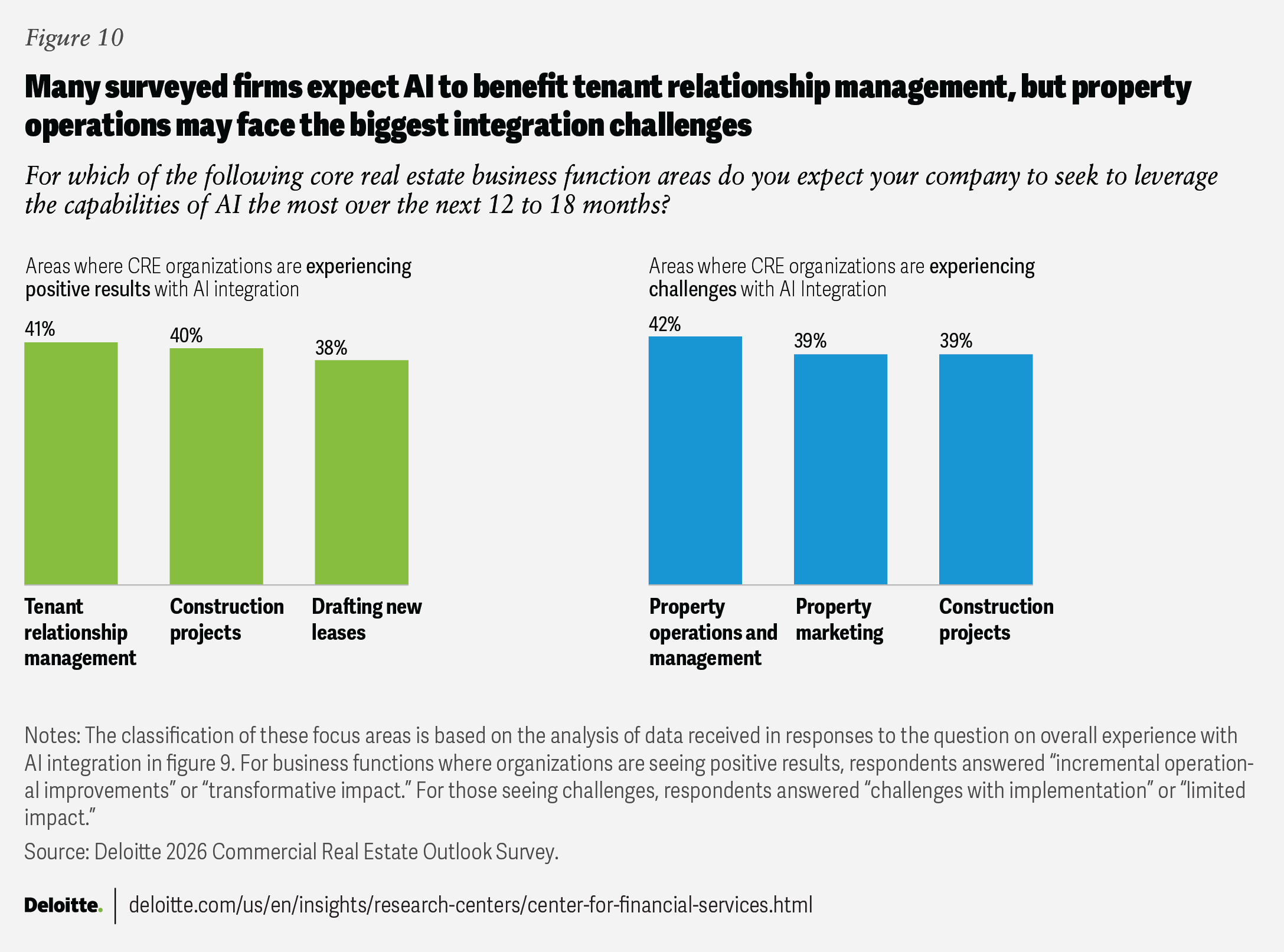

Some CRE organizations are shifting away from broad, scattershot strategies in favor of more targeted AI deployments in areas with the greatest potential for impact. Survey responses indicate that tenant relationship management, lease drafting, and portfolio management are top priorities for the next 12 to 18 months (figure 10). However, AI effectiveness in real estate operations varies. Some companies that are seeing limited effects and challenges with implementation highlighted property operations and management and marketing as being particularly problematic.

Although reliability and trust in AI may have improved over the last year, more remains to be done to enhance explainability in models.64 Human validation and regular algorithm audits are vital to help mitigate risks. Generative AI may summarize standard leases well but may struggle with unique lease terms, though outputs can improve over time with human intervention. Fine-tuning these models could help add extra layers or optimize prompts to guide model responses.

The rise of smaller models and fit-for-purpose AI

No single technology is best for all needs; it depends on the use case. Whether it’s gen AI for content or traditional deep learning for predictive analytics, adoption depends on the specific business challenge at hand. Advances in multimodal AI and deep learning’s ability to process unstructured data—images, audio, and natural language—can help open doors to some use cases previously out of reach.

Many real estate firms are likely to use a portfolio of smaller, pretrained models for operational tasks rather than training large models in-house. Rather than focusing on one large monolithic large language model (LLM) that alone acts as the data store, computation layer, and interface to a system, organizations across sectors are likely to explore use cases or build AI agent systems that break the problem apart or orchestrate smaller AI models.65

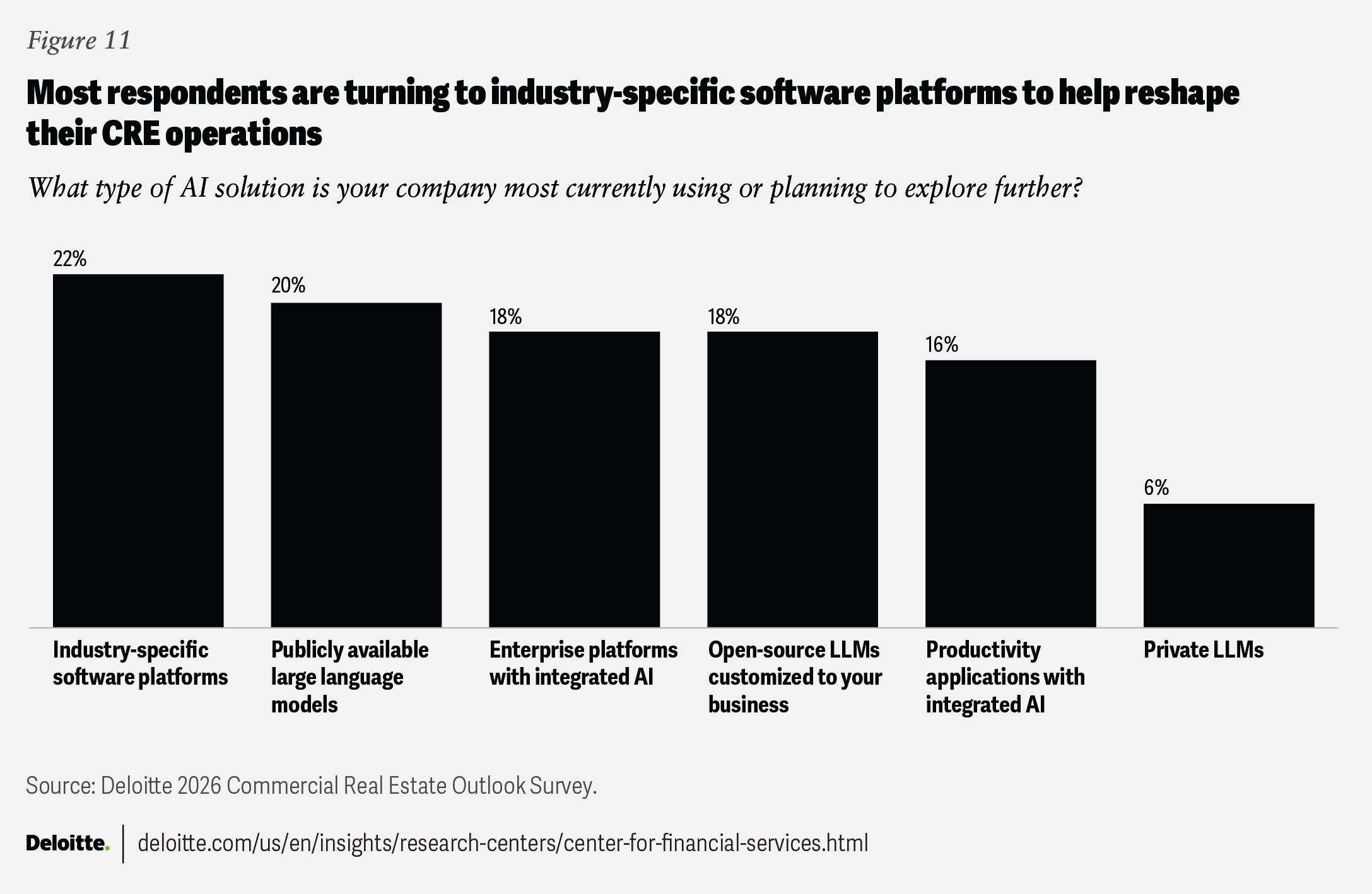

About 22% of survey respondents globally are leveraging industry-specific software platforms like Integrated Workplace Management Systems or Computer-Aided Facilities Management, and another 20% are using publicly available LLMs (figure 11). Public LLMs can be fine-tuned to create smaller, more efficient models tailored to specific real estate tasks, enabling faster inference.66 Fine-tuning takes effort, but human input helps. Alternatively, organizations can develop small language models from scratch by training them on targeted, domain-specific data sets, which can help ensure the models are optimized for unique operational needs. Open source LLMs customized to the unique needs of the real estate sector may also be popular, especially with public REITs.

Small language models, which are built with fewer parameters, could offer a powerful advantage. Instead of relying on massive, general-purpose AI models, real estate organizations can train smaller models using highly curated, industry-specific data—such as property listings, transaction records, and local zoning regulations—to help address targeted business challenges directly on their platform, delivering faster, more relevant results without heavy computing needs.67

Actionable guidance to consider

- Have a risk management plan for all new tools in conjunction with your Sarbanes-Oxley (SOX) and internal audit teams. Gen AI can transform the entire SOX compliance life cycle by streamlining and enhancing key activities such as risk assessment, control design, ongoing monitoring, remediation, reporting, and testing.68 By integrating risk management and audit oversight from the outset, companies can more effectively identify and address potential compliance gaps, safeguard data integrity, and optimize their control environment, which can help make modernization efforts both more secure and sustainable.

- Organizations should explore embedding explainability into core model architectures, like including a “why” explanation for every recommendation, especially for critical tasks that may require advanced reasoning and predictive capabilities. Human review of AI-generated insights and algorithm audits are essential to ensure AI models stay reliable.

- Make AI literacy a board-mandated pillar of your AI strategy as an essential, no-regret action. Build a companywide learning and development program covering value cases (leasing, underwriting, asset operations), data privacy, prompting, and model risk. Track key performance indicators like course completions, use-case pipelines, time to pilot, and even potential incidents of misuse or noncompliance. Finally, tie AI literacy to role expectations—all in the interest of ensuring potentially safer, faster piloting and durable skills regardless of the AI tools of the future.

The opportunities are real

The next chapter for commercial real estate could be best suited for prepared realists. Some of the headline risks, like macro volatility, policy whiplash, and higher‑for‑longer rates are real, but so are the openings our 2026 survey and analysis unearthed for the next 12 to 18 months: repriced, better‑structured loans; a cautiously reawakening lender pool alongside deep private credit; and selective strength in digital infrastructure, logistics, and office.

CRE leaders should keep a pragmatic playbook in 2026: have capital agility, rebalance toward resilient income, partner for scale and operating expertise, and deploy AI where it demonstrably advances leasing, underwriting, and portfolio decisions—not as theater. Stress‑test legacy exposures, sharpen transparency, and move before the crowd while the early‑mover window is open. Don’t wait for certainty—help build it.

Methodology

The Deloitte Center for Financial Services conducted a survey of more than 850 C-level executives (chief executive officers, chief financial officers, and chief operating officers) and their direct reports at commercial real estate owners and investment companies with assets under management of at least US$250 million. The survey was conducted in June and July of 2025.

Respondents were asked to share their opinions on their organizations’ growth prospects and workforce, operations, and technology plans for the coming 12 to 18 months. We also asked about their investment priorities and anticipated changes for commercial real estate fundamentals.

Respondents were broadly based out of three regions: North America (Canada, Mexico, and the United States); Europe (France, Germany, the Netherlands, Spain, and the United Kingdom); and Asia Pacific (Australia, India, Japan, Mainland China, and Singapore).