AI for industrial robotics, humanoid robots, and drones

Can more powerful AI models and chips catalyze what has been a relatively stagnant industry?

A factory floor bustling with humanoid robots that can see and act akin to human intelligence is a compelling vision for 2030 or 2040, and may even be possible. But the reality in 2026 is different. Deloitte predicts that cumulative installed capacity of industrial robots will surpass 5 million units in 2025 and could reach 5.5 million by 2026, globally.1

With greater integration of AI capabilities in robotic systems and the emergence of specialized foundational models, robots can permeate multiple industries and applications from smart factories to public utility services and even autonomous drones. But unless the broader technology, AI, and robotics ecosystem address bottlenecks related to data quality, integration, and cyber security, the market for industrial robots is likely to stay at its current level of relatively modest annual growth.

Advanced and special types of AI models as catalysts for industrial robots

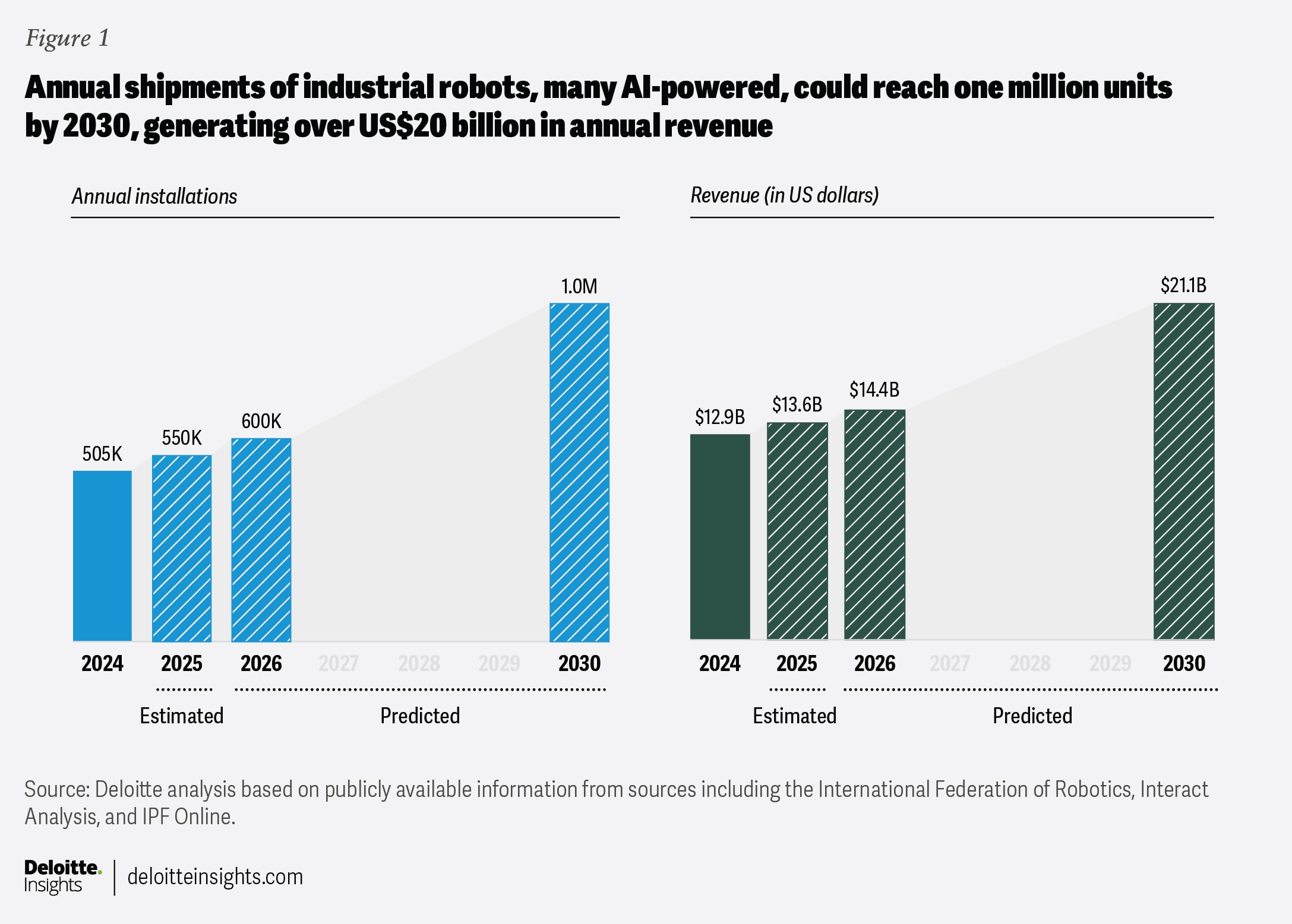

Annual sales of new industrial robots have remained flat at roughly 500,000 units since 2021, in line with what Deloitte predicted in the 2020 TMT Predictions about industrial robots’ slow pace of growth.2 Longer term projections suggest massive growth in the far future, with one estimate pegging the humanoid robotic industry at US$5 trillion by 2050.3 Nonetheless, even as early as 2030, we could see an inflection point with annual new robot shipments doubling from current levels to reach 1 million a year, with projected revenues of US$21 billion in 2030, almost twice 2024 levels (see figure 1).4

What “robots” are covered in this article?

“Robots” is a broad term, ranging from dishwashers (yes, really), to more intelligent and autonomous home vacuum cleaners costing a few hundred dollars, to industrial robots on assembly lines worth millions of dollars each. And the definition sometimes includes flying robots (drones), driving robots (full self-driving cars), and humanoid robots that can do pretty much anything a human being can do, and more.

In this prediction chapter, the focus is primarily on industrial robots, humanoid robots meant for industrial use, and drones. There appears to be a rise in physical AI, robotics, and drones, and there is already a lot of articles and analyst coverage on autonomous vehicles. Therefore, this chapter will focus on industrial robotics and drones.

Two growth catalysts may create a turning point for industrial robots’ increased adoption between 2026 and 2030. First, developed countries face persistent labor shortages due to ageing populations.5 As these regions increasingly bolster domestic manufacturing and build resilient supply chains, demand for robots capable of handling increasingly sophisticated tasks will likely only go up. Second, and perhaps more importantly, exponential advancements in computing power and the emergence of specialized foundational AI models—different from typical large language models—are accelerating the development of AI robots and embodied AI systems.6 Special-purpose models may be paving the way for highly sophisticated AI engines that can allow robots to move beyond simple command-and-control to comprehending natural language, perceiving physical surroundings, and learning and navigating complex tasks in a generalized way just like humans do.7

Despite the enthusiasm and emergence of advanced technologies, certain hurdles to robotics advancement remain. For instance, integration of robotic systems into existing industrial workflows is complex, particularly concerning data quality, interoperability, and legacy system compatibility. Many companies struggle to harness clean, unified datasets (e.g., real-world data, physical surroundings, spatial data), which are essential to train the robots.8 Moreover, the prospect of security and privacy breaches or malicious cyberattacks on connected robotic networks remains a critical concern.9 Additionally, the safety of human workers is an essential aspect that industrial robots and humanoid robots need to address.10

Deloitte believes that a tighter integration of gen AI and agentic AI with robotics and automation tools would help bring AI-enabled robotic devices out of the realm of science fiction and into modernized workplaces.11 As a case in point, a smart factory in Wichita, KS, used to simulate cutting-edge, real-world use cases, houses diverse tech capabilities including gen AI, agentic AI, unlimited reality, as well as robotics such as drones, autonomous mobile robots, quadrupeds, and humanoid robots.12

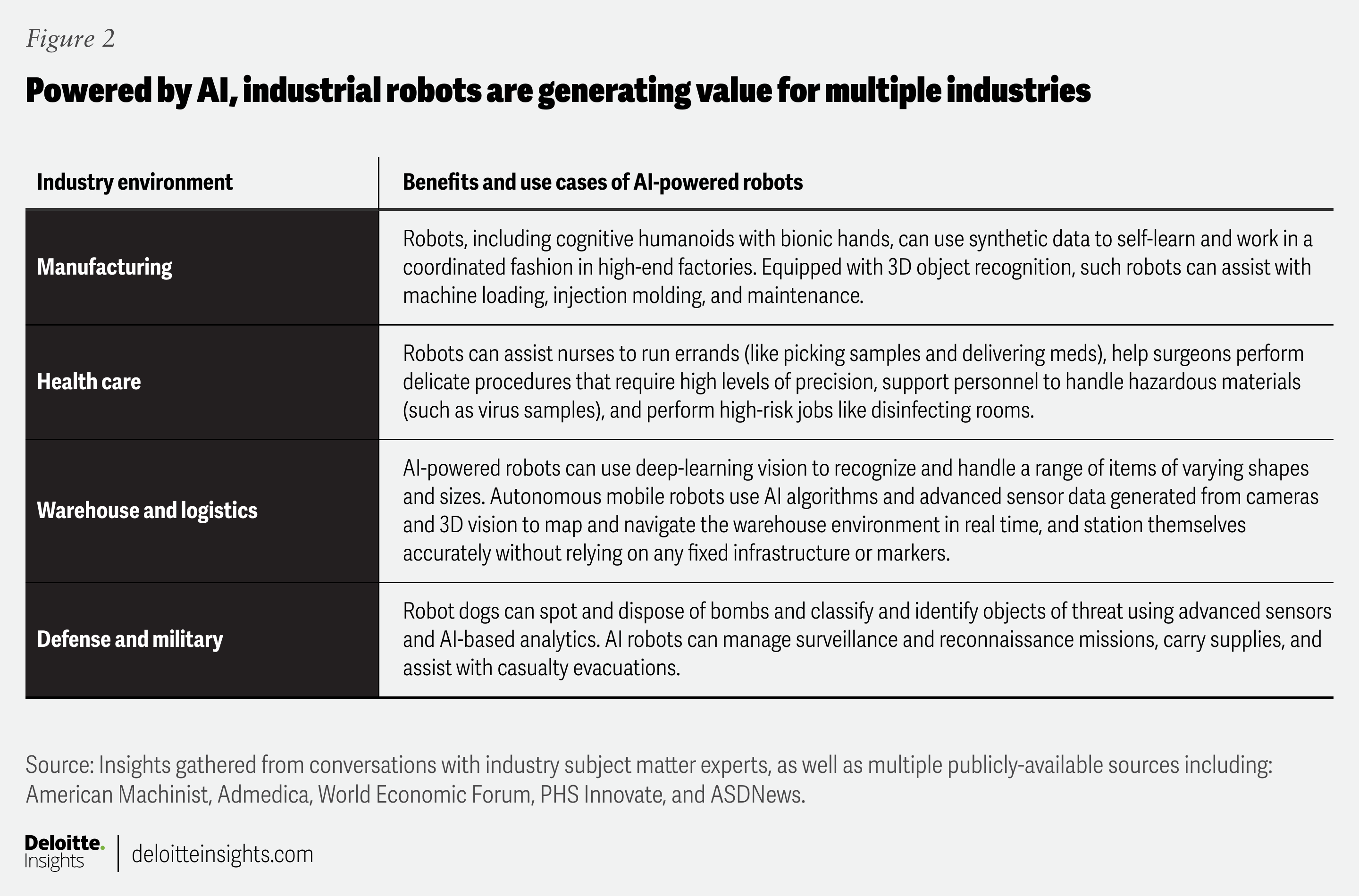

Industrial robots already appear to be unlocking value for multiple industries such as manufacturing, health care, warehouse, and even national defense (figure 2).13 But what’s likely shaping new opportunities for industrial robots appears to be the innovation that some technology companies have been demonstrating, especially with an advent of multimodal AI models, as well as advanced chips and hardware.

Vision-language-action models are likely to make humanoid robots smarter and more autonomous

Some AI startups and major tech companies are developing vision-language-action (VLA) models that can make it possible for robots to advance from performing pre-programmed tasks to understanding context and making decisions autonomously. VLA enables robots to gain more autonomy, allowing them to develop higher order planning and spatial reasoning, and providing them with dexterity to navigate challenging terrains.14 With large scale reinforcement learning in simulation and multimodal learning, robots can get pre-trained on vast datasets.

VLA integrates visual perception (observing the environment and the laws of physics), natural language understanding (verbal commands and comprehension), and real-world actions to perform (responding to visual and textual instructions).15 Typically, as of mid-2025, VLAs were anywhere from 500-million to 7-billion parameter models, enabling humanoid robots to learn, perceive, and act.16 There are select examples where VLA models are being used to augment robotics development in the United States, with the potential for wider commercial adoption between 2026 and 2030:

- NVIDIA’s open foundational model for humanoid robots combines reasoning and actions to help advance robotics development.17 Robotics companies like Boston Dynamics are building humanoid robots by using libraries from NVIDIA’s model and other supporting technologies from NVIDIA.18

- Figure AI’s Helix is a VLA model that trains robots using visual and natural language prompts, enabling humanoid robots to learn intimately about real-world scenes and objects and develop fine motion control.19

- Hugging Face developed open-source data and models specifically for robots, even as it continues to build and test its own open-source humanoid robot,20 allowing developers to customize their own robots.21

Outside the United States, humanoid robots are being developed in Asia and Europe as well, with emphasis on custom foundational models and training on physical world data. For instance, South Korea-based startup RLWRLD is developing foundational AI models that would allow traditional manual-intensive processes to be performed autonomously by robots through automated learning and mimicking human expertise.22 In Japan, FANUC Corporation is focused on developing a range of AI-powered robots across various sizes, designed for industrial environments.23 In Europe, Neural Foundry (London-based) and NEURA Robotics (Germany) are building AI robots for industrial environments by integrating cognitive capabilities and developing custom models.

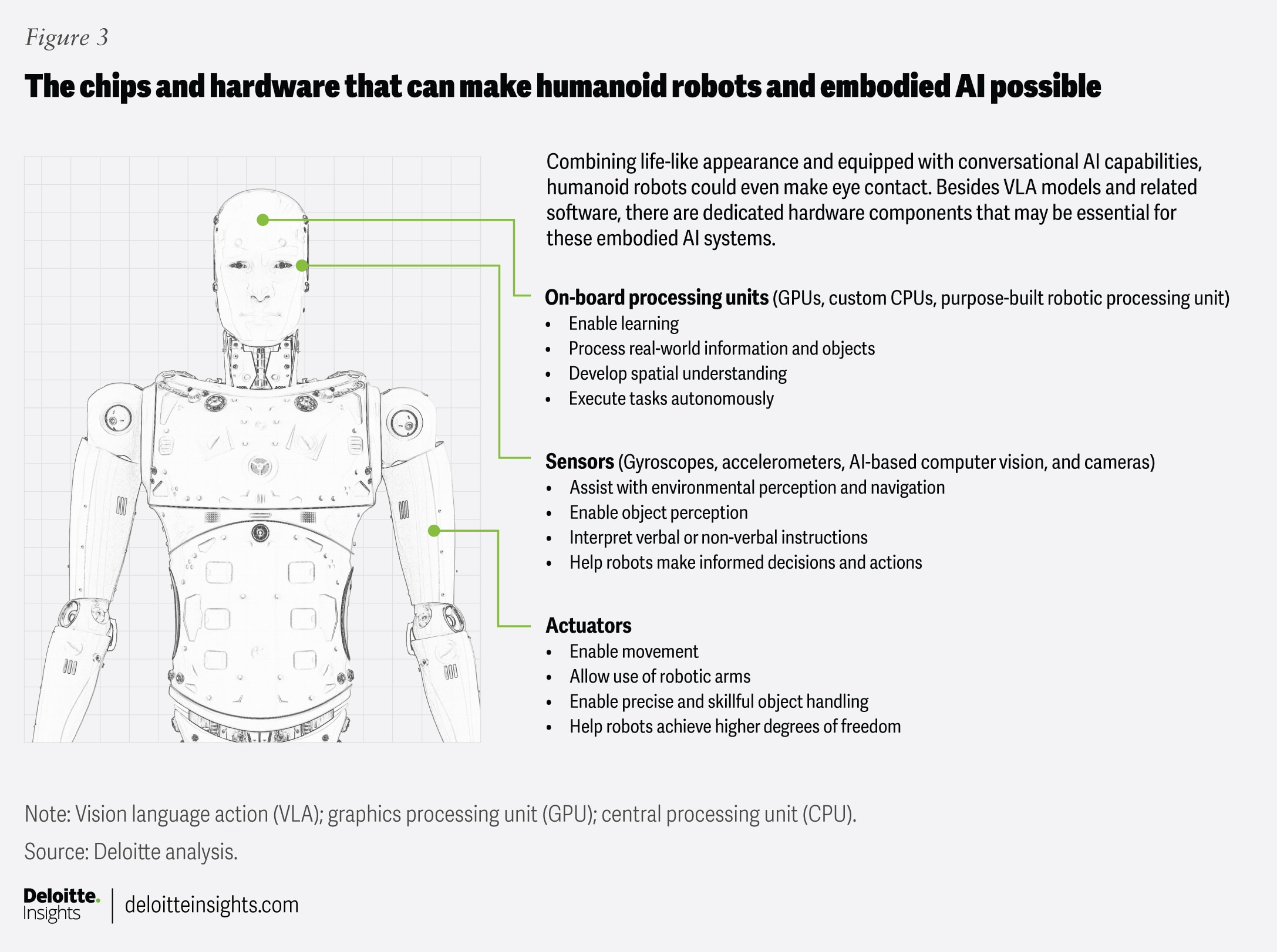

In China, startups such as AgiBot and MagicLab are designing humanoid robots capable of handling complex tasks in manufacturing environments.24 And the likes of Unitree Robotics and UBTECH Robotics are advancing toward mass production and making humanoid robots accessible and affordable to help drive wider adoption.25 Various chip components and hardware go into building a humanoid robot (figure 3), indicating a strong revenue potential for semiconductors (across chip hardware and related software and services) from this market.26

While AI-powered humanoid robots meant for industrial use at scale may still be in early stages, Deloitte estimates annual unit shipments to be in the range of 5,000 to 7,000 in 2025, which may increase to 15,000 in 2026.27 At an average price of US$14,000 to US$18,000 per unit,28 the AI humanoid robot market for industrial use could be worth around US$210 million to 270 million in 2026.29 As the robotics industry overcomes technology, price, and operational barriers between 2026 and 2030, the market for humanoid robots could reach US$600 million to US$700 million (roughly three times the market size of the 2026 baseline scenario) or even attain US$1 billion (four times the market size of the 2026 optimistic scenario) by 2032.30

Advanced AI is likely to make drones more autonomous and versatile

Most drones, also known as unmanned aerial vehicles (UAVs), are currently manually operated, but their autonomous capabilities appear to be advancing rapidly. Many drones now use AI for real-time navigation, communicate with each other, avoid obstacles and collision, and may soon be able to execute missions without human intervention. As a case in point, scientists in Hungary studied patterns and movements of various animals including pigeons and wild horses. They used those insights to help build an algorithm that would guide a swarm of drones capable of making onboard, autonomous decisions. These drones can not only navigate, avoid collisions and hover safely in the skies, but perform missions in diverse environments including land surveying, meteorology, and wildfire management.31

Drones: What’s inside?

New age, sophisticated, AI-enabled drones are often equipped with various types of tech and chips; single or dual microcontrollers serving as flight controllers; onboard power systems that can include lithium-based batteries and distribution boards to supply power to various components; radio-frequency modules to enable communication between drones and ground control units; GPS modules for navigation and positioning; sensors (such as accelerometers, gyroscopes, magnetometers, optical flow sensors, and lidar and ultrasonic); and onboard flight control software and platforms to manage aerial operations.32

As noted in Deloitte’s 2024 prediction on agricultural technology, a combination of spectral sensors, chips, and cameras mounted on UAVs or drones gather large volumes of data (soil moisture, plant health, etc.) that AI models can analyze to offer insights for targeted spraying operations.33 Besides agriculture, drones can be used to inspect wind turbines and electric power lines, minimizing the need for manual inspections.34 China, South Australia, and the United Kingdom are experimenting with UAVs that carry out fully autonomous long-range, remote inspection of high-voltage power lines. They not only help human workers and engineers by taking up such dangerous and critical tasks but can also auto-capture and transmit dozens of images that would help engineers to detect and analyze corrosion through AI and advanced analytics.35

Several countries are aiming to deploy autonomous drones for aerial surveillance to assist with disaster relief (for example, autonomous drones mapped damaged areas following Southwest Florida’s Hurricane Ian during September 2022, assisting emergency responders), as well as to detect and counter potential border threats.36 In many of these applications, the drones are only remotely operated by humans for part of the mission: The AI acts like an autopilot on a commercial jet and handles the relatively simpler task of getting the drones close to their destinations, before handing off to the human operator. But the recent efforts by several countries in drone swarms for military applications 37 indicate how they could possibly influence nonmilitary (industrial and civilian) applications as well. For instance, a swarm of autonomous drones could inspect high-tension power lines in remote and difficult-to-access terrains and even monitor offshore wind turbines in harsh weather conditions.

The bottom line: Commercialization, safety, and workforce readiness

Industrial robots are already an important end market for semiconductor companies, despite the industry’s relatively modest growth in recent years. For example, an industrial robot worth roughly US$ 200,000 could contain approximately US$25,000 to US$50,000 worth of chips and related electronics components.38 Further, making industrial robots better will likely rely on increasingly advanced chips, ranging from processors to networking to sensors, and the semiconductor content per robot will likely increase. Additionally, the semiconductor industry is a significant consumer and an end-user of industrial robots as of 2025, using them in various aspects: fab manufacturing processes, wafer handling, testing, and sorting, advanced packaging, and clean rooms.39 In the journey toward “lights out” manufacturing, the chip industry will potentially use even more industrial robots as part of its operations.

As market opportunities for industrial AI-powered robots including humanoid robots and drones appear promising, many semiconductor and technology companies are actively investing in this area for the long term. Robotics startups are in pilot stages in real-world contexts like warehouses, logistics, and aerial autonomy. Venture capital investments in robotics are growing, which is expected to be the only non-AI market category that may experience an increase in funding during 2025.40 Cloud and IT infrastructure is also falling in place, even as synthetic data generation and physics simulators may be accelerating development and lowering reliance on high-cost real-world trials.

Here are five action steps that AI, robotics, and tech industry leaders can consider taking to help address some of the potential challenges related to industrial robotics commercial adoption, as well as to help address matters related to data integration, privacy and cyber, safety, and workforce readiness.

- Demonstrate commercial viability through open innovation: Tech and AI companies should demonstrate ROI via broader commercialization by promoting open, full-stack robotics ecosystems that allow for the wide-ranging deployment and coordination of robots; and create a collaborative general ecosystem to move toward general-purpose embodied AI.41

- Enhance data quality and address data integration: Ecosystem players should prioritize data standardization and collaboration for common platforms and middleware for a more seamless integration of diverse types of robots into industrial environments.

- Fix cyber vulnerabilities: Companies should embrace common interoperability protocols, adopt privacy and security-by-design approaches, and proactively engage cyber specialists to craft clear and flexible security frameworks.

- Address safety as an essential and integral feature: Right from development and early-testing and prototyping phase, robots should be programmed for safety, whether it’s about working alongside humans safely without causing physical injury, or in ensuring they don’t collide with each other accidentally. Simulation-based training, computer-aided safety planning tools, and proactive collision-free motion planning are novel technologies and approaches that can help make robots safer.

- Augment current workforce proactively: Reskilling and upskilling the workforce on emerging AI tech can be critical for every single company. As robots are increasingly working alongside humans in this next wave of industrial AI automation, companies should assess and level up their workforce’s AI skills on a more regular basis to help stay at the forefront of industrial robot adoption and integration into their broader enterprise fabric.

The way forward appears quite clear: AI, robotics, and technology industries should take the starting steps as there’s both the necessary advanced AI tech and the commercial appetite and interest. A complete 360-degree systems thinking and an ecosystem-based approach may be essential to demonstrate progress across the five areas presented above—related to open innovation, data, cyber, safety, and talent—and accelerate commercial adoption of industrial robotics in 2026 and beyond.