Investment in business structures: Few bright spots emerge in an overall weak outlook

The June 2023 Economics Spotlight assesses the impact of the pandemic on investment in commercial real estate and other nonresidential structures.

Patricia Buckley

Bhavna Tejwani

The pandemic caused businesses to rethink their investment priorities. However, while the slowdown in equipment and intellectual property (software and R&D) investment was short lived, investment in structures continues to lag. But under this topline observation is a highly variable landscape full of valleys (for instance, investment in office buildings) and peaks (for instance, investment in warehouses).

The big picture

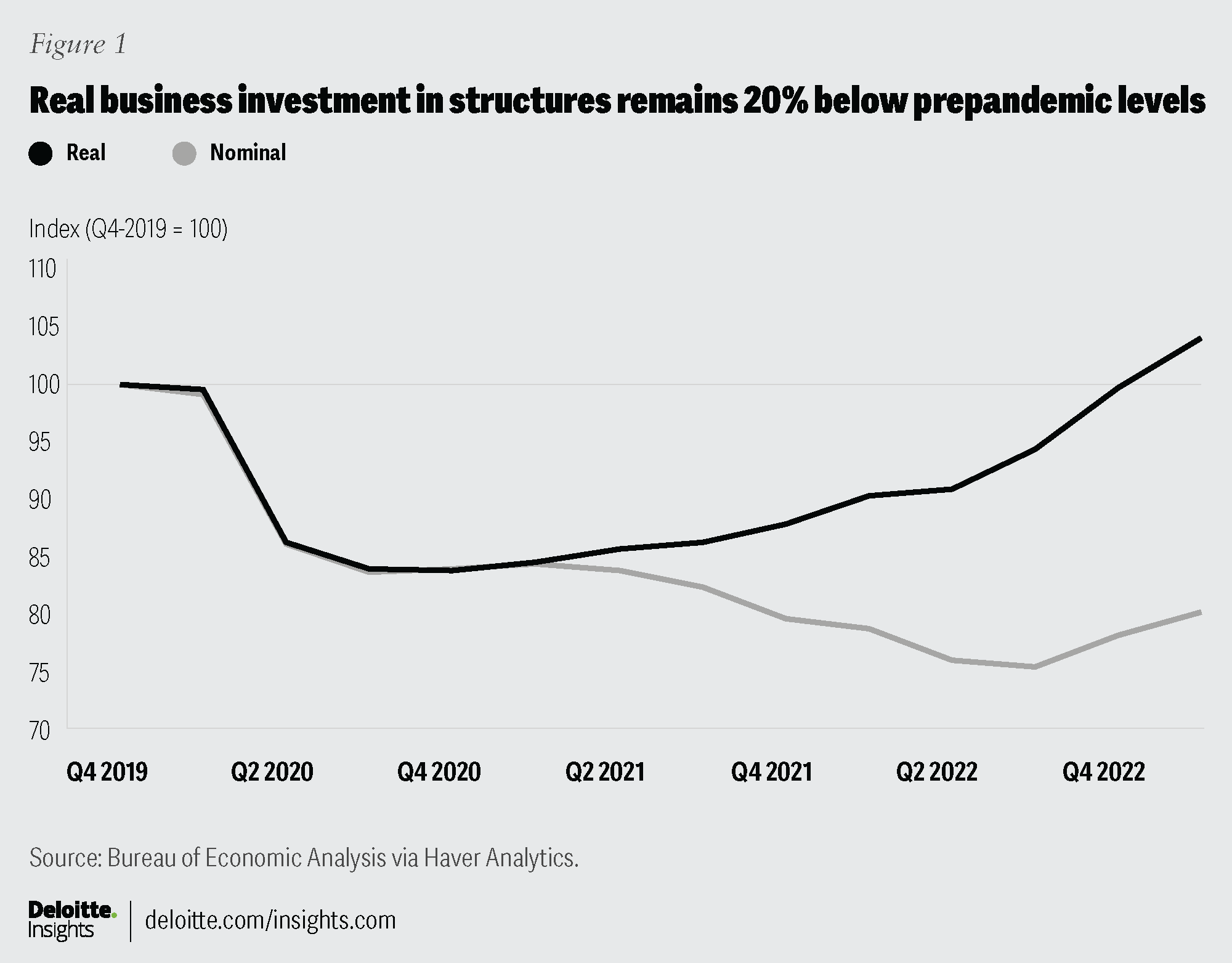

In the early days of the pandemic, investment in business structures fell rapidly before stabilizing at around 15% below prepandemic levels. As shown in figure 1, the pattern and size of the decline was identical in both real and nominal terms. This congruency ended in Q2 2021 when supply bottlenecks increased prices and drove a growing wedge between measures of nominal and real investment, with investment rising in nominal terms but continuing to decline in real terms. Even with recent gains, real business investment in structures remains about 20% below its prepandemic levels, while it is slightly above in nominal terms.

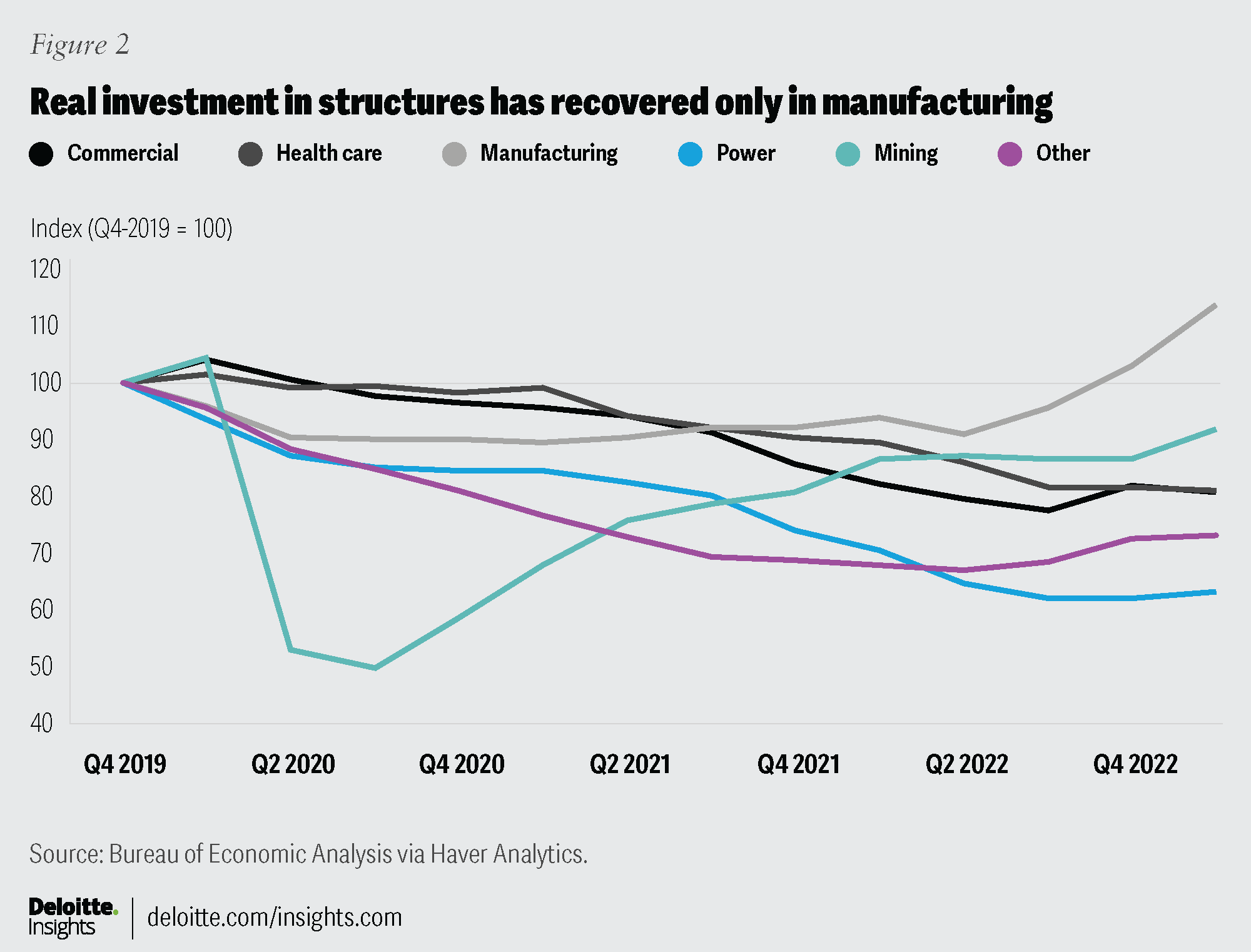

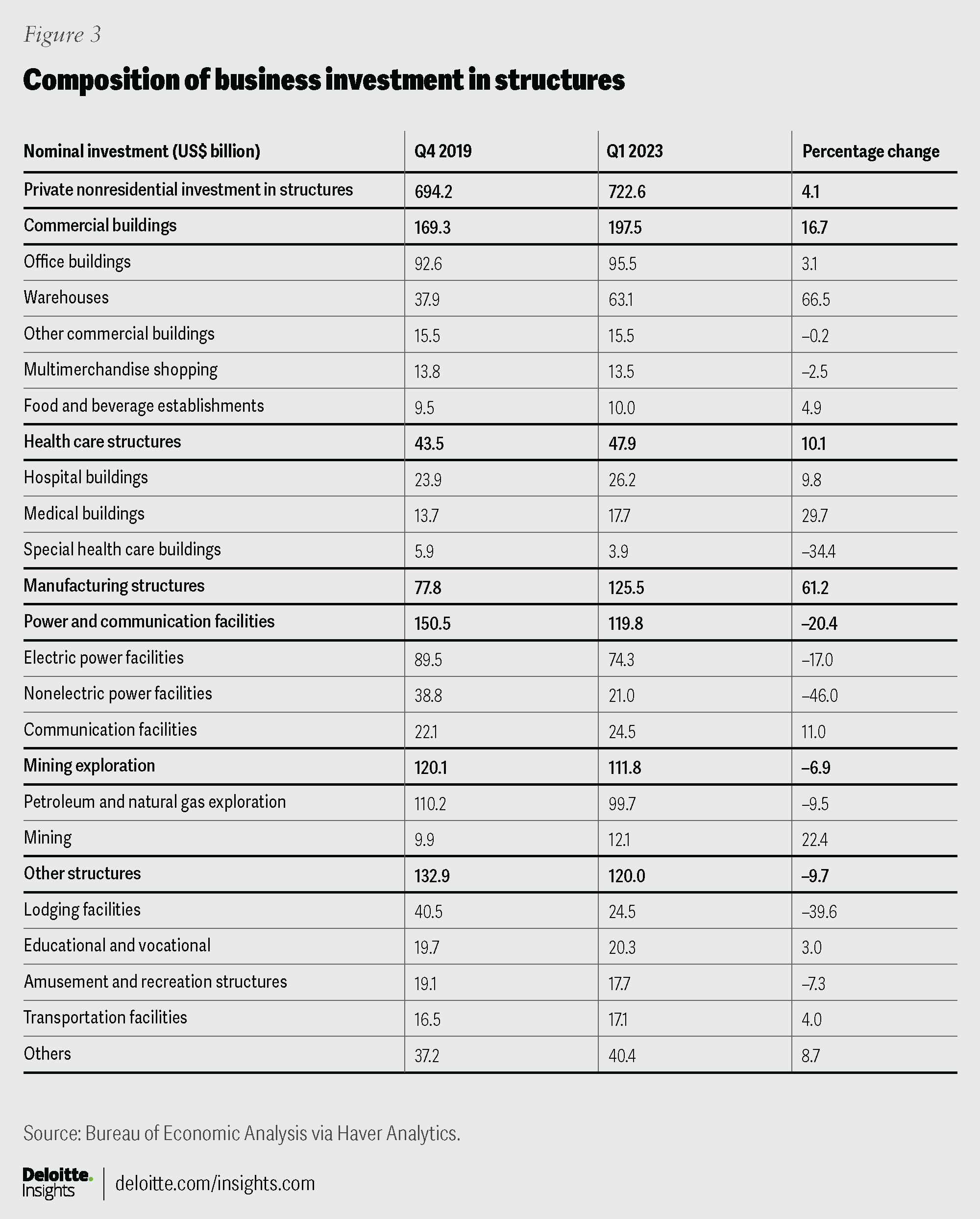

The six major categories of nonresidential investment in structures are commercial, health care, manufacturing, power and communication, mining exploration, and “other.” In real terms, investment declined across all these categories from the onset of the pandemic, with only investment in manufacturing structures now above prepandemic levels (figure 2). In nominal terms, investment declined in power and communication facilities, mining exploration, and other structures, but increased in commercial, health care, and manufacturing structures (figure 3).

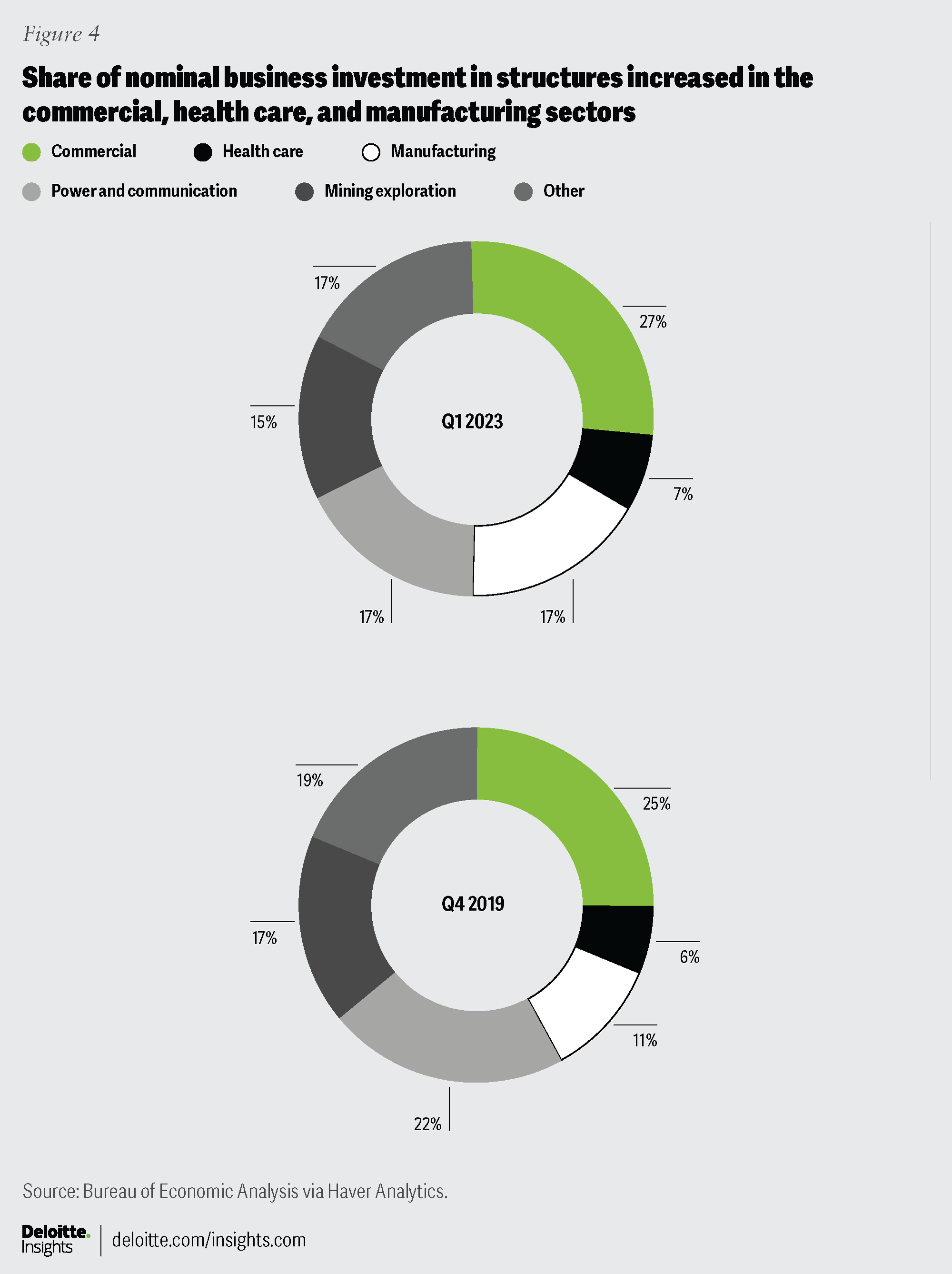

Commercial buildings have historically attracted the most investment in structures, accounting for approximately one-fourth of the total. Over the course of the pandemic, this category gained two percentage points of the total business structures spending (figure 4). Manufacturing structures had the largest share gain, growing from 11% to 17% of the total.

Commercial buildings: Squeeze that office space, we need more warehouses

The major categories within commercial buildings are office buildings, warehouses, multimerchandise shopping, food and beverage establishments, and other commercial buildings. Prepandemic, the largest chunk of commercial investment was in office buildings. However, investment in this category has fallen over time and this decline was accelerated during the pandemic. The recovery in nominal terms was feeble, at around US$3 billion above the prepandemic level of US$92.6 billion, but in real terms, investment in office buildings remains approximately 30% below prepandemic levels.1

As work-from-home increasingly became the norm during the pandemic, business tenants began exiting leased properties, causing a pause in new office building development. Indeed, some existing office complexes considered converting their commercial properties to residential, but due to the complexities of switching, most of these plans were abandoned.2 At present, the competition for tenants between existing commercial buildings and new construction is fierce as they try to help employers lure their employees back to the office.3

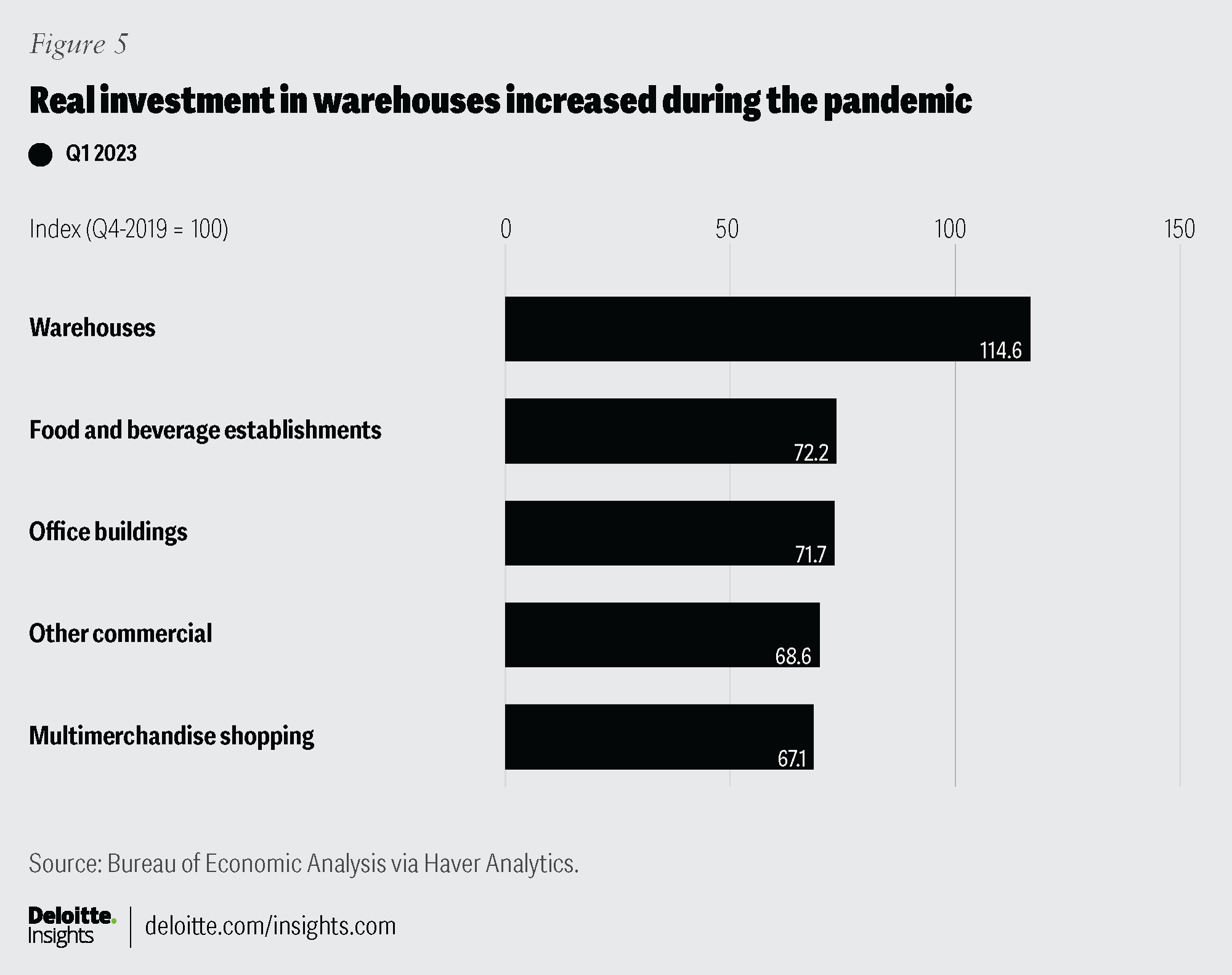

But even as the demand for offices has declined, the demand for warehouses surged with the pandemic-fueled growth in online shopping (figure 5).4 Between Q4 2019 and Q1 2023, nominal investment in warehouses surged by 67% from US$37.9 billion to US$63.1 billion. Real investment peaked at around 22% above the prepandemic level in Q3 2021 and, according to the latest data for Q1 2023, remains 15% higher than in Q4 2019. The aging warehouse inventory in the economy is also pushing demand for larger, modern warehouses that use automation.5

With the growth in online shopping, demand fell at multimerchandise shopping centers and food and beverage establishments, resulting in less building investment in these categories.

Health care structures: More investment in medical buildings

Investment in health care structures increased during the pandemic due to high demand for medical care. Nominal investment was US$43.5 billion in Q4 2019; by Q1 2023, it was up 10% at US$47.9 billion. In real terms, investment in certain types of health care structures rose during the early days of the pandemic, but over the past few quarters, investment has drifted back to prepandemic levels. The latest data for Q1 2023 suggests that real investment in health care structures is around 20% below the level in Q4 2019.

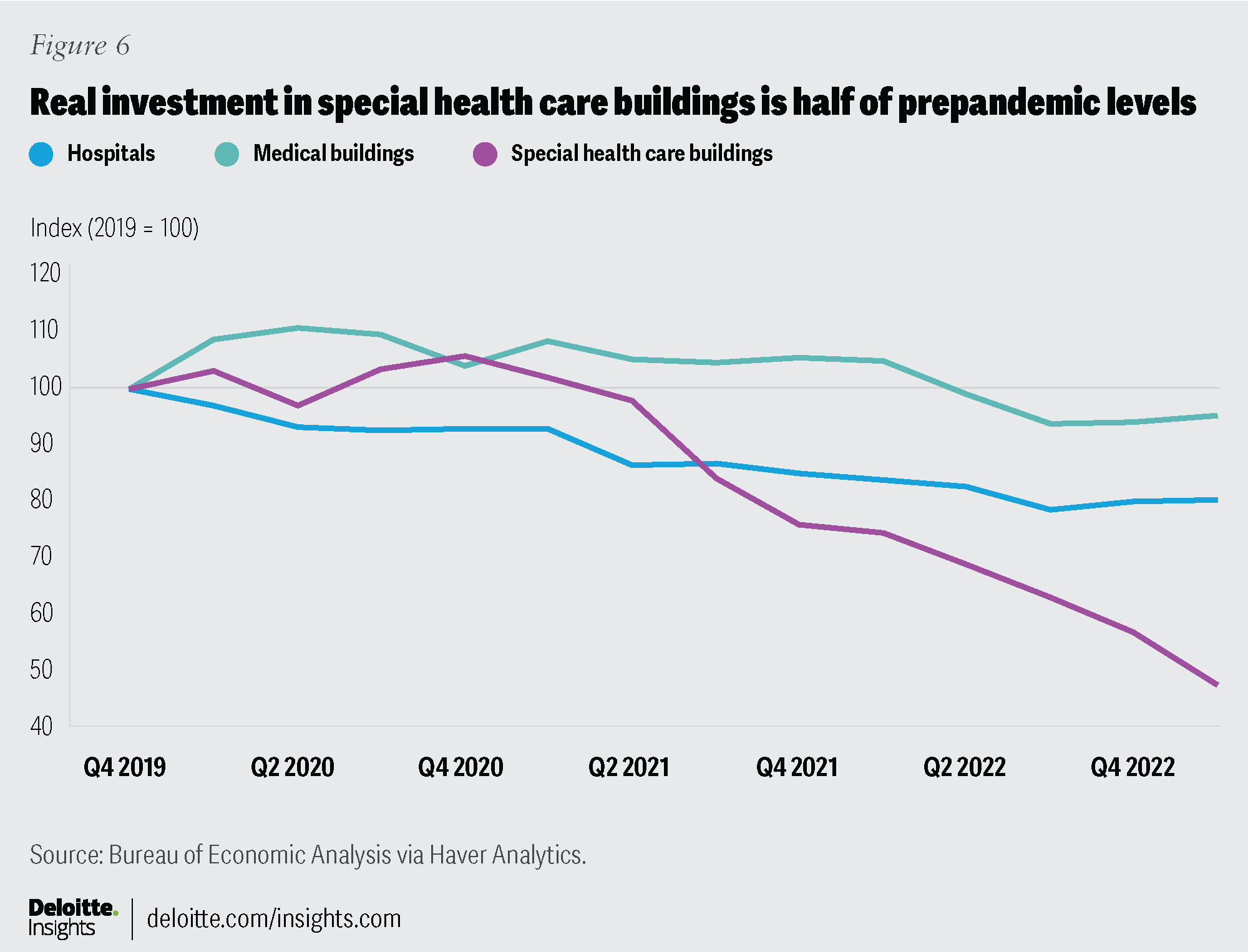

Health care structures are categorized as hospitals, medical buildings, and special health care buildings. Around 55% of the investment in health care structures goes into hospital buildings. Nominal investment in hospitals increased because of the pandemic, although real investment declined and remains below prepandemic levels.

The main shift was between the other two categories. Between Q4 2019 and Q1 2023, nominal investment in special health care buildings, such as nursing homes and hospices, declined 34% from US$5.9 billion to US$3.9 billion, while investment in medical buildings increased 30% from the level in Q4 2019 to US$17.7 billion in Q1 2023. This is not surprising, as the pandemic necessitated more medical buildings, including clinics, medical offices, medical labs, doctor offices, outpatient clinics, and research labs. Real investment in medical buildings consistently remained above prepandemic levels until Q1 2022 but has moderated more recently. In the initial quarters of the pandemic, real investment in special health care building structures also increased, but later fell below prepandemic levels and is now more than 50% below those levels (figure 6).

Manufacturing and mining structure investment have also responded to changing demand

Among the major categories for investment in structures, nominal investment increased the most in manufacturing structures. Investment surged 61% from US$77.8 billion in Q4 2019 to US$125.5 billion in Q1 2023. As a result, investment in manufacturing structures as a share of total business investment in structures increased from 11% to 17% during this period. Manufacturing is the only sector where real investment in structures has recovered and is almost 14% above prepandemic levels. The output in this sector, with a four-quarter lead, is an approximate indicator of the cyclical trends in investment in manufacturing structures. If this relationship were to hold, one would expect investment in manufacturing structures to begin declining as we are seeing the growth in manufacturing output stalling.

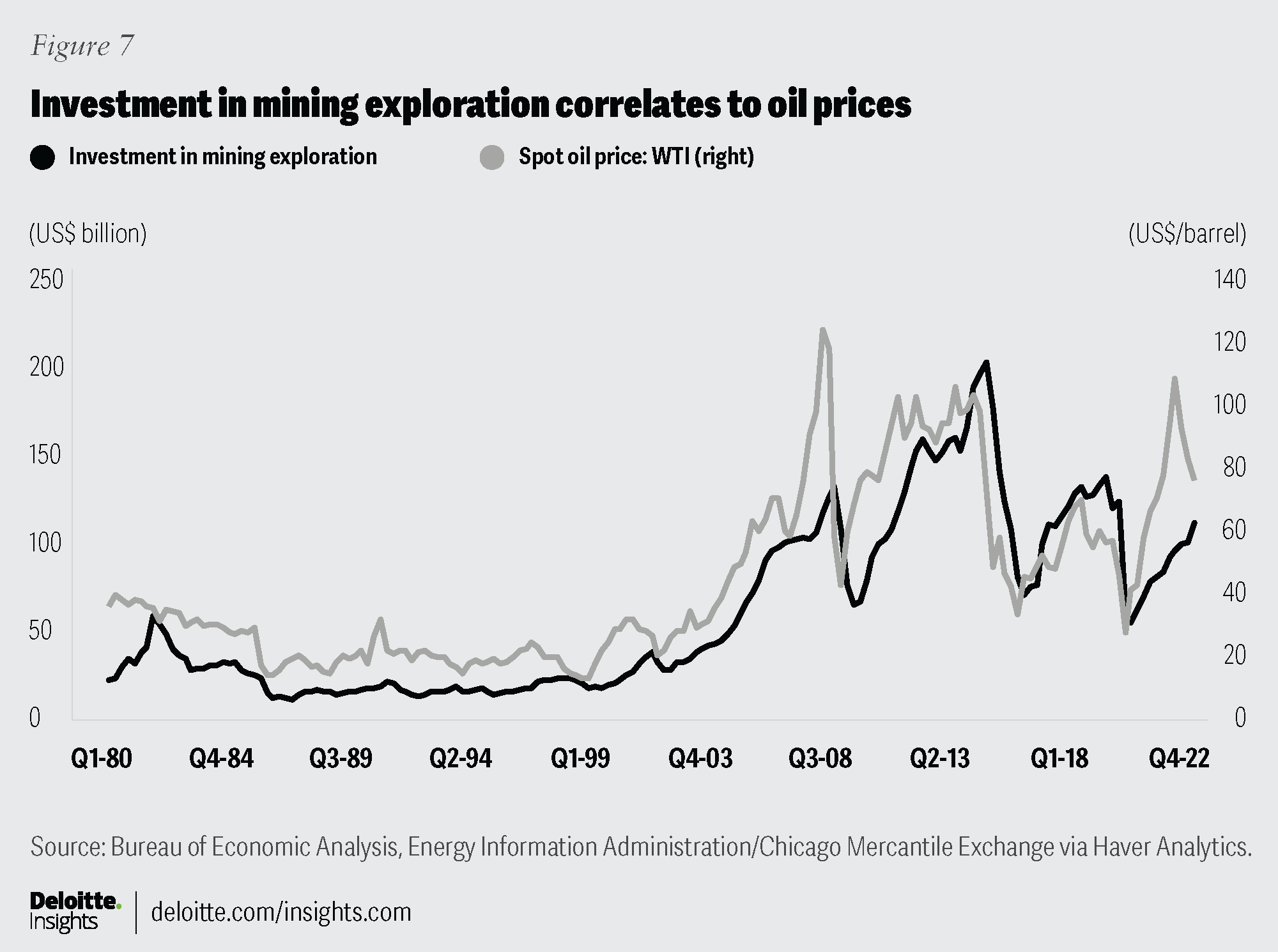

A similar story is unfolding in the mining exploration sector. Historical data indicates close correlation between mining structures and crude oil prices (figure 7). When the pandemic hit, oil prices declined, and so did real investment in mining exploration structures, which fell to half of its prepandemic levels in Q3 2020. As of Q1 2023, investment in mining exploration is below prepandemic levels, both in nominal and real terms. Between Q4 2019 and Q1 2023, nominal investment has declined 7% to US$111.8 billion, while real investment is down 8%.

Investment in mining exploration structures is classified into 1) structures for petroleum and natural gas exploration and 2) mining structures. Of the total business investment in mining exploration structures, around 90% comprises structures for petroleum and natural gas exploration, and the remaining is in mining structures. In the case of structures for petroleum and natural gas exploration, investment remains below the prepandemic levels, both in nominal and real terms. Real investment in mining structures has not yet recovered, but with the increase in crude oil prices, nominal investment was 22% above the prepandemic level in Q1 2023.

The decline in investment in power facilities is not good news for aging infrastructure

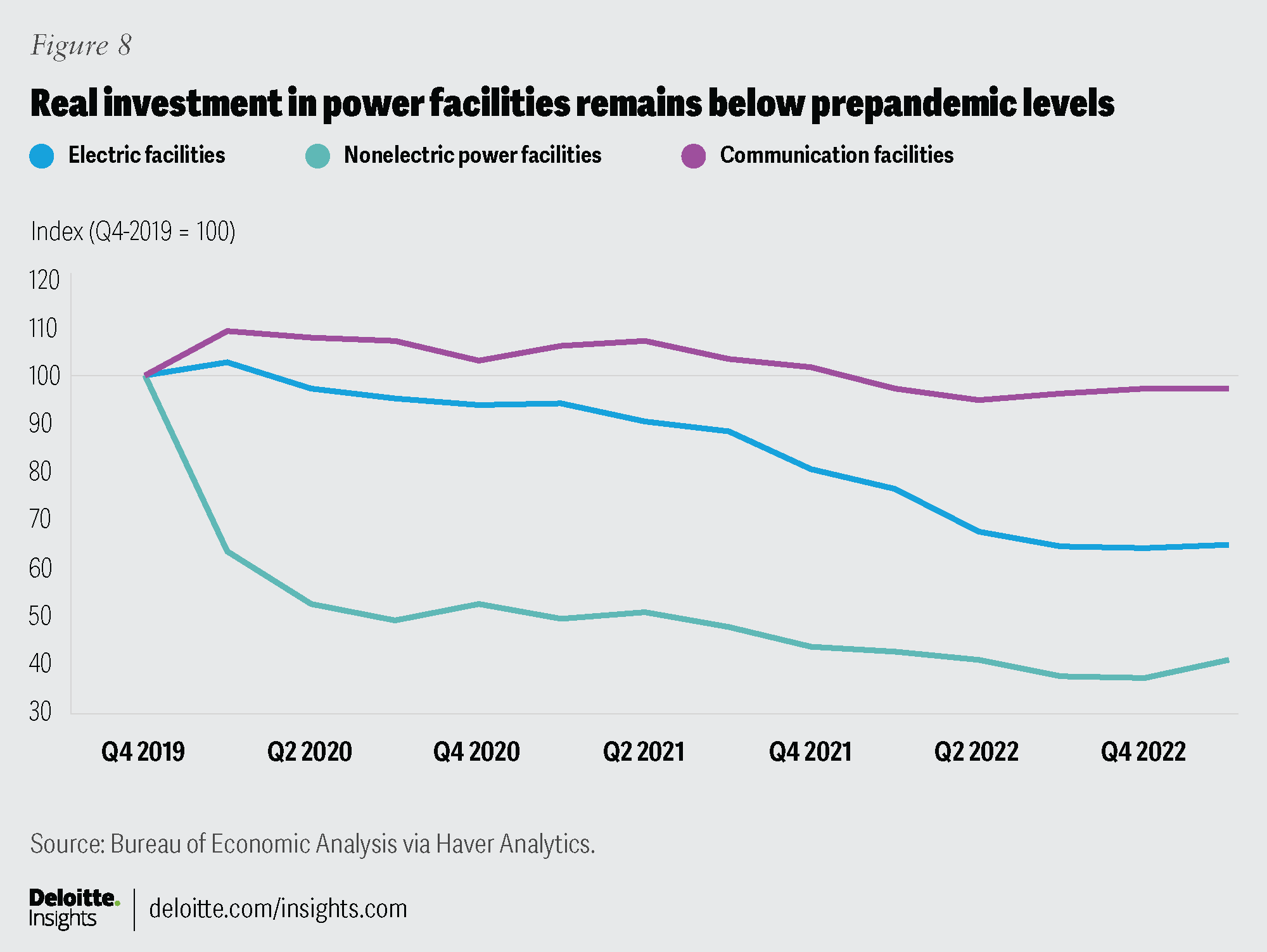

Investment in power and communication facilities is classified into electric power facilities, nonelectric power facilities, and communication facilities. Most of the investment in this sector goes toward power facilities, particularly electric power (around 60% of the total investment in power and communications).

Electric power facilities include buildings and structures for the generation and distribution of electric power, including coal and gas fired plants, nuclear reactors, hydroelectric plants, dry-waste generation, and thermal, wind and solar energy facilities. This category also includes electric distribution systems, electrical substations, switch houses, transformers, and transmission lines. Nonelectric power facilities include buildings and structures for the distribution, transmission, gathering, and storage of natural gas and crude oil.

Real investment in both electric and nonelectric power facilities has largely been below prepandemic levels between Q4 2019 and Q1 2023, so the real investment in overall power and communication facilities was 37% below the prepandemic level in Q1 2023 (figure 8).

Nominal investment in overall power and communication facilities fell around 20% from US$150.5 billion in Q4 2019 to US$119.8 billion in Q1 2023. As a result, investment in these facilities as a share of total business investment in structures declined from 22% to 17%. During this period, although nominal investment decreased in electric (-17%) and nonelectric power facilities (-46%), it increased in communication facilities (11%).

The demand for communication facilities increased during the pandemic. Communication facilities include telephone, television, and radio, as well as buildings and structures for distribution and maintenance of these facilities. Real investment in these facilities increased during the pandemic and stayed above the prepandemic level until Q4 2021, after which it gradually declined.

A look at investment levels in other structures

In addition to the five main sectors, 19% of business investment in structures fell into the “other” category in Q4 2019. This amounted to a nominal investment of US$132.9 billion, which declined by around 10% to US$120.0 billion in Q1 2023.

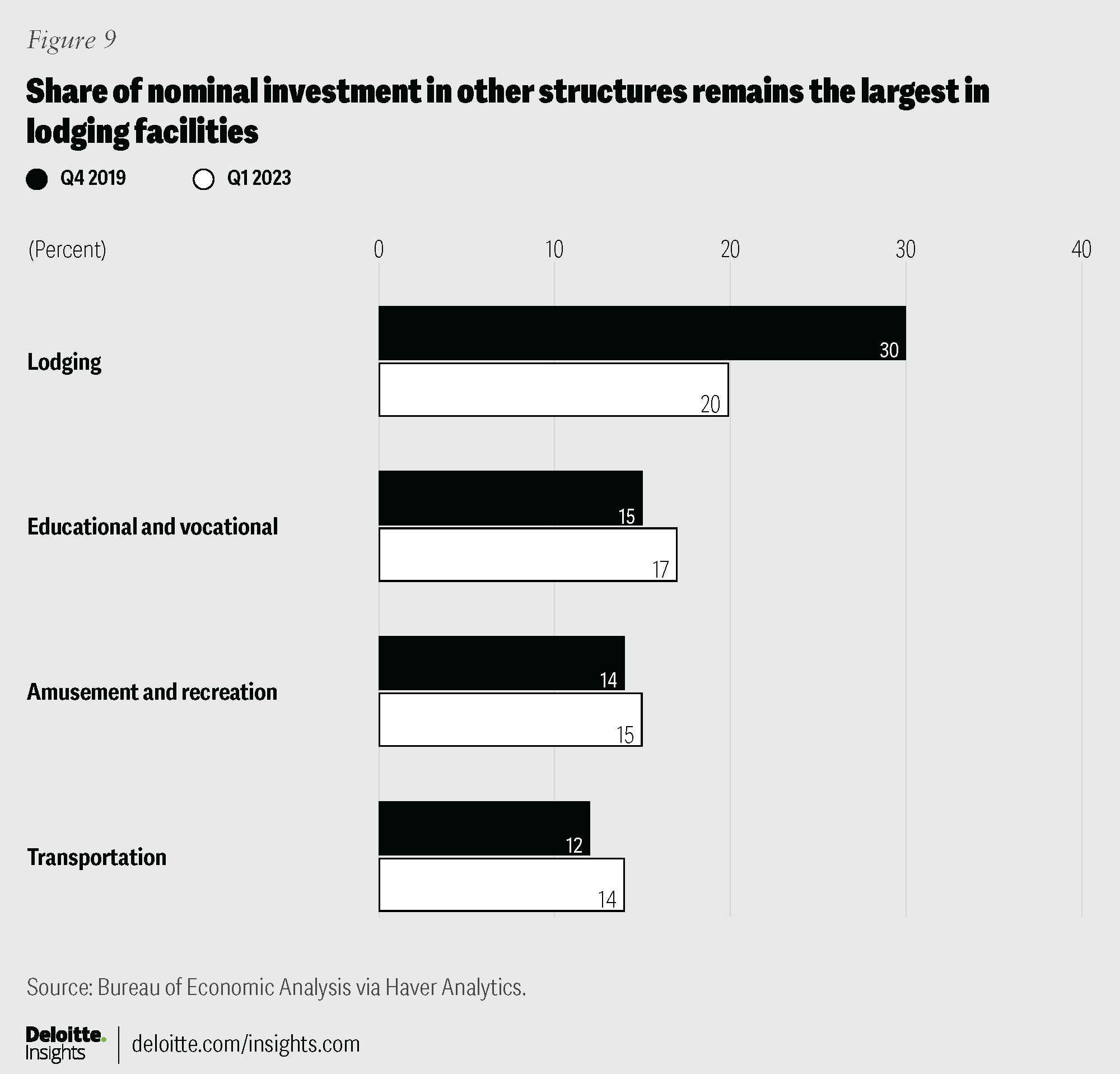

In Q4 2019, over 70% of investment in structures in the other category went into four subsectors, and by Q1 2023, this combined share fell to 66%. These subsectors include lodging facilities, education and vocational structures, amusement and recreation facilities, and transportation structures. In real terms, combined investment in these four subsectors was 33% below the prepandemic level in Q1 2023.

The largest share of investment in other structures was in lodging facilities, but due to the pandemic, investment took a hit. Even in Q1 2023, investment in nominal and real terms was below the prepandemic level (figure 9). This trend also holds true for amusement and recreation structures, as people stayed home due to pandemic-induced lockdowns. In fact, in real terms, investment has not recovered in any of the major subcategories within other structures. However, in nominal terms, educational and vocational facilities, and transportation facilities were exceptions as investment recovered and was above the prepandemic level as of Q1 2023.

What does this mean for future investment?

Overall, there are a few bright spots for investment in structures, such as manufacturing, warehouses, and communication facilities, but the outlook for the commercial real estate sector is not positive.

In an article published in 2015,6 we noted that most types of nonresidential construction had been stagnant for decades due to the changing structure of the US economy. The shift toward a knowledge economy made investment in building structures less critical to growth, paving the way for more investment in technology through equipment and intellectual property products. This trend has been exacerbated by the Federal Reserve’s path of monetary tightening to combat inflation.

In its latest Financial Stability report,7 the Fed notes the risk from the exposure of financial institutions, including banks, to commercial real estate mortgages. The increase in interest rates could make it difficult for mortgage borrowers to refinance loans at the end of the term. Also, although commercial real estate prices have declined, valuations are relatively higher, and a potential correction could lead to credit losses by holders of commercial real estate debt. These factors could be additional sources of vulnerability for the banking sector, which is already under pressure due to runs on SVB and Signature Bank, and the failure of First Republic Bank in March. In fact, some banks are willing to sell off commercial real estate loans at a discount to reduce exposure to the sector amid fears of an increase in delinquencies.8

A combination of cyclical and structural factors clouds the outlook for the commercial real estate sector, and, therefore, investment in structures. However, there is a silver lining on the policy front. As noted in one of our recent articles on the US economic outlook,9 the Inflation Reduction Act has provisions for investments in climate protection, including clean energy production and other climate change remediation measures, which could create avenues for construction activities in the economy.

Table of contents

- The big picture

- Commercial buildings: Squeeze that office space, we need more warehouses

- Health care structures: More investment in medical buildings

- Manufacturing and mining structure investment have also responded to changing demand

- The decline in investment in power facilities is not good news for aging infrastructure

- A look at investment levels in other structures

- What does this mean for future investment?

- Deloitte Services