Halloween horror: Feeding audiences’ appetites for cheap and bloody thrills

With younger generations enjoying horror and thrillers, streamers and studios should embrace genres that are cheaper to produce but return outsized results.

Chris Arkenberg

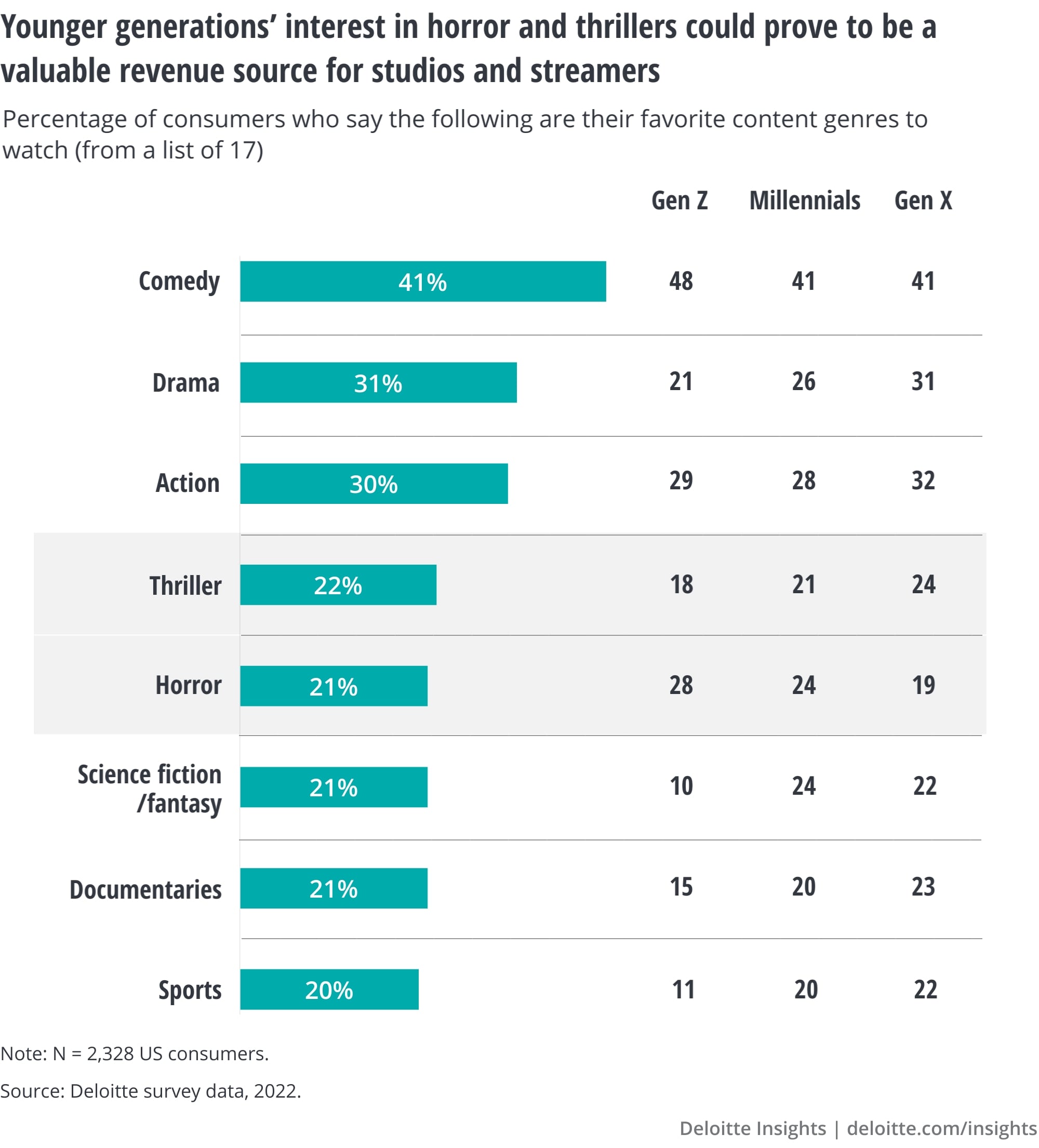

A recent Deloitte study showed that US consumers overall rank comedy, drama, and action as their top three favorite genres for video content.1 For Gen Z, comedy is still a strong first (48%), action is second (29%), but horror is a very close third (28%). Big-budget blockbusters may get the buzz, but younger audiences also love cheaper-to-produce genres that can deliver an outsized return on investment (RoI).

Twenty years ago, drama was the most popular and successful genre of film.2 Today, adventure, action, and fantasy rule the box office, thanks in part to advances in computer graphics and visual effects that take audiences on fantastic journeys into impossible worlds.

However, these are also the most expensive genres, often costing upwards of US$100 million to produce and market.3 With increased competition for talent, supply chain challenges, and macroeconomic headwinds, the cost of production is getting even higher.4 Hits can net a billion dollars, making such films attractive for the most well-heeled studios. Flops, though, can earn less than US$20 million. Win or lose, the cost of entry is extraordinarily high.

With the rise of streaming video, the lines between theatrical and TV releases are blurring, as are the lines between studios and distributors. Many spend big bucks to produce streaming blockbusters in the hopes of attracting and retaining subscribers. At the same time, those streamers are under growing pressure to find greater profitability amid a shift into the on-demand living room. Even the biggest streamers can only produce so many blockbusters, so keeping subscribers through the quieter months requires a deeper library of content.

This is where streamers and studios can capitalize on the rising interest in thrillers, true crime, and horror.5 Audiences enjoy them, and they generally don’t rely on large visual effects budgets or famous actors. From 2010 to 2020, action and adventure movies may have earned more than US$300 billion combined, but thrillers, crime, and horror together earned an estimated US$120 billion.6 In terms of sheer RoI, horror films can be very lucrative, costing little to produce and earning big numbers.7

Streamers should take a strategic view in how they invest in these and other cheaper-to-produce genres. Streaming services may always need blockbusters and big-budget franchises, but they should also look to cheaper genres that can support audience engagement at significantly lower costs.

Recommendations to leaders

We’ll sidestep the deeper psychological questions of why younger generations are so drawn to horror films and thrillers and, instead, simply assert that content portfolios should lean heavily into cheaper forms of entertainment. These can engage younger demographics and help keep audiences around in between the big-budget spectacles.

- Focus on content impact and RoI. Blockbusters get the buzz, and the hits can generate revenue, but a robust portfolio of content types can help reach younger viewers, retain subscribers, and lower production costs. Providers should lean on their analytics to make sure the cheaper content gets to the right audience segments.

- Engage and leverage social media audiences. Big-budget ad campaigns can help boost the blockbusters, but streamers can further cut costs by leaning into social media. A savvy social media department can engage audiences around their content, enabling discovery and driving excitement for their own titles. A campaign of previews, clips, bios, and behind-the-scenes video content can generate awareness and buzz, especially when it’s done authentically.8 This approach can also revitalize dormant titles that may have fallen into the streaming archives.

- Pay attention to social media trends. If left to their own devices (pun intended), younger generations may be satisfied with endless streams of algorithmically sorted short-form videos. But providers should be careful in pursuing their own short-form video offerings. Instead, they should leverage trends and celebrities that animate social media, bringing them into proprietary, longer-form video offerings. More studios and agencies have been finding success with shows featuring popular social media content creators—or at least more accurately reflecting the Gen Z experience.9