SPACs dominate headlines, but it’s traditional technology M&A that’s booming

What the rise of SPACs means for technology executives

Everyone’s talking about SPACs, but tech companies are mostly still looking to traditional M&A for growth.

No question that special purpose acquisition companies—SPACs—are hitting peak hotness.1 In short, SPACs are empty-shell investment companies that raise money via an IPO with the intent of consummating a merger with a private company and, in the process, taking the target company public. These IPOs exploded in popularity in 2020 largely in response to the high level of market and economic uncertainty created by pandemic lockdowns; for private companies seeking access to public markets before their potential closing, SPACs can offer a faster and cheaper path than traditional IPOs.

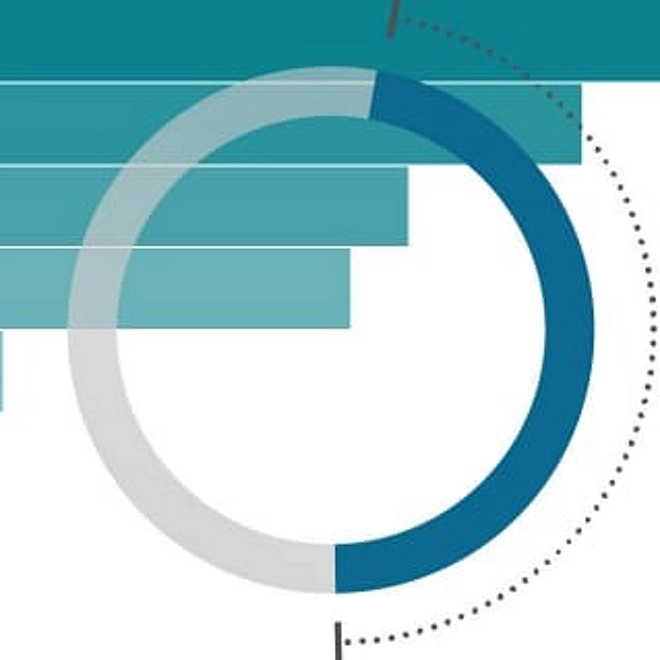

The headlines, though, may skew tech leaders’ perspective: Relative to the overall universe of fundraising options available to private companies, SPACs still play a minor role. Based on our analysis of tech-related deal activity,2 SPACs accounted for only 8% of the total 2020 deal value in the technology sector, compared to 65% for strategic corporate acquisitions and 21% for deals led by private equity (PE). Yes, SPAC deals soared 251% from 2019 to 2020, but they were starting from a low baseline.

And the real story in technology—the only sector to grow in value over 20193—is the continuing strength of traditional corporate M&A. In the face of what should, by all accounts, have been a challenging year, traditional M&A activity in the tech sector grew 88% by value in 2020, followed by PE-led deals at 42% and 19% for conventional IPOs.

With strong balance sheets, easy access to capital, and stocks trading at record-high multiples, technology companies in 2020 were solidly positioned to offer targets attractive combinations of stock and cash. Meanwhile, nontech companies increasingly looked to technology acquisitions to accelerate their digital ambitions in an environment dominated by home-based, contactless work, play, education, and commerce.

There are good reasons why private tech companies may favor traditional M&A over public markets—either SPACs or IPOs—as an exit strategy. Strategic corporate buyers typically pay more than financial buyers for private companies, justifying premium valuations based on their greater capacity to realize cost and revenue synergies as they integrate and scale acquired businesses into their operations.4

SPACs do help fill a market void: They provide another funding option for private companies that might not necessarily meet the eligibility requirements for a traditional IPO or corporate acquisition.5 While corporates may be more willing to pay for a target’s potential than, say, a PE firm, they are less likely to climb far out on a limb in acquiring early-stage companies without a clear path to products, customers, or revenue, as a SPAC might. But notwithstanding the flashy headlines, we don’t see SPACs displacing M&A.

Considerations for technology executives: SPACs versus traditional exit options

Are we ready and willing to operate as a public company? When SPAC sponsors approach private companies, often out of the blue, the deal can look attractive enough that leaders find themselves scrambling to meet the strict deadlines in complying with a public company’s immediate and ongoing requirements. SEC registration and regulatory paperwork are basically the same for a traditional IPO or SPAC. An IPO, however, generally provides more time—sometimes years—for a company to ready operations, upgrade financial reporting processes, and mature governance organizations.

Are we willing to negotiate to improve SPAC merger economics? Postmerger shareholders typically assume significant dilution due to SPACS’ inherent structure.6 In many cases, sponsors provide just 2 percent of the IPO value but receive 20% of the SPAC’s total equity.7 But nearly every aspect of SPAC merger transactions is negotiable, and executives should prepare to negotiate everything from setting the opening stock price, sponsor ownership stakes, board composition, lock-up periods, and more. As more target companies actively engage in these negotiations, the quality and economics of deals are steadily improving in favor of postmerger investors.

Do SPACs portend even higher valuation multiples? SPACs are required to close transactions within two years or return IPO proceeds to shareholders. As SPACs approach their two-year anniversaries, the incentive to close deals may pressure some sponsors to overpay for deals.8 Combining record SPAC issuance with close to US$3 trillion in PE dry powder9 and approximately US$2 trillion10 in excess corporate liquidity, it is easy to envision a scenario in which demand for targets exceeds supply, creating upward pressure on valuations.

Technology, Media & Telecommunications

Deloitte’s Technology, Media & Telecommunications (TMT) industry practice brings together one of the world’s largest group of specialists respected for helping shape many of the world’s most recognized TMT brands—and helping those brands thrive in a digital world.