The decarbonized power workforce

Digital and diverse

Jim Thomson

Ben Jones

Brad Denny

Kate Hardin

Carolyn Amon

Introduction

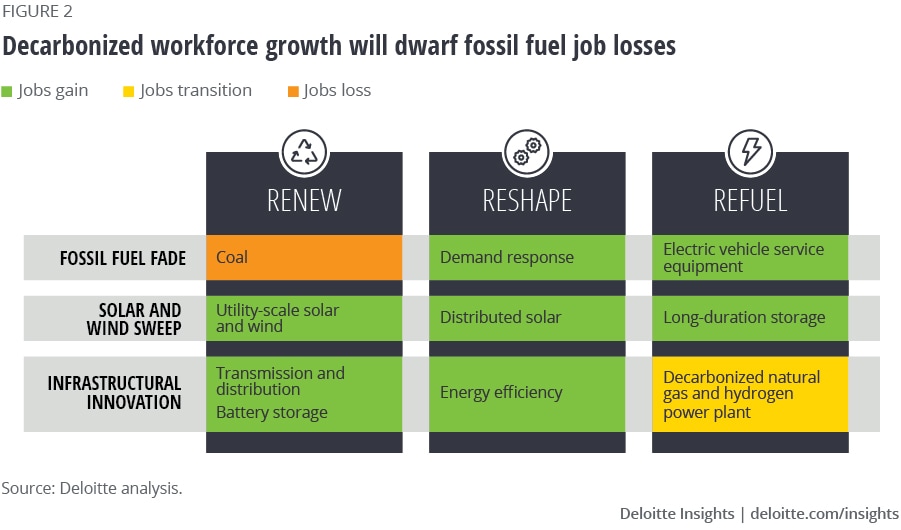

The scope and pace of the energy transition in the United States largely depend on the interplay between technology and workforce. As explored in Utility decarbonization strategies, the US power sector’s decarbonization involves actions and technologies to (1) Renew supply by baseloading carbon-free sources, (2) Reshape demand by harnessing behind-the-meter sources, and (3) Refuel the transportation and power sectors with electricity, hydrogen, and other decarbonized fuels (see sidebar, “A utility decarbonization framework: Renew. Reshape. Refuel.”). However, this technology deployment hinges on a significant workforce transformation. The changes may exacerbate existing inequities, skills shortages, and talent pipeline difficulties. They may render some segments obsolete, while driving growth in others. New types of work are also emerging in a sector which is already undergoing a broad digital transformation, accelerated by the pandemic. At the same time, these challenges may create opportunities for power companies to develop a new brand, operating model, and culture to attract and retain talent. Some of the digital technologies that power companies deployed during the pandemic are rearchitecting work in a way that can help in this regard.

A utility decarbonization framework: Renew. Reshape. Refuel.

Deloitte has developed a utility decarbonization framework encompassing three trends and three strategies that utility companies can pursue to fully decarbonize.

Three cross-cutting trends have already started shaping utilities’ decarbonization opportunities: a fossil fuel fade is underway, as all fossil fuel emissions will need to be phased out; a solar and wind sweep is rapidly increasing the share of variable renewable resources on the grid; and infrastructural innovation is helping to enhance the electric and gas system’s ability to support decarbonization by providing additional flexibility.

The three value-creating strategies utilities can deploy to capitalize on the three trends are to:

Renew supply by “baseloading” carbon-free sources

- Fossil fuel fade: Renewal involves retiring or converting nonrenewable plants and capturing or mitigating the emissions from any remaining or additional fossil-fueled plants.

- Solar and wind sweep: Retirements can pave the way for the continued record deployment of utility-scale solar and wind, as fuel-free, carbon-free, lowest-cost energy sources.

- Infrastructural innovation: The influx of intermittent renewables can require the deployment of storage technologies to provide greater system flexibility.

Reshape demand by harnessing behind-the-meter sources

- Fossil fuel fade: Demand response (DR) can be used to avoid carbon electrons from fossil-fuel peakers by shaving and shifting demand.

- Solar and wind sweep: Distributed energy resources (DER), such as rooftop solar, can reduce demand while providing utilities with a new source of carbon-free electrons if they are connected to the grid.

- Infrastructural innovation: Utility-driven energy efficiency measures can further complement the flexibility provided by DR and DER by avoiding the production of any superfluous electrons. Combining the three can yield a nonwire alternative to building power plants.

Refuel sectors with decarbonized electricity and fuels

- Fossil fuel fade: Renewable electricity could eventually need to replace most of the oil and natural gas in fueling the transportation, heating, and industrial sectors in order to achieve systemwide decarbonization.

- Solar and wind sweep: Maximizing the use of renewables at high levels of penetration while minimizing wasteful overbuild and curtailment would require their seasonal storage via conversion to hydrogen or thermal fuels.

- Infrastructural innovation: In areas that will be most difficult to electrify, it may be more cost effective to convert the infrastructure to carbon-free fuel instead.

The Biden administration envisions a fully decarbonized power sector by 2035, accelerating the timelines of most utilities that have committed to decarbonizing by 2050.1 These utilities were already facing an uncertain path to achieve their decarbonization targets through the scheduled fossil fuel plant retirements, renewable additions, and flexibility requirements. The administration’s linkage of decarbonization to job creation and equity anticipates electric infrastructure and workforce investments commensurate with the power sector’s key role in achieving economywide decarbonization. However, the 15-year timeline will likely necessitate unprecedented capacity turnovers, buildouts, and digitalization. How might rapid decarbonization impact the workforce?

This report explores how the power sector is expected to grow, and the workforce composition to change, to meet the new proposed target. We then analyze growing gaps in the digital skills required in the power sector and what can be done to fill those gaps. Finally, we show how power companies could rebrand, retrain the existing talent, and recruit from new talent pools to achieve this transition.

Renew, Reshape, and Refuel jobs to decarbonize by 2035

A tale of two (work)forces: Groundbreaking growth and delimited decline

Decarbonization of the US power sector by 2035 could entail both unprecedented workforce growth and the elimination of entire workforce segments. Job growth is expected to mostly stem from the buildout of solar and wind generation capacity at levels surpassing 100 GW annually—40% higher than the existing annual record of capacity additions for any energy source, to be sustained for decades—and a doubling of the transmission and distribution (T&D) infrastructure to support it.2 While this growth will dwarf job losses from a complete coal phaseout and natural gas transition, the locational concentration of fossil-fuel generation could have an outsized impact on the affected communities and workforces.

Groundbreaking growth in the broader power sector

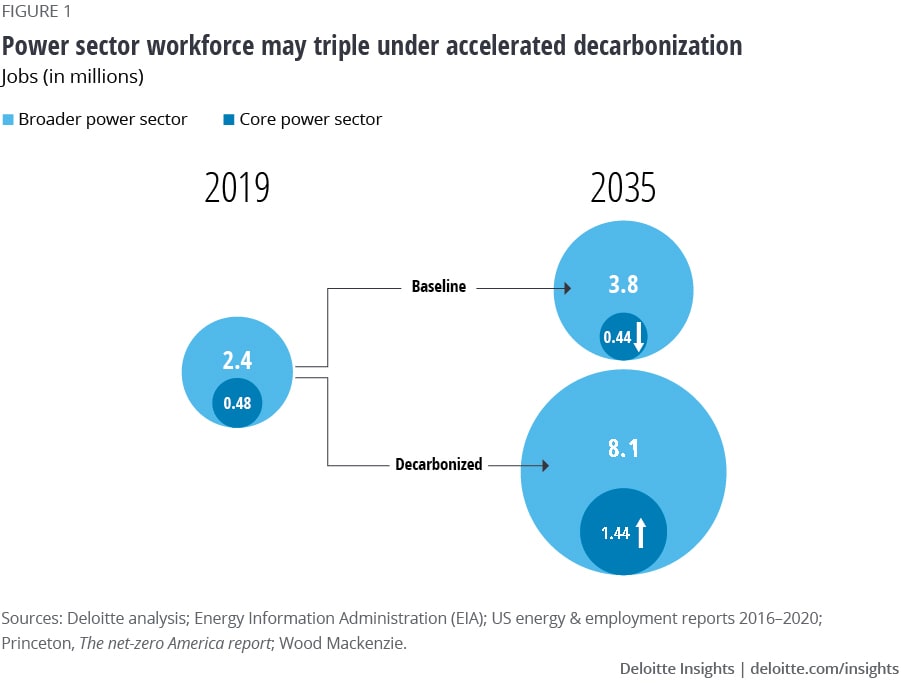

The power sector workforce could triple by 2035 under the decarbonization scenario (figure 1).3 The growth would yield over 8 million jobs while far surpassing the projected 13% employment growth rate for the general economy.4 The analysis takes full account of power sector job growth by considering both the core and the broader sector. We define the core power sector as utility-scale electric generation, transmission, and distribution, in alignment with the US Bureau of Labor Statistics (BLS) categorization. This definition, however, is limiting. It does not capture booming occupations, such as wind turbine service technicians and solar photovoltaic (PV) installers, which are the fastest and the third-fastest growing occupations in the United States, respectively.5 This is because wind and solar jobs are mostly classified in the construction and manufacturing sectors, unlike the fuel-based (coal, natural gas, and nuclear) power generation jobs that mostly fall within the core sector. Furthermore, the core entirely excludes distributed solar generation, which creates 11 more jobs per GW than utility-scale solar.6 It also excludes many jobs that directly result from utility contracts, incentives, and/or financing. What we define as the broader power sector captures these jobs by including firms engaged in facility construction, turbine and other generation equipment manufacturing, operations and maintenance (O&M), and wholesale parts distribution for electric generating technologies, as well as utility-related energy efficiency and electric vehicle (EV) charging infrastructure jobs. The 2035 job estimate in the decarbonization scenario reflects the potential job creation if the domestic manufacturing base grew to fully supply the renewable and storage capacity growth, another goal of the current administration.

Delimited decline, concentrated in the core power sector

Job losses are expected to be concentrated in the core power sector, the locus of fossil-fuel generation jobs that are heavy on fuel handling and O&M. The core power sector was forecast to show job losses over the next decade under the baseline scenario. A record 52.4 GW of uncompetitive coal capacity closed under the previous administration despite its support for coal.7 To meet the new administration’s target, more than quadruple this capacity will need to retire by 2035, leading to a further loss of 79,711 jobs (figure 2). The continued competitiveness of newer plants can allow the natural gas sector to experience a smoother transition. The existing natural gas–fired capacity could mostly remain in place but start operating at increasingly lower capacity factors. The resulting job losses may be mitigated by the potential for equivalent jobs as the plants transition to running on hydrogen or decarbonizing in other ways. Because they require no fuel and few O&M jobs, renewables would not have made up for these losses in the baseline scenario. Conversely, the core power sector would grow in the decarbonization scenario, mainly because of T&D jobs, which are set to increase by 75% according to our analysis. It could further grow by claiming a larger share of the broader power sector by 2035 amid industry convergence (2021 Power and Utilities Industry Outlook). For example, utility investment in EV charging has thus far mostly focused on “make-ready” infrastructure, but could expand into ownership of charging stations, only 0.6% of which are currently utility-owned.8 Utilities are also expanding their scope as they partner to develop multiregional charging infrastructure, such as the Electric Highway Coalition of six utilities.

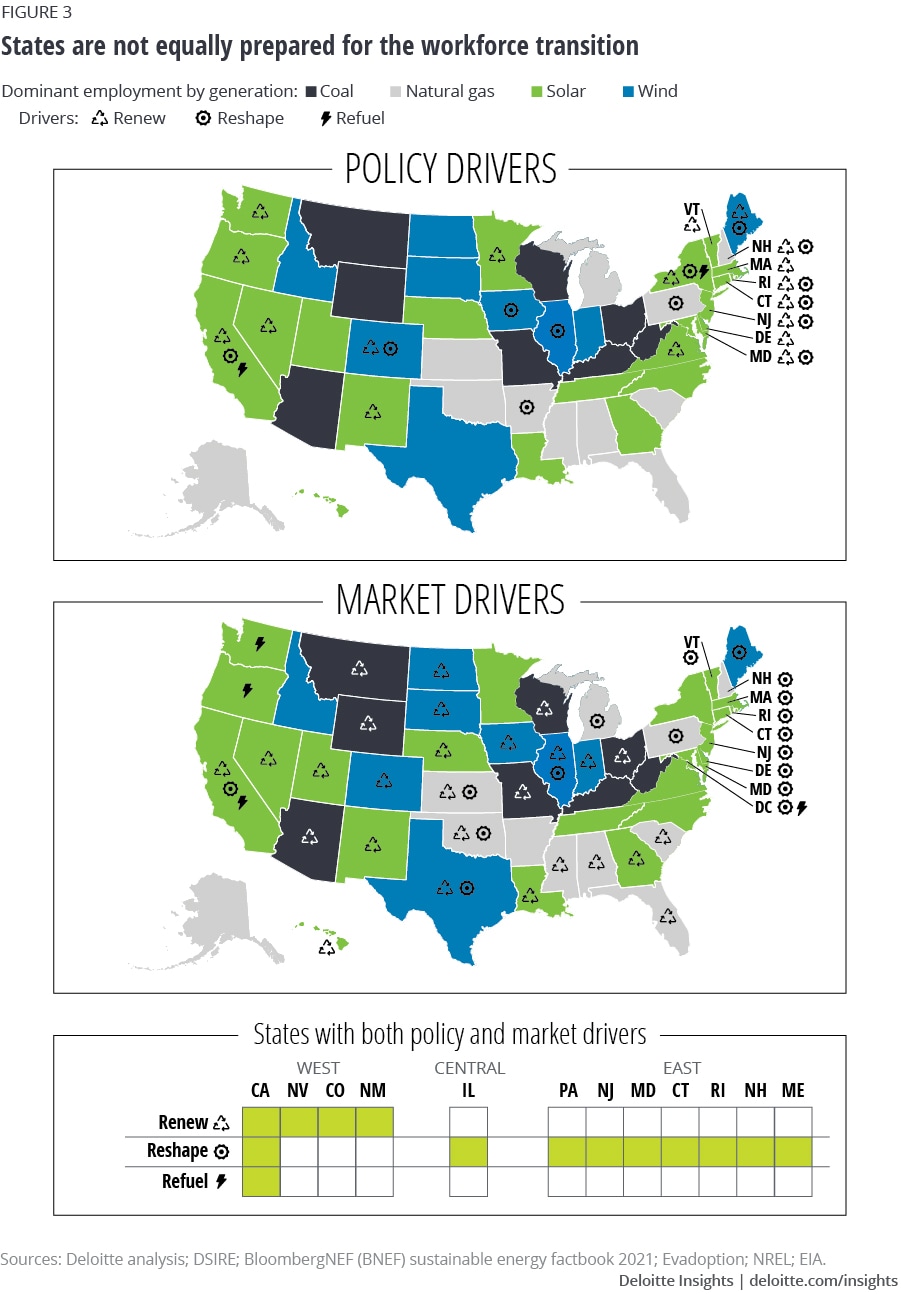

A tale of two states: Uneven market and policy enablers of the workforce transition

The power sector’s workforce transition may proceed faster in states with strong market and policy enablers, and encounter resistance in states without them (figure 3). We created an index to map these enablers across the Renew, Reshape, and Refuel strategies (see sidebar on pg. 3, “A utility decarbonization framework: Renew. Reshape. Refuel.”). States with the highest renewable resources are market-driven Renew states.9 If they have two of three policies—a renewable portfolio standard above 20%, carbon pricing, and green tariffs—they qualify as policy-driven Renew states. Market-driven Reshape states have high smart meter penetration, regional transmission operator access, and high electricity prices (also two of three). They are a policy-driven Reshape state if they have a mandatory energy efficiency resource standard, retail net metering, and third-party solar power purchase agreements. Refuel states are market-driven if EV penetration is above 3%, and policy-driven if they have EV incentives, hydrogen targets, and follow California’s vehicle emissions standards. California, home to the largest power sector workforce, could continue to be a locus of the workforce transition as the only state that currently has all the market and policy drivers across the Renew, Reshape, and Refuel strategies. It is joined by two other Western states—Colorado and Arizona—as the only states with both policy and market drivers to Renew. Meanwhile, the states with both sets of drivers to Reshape are concentrated in the Northeast. Finally, Refuel market and policy drivers are emerging in Pacific Western and Northeastern states. These coastal states are strongly policy-driven, whereas Southern states are almost exclusively market-driven, as are most Midwestern states. None of the states where power sector employment is dominated by coal have any decarbonization policy drivers, and few natural-gas dominant ones do. Most do have Renew market drivers, however. The new administration’s proposed federal policies to support the energy transition and fossil fuel–dependent communities could help unlock the workforce transition in these states.

Job quality could also shape the pace of the workforce transition. Building a wind or solar farm close to a coal plant might temporarily create construction jobs. But we expect there to be fewer O&M jobs matching the skills and salaries of current workers: Of the two dozen power sector occupations we analyzed (see sidebar, “Core power sector jobs”), the onshore renewables-specific ones offer the lowest wages.10 Renewables manufacturing job growth could help compensate for the losses and provide longer-term employment and a better skills and wages match (Creating pathways for tomorrow's workforce today: Beyond reskilling in manufacturing). This could be most crucial in states facing the highest workforce transition risk. These include West Virginia and Kentucky, which have large coal workforces and less market and policy support for the transition.

Calls to action:

• The core power sector should be preparing for a trend reversal to job growth that would require increased hiring.

• Amid industry convergence, the broad power sector growth could also open opportunities for the core power sector to expand into new areas that would require the creation of completely new positions.

• Power companies may need to adopt differentiated workforce transition strategies according to the interplay of state market and policy drivers and federal actions.

• All these developments would require focus on leadership development and transformational change management.

Rearchitect work to unleash a digital power company workforce

The core power sector has been undergoing digitalization over the past decade and the pandemic exacerbated the trend as many power companies sought to digitalize processes to mitigate pandemic-related disruptions.11 It has proved to be a catalyst for many power companies to rethink the workplace and rearchitect the work by deploying digital technologies in concert with human capabilities to transform the way work gets done. An accelerated decarbonization timeline will only expedite the digitalization.

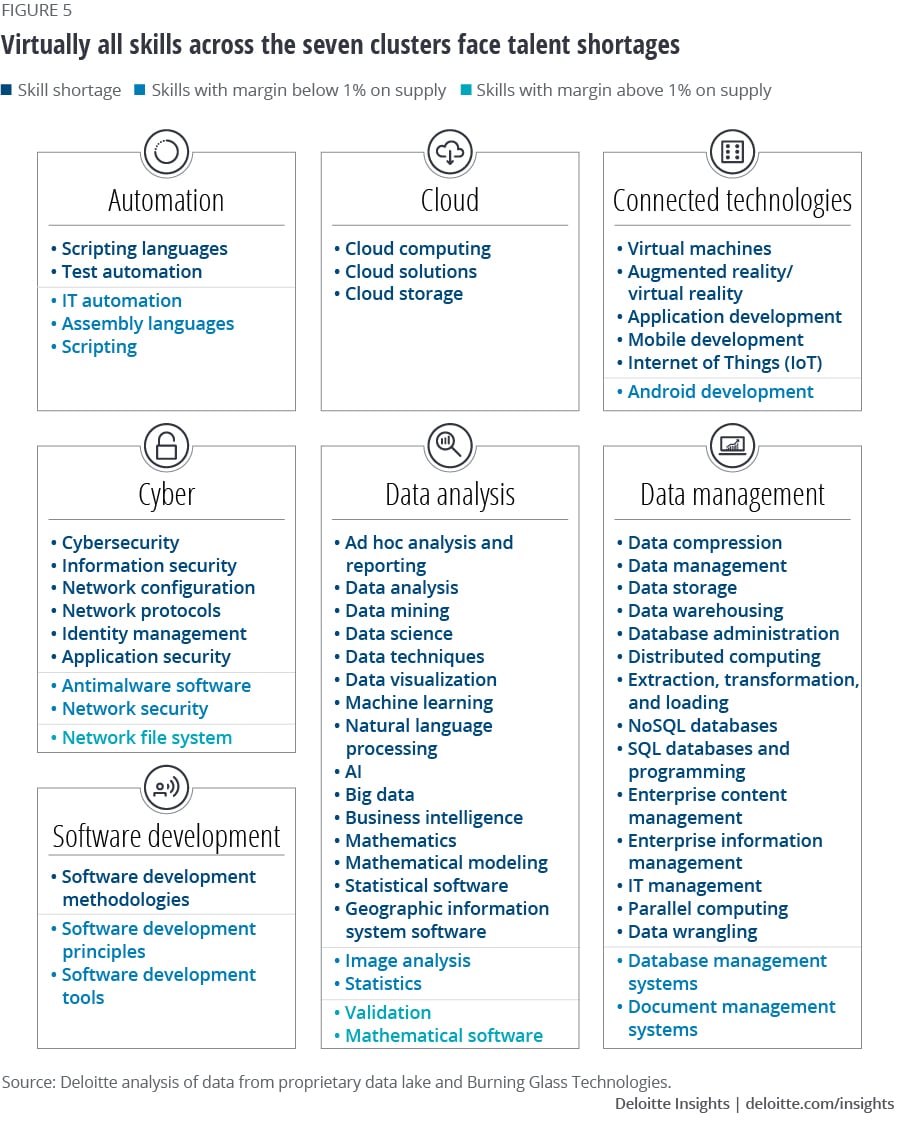

Seven key digital skill clusters for the power industry

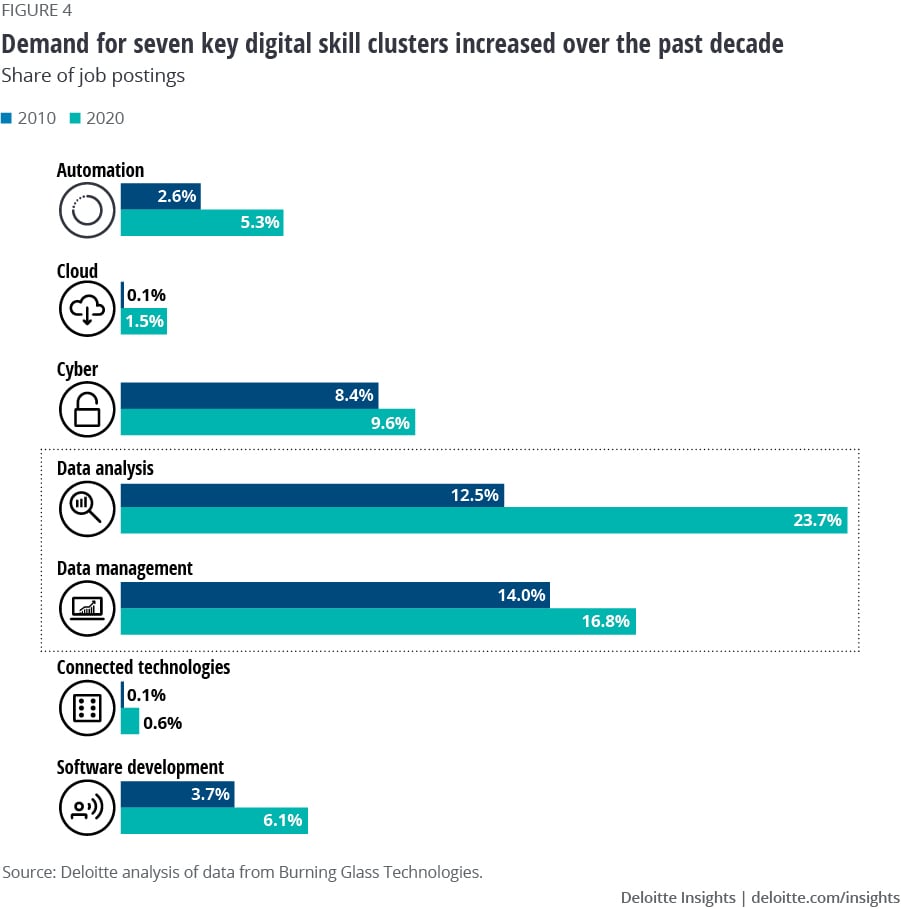

Digital skills have a disproportionately large footprint in core power sector job openings. IT jobs constitute 35% of all utility job openings, the second-highest share of any nontech industry.12 More broadly, our data analysis shows that digital skills, which include both IT and analytical skills, are in highest demand in the power sector. On average, each power sector job posting requires two digital skills, one business skill, and less than one of any other type of skill.13 Seven digital skill clusters in particular were found to have grown in the power sector over the past decade (figure 4).

These clusters include some of the fastest-growing skills in the broader economy, thereby conducive to a fierce competition with other industries for talent. For example, connected technology skill demand is projected to double over the next five years, and IT automation to increase by 59%.14 Within the data analysis cluster, the individual skill of artificial intelligence (AI)/machine learning is projected to grow by 71%.15 In fact, talent shortages are already acute across the seven clusters (figure 5). Our analysis of skill demand and supply data shows that talent demand exceeds or falls within a 1% margin of supply for over 95% of skills required in the core power sector.

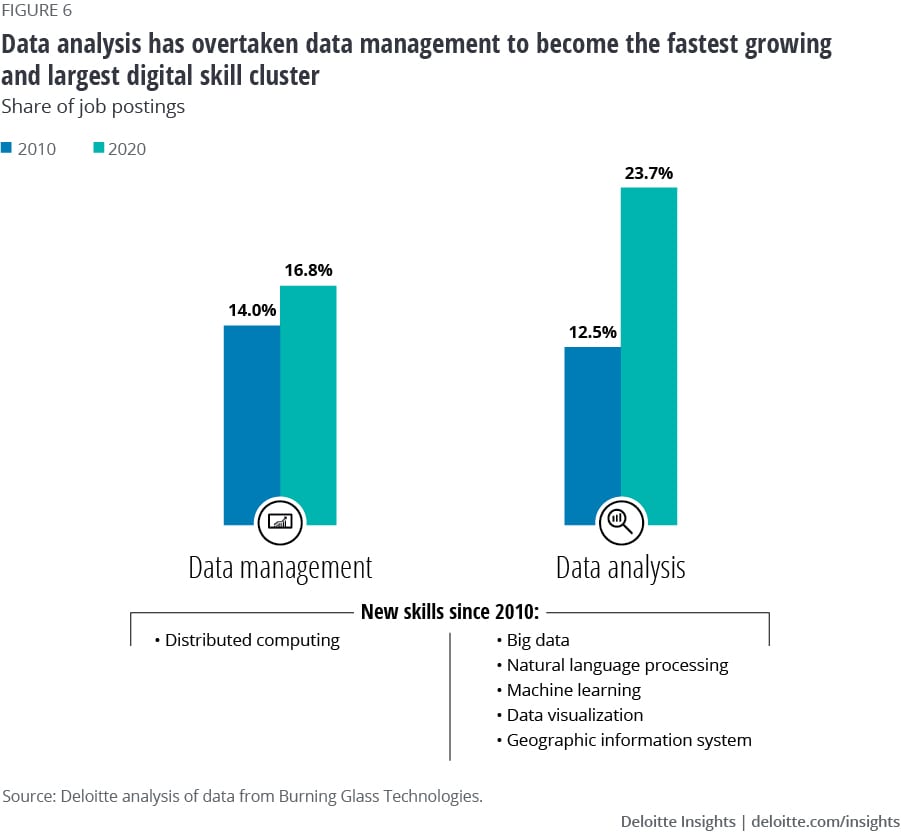

Data-related skills have evolved the most. As smart grid technologies and DR programs embed software into physical systems, creating a real-time and continuous exchange of information, data has become one of the power industry’s most valuable assets, and its effective governance has become an imperative. Naturally, data science skills have grown the most over the past decade and are now in greatest demand. The power sector also requires increasingly advanced digital science skills. Hence, demand for data analysis skills has overtaken demand for data management skills, which are rapidly automating (figure 6). And within these two clusters, demand for new skills, such as natural language processing, machine learning, and data visualization, has emerged.

Digital skill central to all others: Cybersecurity

The growth in data and digitalization raises security concerns. 5G is increasingly becoming the primary connectivity solution for power companies aspiring to digitize. Its lower latency could enable the integration of more devices and broader remote and/or mobile workforce value. The higher number of endpoint systems pose entry threats for adversaries to compromise data, bringing new and greater cyber risks. Ensuring the security of 5G networks will be paramount. While demand for cybersecurity skills is consequently increasing, the supply of cybersecurity workers in relation to current job openings in the utilities sector is very low.16

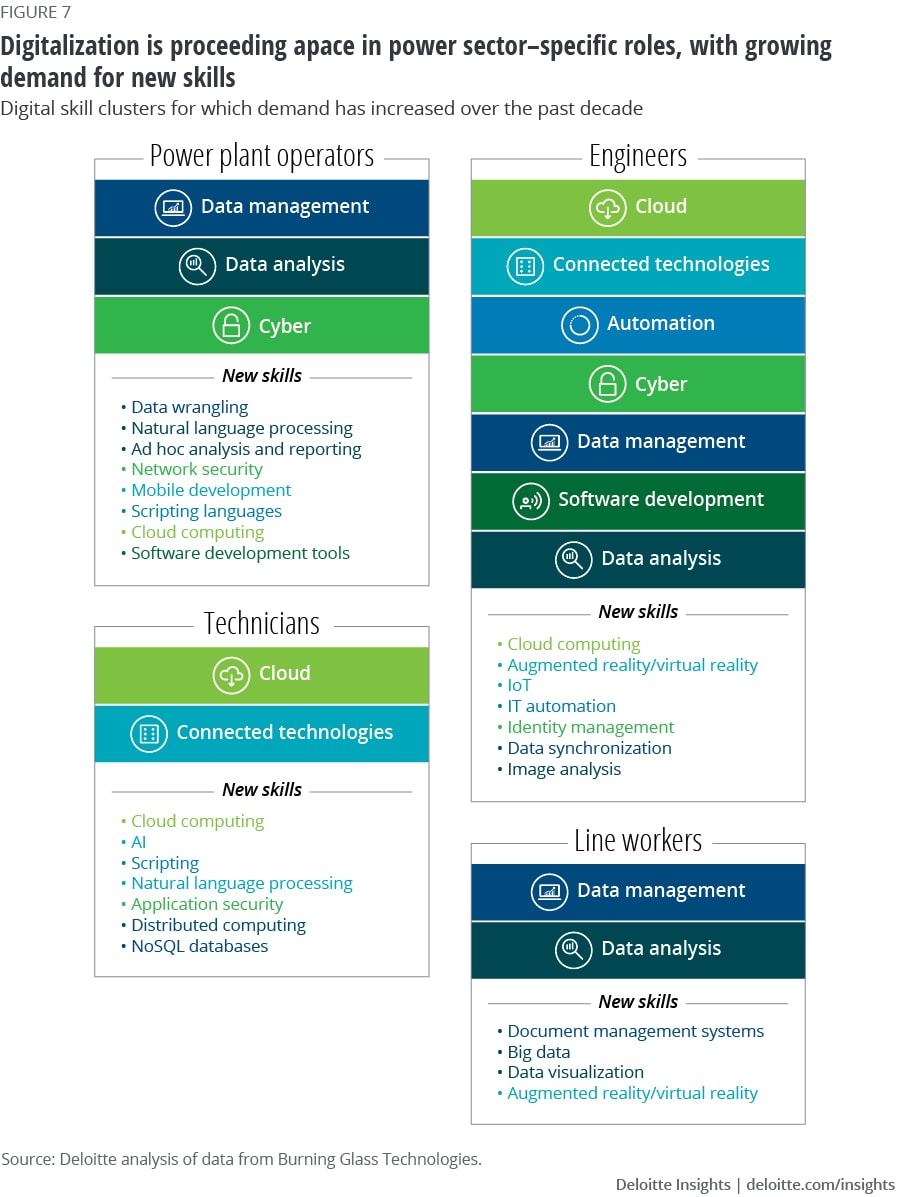

Growing digitalization across traditional power company roles

Demand for the seven skill clusters is notably concentrated in four roles that are specific to the core power sector and account for close to half of its workforce (figure 7). These roles are line workers, engineers, power plant operators, and technicians (see sidebar, "Core power sector jobs"). For example, as line workers jettison pen and paper in favor of a tablet, and pole climbing in favor of operating drones, demand for data management and analysis skills is growing.

Core power sector jobs

• The core power sector should be preparing for a trend reversal to job growth that would require increased hiring.

• Amid industry convergence, the broad power sector growth could also open opportunities for the core power sector to expand into new areas that would require the creation of completely new positions.

• Power companies may need to adopt differentiated workforce transition strategies according to the interplay of state market and policy drivers and federal actions.

• All these developments would require focus on leadership development and transformational change management.

The upward trend in digital skill demand doesn’t undermine the innate qualities and skills that humans bring to the table. While digital skills dominate skill requirements for power sector employees, these will intersect with increasingly important and complementary technical and human skills. For example, someone working with smart grid technologies will likely need to have technical competencies specific to power systems and familiarity with a strong safety culture. Human-machine collaboration to solve increasingly complex and often unpredictable tasks can also increase the importance of soft skills, such as problem-solving, critical thinking, and teamwork.

Calls to action:

• Reassess how current and future roles will be performed in a decarbonized power sector and how the culture may change.

• Plan to continuously train the digital workforce in rapidly evolving data analysis and cybersecurity skills.

• Prepare the workforce for technical and human skills that complement digital skills. This will likely require training on new ways of communicating and working individually, on teams, and remotely.

• Be more open to training generalist new hires and retraining the existing workforce on scarce digital skills, given the competition with other sectors.

Rebrand, retrain, and recruit for a decarbonized workplace

The transformational opportunity of decarbonization can provide access to improved employment outcomes for all, particularly groups that have historically been underrepresented in the sector. The core power sector can seize this opportunity to address skills gaps, talent shortages, and hiring challenges across most of its core occupations, amid stiff competition with other sectors for talent.17 The workforce could also benefit since power companies are among some of the highest wage-payers in the energy sector.18 These wages may not be competitive with those offered in the tech sector for digital skills, but they are higher than those associated with decarbonization in the broader power sector, and could, therefore, provide a pathway to a transition for workers across the energy industry (The Great Compression Report). The other key component to this transition is diverse, equitable, and inclusive workforce development, as reflected in the Biden administration’s specification that 40% of clean energy investments go to disadvantaged communities.19

Rebrand power jobs

The power sector may need to overcome legacy images while creating new ones in order to attract talent. The sector’s jobs have sometimes been associated with giant smokestacks and fossil fuels burning. As a result, segments of the population, especially millennials, may not consider employment in the industry. Recasting the power sector as a leader in the transition to a low-carbon society, a top priority of the Center for Energy Workforce Development, could dramatically alter a potential employee’s perceptions. This, combined with branding around the increasingly digital nature of many jobs (figure 4), paints an expanded view of what it means to be a power sector worker. Finally, power companies are integrated into communities across the country and can leverage geography in their brand. Power companies in smaller cities can take advantage of people’s peripandemic willingness to move, while ones in large metropolitan areas can emphasize their role in helping decarbonize the metropolis.20

Retrain the fossil-fuel workforce: Spatial equity

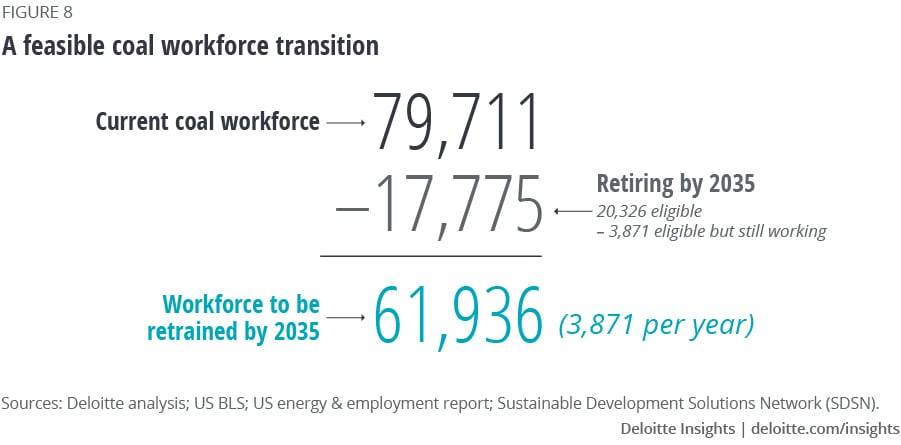

The power sector is facing digital skills shortages at a time when it will be transitioning whole segments of its workforce. This declining workforce is often geographically concentrated in socioeconomically disadvantaged areas. After accounting for attrition from voluntary retirements, data analysis shows that power companies would need to retrain as many as 3,871 employees currently engaged in coal-fired generation annually if they were to fully transition their workforce to other core power sector jobs (figure 8). Even more, power companies could radically adapt the workplace by converting coal-fired power plants to renewables-powered ones, taking advantage of the existing T&D infrastructure. Examples include the conversion of coal plants into logistics and manufacturing hubs for offshore wind and storage (Massachusetts), and into green hydrogen plants coupled with seasonal storage (Utah).21 Alternately, they could repurpose the plants for digital purposes by converting them into data centers, as the Tennessee Valley Authority has done in partnership with Google in Alabama.22

Recruit from new pools of talent: Identity equity

The power sector has been toward the forefront of gender diversity at the C-suite level,23 and above average at the board level,24 but lags across its core workforce. Some of the reasons for this seem structural. For example, the gender mix of graduate cohorts in STEM is skewed: Women make up just 28% of the STEM workforce that is key to the power sector. Other minorities—Latinx, Blacks, and American Indians/Alaska Natives—also account for disproportionately small shares of the STEM workforce.25 Other reasons seem specific to the power sector. An industrywide survey revealed that responding utility workers were 53% more likely than workers in other industries to say their employer does not invest in job skills and career development, increasing the risk of talent flight.26 Due to the nature of the work, the power sector has not previously embraced workplace flexibility. But during the pandemic, many power companies developed the infrastructure to enable a hybrid workforce, which can open new talent pipelines.

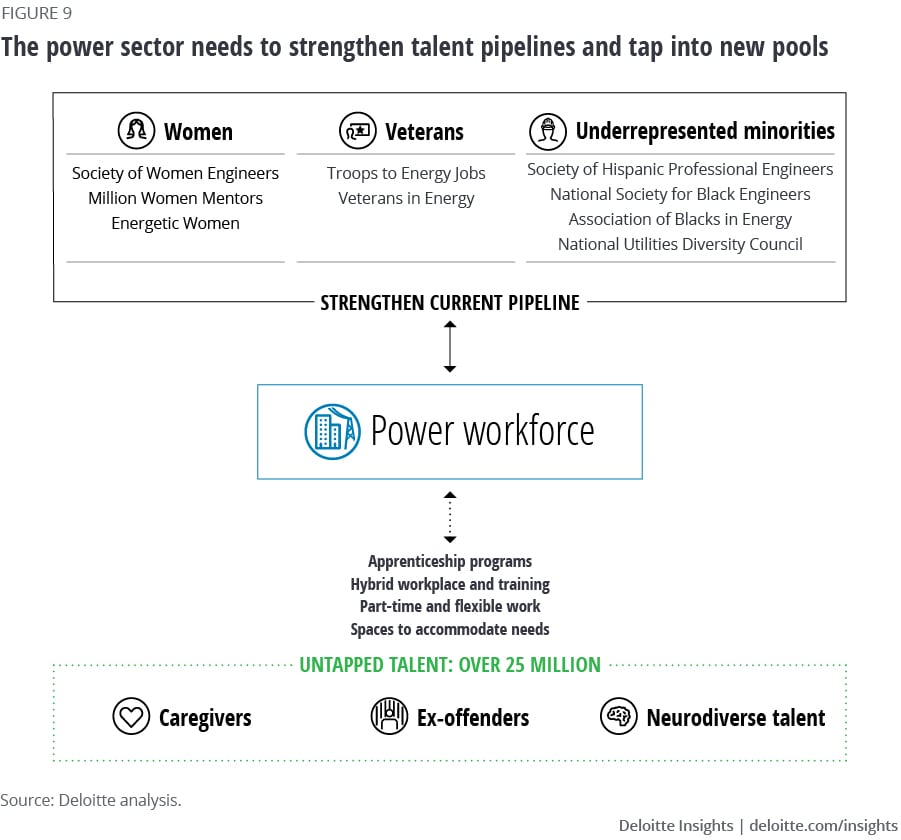

Power companies can address both—structural and sector-specific challenges—by pursuing targeted talent pipeline development. They could do so via early interventions, such as investing in local STEM programs down to the elementary school level. At the same time, they can partner with existing associations to attract women and other underrepresented professionals into energy. Given the competition with other sectors for digital skills, the power sector should also consider creative options in tapping new talent pools that include over 25 million potential employees, and adapting the workplace accordingly (figure 9).

1) Offering part-time and/or remote engineering work could create a new talent pipeline of STEM graduates or professionally qualified people with caretaking obligations. These caretaking obligations disproportionately fall to women, a trend the pandemic has exacerbated.27

2) A seamless remote-to-physical workplace can enable ex-offender training and reintegration programs, subject to regulatory approval, by allowing for remote training and phased integration.

3) Workplaces incorporating sensory rooms, more transparent communication protocols, and remote working options could attract a pipeline of neurodiverse talent with unique pattern recognition skills, key to data analysis and other digital skills.

4) Instituting apprenticeship programs as integral components of the workplace can help power companies tap these talent pools and others who may not otherwise qualify for lack of higher education.

Concluding thoughts

Accelerated decarbonization and digitalization are upon us, with major ramifications for workforce transformation. The power sector is expected to most acutely experience the talent pressure these processes entail given that it needs to decarbonize first while fiercely competing with other sectors for talent with the required combination of scarce digital skills and complementary technical and human skills. At the same time, the core power sector is in a strong position to enhance its brand profile nationally to attract more talent. It can do so by promoting its role as the first mover of the clean energy transition. Under a 2035 decarbonization scenario, it would be leading a moonshot effort to achieve net-zero emissions in its own sector and economywide, while creating high-quality jobs. At the same time, it would be helping to expand the workforce to include historically underrepresented groups by providing access to and training for fast-growing digital skills of great value in the broader economy.