Did removing weak links make pharma supply chains stronger?

By William Greenrose, managing director, Deloitte & Touche, LLC, and Wendell Miranda, assistant manager, Deloitte Services LP.

The COVID-19 pandemic was a stress test that exposed weak and missing links along the pharmaceutical manufacturing supply chain.1 Nearly four years after COVID-19 emerged, the pharmaceutical supply chain is more complex than ever, and evaluating supply chain risk has become a priority.2

During much of 2020, lockdowns, understaffing, shipping bans, border closures, travel restrictions, and regulatory hurdles contributed to severe shortages of raw materials used to produce many critical drugs. Some pharmaceutical manufacturers shut their doors as inventories dwindled.3

Before the pandemic, the supply chain model used by the pharmaceutical sector had not changed much during the prior 30 years. One substantive change was the transition to just-in-time (JIT) inventory management for some raw materials. Under this strategy, vendors deliver some supplies only as they are needed.4 JIT was pioneered by Japanese automobile manufacturers in the 1970s, and has since been borrowed by many other industries, including pharmaceutical manufacturers.5 Pharmaceutical manufacturers adopted a variation of that model.

JIT served the industry well for decades, and pharmaceutical companies often relied on just a few key suppliers of active pharmaceutical ingredients (APIs). Sole-supplier sourcing helped to ensure lower costs for materials, and it meant fewer vendors needed to be managed. Having only the inventory needed to meet immediate demand reduced the need to store materials. Moreover, many pharmaceuticals—and the raw materials needed to make them—might have a limited shelf life, which can make large inventories unsustainable. COVID-19, however, revealed JIT as one of the weak links in the supply chain.6

Post-COVID supply chains tend to be complex

Companies may have moved away from lean inventories and become more strategic about supplies and infrastructure. However, the move away from JIT and sole-supplier sourcing has led to other challenges. Lean warehousing saved on space. But the decision by many companies to increase inventory to try to avoid disruptions can lead to storage capacity issues. This might be addressed in the short-term by using local or regional third-party warehousing services. But this strategy can add both to the third-party quality assessment and management burden, as well as cost, which is already going up due to the larger material inventories.

To protect against future disruptions, pharmaceutical companies now often rely on multiple vendors from a broad range of locations.7 Nearly 80% of manufacturing facilities that produce APIs are located outside of the United States.8 And those vendors likely have relationships with their own suppliers. A large pharmaceutical manufacturer might have relationships with multiple suppliers in multiple countries, which could mean hundreds of vendor-audits must be conducted each year.

Some companies likely do not have the time or the resources to monitor all of their suppliers and have opted to outsource that function to organizations that can offer a consistent standardized and leading-edge approach.

Evaluating supply chain risk should be a priority

Pharmaceutical companies may have fragmented supply chains due to complex products, multiple divisions, research and development, and worldwide manufacturing facilities. In addition, the rapid pace of digitalization over the past several years seems to have amplified the need to monitor various types of risks, including cyber, operational, and technological risks, which are generally faced by suppliers and their sub-suppliers.

We recently surveyed leaders from across supply chain functions, including supply chain operations, planning, manufacturing, procurement and sourcing, and digital.

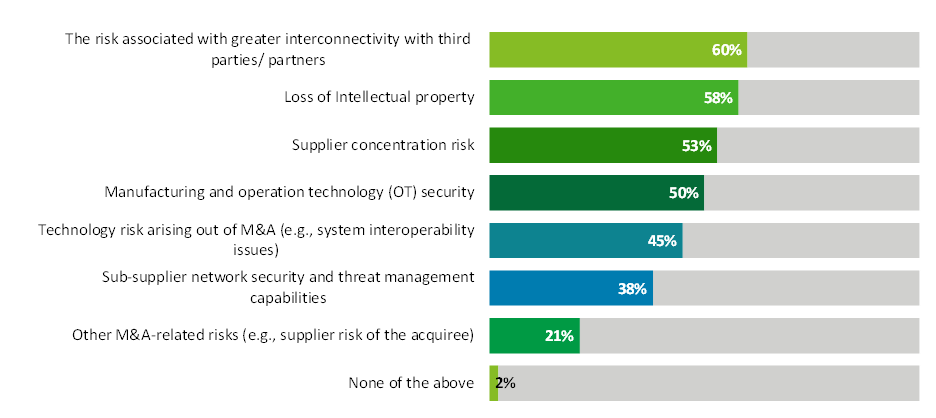

About 60% of respondents said their organization is actively assessing supplier concentration risk, but just 38% said their organization is monitoring sub-supplier cybersecurity and threat management capabilities, according to results from our 2023 Biopharma Supply Chain Digitalization Survey (see chart below). More than half of the respondents represented companies with annual revenue greater than $5 billion.

Two key strategies to include in risk-management programs

Supply chain risk-management programs have become important for pharmaceutical companies. Here are two key philosophies that should be considered:

- Take advantage of digital technologies: Digital tools (e.g., artificial intelligence, predictive analytics, cloud) can help to provide end-to-end visibility into potential risks in the ecosystem of suppliers and third parties. This could form the basis of more comprehensive risk-management plans/programs to predict risk across multiple tiers of the supply chain.

- Treat data like an asset: Data is as much a part of the supply chain as raw materials. Just like APIs, data requires checks and controls to help ensure quality. Teams should define governance on how data from suppliers and sub-suppliers is processed and reacted to. This data will likely be key to using digital technologies, such as AI, to evaluate and monitor supplier and sub-supplier risk.

Lawmakers target pharma supply chains

A 2021 executive order from the Biden Administration identified the pharmaceutical supply chain as being critically important to the country. The White House called on the Department of Health and Human Services (HHS) to work with other agencies to identify risks in the supply chain for pharmaceuticals and active pharmaceutical ingredients and policy recommendations to address those risks.

In June of this year, Senators Gary Peters (D-Mich.) and Joni Ernst (R-Iowa) introduced the Pharmaceutical Supply Chain Risk Assessment Act. The bill calls on the Department of Health and Human Services to conduct a risk assessment of the pharmaceutical supply chain in partnership with the Department of Defense, Department of Homeland Security, and White House Office of Pandemic Preparedness and Response Policy to determine how potential shortages can impact national security and broader public health.9

Conclusion

Risk tends to exist at all levels of a supply chain in virtually every sector. Everything from the availability of raw materials to transportation can have an impact. Some risks might lie four or five tiers deep in the supply chain. As pharmaceutical companies continue along their supply chain digitalization journey, it will likely be important to establish effective and comprehensive extended risk management capabilities. Gaining insights and visibility into the risk profile of suppliers and sub-suppliers could be paramount to understanding the complexity of extended supply chains and effectively managing them.

Focus on supplier diversification has amplified the monitoring of other risk by biopharma companies

Source: Deloitte US 2023 Biopharma Supply Chain Digitalization Survey

Endnotes:

1 How are pharma supply chains reacting to COVID-19?, Fierce Pharma, March 16, 2020

2 Strengthening and transforming the pharmaceutical supply chain, European Pharmaceutical Review, July 21, 2023

3 Post-COVID supply chains: Lockdown lessons learned, July 25, 2023

4 Did COVID-19 kill just-in-time pharma supply chains?, Redica Systems, April 9, 2020

5 JIT Just-in-Time manufacturing, University of Cambridge, Management Technology Policy, 2018

6 Strengthening and transforming the pharmaceutical supply chain, European Pharmaceutical Review, July 21, 2023

7 Post-COVID supply chains: Lockdown lessons learned, July 25, 2023

8 The Health and National Security Risks of Drug Shortages, U.S. Department of Homeland Security, March 22, 2022

9 Ernst, Peters fight to secure medical supply chain, Senator Joni Ernst (R-Iowa), Press Release, June 15, 2023

Latest news from @DeloitteHealth

This publication contains general information only and Deloitte is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This publication is not a substitute for such professional advice or services, nor should it be used as a basis for any decision or action that may affect your business. Before making any decision or taking any action that may affect your business, you should consult a qualified professional advisor.

Deloitte shall not be responsible for any loss sustained by any person who relies on this publication.

Return to the Health Forward home page to discover more insights from our leaders.