2026 Renewable Energy Industry Outlook

Renewables recalibrate for resilience amid policy shifts

2025 has been a challenging year for renewables. The new tax law, commonly referred to as the One Big Beautiful Bill Act, rolled back many clean energy tax credits and imposed new restrictions, pressuring early-stage wind and solar pipelines. Wind and solar investments in the first half of 2025 fell 18%, to nearly US$35 billion (prior to the enactment of this act), compared to the same period in 2024.1

Still, renewables dominated US capacity growth, accounting for 93% of additions (30.2 gigawatts) through September 2025, with solar and storage making up 83%.2

Deployment could surge in 2026 as developers shift to safe-harbor projects, while the new foreign entity of concern (FEOC) sourcing rules—restrictions targeting entities linked to covered nations (China, Russia, Iran, and North Korea) through ownership, control, or jurisdiction—take effect.3 With only 35% of the pipeline under construction, renewable starts are expected to accelerate despite supply chain pressures from FEOC and tariffs.

Executives may focus on near-term deployment to capture safe-harbor credits while embedding flexibility through digital tools, artificial intelligence, and resilient supply chains.

This 2026 outlook highlights five key trends shaping the year ahead, along with associated risks and opportunities, and actionable strategies.

- Policy shifts: Adapting to a changing energy landscape

- Storage integration: Delivering clean, firm power on demand

- Capital and operational efficiency: Implementing a leaner, smarter strategy

- Strategic merger and acquisition: Attracting capital through platform and mature assets

- Supply chain agility: Prioritizing alternative sourcing and reshoring

1. Policy shifts: Adapting to a changing energy landscape

Policy changes in 2025 may worsen compressed timelines and raise costs, reshaping renewable economics. The One Big Beautiful Bill Act (OBBBA) shortened qualification windows for wind and solar credits, while new guidance from the Internal Revenue Service requires continuous construction.4 FEOC restrictions further raise supply chain pressures, making developers weigh credit value against compliance costs.

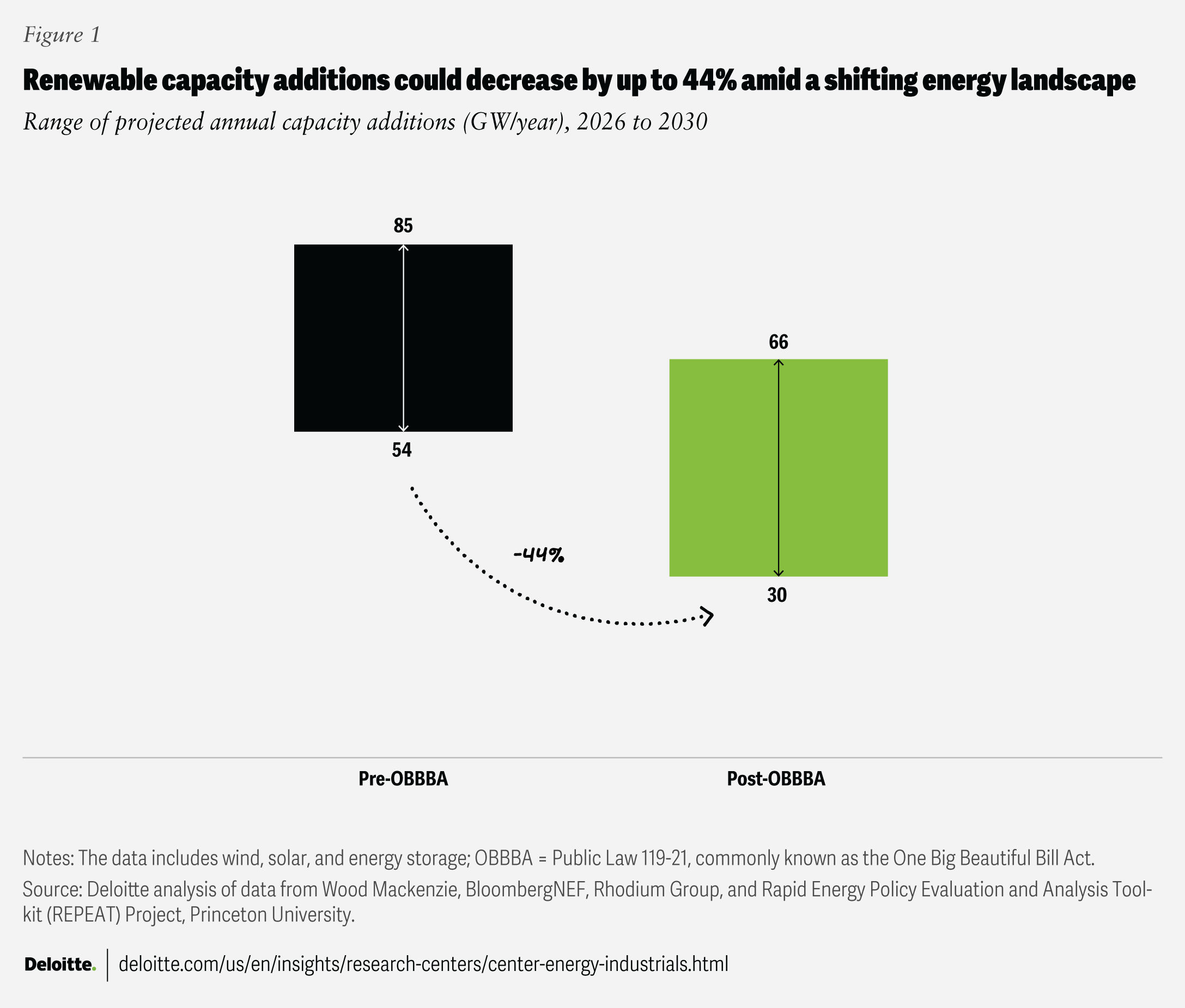

These shifts also create additional clarity through 2030.5 Deloitte analysis projects that annual solar, wind, and storage additions between 2026 and 2030 could fall to a range of 30 GW to 66 GW, down from a range of 54 GW to 85 GW under pre-OBBBA trajectories (figure 1).6

Compressed timelines and shifting economics

Wind and solar developers are accelerating projects to secure safe-harbor eligibility.7

- Pre-2026 starts: Projects that begin construction by Dec. 31, 2025, may still qualify for tax credits without being subject to the new FEOC restrictions and have four years to be placed in service, potentially preserving credits with supply flexibility.8

- Mid-2026 starts: Projects beginning construction by July 4, 2026, or in service by 2027, may still qualify but face uncertainty around FEOC compliance.

Beyond utility-scale wind and solar, phaseouts are reshaping other technologies. The residential solar 25D credit sunsets after 2025, pushing installers toward leasing, power purchase agreements (PPAs), and cooperatives, while storage, hydro, and geothermal retain longer credit windows into the 2030s.9

Phaseouts alone could increase solar costs by 36% to 55% over the next year and onshore wind by 32% to 63%, but data center demand and rising electricity prices reinforce renewable viability.10 Fixed-mount solar already outcompetes natural gas combined cycle in many regions without credits.11

Project and trade headwinds

The Department of the Interior paused offshore wind leasing, removed designated areas, and halted projects.12 Funding reductions across agencies are impacting siting and financing,13 while the Environmental Protection Agency’s proposed repeal of the endangerment finding and fossil plant emissions standards could further weaken renewable demand.

Trade investigations are compounding costs. Antidumping and countervailing duties investigations are targeting solar and battery inputs, while Section 232 probes could extend exposure to wind and electrical components.14

States as swing factors

In 2024, 28 states with renewable portfolio standards (RPS) drove 37% of renewable additions.15 Yet momentum is uneven: Ohio is sunsetting its RPS after 2026, while North Carolina rolled back its 2030 carbon reduction target, both citing affordability concerns.16 More states could revisit commitments under economic pressure. Permitting and long-term targets remain critical levers, but local opposition and interconnection queues still pose barriers.17

In 2026, developers are working toward front-loading construction to secure safe-harbor eligibility and four-year flexibility, diversifying suppliers and investing domestically to manage FEOC and tariffs, and siting projects where market drivers, RPS support, and permitting clarity sustain deployment. Supply chain and workforce challenges persist, underscoring the new playbook: build fast, stay flexible, and invest in resilience.

2. Storage integration: Delivering clean, firm power on demand

Hyperscalers are driving unprecedented demand for firm, low-carbon power.18 The United States hosts 90% of hyperscalers’ global carbon-free energy contracts, with renewables supplying 78% and nuclear providing the rest.19 Battery storage is the fastest bridge to 24/7 clean power, as clean baseload options like nuclear, hydro, enhanced geothermal, and natural gas with carbon capture take years to develop.20

Hyperscaler demand accelerates solar-plus-storage

By October 2025, US operating storage capacity reached 37.4 GW, up 32% year to date. Another 19 GW is under construction through 2026, with a 187 GW pipeline by 2030.21 Over half of the utility-scale storage coming online by 2026 is paired with solar, concentrated in three southwestern states.22

Some data centers are exploring on-site or co-located gas, nuclear, and solar-plus-storage as a way to avoid interconnection queues.23 Some hyperscalers are absorbing post-OBBBA renewable PPA price hikes of 4%, supporting solar-plus-storage growth. The Electric Reliability Council of Texas (ERCOT) and the Southwest Power Pool (SPP) remain strong PPA markets.24

Business models and market signals

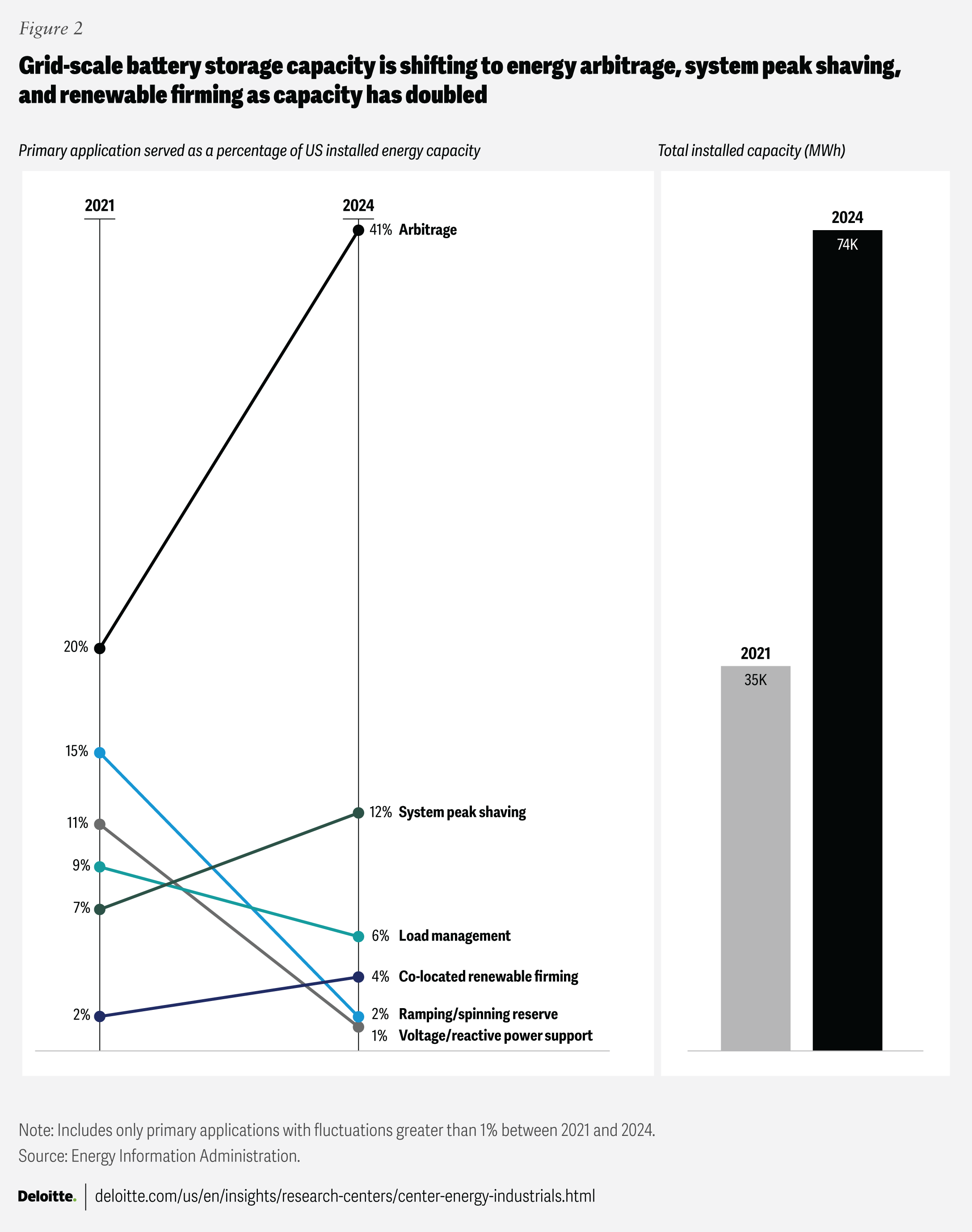

Storage economics are shifting from ancillary services toward energy arbitrage and multi-contract models (figure 2), blending energy sales, capacity payments, and hedging instruments to stabilize returns.25 In SPP, 10 GW of storage could avoid US$2.2 billion in system costs over the next decade.26 Market reforms are reinforcing storage momentum: ERCOT introduced new reliability services, PJM updated interconnection rules, and New York launched bulk energy storage credit programs.27

Storage diversifies and scales

Technology and market innovation are broadening storage’s role.

- Technology innovation: Lithium iron phosphate batteries are displacing nickel manganese cobalt lithium-ion batteries for cost and safety reasons. Long-duration pilots include 48-hour hydrogen-lithium hybrids and 100-hour iron-air batteries.28

- Distributed growth: Distributed storage has grown fivefold since 2020 to 4.8 GW in 2024, with another 4 GW expected by 2026.29 Virtual power plant enrollment—aggregated distributed energy resources (DERs) like batteries, solar, and electric vehicles coordinated to act as a single resource—reached 30 GW in 2024. Federal Energy Regulatory Commission Order 2222 is expected to accelerate aggregated DER participation in wholesale markets.30

In 2026, developers are likely to accelerate solar-plus-storage to serve hyperscaler demand, diversify revenue to manage volatility, and position early in long-duration and distributed storage for the next wave of growth.

3. Capital and operational efficiency: Implementing a leaner, smarter strategy

Policy shifts and macroeconomic pressures are intensifying the push for efficiency. Developers are prioritizing cost discipline across equipment, design, engineering, and labor while accelerating project timelines. Investors are expecting strategies that balance cost with growth.

Sharpening capital discipline

Compressed credit timelines are driving more selective capital deployment, with emphasis on mature assets and financing structures that maximize returns. Developers and asset owners are pursuing three strategies.

- Reprioritizing portfolios: Mature development and operating assets—especially those backed by long-term PPAs—come first, followed by repowering and relicensing.31 Capital is recycled through asset sales and divestitures to fund these priorities, while large players and investors target operating assets and near-term pipelines for secure returns.

- Accelerating near-term projects: Developers are tapping into flexible financing to bridge construction costs and fast-track projects before credit expiration.32 In residential solar, third-party ownership models are helping to sustain growth.33

- Capturing tax credit value: Developers are combining hybrid tax-equity partnerships with transferability benefits. Phaseouts may simplify financing by reducing complexity and accelerating capital flows.34

Optimizing costs and performance

Operational efficiency in the new normal now hinges on fundamentals—containing costs, ensuring reliability, and boosting productivity. Developers are standardizing design, optimizing procurement, and streamlining operations and maintenance. Digital and AI-driven tools are scaling to support these goals.

- Maintenance and performance: Predictive and event-based maintenance reduces asset downtime and operations and maintenance costs, while weather forecasting can boost solar and wind output by up to 20%. 35

- Revenue optimization: AI models predict market conditions and optimize battery charging to capture arbitrage.36

- Risk reduction: AI trained on geophysical data improves drilling success rates and lowers costs.37

- Workforce productivity: Robotic assembly and AI-prepped field crews accelerate deployment and repairs.38

Beyond asset operation, firms are digitizing and automating compliance, siting, and system management through digital twins and analytics.39

In 2026, the industry is expected to focus on strategic alignment and collaboration. With 76% of US power and renewable executives planning to increase AI spending in 2025, companies are recognizing that efficiency gains require talent, governance, collaboration, and technology.40 In the year ahead, developers are likely to align capital and operational strategies, embedding leaner practices and digital tools across the value chain.

4. Strategic M&A: Attracting capital through platform and mature assets

Well-capitalized investors and operators are seeking stable returns and pursuing differentiated strategies. Strategic energy firms, private equity firms, and infrastructure funds are prioritizing established platforms—developers that combine operating projects with late-stage pipelines, teams, and scale—and de-risked portfolios, while developers and independent power producers recycle capital by selling mature, PPA-backed assets to fund near-term pipelines. Solar and energy storage remain the leading focus areas.

Moderated activity with sustained platform interest

In the first nine months of 2025, US$6 billion across 58 renewable deals were announced—a 41% fall in value and a 45% drop in volume from the prior year.41 Yet platform acquisitions surged 4.6x in value,42 as financial buyers pivoted to company-level purchases to secure scale and talent. Multibillion-dollar transactions such as TPG’s acquisition of Altus Power and the sale of National Grid Renewables highlight sustained appetite.43 Operating projects and late-stage pipelines with safe-harbored credits remain top focus, followed by capable teams backed by scalable delivery infrastructure.

Evolving asset strategies

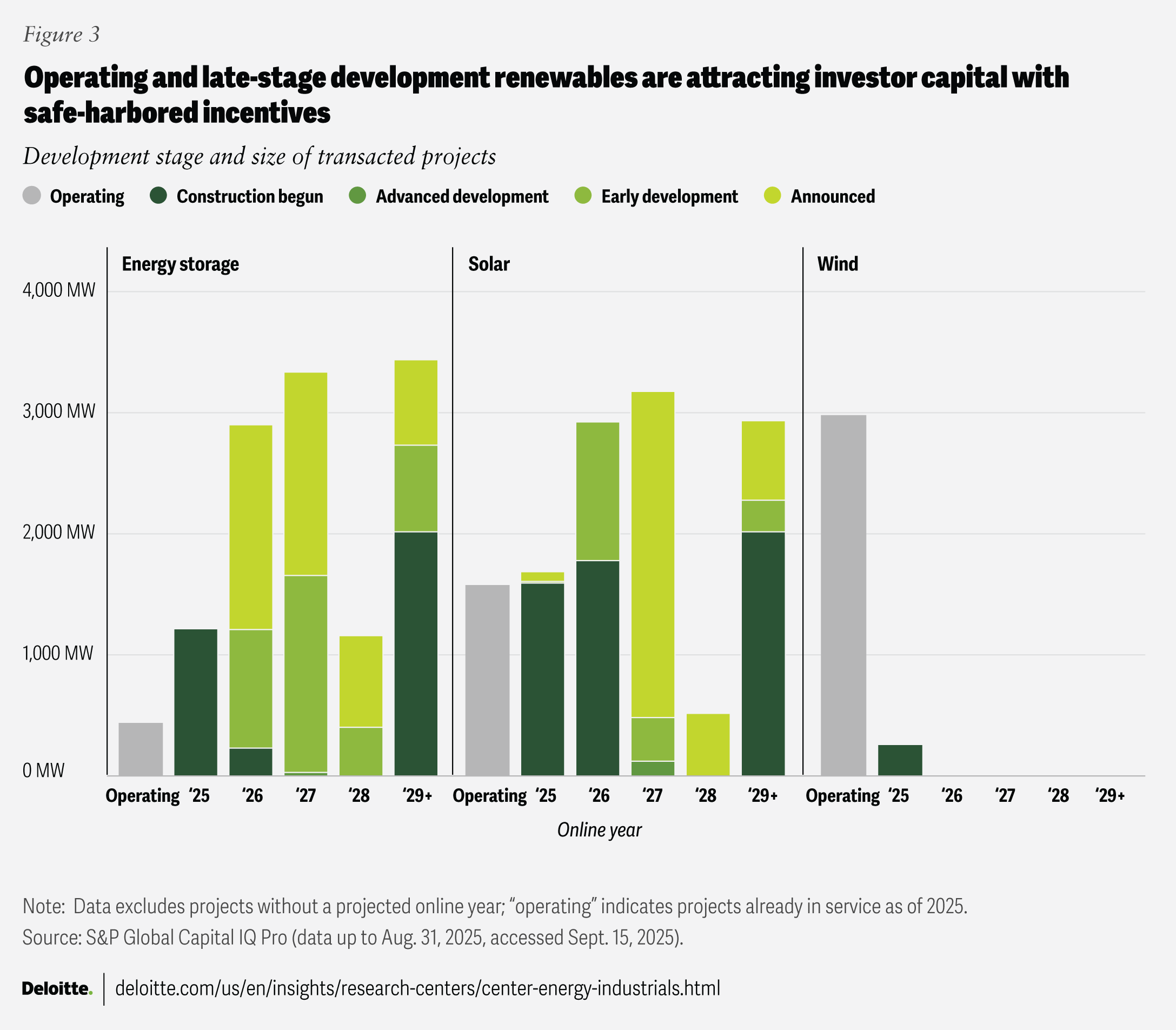

Asset-level deals slowed sharply, down 89% in volume in the first eight months of 2025 compared with 2024. Of the 58.4 GW pipeline capacity transacted, 38% is positioned to meet the safe-harbor deadlines, with 15% already under construction (figure 3).44 Notable solar-plus-storage portfolios changed hands—such as Repsol’s 777 megawatt portfolio across New Mexico and Texas and Samsung C&T’s 111 MW portfolio in Colorado—highlighting investor focus on hybrid capacity and PPA-backed stability.45

Capital strategies in 2026

Investor approaches are diversifying:

- Safe-harbor repricing: Credits and supply chain risks are driving a premium on operating assets with preserved credits and transferability, while early-stage pipelines face discounts reflecting safe-harbor risk.

- Storage optionality: Hybrid portfolios dominate storage deals, with most capacity yet to come online, underscoring investor preference for flexible platforms.46

- Strategic partnership: Co-investments and long-term PPAs (for instance, AES-Meta solar PPAs) are enabling risk-sharing and yield stability.47

In 2026, a long tail of qualifying assets will likely sustain deal flow, but capital will increasingly pivot beyond credits toward fundamentals—favoring storage, hybrid platforms, and long-term competitiveness.

5. Supply chain agility: Prioritizing alternative sourcing and reshoring

FEOC restrictions, changes to the 45X advanced manufacturing production tax credit, and expanding tariffs are raising costs from critical minerals to end products.48

Uneven exposure across technologies

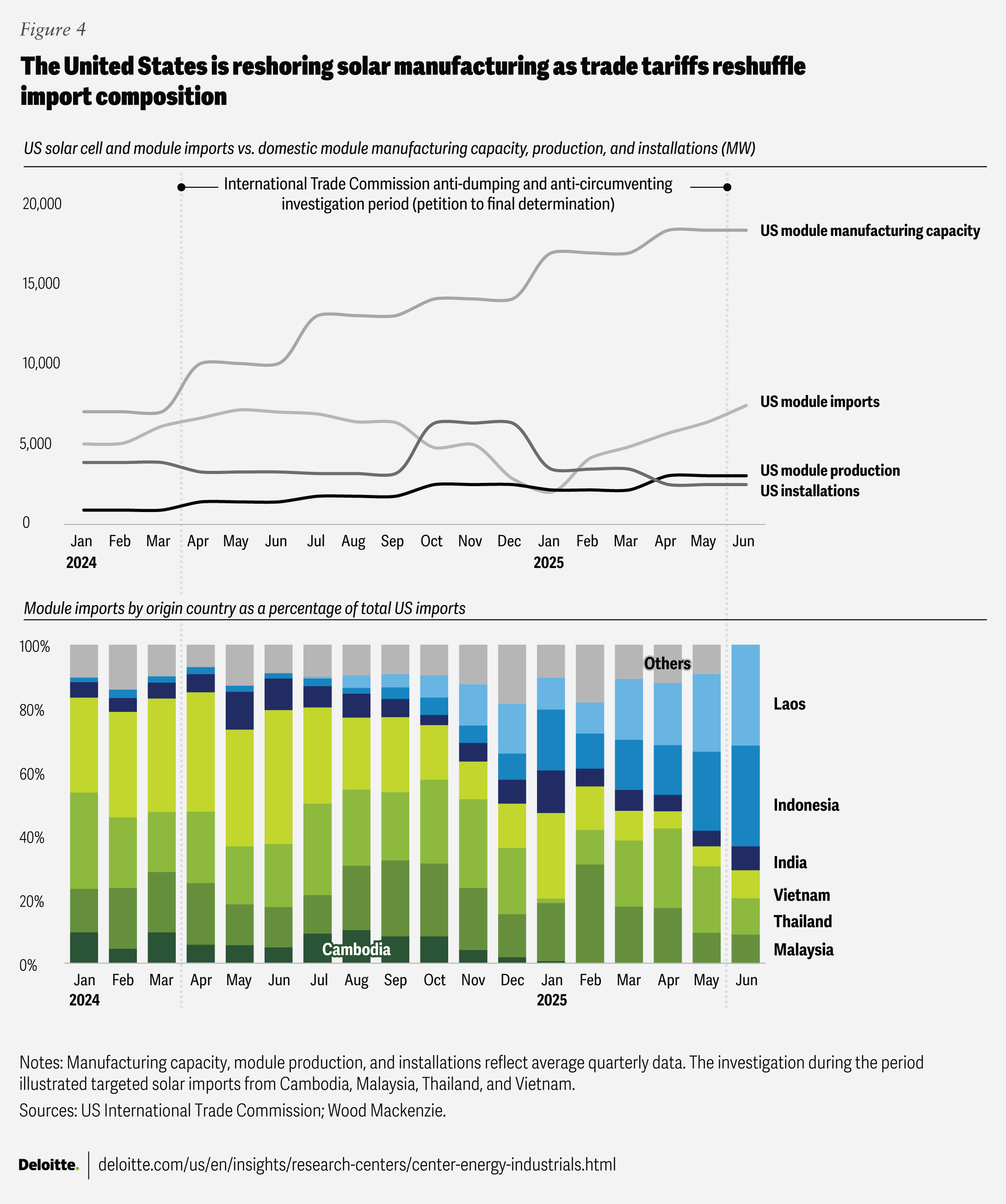

Trade enforcement actions are intensifying exposure. Antidumping and countervailing duties impose tariffs of up to 3,404% on solar imports from four Southeast Asian countries (figure 4), while Section 232 tariffs add costs to metals.49 Probes are expanding into solar, wind, battery, and critical mineral sectors.50 Domestic supply chains face some uneven risks.

- Wind: Blade manufacturing has remained flat at 4 GW since 2023, below the 2024 demand of 4.8 GW; tower capacity fell 20% to 10 GW, while nacelle capacity grew 14% to 17 GW.51

- Solar: Module production has expanded sevenfold to 56.5 GW since 2022, outpacing the 2024 demand of 35.3 GW. Yet, cells, wafers, ingots, and polysilicon remain import-reliant.52

- Storage: China supplied 70% of the lithium-ion batteries to the United States in 2024.53 Over 83% of the planned 219 GW of grid storage could lose credits under FEOC rules starting in 2026.54

- Minerals: The United States remains heavily import-reliant on critical minerals; 80% of rare earth elements (REEs) and 100% of graphite are imported.55 China currently controls 61% of REE mining and 91% of refining, leaving wind turbine magnets and EV motors highly exposed.56

Agility as a near-term differentiator

Companies adapting fast can gain an edge:

- Alternative sourcing and stockpiling: Firms are securing non-FEOC inputs for key components such as cathode active materials, which represent up to half of battery cell costs.57 From 2023 to the start of the antidumping and countervailing duties probe by the International Trade Commission in May 2024, developers stockpiled 35 GW of solar modules.58

- Visibility and flexibility: Digital tools and flexible contracting improve visibility, while executives stress-test strategies via scenario planning.59

- Life extension and substitution: Condition-based maintenance extends asset life, while sodium-ion batteries and other chemistries diversify beyond traditional lithium-ion supply chains.60

Resilience through reshoring and partnerships

Over the longer term, participants are investing in structural shifts:

- Reshoring and scaling: A leading solar manufacturer is targeting 14 GW of US module capacity by 2026. 61 Battery alliances have committed US$100 billion toward 100 GW by 2030.62

- Partnership and recycling: Joint ventures are securing US-made battery cells and solar glass supply, while partnerships are scaling the recycling of solar glass and EV batteries.63

In 2026, renewable developers are expected to emphasize near-term agility—diversifying inputs, stockpiling, and digitizing visibility—while investing in long-term resilience through reshoring, recycling, and partnerships.

2026: Renewables advance with agility

Compressed timelines and intensifying competition will define 2026. The imperative is to accelerate near-term deployment to capture credits while positioning for continuity through 2030 under safe-harbor and construction-start provisions. Adaptability is essential: Flexible strategies, resilient supply chains, and capital discipline are needed to manage FEOC rules and policy shifts. AI and digital innovation can sharpen efficiency, while M&A and partnerships provide scale.

By balancing speed with resilience, renewables can help contribute to a more resilient energy system that extends well beyond 2026.

Future in focus: Baseload renewables expand to meet surging power demand

Battery storage will scale rapidly to serve surging data center demand, while firm baseload renewables—hydro and geothermal—expand from a small base. Preserved tax credit horizons, evolving procurement mandates, hyperscalers, and advances across storage, hydro, and geothermal will help position these resources to complement intermittent renewables, anchor grid stability, and deliver the 24/7 clean power hyperscalers require.