Consumer electronics sales: During the pandemic, computer and TV sets outgrew smartphones

As smartphone sales flatten, what happens to the prediction of a mobile-only future?

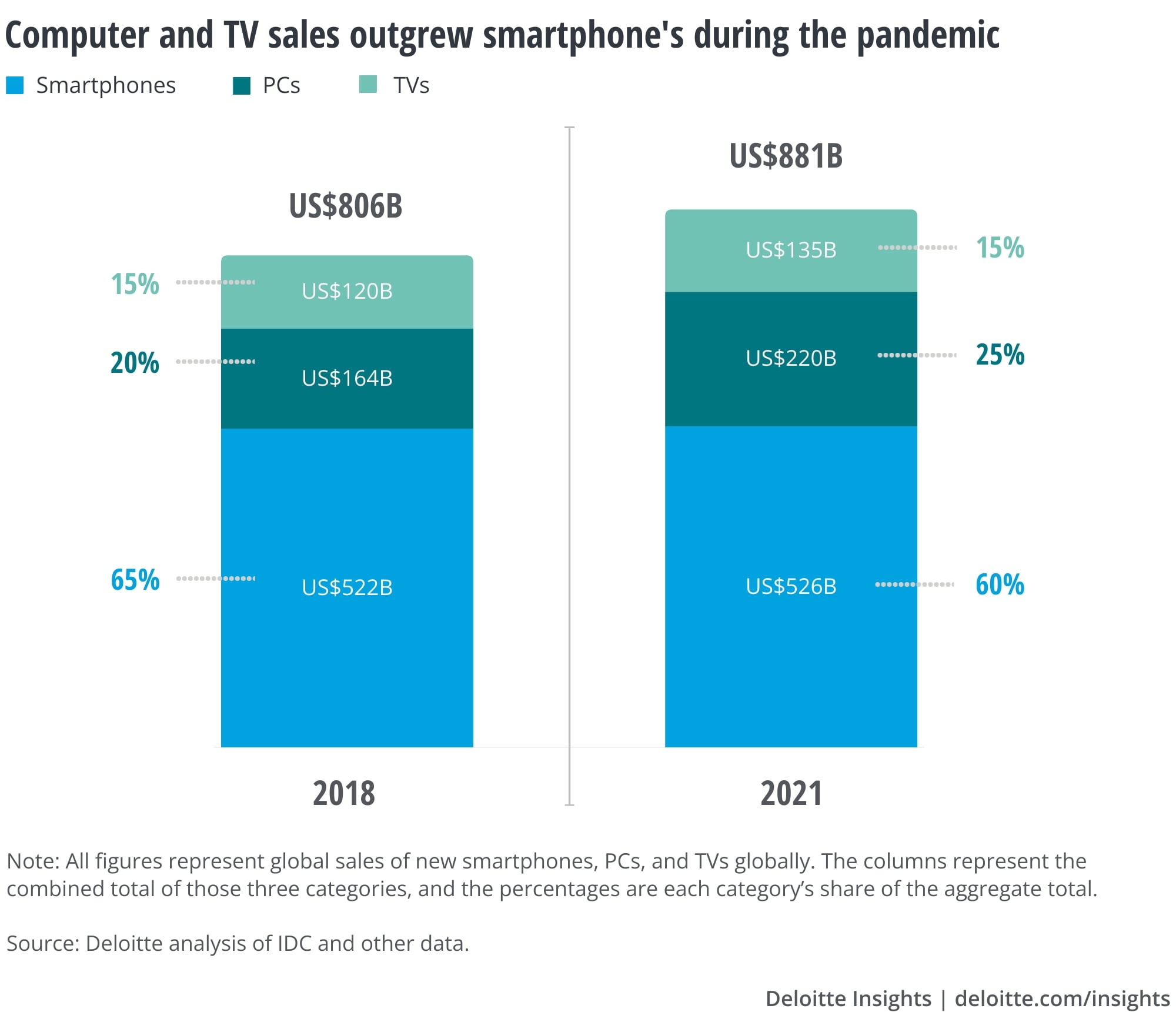

Across the consumer electronics sales categories, computers (+34%) and TV sets (+12%) have grown much faster than smartphones (+1%) in the past three years globally, likely due to COVID-19 restrictions and more time spent working and learning from home. As a result, smartphones’ share of combined sales dollars for the three device categories has fallen from 65% to 60% (see figure).

And it doesn’t look like smartphones are about to regain that share. Growth rates for units of smartphones,1 computers,2 and TV sets3 are each forecast to be 3–4% for 2022. Although PC and TV set average prices are likely to be flat, smartphone average selling prices are predicted to drop by more than 15% during the year, resulting in a likely net decline in dollar value.

These three categories were a combined US$880 billion in 2021.4 For context, the next largest consumer electronics sales category is tablet computers (both slate and detachable), at about US$60 billion in 2020.5

It’s more complicated than just sales of new devices, of course.

- The installed base of smartphones globally in 2021 is about 4.3 billion, versus 1.4 billion computers, or half a billion tablets.6 (The exact TV set installed base is not known but is well over a billion by Deloitte estimates.) The shifts in new device sales between 2018 and 2021 are unlikely to have moved the installed base needle very far: Smartphones are still a much larger market.

- In the United States in 2021, the average person spent roughly the same amount of time daily on each device: just under four hours daily on the computer,7 just over four hours on their smartphones,8 and four hours and 20 minutes daily using their TV set for traditional TV, plus other video and gaming content.9

In 2018, a mobile-only world looked plausible—after all, smartphone grew tenfold from 2008 to 2018, while PC sales fell every year between 2012 and 2018.10 However, with smartphone sales remaining flat since 2018,11 the future looks more like a three-ring circus, with consumers continuing to support smartphones, computers, and TV sets with their wallets and their attention.

Implications for executives to consider

- Although computers are often thought of as business tools, they are still important for media consumption, online commerce, online education, and gaming. Their recovery and resilience matter for those markets.

- Mobility and time spent out of home are likely to rise post-pandemic. But it seems probable that hybrid work models will persist to some extent,12 suggesting that PC sales are unlikely to fall to 2018 levels.

- Although traditional TV viewing is declining in many markets,13 other forms of content, including subscription and ad-supported video streaming as well as gaming, are filling up the TV screen.

- Devices are just the hub of an ecosystem. The value of software, services, subscriptions, and accessories will likely pay dividends for years to come.