‘TV’ today can be described as anything on a screen that feels relevant, authentic, and worth an audience’s time

Digital Media Trends, Fall 2025: The idea of ‘TV watching’ is growing beyond televisions. Studios, streamers, and advertisers that embrace this mental shift may make this fragmented media ecosystem more coherent.

Chris Arkenberg

Jeff Loucks

Brooke Auxier

Doug Van Dyke

For more people, TV is no longer a single screen or even a platform. It’s an activity. The definition of TV is being redefined by social media, creator content, and the ubiquitous smartphone. A need to gain greater revenues from advertising may be driving more convergence and coherence across a highly fragmented media landscape. To stay relevant, studios, streamers, and advertisers should think less like broadcasters and more like ecosystem players—rethinking their business models to reflect a world in which “TV” is evolving to include short-form social video from an emerging industry of professional independent creators.

Consumer behavior appears to be redefining small-screen entertainment

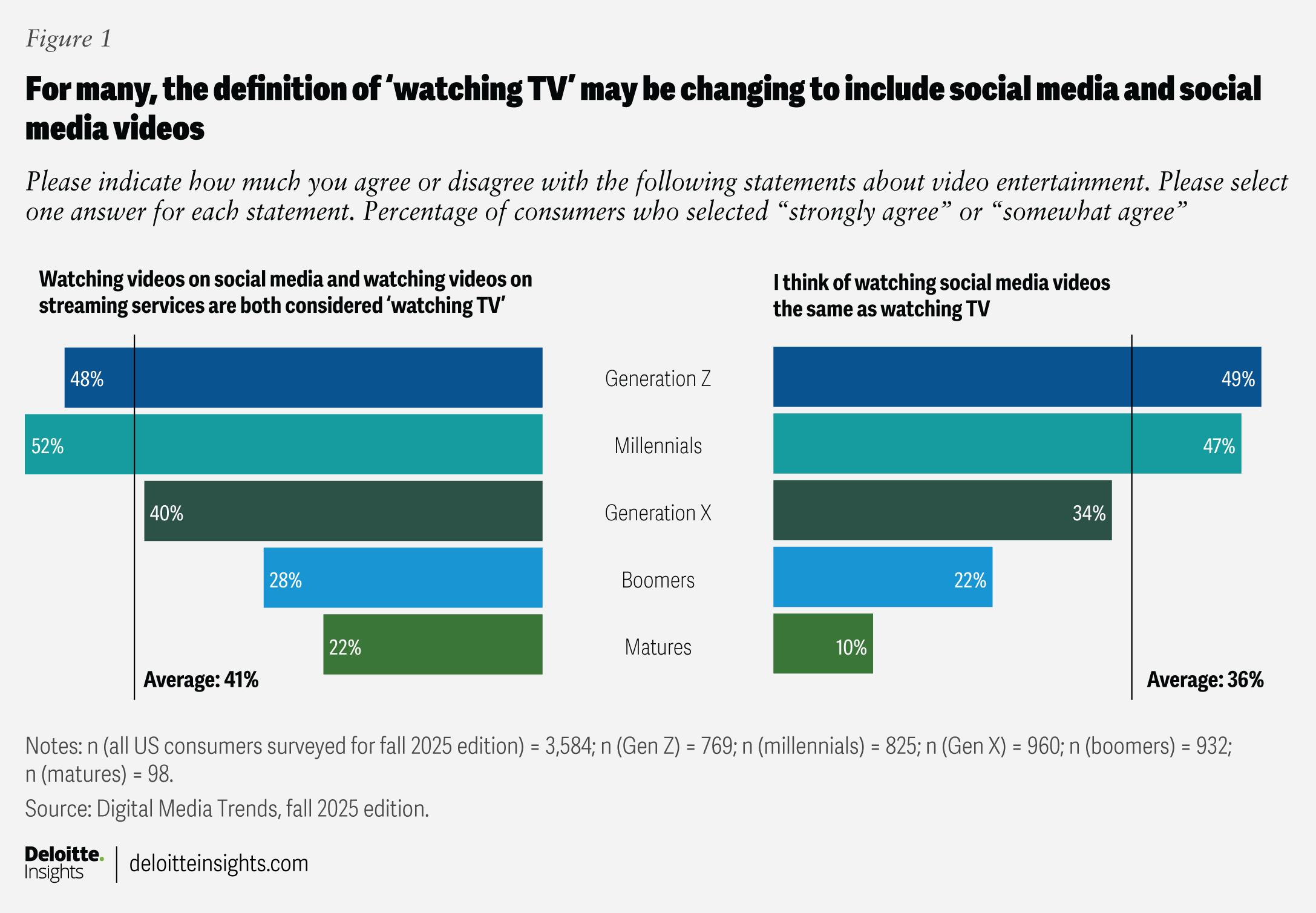

In Deloitte’s fall 2025 update to the Digital Media Trends study, 41% of surveyed consumers say watching both social media videos and streaming services are forms of “watching TV” (figure 1). Notably, this number doesn’t jump much when we focus on a particular generation: The trend is growing among all ages—from Generation Z to boomers.

Social video is winning the battle for time

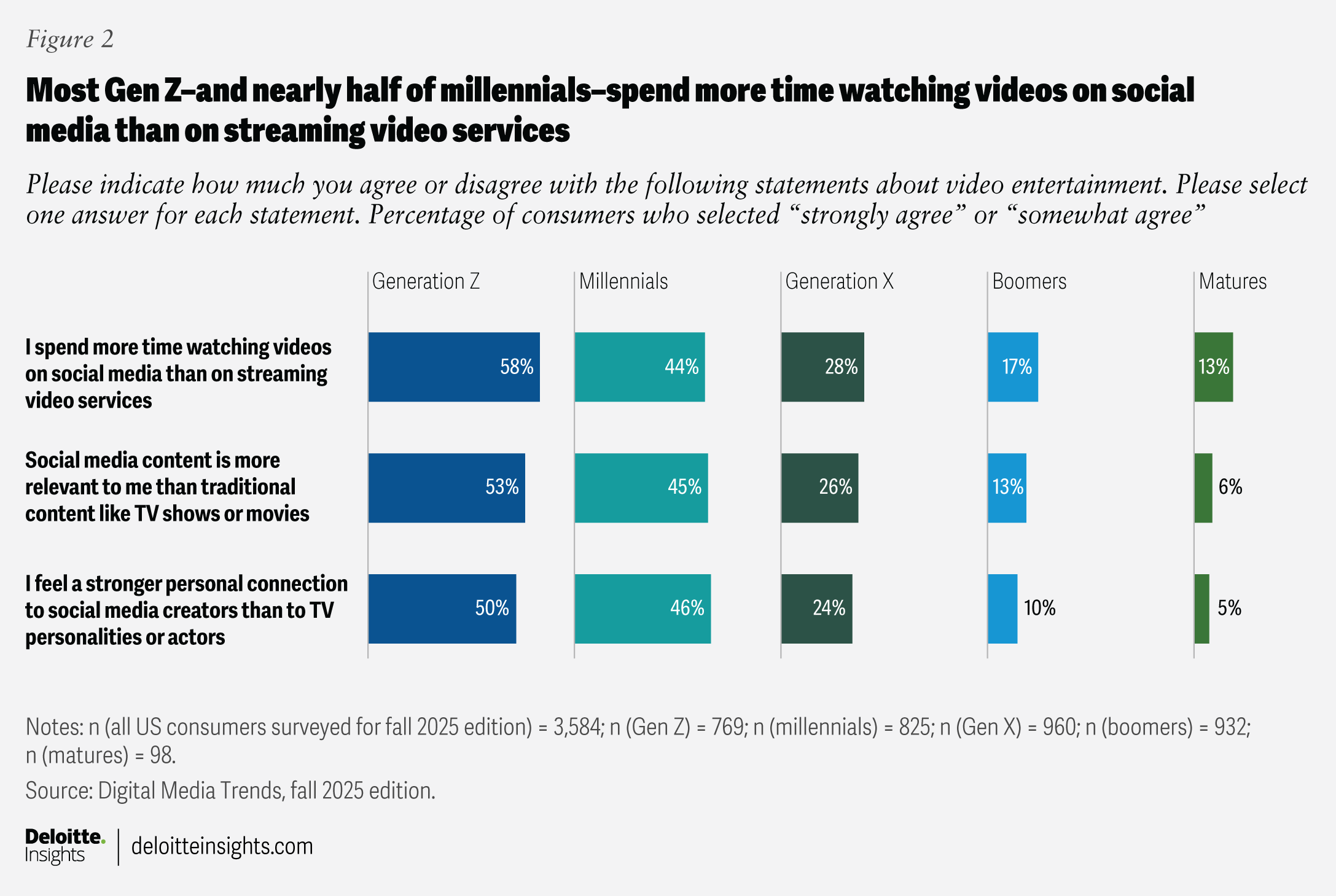

In our latest survey, 35% of all respondents say they spend more time watching social media videos than streaming services, and this behavior is even more prevalent among millennials (44%) and Gen Z (58%) (figure 2). For Gen Z and millennials, social video is increasingly where their “TV time” lives, eroding the idea of “appointment viewing.”

Why are many audiences giving more of their time to social video? In today’s media ecosystem, the most expensive parts of traditional TV—video effects, famous actors, distribution, and marketing reach—may be the least valuable. For some cohorts, perceived authenticity and relevance can be more valuable than high production values. The rising influence of independent and professional creators has shown that many people are hungry for niche content with more authentic appeal from creators that they feel are more relatable.1 Over half of Gen Z respondents in our survey say social content is more relevant than traditional content, and half feel a stronger connection to creators than to TV actors (figure 2). As some major marketing deals can attest, creators are the new “TV stars” for many Gen Z and millennial audiences.2

With micro series, TV and social media can learn from each other

Blockbusters are still exciting many audiences, but they can be a difficult business with high costs and high risk of failure. The TV experience is still valuable, but it has become a smaller part of entertainment—and less profitable: Streamers are often chasing cost-sensitive audiences, and ad spending is migrating to much larger social platforms.3 Social platforms can have their difficulties too: Their algorithmic scroll can be highly engaging, but also highly ephemeral, and difficult to anchor into durable and monetizable intellectual property. Will the convergence of TV, streaming, and social media deliver something different and new?

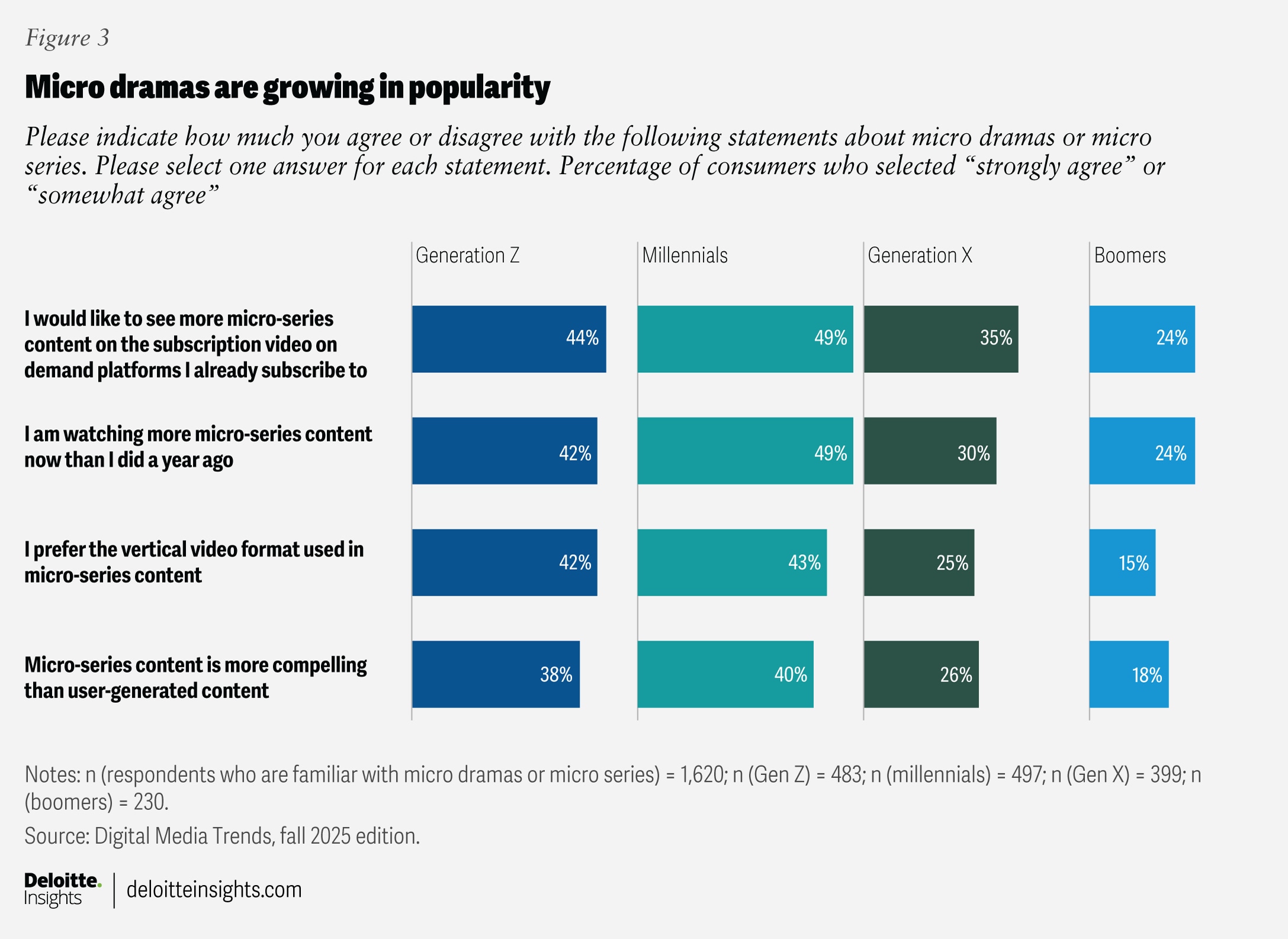

Many audiences are embracing a new form of linear TV geared for the modern media ecosystem. Micro series are serialized short-form videos like soap operas, with minute-long episodes but designed for the vertical smartphone experience. Micro-drama mobile apps have emerged as publishing platforms for short-form serials, earning billions of dollars globally, and more micro series are moving on to social media platforms.4 About 45% of our respondents were familiar with micro dramas or micro series and, among them, about 45% of millennials and Gen Z are watching more micro-series content now than they did a year ago (figure 3).

Notably, 42% of surveyed Gen Zs watching micro series prefer the vertical video format used on smartphones. This suggests how tightly coupled the growth of social media has been to the smartphone, and how much “TV” is being pulled out beyond the television screen into other media and devices. Indeed, more publishers and advertisers are designing for vertical video, not just on mobile but also for connected TVs.5

Micro series can exemplify how the meaning of “TV” is dissolving into a spectrum, from long-form streaming dramas to short-form user-generated content to micro series that combine narrative with snackable—or bingeable—short content. Content categories are being remixed by smaller creators and independent studios. For Gen Z and millennials, in particular, our survey results suggest that “TV” is less about short- versus long-form or where you watch, and more about what video content feels relevant, authentic, and worth the time.

Advertising could drive more convergence in a fragmented media landscape

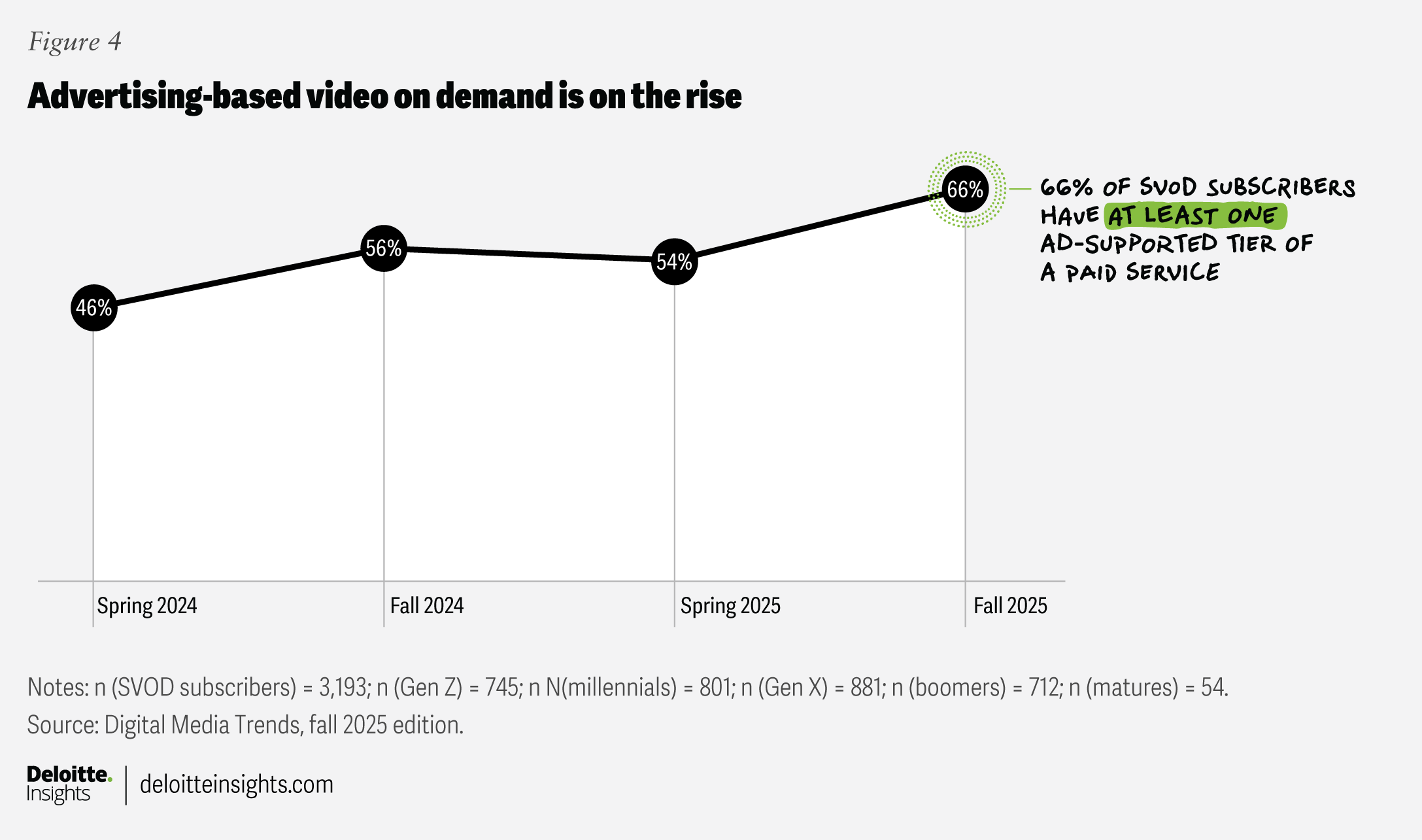

Deloitte’s fall 2025 Digital Media Trends study found that adoption of advertising-based video on-demand (AVOD) services continues to increase: Sixty-six percent of households that have subscription video on demand (SVOD) now have at least one AVOD service—rising over 10% from six months ago (figure 4). Notably, the highest growth in AVOD penetration is among millennial (70% of subscribers), Generation X (74%), and boomers (71%). Our youngest cohort surveyed—Gen Z—was the exception at 42%, tugging at the big question: As they mature, will Gen Z behaviors look more like some of the older generations that often seek the premium streaming TV experience, or will they stay close to social video, trending and viral user-generated content, and the class of professional independent creators pushing the envelope of media?

As ads become more common in the streaming video experience, streaming can look more like traditional TV, monetizing eyes with ads. Two distinct business models—TV and SVOD—appear to be steadily converging into one.

However, unlike cable or broadcast TV, AVOD is often being chosen (or tolerated) by consumers as part of a broader mix of services, bundles, and household budget strategies. With minimal friction for canceling subscriptions, streamers are challenged to gather large enough audiences to draw premium ad spending from brands. Streamers may lack the customer data and advanced technologies of social platforms, and connected TVs still lack the interactivity of smartphones and the web. For example, early experiments with shoppable media on connected TVs have relied on on-screen QR codes that can be captured by a viewer’s smartphone, handing off the purchase to that device.6

As Deloitte has shown in our 2025 Media and Entertainment Outlook, ad spending is growing more on larger open video platforms, with advanced data and AI, trusted creators, and massive global audiences.7 On social video platforms, ads are targeted, clickable, and often skippable, and can be seen as more personalized, creator-led, and “native.” Streaming ads can still feel interruptive to the paid experience—and less effective. Deloitte’s spring 2025 Digital Media Trends research found that surveyed Gen Z and millennials say social media ads influence their purchases more than ads on streaming.8

Herein lies a warning as some more traditional media companies work to rebuild TV business models: Streamers should not simply recycle linear TV ad models. Many Gen Zs and millennials already spend more time on social video, where ads and influence are often baked into the culture. As these generations lean into AVOD more, they will likely respond more to ads that mirror social experiences: personalized, relevant, and creator-driven. This may require streamers to gather larger audiences, be much more data-driven, and optimized for engagement and interaction across today’s media ecosystem.

By adapting to a broader definition of ‘TV,’ media companies can fight fragmentation

To stay relevant, streamers and advertisers should think less like broadcasters and more like ecosystem players, planning and strategizing across TV, streaming video, social, and beyond. If 41% of consumers surveyed say that consuming social and streaming video are both “watching TV,” advertisers can’t afford to silo budgets or overcommit to a single platform. They should be designing campaigns that work across SVOD, AVOD, and social video formats.

Likewise, studios should be telling stories, growing IP, and minting fandoms designed for today’s ecosystem of TV—short form, long form, serialized, episodic, big budget, and indie. Studios, streamers, and advertisers should be working—and competing—with influencers and professional creators and creator studios. Such tactics can require a more comprehensive view of today’s media ecosystem—and an acceptance that premium TV may no longer be at the center.

As more audiences accept ads to reduce costs, and redefine “TV” to include social video, the industry should embrace a world where “TV” equals anything on a screen that feels relevant to an audience. This approach can drive more convergence across the fragmented media landscape and make it easier for media companies to reckon with it all.