Perspectives

Recovery and the data-enabled tax department

The key to effective digital transformation

Time for a big step forward

For years, digital transformation has steadily encircled tax departments. Other enterprise functions are well along the digital maturity curve, many using cloud computing, mobile applications and devices, automations, analytics, artificial intelligence, and other digital innovations. They are rapidly and systematically changing business models and the conduct of business globally and remotely through digitization.

Tax departments have participated up to a point. Many now use tax-specific applications either built into, or bolted onto, enterprise resource planning (ERP) systems. Others use standalone applications for specific tax purposes such as tax provisions, indirect tax compliance, or state and local taxes, just to name a few.

Yet the digital transformation of tax on par with those other areas of the enterprise can be challenging. Why? Because it’s often hindered by continued reliance on spreadsheet programs and the disjointed, isolated tax data they typically contain. Spreadsheets are often the engines of tax planning, compliance, and reporting, central to everything tax professionals do—and they have been for a long time. But it’s time to change.

Let’s take a closer look at why many tax departments are reluctant to abandon their spreadsheets and how the data-enabled tax department may be the key to setting them free.

A natural reluctance

Tax departments are judged by the accuracy, completeness, and timeliness of their output. Whether it’s tax projections, tax returns, or tax reporting for financial statement purposes, errors can lead to tax adjustments and penalties by tax authorities, material weaknesses and significant deficiencies in audits, financial report restatements, and under certain circumstances criminal indictments of CEOs and CFOs. The pressure on tax executives to avoid mistakes is intense, ongoing, and ever increasing.

It’s no wonder they are inclined to stick with what they know. Always on the stopwatch and constrained by tight budgets, they have to be confident that their data, calculations, and outputs are fit for scrutiny by very critical stakeholders. Who wouldn’t be hesitant to change the status quo under those circumstances?

Yet the errors that cause so much consternation often stem from the very approach that has been relied on for so long:

- Manual data collection and handling

- Siloed spreadsheet calculations and data storage

- Consolidation of results into additional spreadsheets for various compliance and reporting purposes.

The remote work environment necessitated by the COVID-19 crisis has exacerbated these spreadsheet risks. Even with stringent policies, procedures, and internal controls in place, errors still happen. It’s just the nature of manual processes and pervasive spreadsheet usage.

Spotlight on—the trial balance

Let’s consider an example. As the starting point for many tax calculations, the trial balance is usually downloaded from an ERP system or other financial software and then used in various ways by different tax teams. Each team downloads the trial balance into their own set of spreadsheets often containing dozens, if not hundreds, of sheets that reference different elements of the trial balance data.

After mapping the trial balance data into and among their worksheets, each team then “enriches” the data with specific tax calculations, logic, and rules—e.g., working out permanent items, timing differences, and other adjustments—in order to produce whatever output is required of them. That enrichment process may involve a few steps, or dozens.

All the while, each team constantly checks the source data, calculations, and enriched data for errors—a significant investment of time and resources that is embedded across each tax process. If an error is discovered or a change is introduced at any point in the process—from adjustments to the trial balance itself or to any of the calculations made during enrichment—every step of the enrichment process through to output must be rechecked for accuracy and completeness. This sometimes happens many times.

Importantly, all these activities take place in isolation because the enrichments and outputs of the various teams are distinct from one another. Yet at the end, the outputs typically need to be consolidated to tell a complete story about the tax provision, tax return, or other tax reporting requirement. Often, that consolidation process is yet another manual, spreadsheet-based exercise that is prone to errors and requires additional time-consuming validation.

Question: Should tax professionals who have earned advanced college degrees, gained many years of business experience, and are often highly paid spend 25 percent or more of their time on data-wrangling, data enrichment, and data validation? Couldn’t they drive more value for the organization if more of their time was focused on technical analysis of tax positions, effective tax rates, tax projections, and other vital planning, compliance and reporting activities?

The answer, of course, is yes. But it means being able to trust your data. So what does that look like?

The data-enabled approach

A data-enabled tax department centralizes tax data in a way that reduces the amount of time that tax professionals spend on data extraction, validation, and formatting in various spreadsheets. Instead, those activities—acquisition, validation, and tax-enrichment—are automated, potentially using tools that may already exist elsewhere in the enterprise, such as in finance. Using data wrangling tools, the tax department can apply its own rules, governance, and internal controls to those tools and activities. From that point on processes are carried out automatically with periodic updates and enhancements as the business evolves.

Moreover, every time the data is modified or updated—whether in the beginning with the trial balance, across the various discrete tax-enrichment processes described previously, or through the consolidation process at the end—that modification or change can be executed automatically backward and forward through each process, as well as across processes.

Consider two key implications of such a data-enabled approach:

- Reliability. No longer do discrete tax planning, compliance, and reporting processes necessarily rely on the specialized knowledge and memory of one or a few individuals. Instead, the institutional knowledge and experience from across the tax organization can be documented and embedded in the data wrangling tools. The importance of establishing automated processes to mitigate key person dependencies has never been clearer than now as tax departments suddenly deal with the uncertainties of stay-at-home conditions due to COVID-19. Furthermore, these automations don’t make tax professionals any less valuable. On the contrary, it frees them to expand their knowledge, skills, and experience into new areas so they can generate more value for the organization, thereby making themselves more valuable to the organization.

- Visibility, transparency, and traceability. With such a capability, errors or omissions can no longer hide in disconnected spreadsheets, eluding detection without time-consuming forensic analysis. Instead, data-enabled tax processes inherently and automatically create audit trails that make subsequent data retrieval, drilldown, and analysis much faster and more accurate.

What do these implications mean for tax professionals?

Instead of being deeply mired in manual manipulation and validation of tax data with constant concern about its accuracy and completeness, you can instead turn your full attention and professional capabilities to generating insights from the tax-ready data that is now at your disposal.

Getting from here to there

The words “transformation” and “journey” tend to make people’s eyes roll, but if there was ever a cause that warranted their use, the data-enabled tax department is it. Just as most businesses choose different business models and take their products and services to market in unique ways, your tax department is likely to chart its own path toward data-enablement.

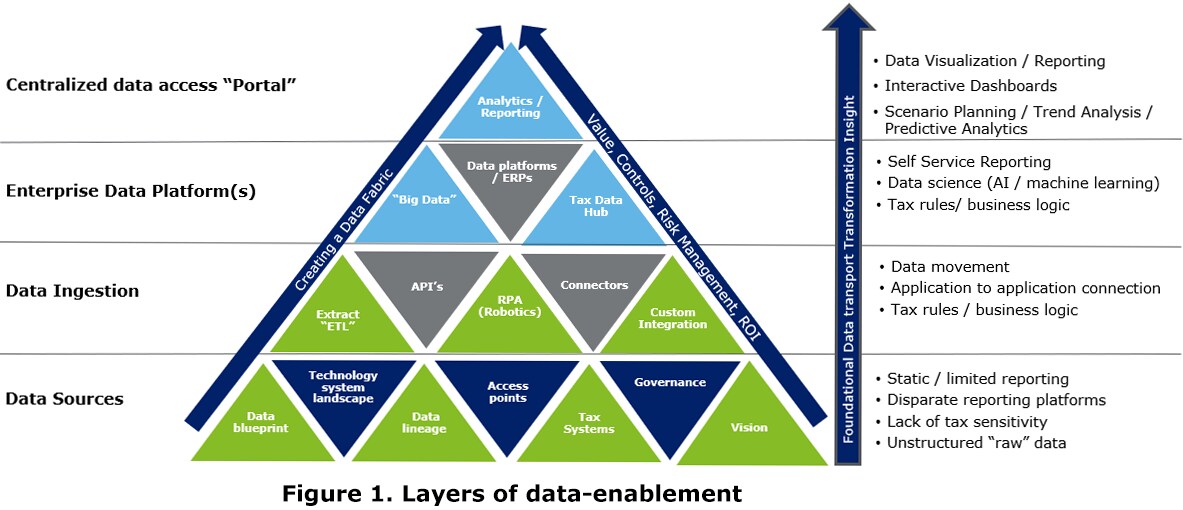

The framework for a data-enabled tax department has many elements or building blocks (see Figure 1). How your tax department puts them together should be unique depending on its current “digital maturity” and many other factors, including the completeness and strength of the organization’s foundational data source layer. Nevertheless, as you piece together these building blocks, your ability to automate processes, generate insights, and create value can grow and accelerate.

* Click on image to zoom in

${caption-text}

${caption-text}

One challenge almost every organization faces with an initiative of this scope and importance is the decision of where to begin. These steps can help point you in the right direction:

1. Think big: Start by identifying the landscape and sizing up your opportunities. Talk to people in your tax department to identify recurring instances when significant time is spent today on inefficient manual processes. Include your finance colleagues in the brainstorming, as they often face similar challenges. Video conferences and virtual whiteboarding tools can help accelerate these efforts.

2. Start small: Next, prioritize opportunities based on potential value, risk, and ease of implementation. Start with things that are critical to supporting remote work (given the likelihood of continued disruption from COVID-19), or that have a wide impact—think beyond financial benefits. For instance, the value might be increased efficiency, mitigated risk, or new benefits from prior technology investments. Once you’ve identified one or two top priorities, prove it works. Develop a proof of concept that clarifies the approach and demonstrates the value.

3. Act fast: Then socialize the benefits to help others understand. It’s critical at this stage to let end users react to what you’re planning, so you can gauge your change management challenges and tailor the end product to users’ needs. You don’t want to push your idea to the finish line only to learn it’s not being adopted because you didn’t get enough input from the people who are expected to use it. Once that initial buy-in is established, sequence your opportunities based on impact and continue to deploy them in short sprints that build on each other and create momentum for change.

What’s stopping you?

Letting go of, or at least significantly reducing the dependence on, spreadsheet-based tax processes is a tall order for many tax departments. Yet it doesn’t have to be done in a day, nor does it need to put the department at risk.

Start by understanding big-picture the capabilities of a data-enabled tax department. Work with stakeholders to envision and gain buy-in for what that data-enabled state could look like. Identify small, achievable “wins” that can become the foundation for bigger, long-term success. And then involve your stakeholders in the process of making the vision become a reality.

There’s no reason for tax departments to sit back and watch other areas of the enterprise enjoy the benefits of digital transformation alone. Now is the time to stake your claim—and make it a reality.