In the gen AI economy, consumers want innovation they can trust

Deloitte’s 2025 Connected Consumer Survey reveals that, by pairing strong data responsibility with bold innovation, tech companies can win greater trust, loyalty, and spending

Steve Fineberg

Susanne Hupfer

Jeff Loucks

Michael Steinhart

Sayantani Mazumder

Generative AI is becoming a part of everyday life for millions of US consumers. From enhancing productivity to sparking creativity, this transformative technology is reshaping how people work, create, and make decisions. But as consumers dive deeper into personalized digital experiences, they’re starting to evaluate the trade-offs, especially when it comes to privacy and security.

Deloitte’s sixth Connected Consumer study, which surveyed about 3,500 US consumers in June 2025 about their digital lives (see methodology), reveals that while consumers are embracing gen AI and other digital technologies, many feel that technology is advancing too quickly, often without sufficient safeguards or transparency. This sentiment underscores a critical demand from consumers: They want innovation, but they also want transparency, control, and data security. Tech providers who prioritize responsible practices, such as empowering users with greater control and ensuring robust protections, will likely be better positioned to earn trust and drive deeper engagement.

What do we mean by “tech providers?”

In this report, “tech providers” refers to any of the following types of companies that deliver consumer tech solutions:

- Tech device makers: Companies that manufacture and sell consumer technology devices, including smartphones, laptops, desktop personal computers, smartwatches, voice-enabled speakers, and smart home appliances.

- Application and online service providers: Companies that develop and deliver software applications and digital platforms, such as mobile and desktop apps, web browsers, and e-commerce websites.

- Gen AI providers: Companies that offer generative AI tools and capabilities to consumers, including gen AI chatbots, AI-powered search engines, and software with embedded gen AI functionality.

Gen AI embraced by the mainstream

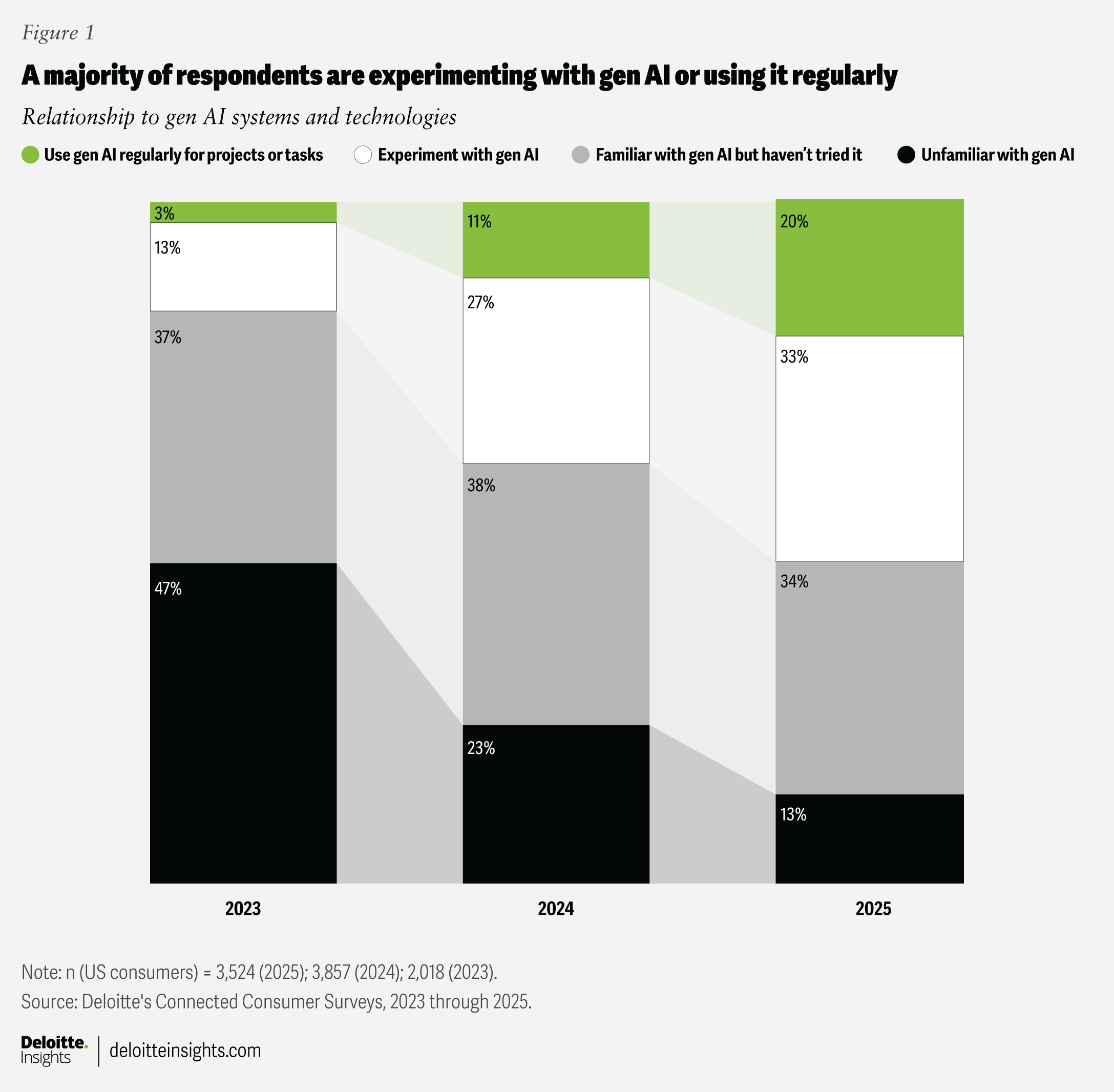

Our survey finds that most surveyed consumers (53%) are now either experimenting with gen AI or using it regularly—up sharply from 38% in 2024 (figure 1). They’re integrating the technology into their everyday lives, accessing gen AI tools and bots for personal, professional, and educational use. Moreover, 42% of regular gen AI users say it has a “very positive” effect on their lives—outpacing perceptions of both devices (36%) and apps (29%).

Gen AI users—those who use it regularly for projects and tasks beyond experimentation—nearly doubled to 20% over the past year. Experimenters—those who don’t yet use gen AI as regularly—rose to 33%. The group reporting that they’re not familiar with the concept of gen AI has dwindled to just 13%.

Roughly half of surveyed gen AI users (51%) say they use it every day, and 38% say they use it at least once a week, which suggests that gen AI is becoming part of their routine digital activities.

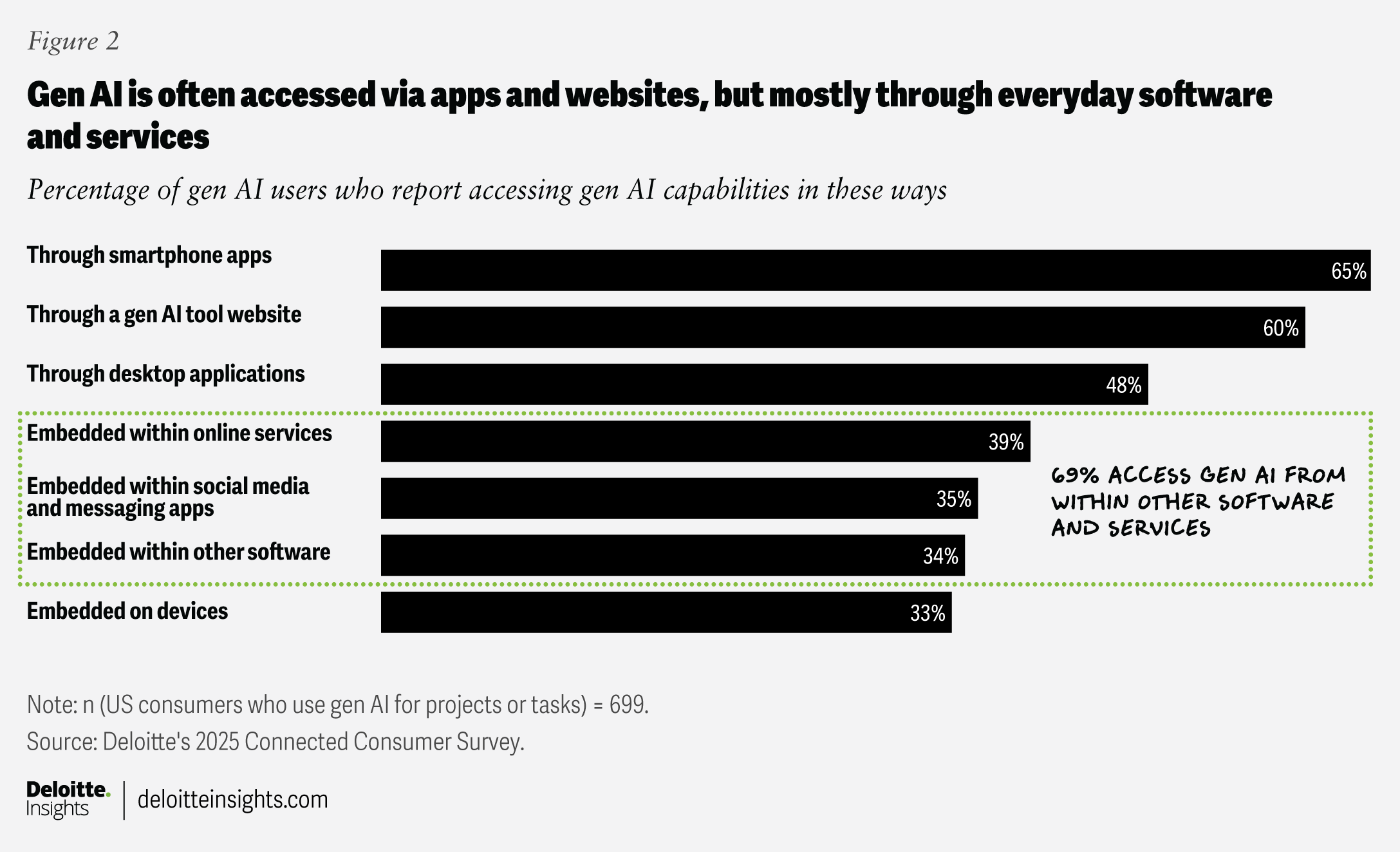

Most gen AI users report engaging with the technology through standalone gen AI applications on their phones (65%) or via tool-specific websites (60%) (figure 2). Sixty-nine percent of users also report tapping into gen AI capabilities built into other familiar software and services they use, such as search engines, social platforms, and office productivity apps.

About four in ten surveyed gen AI users say they or their households pay for gen AI tools or services. Among users who don’t pay for gen AI, half say the main reason is that free tools are good enough, 20% say they don’t use the tools often enough to warrant paying, and 17% cite price. For tech providers, this raises a strategic question: Can they create enough differentiated, meaningful value to convert more free users into paying customers?

Digital spending shows growth

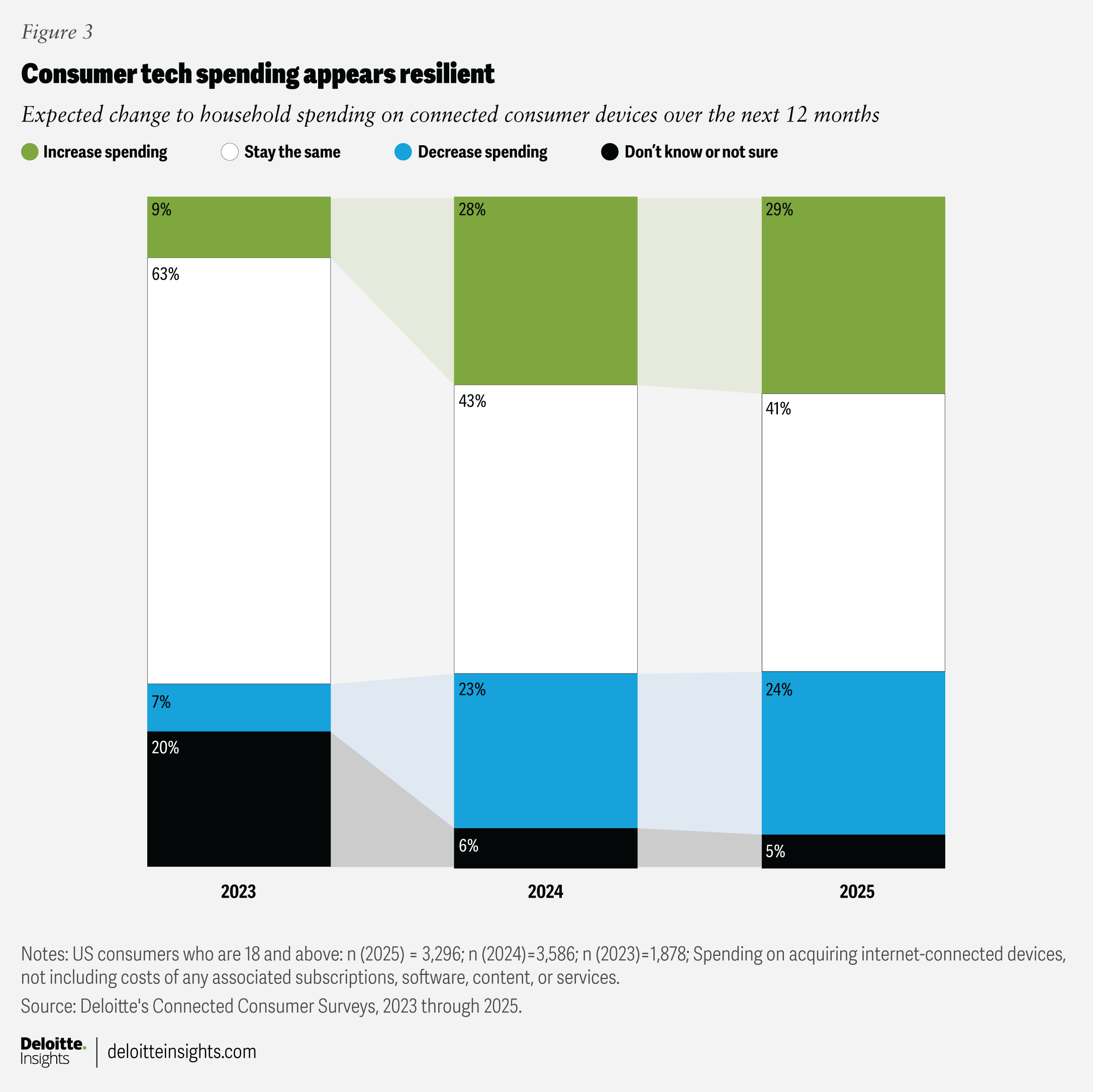

Deloitte’s 2025 Connected Consumer survey shows that US households spent an average of US$896 on connected devices in the past year—a significant uptick from US$764 in 2024. Looking ahead, 29% of respondents say they plan to boost their device spending in the coming year—up threefold from 2023—while 24% say they’re looking to cut back on their device spending (figure 3).1

Overall, tech affordability pressures appear to be easing slightly. In 2025, about half of respondents (51%) say they expect affordability challenges in the coming year, compared to 61% of respondents in 2024. Among surveyed consumers, 23% expect to delay device purchases, 17% anticipate not being able to afford the more advanced devices their household wants, and 16% think they may cut back on tech services, subscriptions, or software.

Along with the growth in device spending, US households also appear to be spending slightly more on tech services and software subscriptions, such as internet connectivity, mobile plans, cloud storage, and antivirus protection. Respondents report that their households spend an average of US$183 monthly on digital services, a slight uptick from US$175 in 2024. The data suggests this upward trend is likely to continue: A quarter of survey respondents expect to increase their spending on tech services and subscriptions—a sharp jump from 14% who said the same last year. Another 57% of respondents say they plan to keep their spending steady, down significantly from 72% last year.

Personal use leads gen AI adoption, but work-related use is growing fast

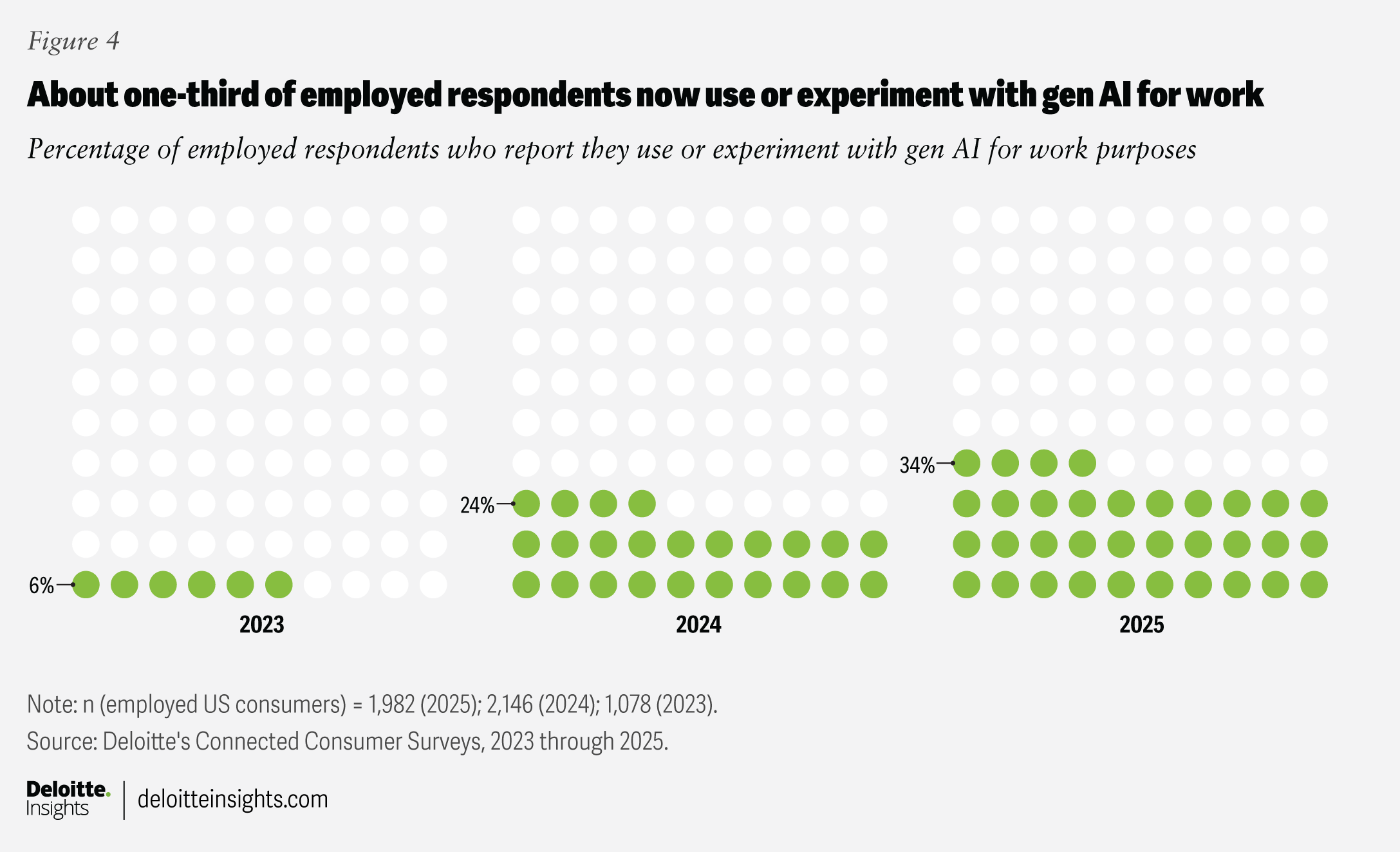

Personal use remains the leading application of gen AI, cited by 85% of surveyed users and experimenters, while 22% say they use it for educational or school purposes. Work-related use (among employed respondents) shows steady growth, climbing from 6% in 2023 to 34% in 2025 (figure 4). Top use cases include writing and editing, conducting research, summarizing information, explaining concepts, and taking notes.

Among those surveyed who are using gen AI for work, more than half (55%) say their organizations encourage its use, and 40% say their companies provide training. Employees report that these tools boost productivity “substantially” (46%) or “moderately” (35%). While 57% say they use company-provided gen AI tools, 69% also admit to using their own tools (installed on personal devices or accessed via personal accounts).

This “shadow AI” trend seems to reflect an element of unmet demand, with many employees recognizing the value and utility of gen AI and taking the initiative to use their own solutions. But it also opens a gap in governance, security, and integration that organizations would be wise to address. With many technology providers targeting enterprise adoption, organizations have a chance to offer sanctioned, secure, and well-supported gen AI tools that meet both employee needs and corporate compliance requirements. Employee demand for these tools is likely to rise: More than half (53%) of surveyed workers—and 59% of students—agree they can see gen AI serving as a valuable assistant in their future roles.

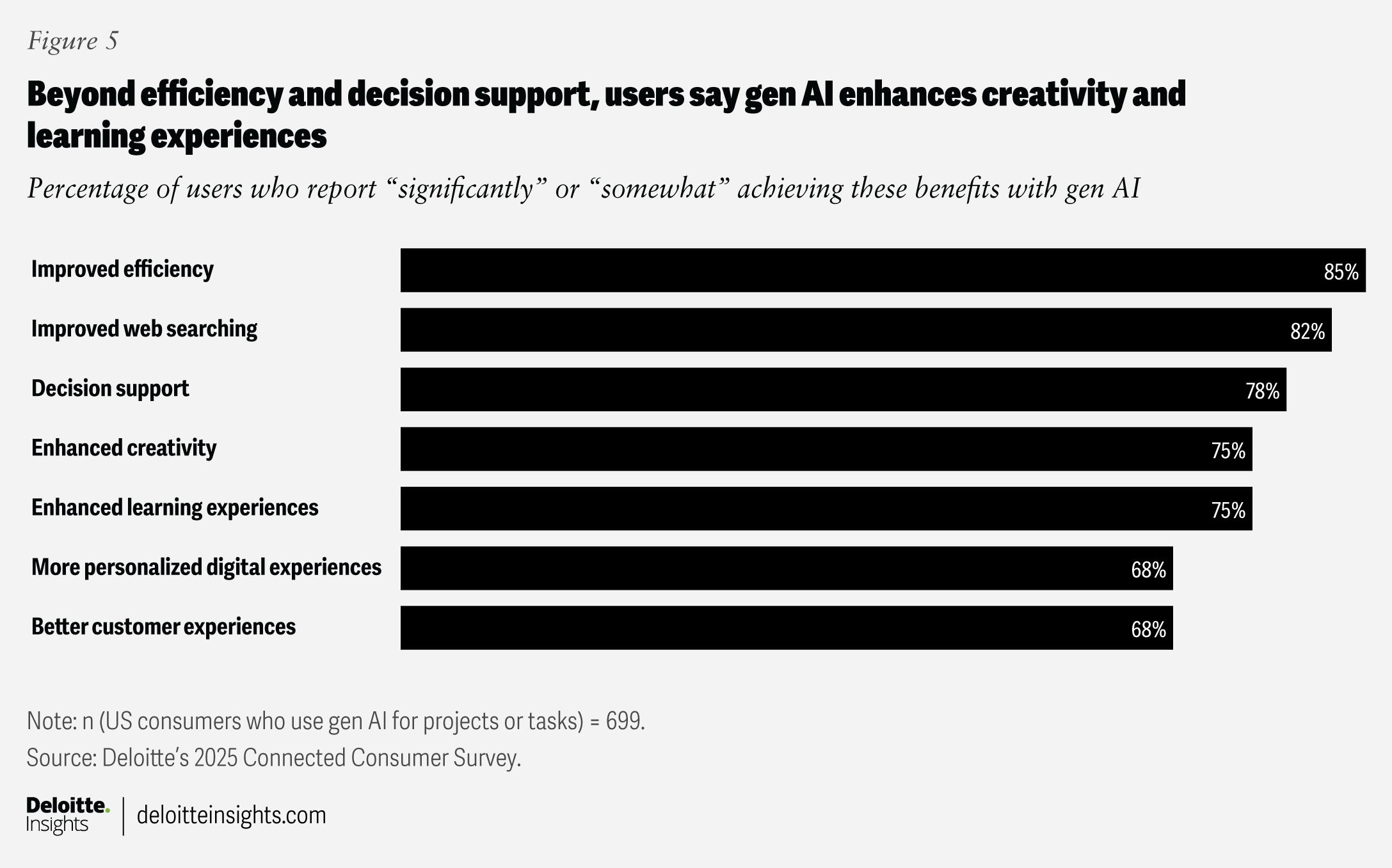

Consumers are using gen AI to enhance creativity and efficiency

Gen AI users are unlocking a broad spectrum of benefits, especially with improved productivity, web search, and decision-making (figure 5).

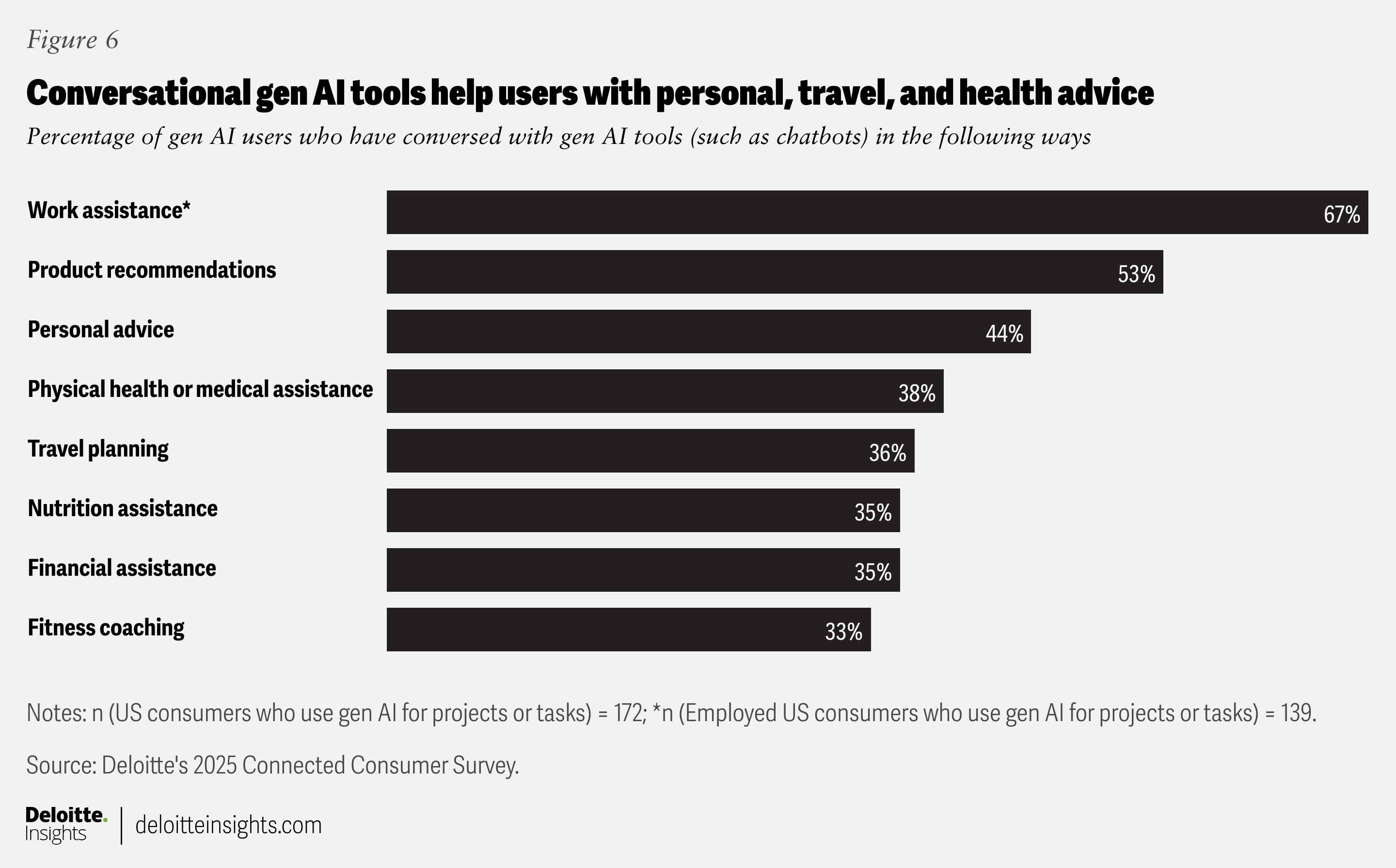

One growing form of gen AI engagement is through conversational chatbots. Among regular gen AI users surveyed, the top five reported applications are work assistance, product recommendations, personal advice, travel planning, and physical health (figure 6).

Surveyed gen AI users describe the chatbots they’ve used as knowledgeable, friendly, and reliable. Some also say they appreciate the convenience, cost, and discretion of chatbots versus human advisors. Gen AI chatbots appear to be winning fans: Seventy-two percent of those using them report that the assistance they’ve received is as good as that of humans.

Gen AI concerns: Accuracy, privacy, and potential misuse

Despite its rapid adoption and overall positive perception, gen AI still raises some concerns. Awareness of potential dangers has grown: Eighty-two percent of surveyed gen AI users and experimenters now say the technology could be misused (up from 74% last year), while 74% fear it could erode critical thinking skills—a concern shared evenly by surveyed users and experimenters, as well as those merely familiar with gen AI.

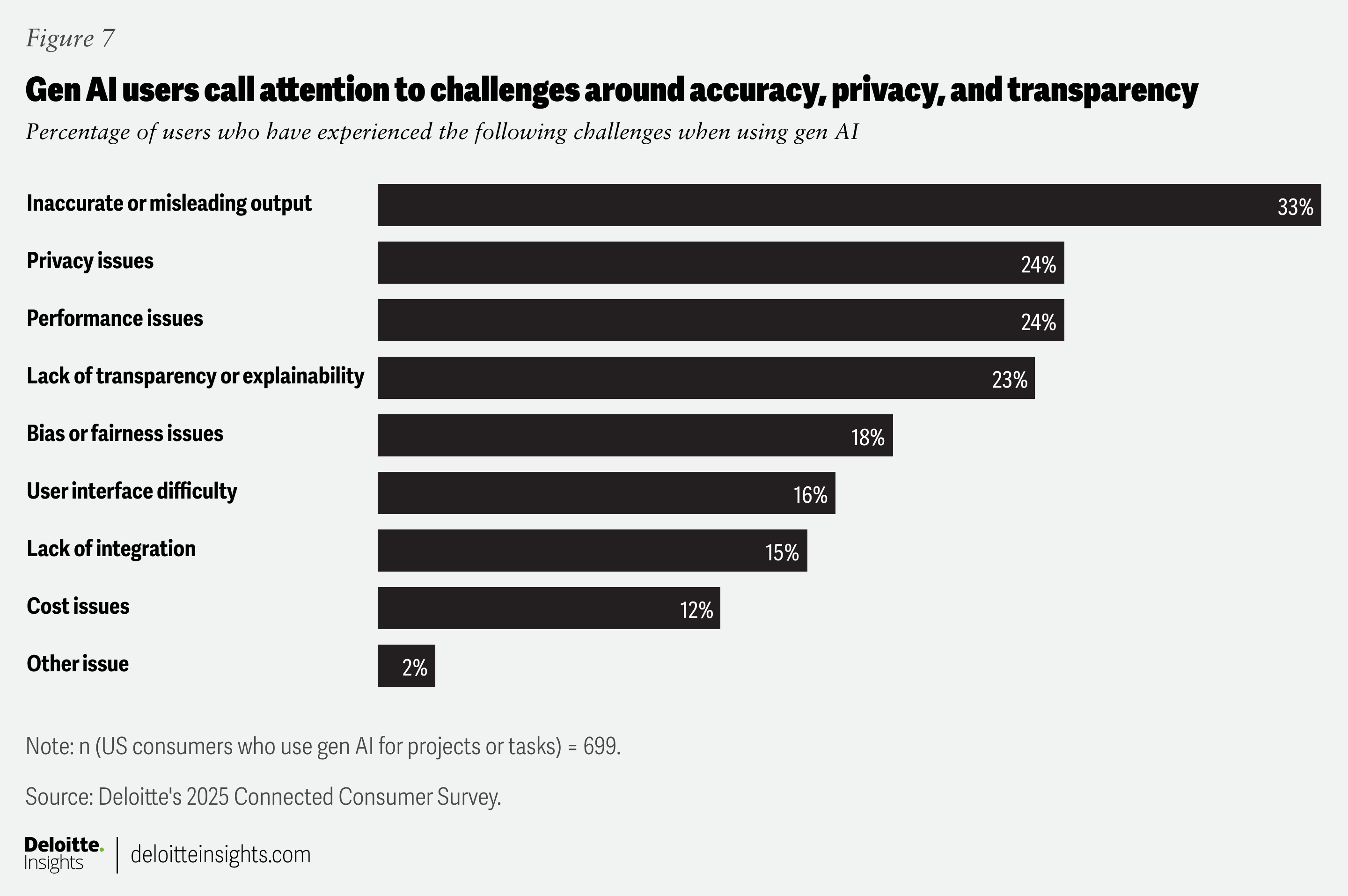

One-third of surveyed users say they’ve encountered incorrect or misleading information when using gen AI, and 24% report they’ve had data privacy issues (figure 7).

Many gen AI tools do include a disclaimer that results may contain errors. More than half (53%) of surveyed users say they mostly or always verify gen AI outputs independently—often by checking trusted sources or cross-referencing their own knowledge, and sometimes by using iterative prompts or reviewing the sources cited by the AI tool.

Increased use of gen AI may foster better discernment. Sixty-two percent of regular users surveyed are confident they can tell the difference between gen AI- and human-generated content, compared to 50% of experimenters. Skepticism persists, however: Nearly three-quarters (74%) of those familiar or experimenting with gen AI—and even 62% of regular users—say the increasing popularity of gen AI makes it harder for them to trust what they see online.

Consumers call for responsible innovation

Today’s consumers appear to be sending their tech providers a clear, consistent message: Don’t just deliver innovation—deliver it with care. For tech providers, the path to sustained loyalty and growth likely lies not only in personalization and speed but also in earning trust through transparency, control, and security by design.

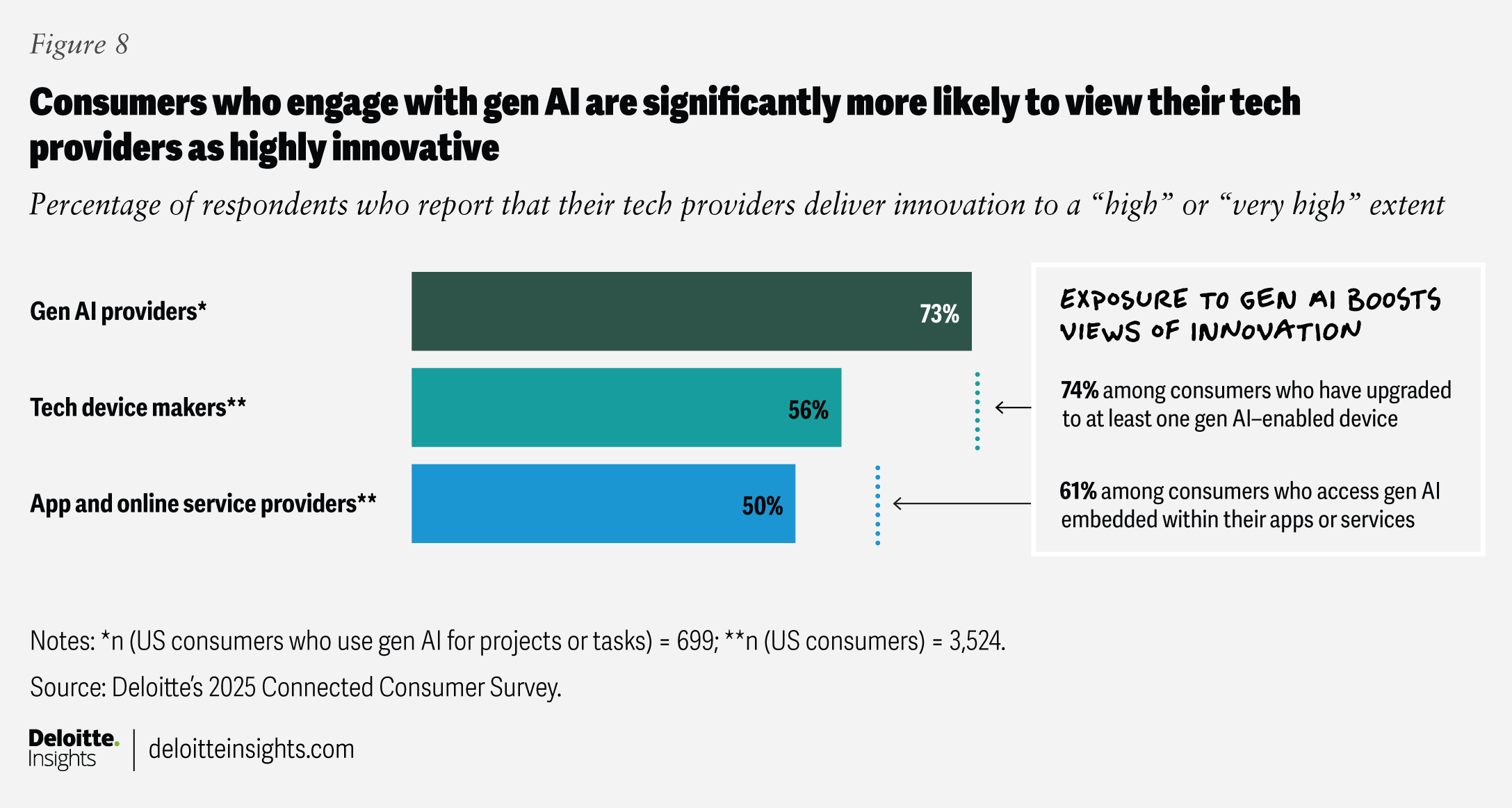

Consumers who engage with gen AI—whether through apps, devices, or dedicated tools—are significantly more likely to perceive their tech providers as highly innovative. Among general consumers surveyed, only 50% to 56% say their app, service, or device providers deliver high innovation (figure 8). But those numbers rise among gen AI users: Sixty-one percent of consumers using gen AI-embedded apps,2 74% of those with gen AI-enabled devices, and 73% of regular gen AI users rate their providers as highly innovative. This suggests that exposure to gen AI can elevate perceptions of innovation across the digital ecosystem.

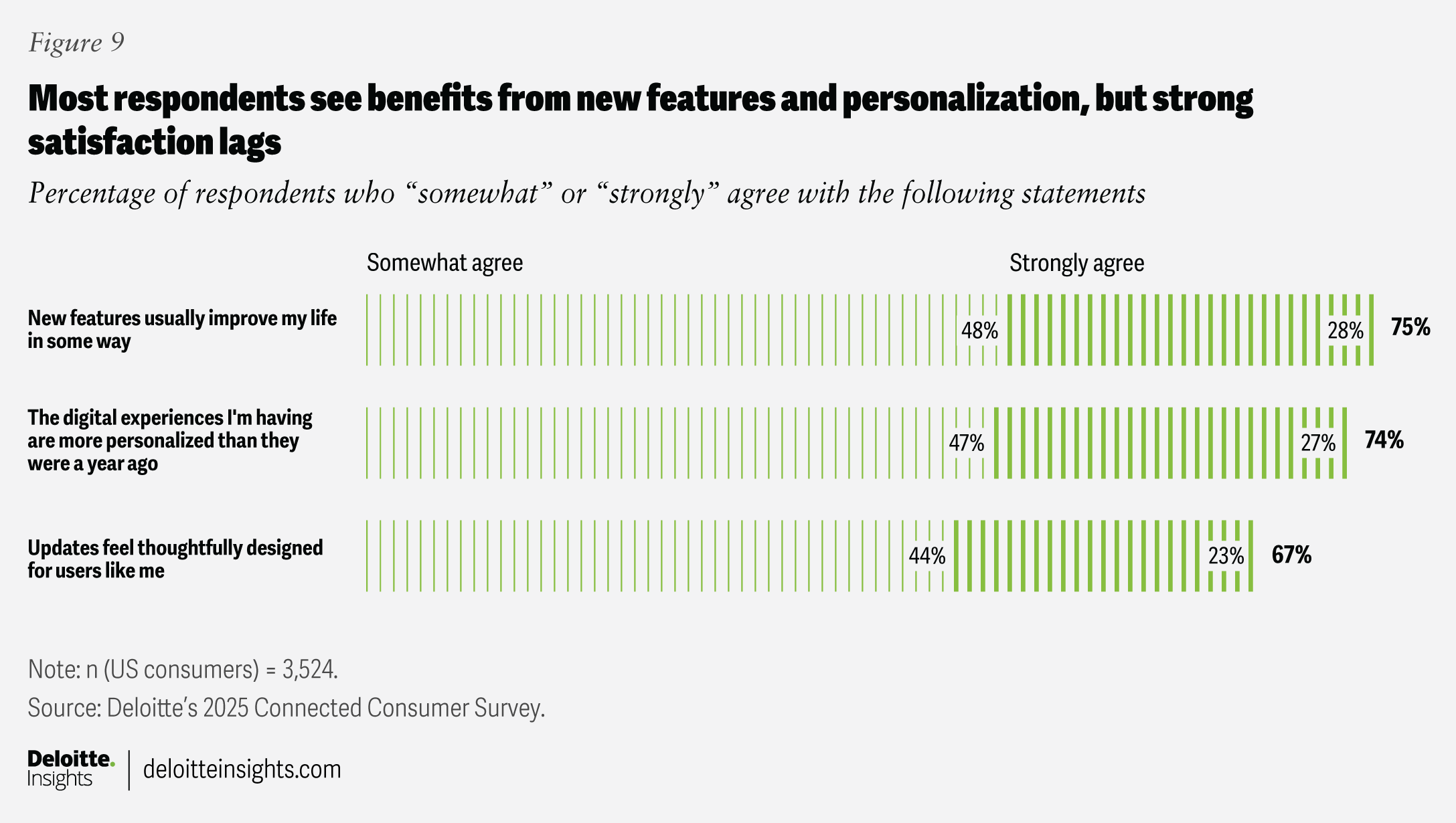

While about three-quarters of surveyed consumers feel that new features improve their lives and that digital experiences are becoming more personalized, fewer than 3 in 10 say they strongly agree, signaling room for tech providers to improve user satisfaction (figure 9).

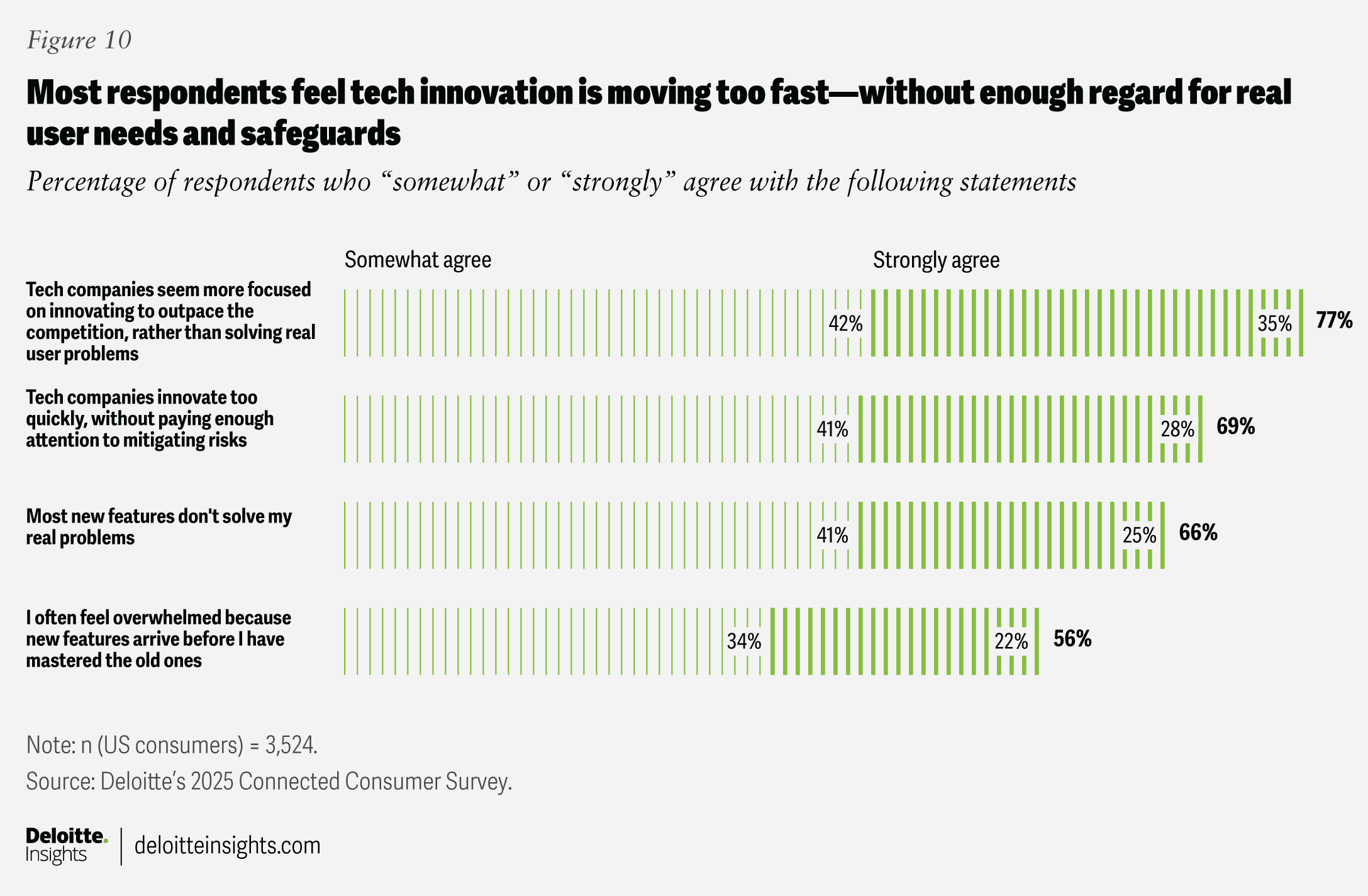

At the same time, surveyed consumers report concerns about how their tech providers innovate: Seventy-seven percent of respondents feel that tech companies are more focused on outpacing the competition than on solving real user problems, and 69% believe that innovation is happening too quickly, without enough attention to risk mitigation (figure 10). Indeed, when asked which innovations they want most in their tech devices, respondents ranked improved security and privacy first. Many also express frustration that new features often don’t meet their needs or change too quickly.

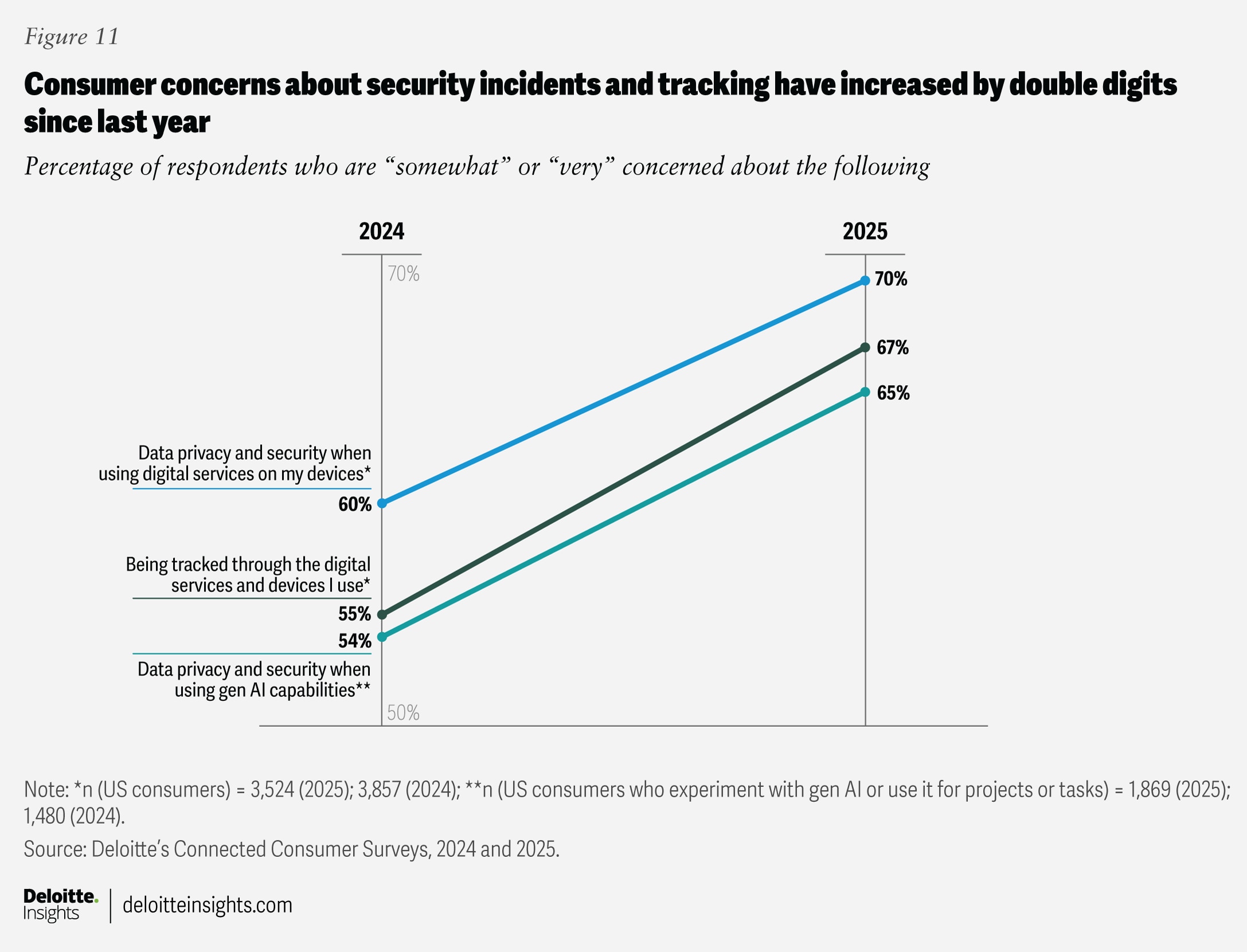

Tech companies routinely collect personalized data to deliver tailored digital experiences, but this can introduce risks that demand careful attention. In just one year, the percentage of respondents worried about data privacy and security jumped from 60% to 70% (figure 11). Concerns about being tracked and worries about data security when using gen AI have followed a similar upward trend. And those concerns are not hypothetical. Nearly half (47%) of consumers report experiencing at least one type of digital security failure in the past year—such as a device hack, account breach, or stolen identity—and over a quarter (27%) report experiencing two or more. At the same time, 58% encountered at least one scam attempt in the past year, including phishing, fake profiles, chatbots impersonating real people, deepfake videos, ransomware or malware attacks, and voice cloning.

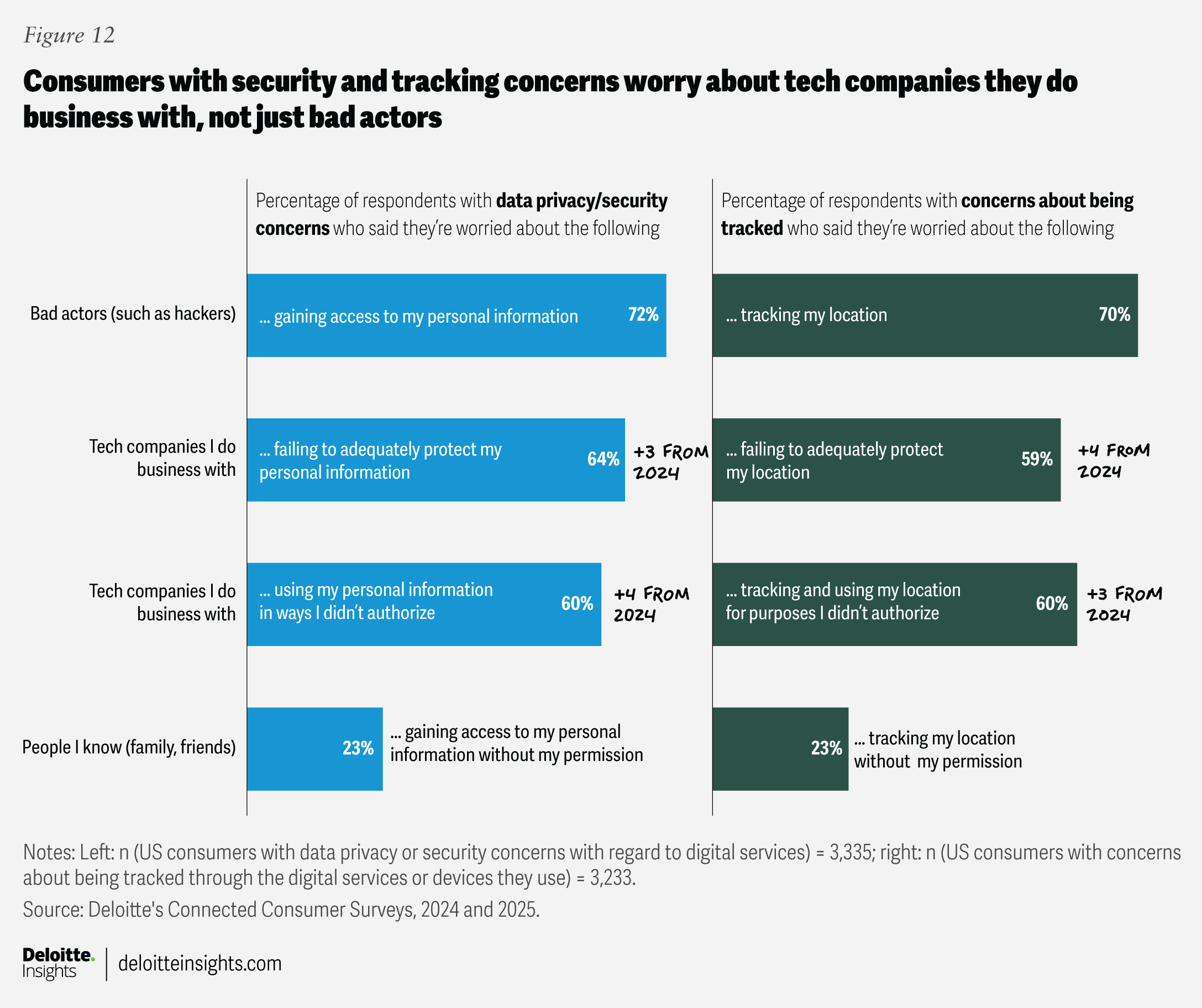

Importantly, consumers are not just afraid of bad actors—they indicate increasing worry about the tech companies that provide their devices and services (figure 12). While most respondents with security concerns worry about hackers accessing their data, almost as many fear that tech providers may use their information in unauthorized ways or not protect it adequately. Similarly, while 7 in 10 of those with tracking concerns worry about being tracked by malicious parties, about 6 in 10 worry that tech platforms themselves could fail to protect their location or use it without consent. These reported concerns about tech companies grew year over year, pointing to a widening trust gap.

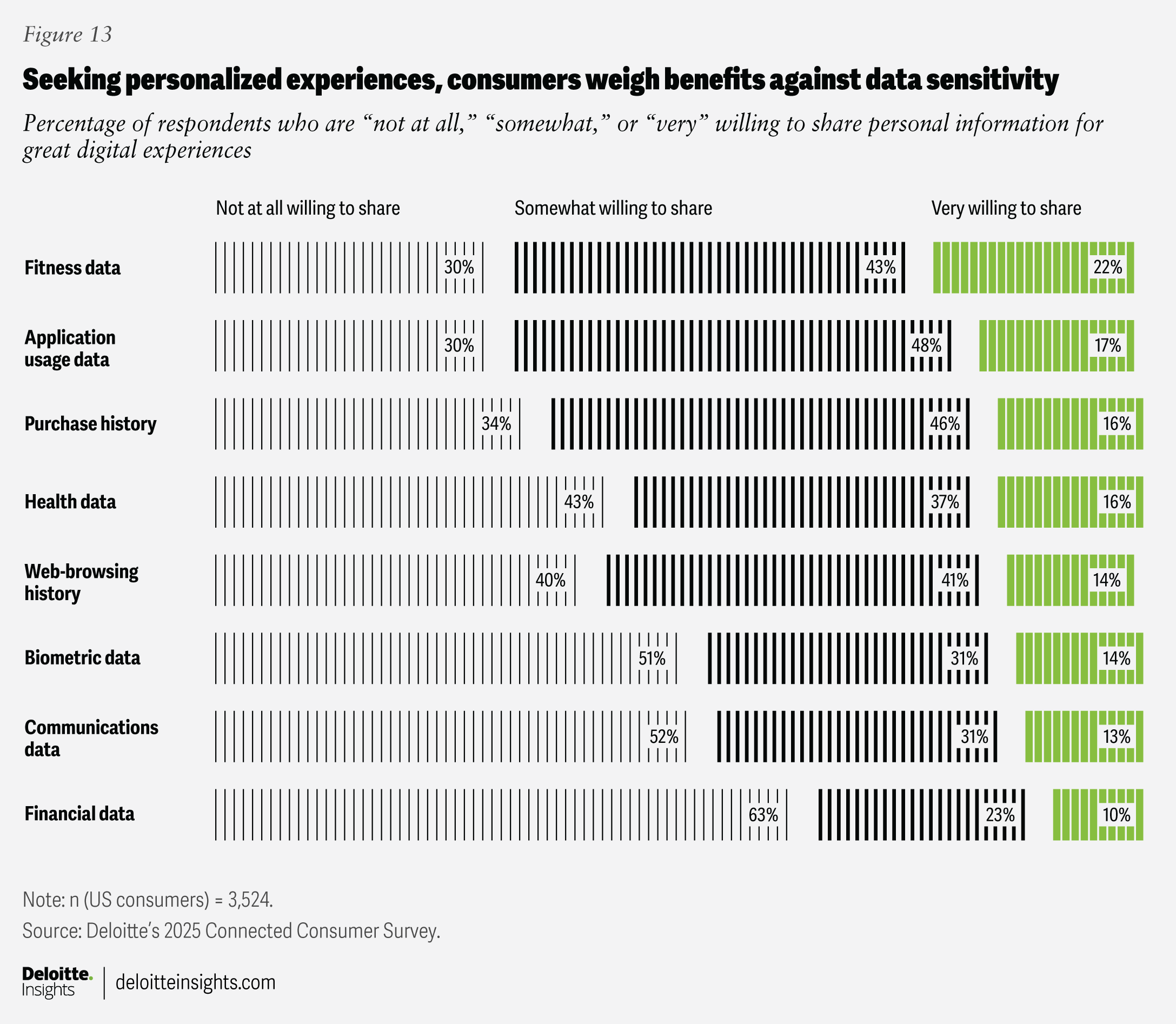

That gap seems to be reflected in respondent behavior. Only around 1 in 10 consumers say they are very willing to share sensitive information such as financial, communication, or biometric data (figure 13). And more than half of respondents say they are not at all willing to share those types of information—even in exchange for better digital experiences. Meanwhile, fewer than half (48%) believe that the benefits they get from online services outweigh their privacy concerns—a steep drop from 58% in 2024 and the lowest level since we began surveying this sentiment in 2019.

Most consumers appreciate innovation—but they also want data transparency, control, and security. Just 20% of surveyed respondents say tech providers are “very clear” about what data they collect or how it’s used, and only 20% say it’s “very easy” to control what’s collected about them. Confidence in data protection is low, with only 27% saying they have “high” or “very high” trust that tech providers are keeping their data secure. At the same time, 9 in 10 surveyed consumers believe tech companies should do more to protect data privacy and security, and that they should have the ability to view and delete the data companies collect.

Moving from innovation to impact

Does an emphasis on responsible innovation drive better outcomes for consumers—and for tech providers themselves? Does earning trust through high standards of data protection, clarity, and control translate into stronger satisfaction, loyalty, and spending?

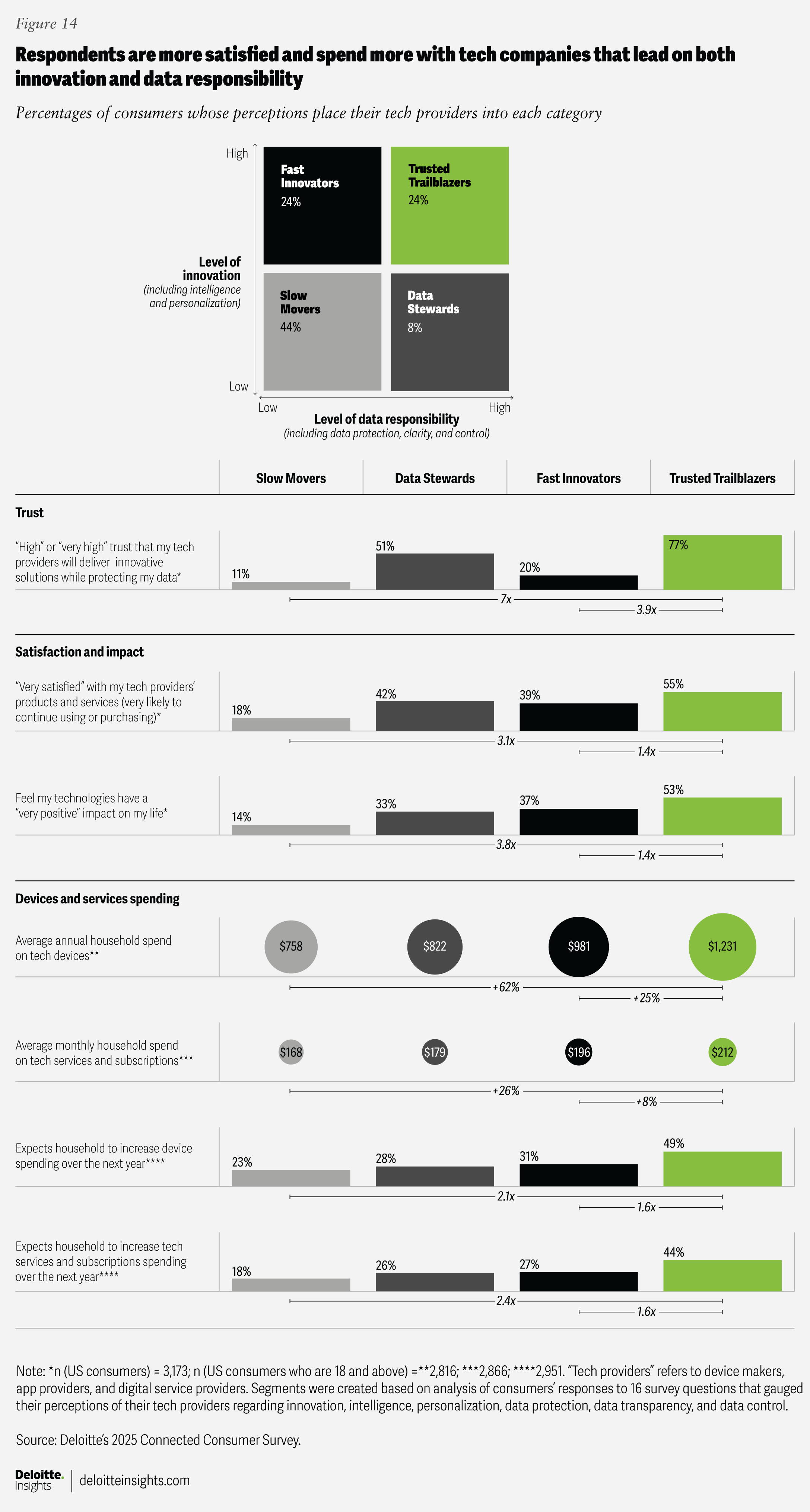

To explore these questions, we asked survey respondents to evaluate how well their tech providers deliver on two key dimensions: innovation and data responsibility. By analyzing how consumers rated their tech providers on innovation, intelligence, personalization, data protection, transparency, and control, we identified four distinct segments:3

- Trusted trailblazers (24%): These providers are seen as delivering both high innovation and high data responsibility—offering intelligent, personalized experiences while also excelling in data protection, transparency, and user control.

- Fast innovators (24%): Known for bold innovation and advanced features, these providers score high on intelligence and personalization but fall short when it comes to transparency, data protection, and user control.

- Data stewards (8%): These companies earn high marks for data responsibility—prioritizing privacy, transparency, and control—but are not viewed as leaders in innovation or personalized experiences.

- Slow movers (44%): The largest segment; these providers are perceived as lagging on both fronts, delivering neither standout innovation nor strong data stewardship.

These segments reveal more than just consumer opinions—they correlate closely with behavior and impact. Providers viewed by respondents as both highly innovative and responsible (trusted trailblazers) enjoy the strongest outcomes across trust, satisfaction, and consumer spending (figure 14).

Analysis of our four tech provider segments reveals a stark divide in outcomes between those perceived as both innovative and responsible—trusted trailblazers—and those seen as lagging on both dimensions—slow movers. Surveyed consumers who view their providers as trusted trailblazers are seven times more likely to express high trust that their providers will deliver innovative solutions while protecting their data. They’re also more than three times as likely to report high satisfaction with their tech products and services, and nearly four times as likely to say that digital technology has a “very positive” impact on their lives.

This trust and satisfaction can translate into meaningful financial outcomes. Respondents aligned with trusted trailblazers spend 62% more annually on tech devices and 26% more monthly on tech services than those aligned with slow movers. They’re also more likely to anticipate increasing their spending in the year ahead—more than twice as likely for both devices and subscriptions. These findings suggest that a dual focus on smart, personalized innovation and strong data stewardship is more than just good practice—it can be a powerful driver of consumer loyalty, engagement, and wallet share.

While fast innovators outperform slow movers across our metrics, their outcomes still lag those of trusted trailblazers. Despite their strengths in innovation, fast innovators earn far lower trust (just 20%) and less satisfaction and impact than trusted trailblazers. This gap underscores the importance of not just moving fast but moving responsibly. Meanwhile, data stewards—a relatively small group that lags on innovation but leads on data responsibility—outperform slow movers on all measures of trust, satisfaction, and spending, showing that strong data practices alone can drive better consumer outcomes, even in the absence of cutting-edge features. Even compared to fast innovators, data stewards earn more than twice the level of trust, underscoring the critical role that data responsibility plays in building consumer confidence.

Responsible innovation, therefore, appears to pay off. According to our analysis, consumers are rewarding tech providers who deliver not just novel, intelligent, and personalized experiences—but do so in ways that protect their data, respect their agency, and earn their confidence. In today’s landscape, trust isn’t a nice-to-have—it’s a growth strategy.

Considerations for tech companies

Most surveyed consumers value innovation—especially the intelligence and personalization that gen AI can offer. But their concerns around accuracy, privacy, and the pace of change may dampen their enthusiasm. To earn trust and deepen loyalty, tech providers should take thoughtful, proactive steps to align innovation with consumer priorities by:

- Treating trust as a product feature. Consumers are more likely to engage with—and pay for—tech experiences they trust. Providers can build long-term affinity by embedding transparency, explainability, and strong data protection directly into their products, and not just their policies.

- Turning personalization into relevance. Consumers may like personalized features, but they want them to feel meaningful, not just novel. When personalization solves real problems and enhances life quality, it can help drive stronger satisfaction and perceived impact.

- Closing the trust gap with better communication. Less than a third of surveyed consumers feel confident about tech providers’ data practices. Clear, simple language around what data is collected, how it’s used, and how users can control it could shift perceptions and behavior.

- Building for critical thinking, not just convenience. As gen AI becomes more embedded in daily life, providers can help consumers stay grounded by designing tools that encourage source checking, transparency of output origins, and healthy skepticism.

- Addressing the reality of “shadow AI” in the workplace. Nearly 7 in 10 surveyed workers who use gen AI on the job say they rely on their own tools—accessed through personal devices or accounts. Companies could meet this demand with more secure, sanctioned solutions, supported by clear guidelines and training.

Technology that’s smart, personalized, and innovative will continue to drive interest. But there could be even more opportunity in delivering it responsibly. The providers that meet rising expectations around transparency and security can win greater trust, loyalty, and spending.

Methodology

To understand consumer attitudes toward digital life, the Deloitte Center for Technology, Media and Telecommunications conducted a survey of 3,524 US consumers in the second quarter of 2025. This is the sixth annual edition of the survey. All data was weighted to the most recent US Census to arrive at a representative view of US consumers’ opinions and behaviors. To gain a more detailed understanding of various consumer groups, we also segmented respondents into generational groups defined by their birth year: Generation Z (1997 to 2011), millennials (1983 to 1996), Generation X (1966 to 1982), boomers (1947 to 1965), and matures (1946 and prior).