2026 Aerospace and Defense Industry Outlook

The aerospace and defense industry is entering a new era of growth, powered by AI, digital sustainment, and rising demand across the commercial and defense segments

Lindsey Berckman

Steve Shepley

Ajay Chavali

Kate Hardin

Scott Welch

Tarun Dronamraju

The aerospace and defense industry stands at a pivotal crossroads as it enters the latter half of the decade. Forces that have shaped the sector in recent years—digital transformation, supply chain volatility, talent constraints, and geopolitical events—are converging with new catalysts such as agentic AI, emerging vehicles, and the rapid evolution of autonomous systems.

The commercial aerospace sector appears poised to continue growth, fueled by rising fleet utilization, continued fleet growth, and steady gains in both passenger and cargo demand.1 Persistent aircraft production backlogs are prompting operators to fly existing fleets longer and invest more in reliability, availability, and maintainability. On the defense side, budgets are a key focus, with a growing emphasis on enhancing mission readiness. At the same time, defense priorities are shifting to accelerate the fielding of AI-enabled systems and collaborative combat aircraft. “Speed to field” is becoming the unifying metric across portfolios.

Deloitte’s 2026 aerospace and defense (A&D) outlook explores five trends likely to shape the industry in the year ahead.

- AI and agentic AI: Transforming A&D

- Aftermarket: Reshaping maintenance, repair, and overhaul

- Supply chain: Building resiliency and efficiency amid volatility

- Contracting and procurement: Unlocking competitive advantage in A&D

- AI-driven workforce transformation: Shifting from ‘big data’ to multidisciplinary skill sets

1. AI and agentic AI: Transforming A&D

AI and its more advanced form, agentic AI, are steadily reshaping A&D, but their impact is unfolding unevenly. Most organizations remain in early adoption stages, due in part to industry-related operational risks and regulatory requirements. Still, agentic AI is already yielding notable productivity gains. A recent Deloitte report, “From vision to value,” estimates that 36% of tasks performed across industrial products manufacturing could benefit from augmenting human capabilities with agentic AI.2

In defense, the US Department of Defense (DoD) agency is positioning AI as a foundational capability across missions like modeling and simulation, operator assistants, and command and control.3 The US Air Force recently completed the first two Decision Advantage Sprint for Human-Machine Teaming experiments and demonstrated how AI can help operators make faster, smarter decisions in complex battlespaces.4

Positioning agentic AI in the broader autonomy or network-centric stack

Rather than viewing agentic AI in isolation, it’s vital to position it within a broader operational framework that spans drones, connected devices, fusion or data fabrics, and open interfaces. This goes beyond the enterprise AI used to accelerate engineering or automate back‑office routines. A critical challenge for new autonomous products is the need for seamless interoperability with legacy systems already deployed in theater; solutions built as closed ecosystems risk slower adoption. This perspective directly supports the DoD’s Combined Joint All Domain Command and Control vision for data‑centric, multidomain interoperability.

In space, the Space Force’s Data and AI FY2025 Strategic Action Plan prioritizes enterprisewide data or AI governance; a data- and AI-driven culture and workforce; rapid adoption of analytics and AI tech; and deeper government, industry, and academia partnerships.5

In mission systems, AI is being trialed for autonomous mission planning, real-time collision avoidance, and geospatial targeting.6 Both government and private organizations are exploring agentic AI for tasks such as operational planning, situational simulations, and autonomous navigation. The US DoD has awarded contracts to four leading US AI companies to accelerate AI adoption across critical mission areas for key defense priorities.7 However, regulatory ambiguity and certification requirements continue to slow broader adoption, particularly for mission-critical applications.

Commercial aviation is leveraging AI for scheduling flights, managing crew, and enhancing passenger experience. Meanwhile, aftermarket companies are piloting AI-driven maintenance diagnostics and predictive health for equipment, inspection, and inventory optimization.

A&D manufacturing presents a more complex challenge due to the stringent safety requirements, reliance on legacy systems, and the high cost associated with potential failures. Nonetheless, investment prospects remain strong. According to an International Data Corporation forecast, US A&D spending on AI and generative AI is expected to reach US$5.8 billion by 2029, 3.5 times higher than 2025 levels.8

While pilot programs in AI-powered defect detection and automated inspection are underway, scaling these solutions remains difficult. The push to increase production rates, especially for munitions and aerospace components, may accelerate experimentation, but full-scale industrialization is unlikely in the near term.

By 2026, agentic AI is expected to progress from pilot projects to scaled deployments, with the most visible advances occurring in the decision-making, procurement, planning, logistics, maintenance, and administrative functions.

2. Aftermarket: Reshaping maintenance, repair, and overhaul

Aftermarket services and sustainment remain one of the industry’s most resilient revenue streams (figure 1). Aftermarket companies report robust momentum, citing double-digit growth and record sales and backlogs; engine activity is the dominant driver.9 Higher utilization and continued shop visit demand are sustaining strong engine maintenance, repair, and overhaul (MRO) pipelines and parts and spares flows. Demand is expected to grow, keeping legacy fleets in service longer, even as new systems enter service. Aviation Week projects that global commercial aftermarket MRO demand will grow at a 3.2% CAGR between 2026 and 2035, with an increasing focus on engines. The forecast also notes that the engine segment’s share of total MRO demand is expected to rise to 53%, reflecting its faster growth compared to other MRO categories.10

While companies continue to emphasize growth in long-term service agreements and predictive maintenance, new geographic hubs and capacity expansions are reshaping the MRO landscape. Aftermarket offerings are converging into end-to-end service portfolios, including parts supply, repair or overhaul, engineering modifications, training, and digital support. In defense, the aftermarket has seen steady spares revenue for military fleets, with ongoing refreshes driven more by technology updates rather than failure rates. However, sustainment services to address the age of the fleet and improve mission-capable rates continue to grow.

Technology integration remains a focal point for the aftermarket. Many firms are piloting AI-enabled inspection systems to accelerate turnaround times and improve accuracy, reflecting a broader industry push to embed digital tools in aftermarket processes and move toward predictive and condition-based maintenance models.11 As predicted in the previous year’s outlook, companies’ data show a clear shift from isolated analytics to orchestrated, embedded workflows, spanning inspection, predictive health, inventory positioning, and repair scheduling.

Note:

Some traditional original equipment manufacturers (OEMs) are expanding service capabilities to capture higher-margin aftermarket revenues. Several firms have announced ambitious capacity increases, with some targeting 40% to 50% expansions over the next five years, driven by surging demand for engine maintenance and airframe support.12

Regional markets, particularly in the Middle East, are rapidly scaling MRO networks. Emerging players are investing heavily in facilities and capabilities to reduce reliance on concentrated hubs, aligning capacity closer to where fleets operate.

In 2026, the aftermarket will likely remain a stable cash generator for incumbents, particularly as commercial aviation recovery drives flight hour growth. However, the real story lies in how the network expands: US prime MRO operators are likely to consolidate capabilities in core hubs, while emerging regions diversify the global MRO footprint.

3. Supply chain: Building resiliency and efficiency amid volatility

Persistent demand growth across the industry is occurring alongside shortages of materials, skilled labor, and geopolitical disruptions, keeping the A&D supply chain under pressure through at least 2027, despite recent relief for a few components. The industry faces a paradox: Supply chains must simultaneously become more efficient and more resilient. A&D companies that have worked on diversifying sources and investing in digital tools are expected to progress further in 2026, but capacity will continue to govern performance.

From raw material shortages to supply chain volatility, companies face persistent fragility and unpredictability. Supply chain fragility is not just about cost; it impacts delivery credibility. The strain is expected to intensify as defense primes aim to increase output of various defense equipment, like missiles, munitions, and drones, and aircraft manufacturers push ambitious rate increases, stressing every tier of the A&D supplier base.13

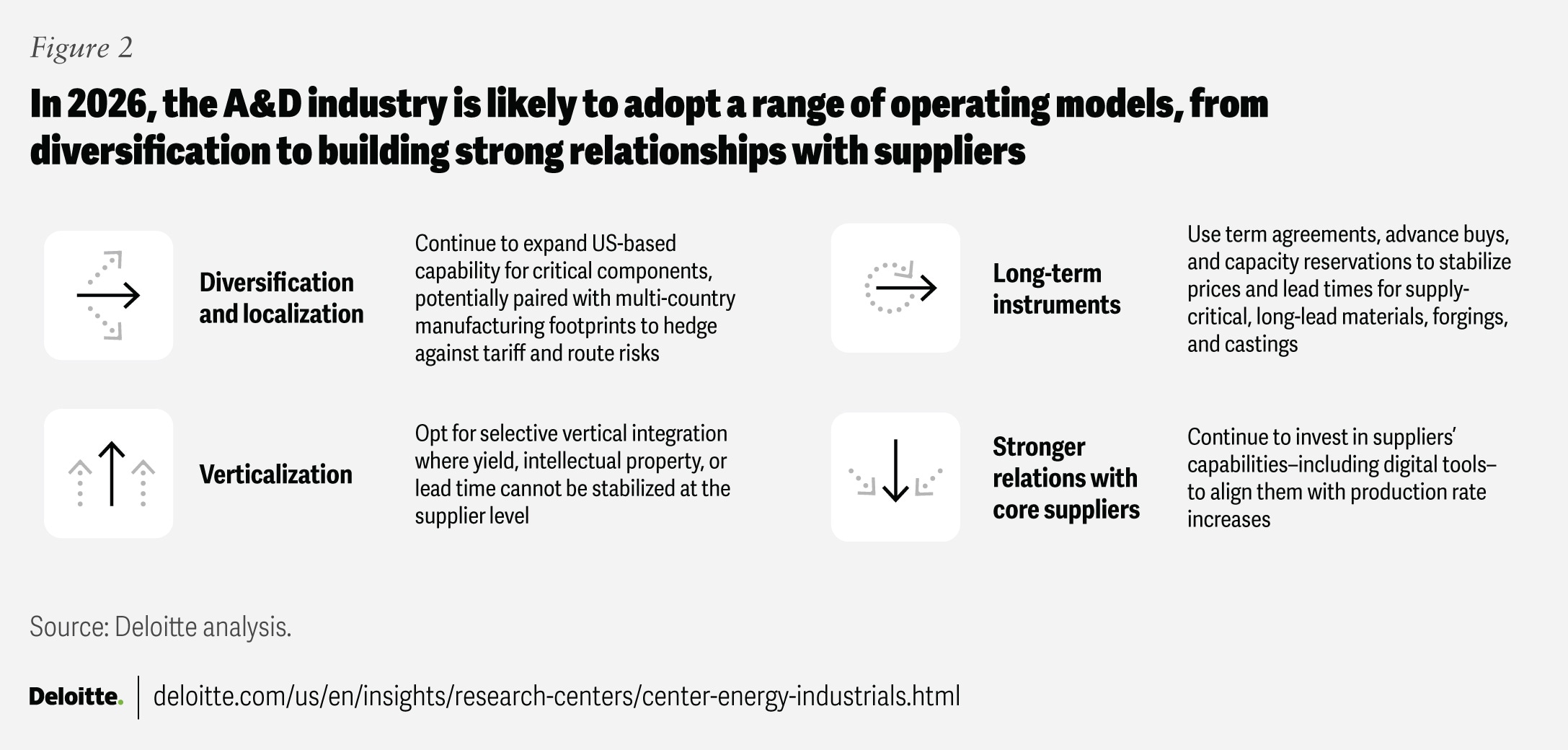

Supplier strategies could vary (figure 2). Some US A&D companies may pursue supply chain consolidation, centralizing storage and sourcing within the domestic market to reduce supply chain uncertainty. Conversely, international customers may encourage diversification, building distributed networks to expand access beyond US-centric suppliers. Companies are increasingly turning to structural moves like vertical integration, expanded local footprints, multicountry manufacturing, long-dated supply contracts, and supplier development, in addition to digital solutions that address dynamic supply chain challenges like visibility, compliance, and counterfeit parts.

In 2026, companies that begin or continue investing in redundancy, supplier development, data integration, and digital visibility can better mitigate risk from external factors like tariffs and demand surges. A&D prime contractors may continue investing in tools, quality systems, and capital to turn fragile lower-tier suppliers into predictable partners. Although capital constraints limit widespread adoption of dual-sourcing strategies, many firms are simply too lean to carry excess supplier capacity.

Ultimately, becoming more efficient and more resilient will demand creative approaches, from vertical integration in select components to strategic partnerships with trusted international suppliers. In an environment where tariffs are shifting and defense output targets climb rapidly, resilience is not a one-time fix but an ongoing capability.

4. Contracting and procurement: Unlocking competitive advantage in A&D

The A&D industry is rapidly expanding beyond traditional aircraft and weapons systems to include reusable launch vehicles, hypersonic weapons, unmanned aerial systems, and a wide spectrum of autonomous platforms. These advances reflect sweeping changes in how industry participants compete and contract, driven by government urgency, regulatory reform, and market disruption by emerging players.

In parallel, recent US acquisition reforms are actively transforming the mechanics of competition, placing increased emphasis on speed, a preference for commercial solutions, and expanded access for a wider spectrum of vendors. Executive actions and agency guidance are expanding the use of commercial solutions openings and Other Transaction Authority (OTA) to attract nontraditional suppliers and compress timelines; contracting officers are being pushed to favor commercially available tech when feasible.14

Legislative and policy advances, such as changes to the Federal Acquisition Regulation and Defense Federal Acquisition Regulation Supplement, Streamlining Procurement for Emerging and Efficient Defense Act, and the DoD’s Software Acquisition Pathway, can reinforce this shift with dedicated pathways for outcome-focused and software-driven procurements.15 These reforms and proposals aim to enable a new generation of smaller, software-centric firms to scale rapidly. Companies combining modular hardware platforms with continuously developed software, for example, are leveraging these pathways to compete with established primes, often with increased agility and shorter development cycles.

In response, industry incumbents are deploying strategies ranging from internal investment and faster delivery of mission capability to partnerships and acquisitions with emerging players. These approaches are raising important questions around intellectual property and data rights. Recent DoD guidance underscores the need for a clear upfront definition of IP deliverables and access rights to support teaming arrangements while mitigating the risks of unintended technology transfer.16

Despite these advances, procurement readiness remains critical, and new vendors should still plan for multiquarter or even multiyear ramp-up periods from first engagement to contract award. Oversight agencies, such as the Government Accountability Office, have noted that while OTAs offer valuable flexibility and lower barriers to entry, they can also present challenges like cost transparency and governance.17

Two emerging market trends warrant continued observation.

- The increasingly shorter procurement processes available to new entrants (relative to more detailed incumbent procedures), which is fostering collaborative bids but intensifying IP negotiations

- A notable shift toward self-funded research and “build-first” models, with both primes and new entrants investing ahead of contract to match the pace set by venture-backed technology firms

5. AI-driven workforce transformation: Shifting from ‘big data’ to multidisciplinary skill sets

The competition for AI-capable talent continues to intensify, compelling organizations to move beyond competitive compensation and offer continuous learning and AI skill development opportunities. Entry-level professionals are often expected to rapidly acquire and apply AI competencies, driven by the accessibility of technology-enabled training. And while senior leaders in A&D organizations are generally optimistic about AI’s transformative potential, middle management often remains more skeptical, untrained, and risk-averse, sometimes resisting change due to concerns about disruption or uncertainty. The organizational model is expected to include hybrid human-AI teams, where professionals leverage AI to enhance their domain expertise. A&D companies should prioritize targeted initiatives to build AI literacy and confidence, ensuring that organizational momentum is not stalled at this critical layer.

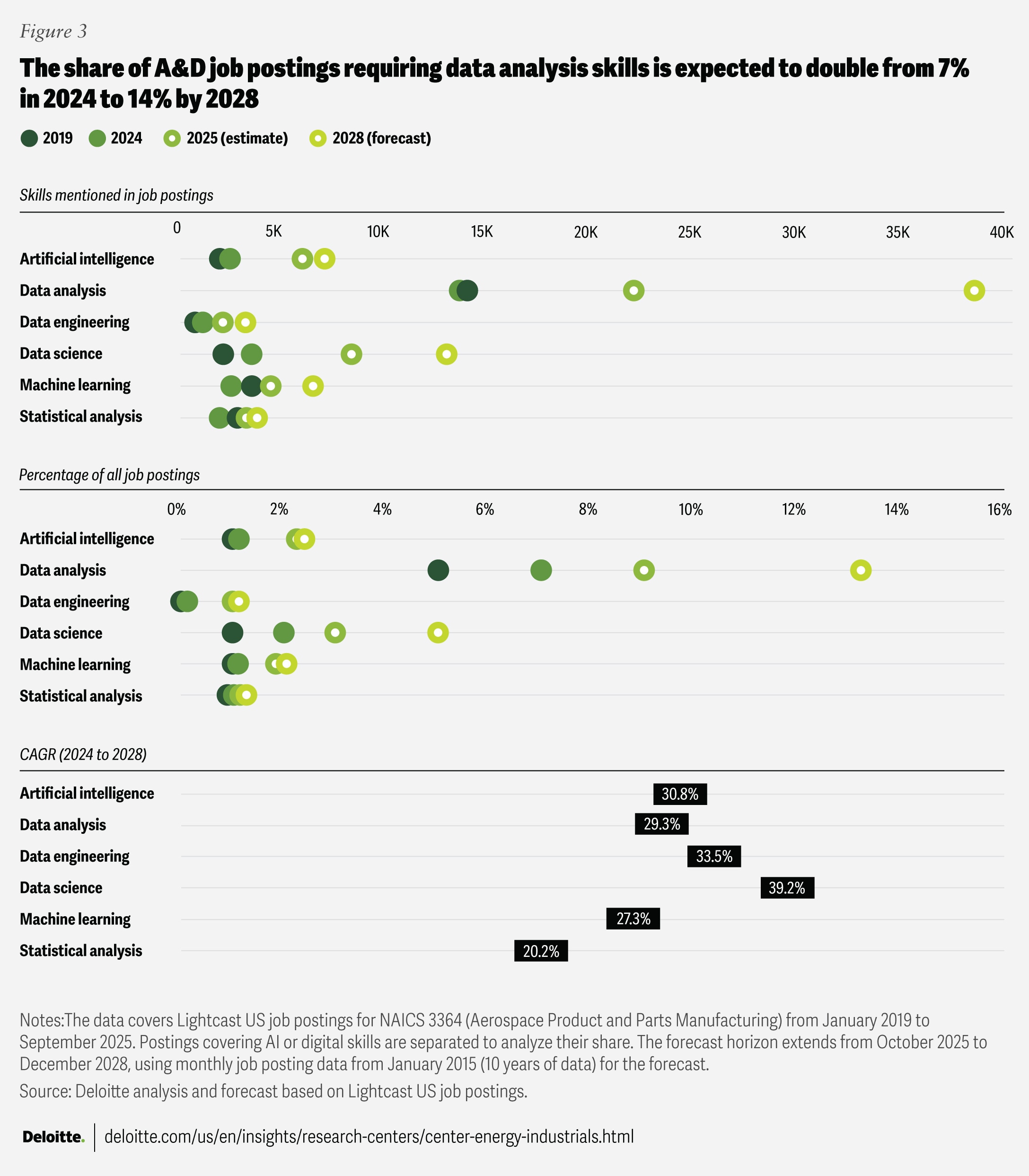

Within A&D, demand for AI talent is often shifting from narrow “big data” or general programming expertise to integrated, multidisciplinary skill sets. A Deloitte analysis reveals that data science, data engineering, AI, data analysis, machine learning, and statistical analysis are expected to be the fastest-growing skills between 2024 and 2028, reflecting the A&D industry’s accelerated digital transformation. The percentage of industrywide job postings requiring data analysis skills is projected to increase from 9% in 2025 to nearly 14% by 2028. Likewise, the demand for data science skills is expected to grow from 3% to 5% during the same period (figure 3).18

Building this talent base will likely require targeted workforce development initiatives, leadership programs, and strategic hiring focused on the specialized skills and security clearances unique to A&D technology applications. AI is anticipated to serve as a force multiplier, increasing productivity and effectiveness across the workforce.

A&D companies are expected to deepen partnerships with educational institutions to cultivate AI-competent talent pipelines. The focus may shift from hiring AI specialists to embedding AI fluency across the entire workforce, which will foster greater resilience and adaptability and position organizations to thrive in a digital environment.

The year ahead

As commercial operators contend with persistent production backlogs, aging fleets, and readiness challenges, the focus is shifting from expansion to maximizing the reliability and availability of assets already in service.

Defense priorities are evolving rapidly, with budgets channeling investment into autonomous unmanned systems, drones, and advanced weapons platforms. Yet, the realities of aging platforms and parts shortages mean that operational readiness hinges on scalable, data-driven sustainment and a deeper pool of skilled talent.

Digital transformation is no longer aspirational; it is becoming essential. Companies are leveraging AI and advanced analytics as part of a broader, digitally enabled sustainment strategy that spans supply chain resilience, aftermarket services, parts management, and mission assurance.

Growth is expected to continue, but it will likely be powered by the industry’s ability to sustain and optimize existing assets while fielding next-generation capabilities. Companies that prioritize digital infrastructure, invest in talent, and operationalize advanced systems can be well positioned to seize the opportunities and meet the challenges ahead.

Future in focus: Agentic AI’s journey from back office to battlefield

By 2028, agentic AI adoption is expected to expand significantly within A&D firms’ enterprise and support functions, including procurement, logistics, maintenance, and administrative operations. However, AI’s deployment on the actual manufacturing floor will likely remain targeted and incremental. Widespread, “AI-driven” factory operations, where agentic AI orchestrates core shop-floor processes, are unlikely before 2028, as the technology matures beyond the pilot phase. In parallel, agentic AI will play a growing, but supplementary, role in battlefield operations, primarily as a decision support tool. Competitive dynamics and procurement processes are anticipated to shift through 2028, potentially accelerating industry access to AI-driven solutions and agentic AI capabilities.

Access the archive

- 2025 Aerospace and Defense Industry Outlook: Midyear update

- 2025 Aerospace and Defense Industry Outlook

- 2024 Aerospace and Defense Industry Outlook

- 2023 Aerospace and Defense Industry Outlook

- 2022 Aerospace and Defense Industry Outlook

- 2021 Aerospace and Defense Industry Outlook

- 2020 Aerospace and Defense Industry Outlook: A Midyear update

- 2020 Global Aerospace and Defense Industry Outlook