- Autonomous robots and collaborative cobots. Implementing autonomous robots can drive value by reducing direct and indirect operating costs and increasing revenue potential. They can lower labor costs and increase productivity by working around the clock.8 Likewise, cobots work alongside human workers, augmenting their performance. Their movements are easily programmable, which enables them to perform specific, limited tasks such as sorting packages. In material transportation environments, cobots can zip past each other, humans, or moving objects in a warehouse or on a factory floor thanks to advanced collision avoidance capabilities.9

- Aerial drones. Companies can use unmanned drones for a variety of tasks, from providing inbound logistics in time-critical situations to carrying materials from storage to factory and transporting directly from receiving to shipping. Drones can also scan inventory efficiently and reduce labor costs.10

- Computer vision. Cameras are rapidly becoming ubiquitous and connected. Supply chain operators are placing them, in tandem with AI, throughout warehouses and freight yards to count stock. Companies are also using these computer-vision technologies on factory floors and in offices to monitor social distancing among employees, validate safety protocols, and help maintain procedural compliance. More advanced computer vision capabilities make it possible to visualize temperature radiation, detect subtle movements imperceptible to the human eye, and “ultra-zoom” in on individual parts of a complex whole.

Loading...

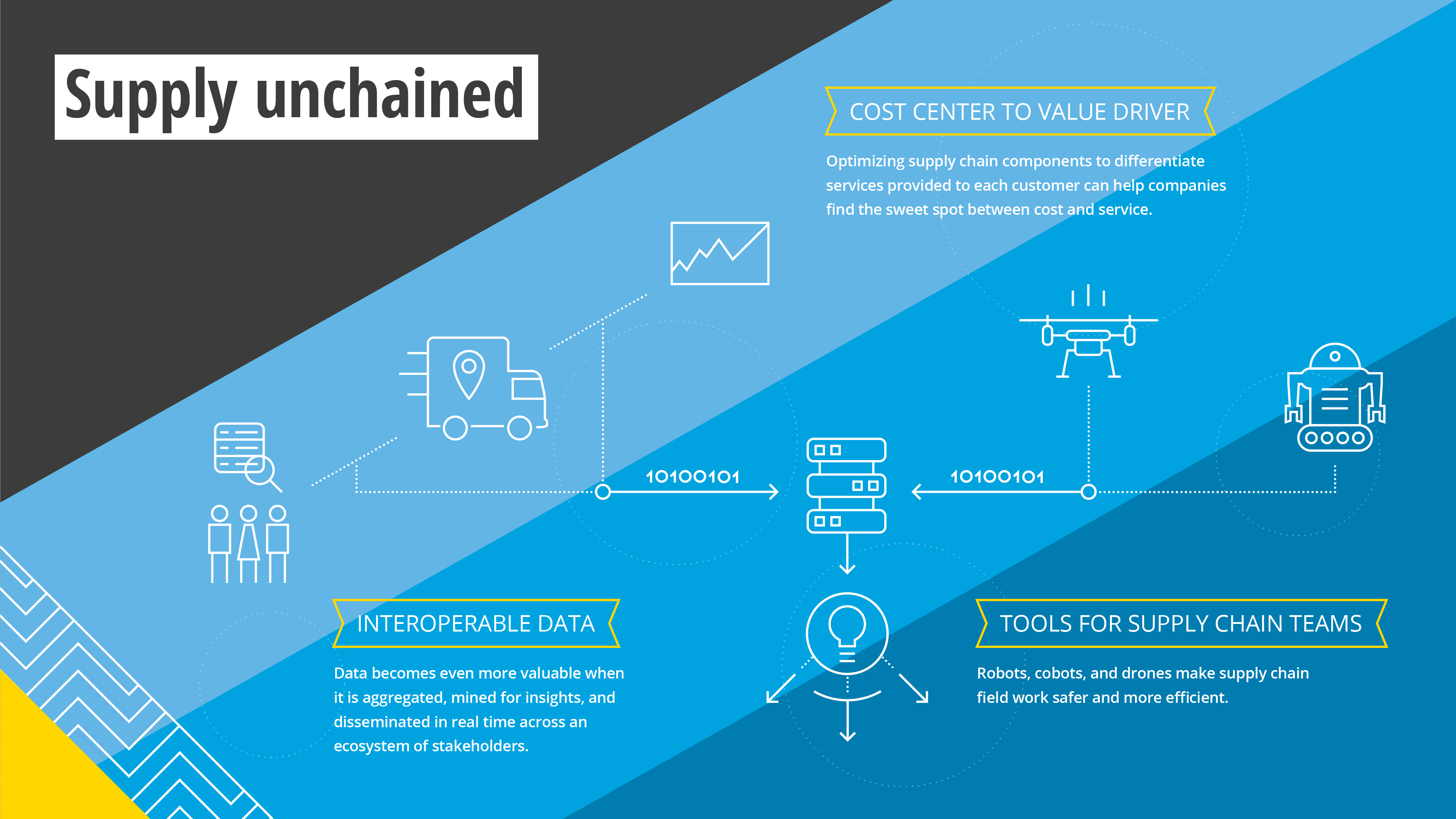

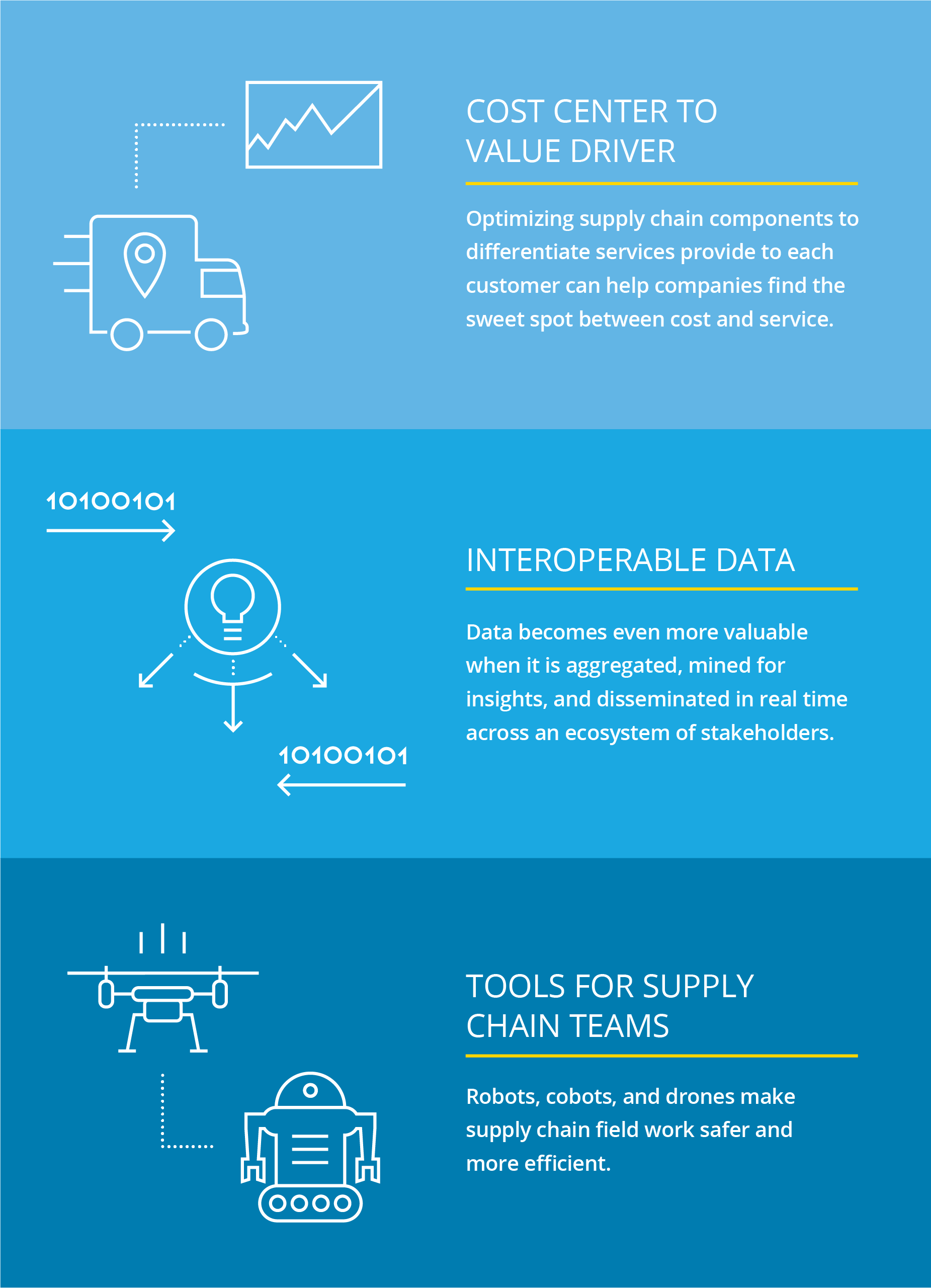

traditional cost center

into a value driver

traditional cost center

into a value driver

- Trend participants can deploy an array of digital tools to hypersegment customers and capture demand signals from disparate parts of their value chains. They can then use this information to make supply chains more responsive to unique customer needs and to fluctuations in demand.

- They can explore ways to capture larger volumes of structured and unstructured data. By mining this data for operational insights, they can continuously optimize systems and processes throughout the organization. And by sharing the data more widely, they can look to optimize their entire supply ecosystem.

- Organizations may also pursue opportunities to use robots, drones, and other technologies to make supply chain teams more effective, efficient, productive, and safe.

Is your supply chain ready?

- Leverage IT/OT convergence. The same smart factory applications and Industrial Internet of Things (IIoT) sensor technologies that marry IT networking with operational technology software and machines on the factory floor are finding new applications in smart warehouses, logistics, and sourcing. Aggregating real-time operational data from these and other supply chain functions into a commonly shared data platform enhances end-to-end transparency, live metrics that support human and machine-based decision-making, and operational efficiency.6 In addition to IIoT sensors, visual, acoustic, and temperature monitoring tools can generate unstructured and nontraditional data streams that, once digitized and analyzed, can help maintenance teams identify anomalies and perform predictive maintenance.

- Boost data capabilities at the edge. In the arena of data management, time is money. Time-sensitive data can become essentially valueless after it is generated, often within milliseconds. Therefore, the speed at which organizations can convert data into insights and then into action across their supply chains is often mission critical.7 Edge computing can turbocharge this process by moving processing and storage capacity closer to the source of data. In this distributed architecture model, data does not have to go to the core or cloud for processing, analysis, and dissemination. For example, digital data generated at the point of manufacture or sale can be analyzed in the moment, its insights then disseminated in real time from the edge directly to disparate pockets within the supply chain ecosystem that may not have their own analytics and compute capabilities.

Lessons from the front lines

Read insights from thought leaders and success stories from leading organizations.

Pactiv Evergreen gets proactive with factory asset intelligence

The factory floor is a critical component in a supply chain’s overall flow from materials to finished products.Pactiv Evergreen gets proactive with factory asset intelligence

The factory floor is a critical component in a supply chain’s overall flow from materials to finished products. Within this controlled environment, manufacturers not only create value but, to a degree, set the pace at which other supply network components

such as sourcing and distribution operate. When factory machines malfunction, the impact can ripple across the entire supply chain, which is why a growing number of companies deploy an array of digital technologies

on factory floors to generate the data they need to better understand machine efficiency and create a continuous machine optimization cycle.

Case in

point: Pactiv Evergreen, one of the world’s largest producers of food and beverage plastic, paper, and foam containers, wanted to explore opportunities to use digital capabilities including IoT, visualization

tools, and advanced analytics to increase overall equipment effectiveness (OEE) to drive increased revenues without a significant investment in additional factory equipment. Leaders also wanted to reduce

operating costs by making the company’s existing industrial assets more efficient.

The company embarked on a factory asset intelligence program to merge the physical and digital worlds by investing

in IoT technology, artificial intelligence, and advanced analytics to drive both asset and people performance improvements.

First, Pactiv Evergreen had to “light up” the dark data that already existed

within plant assets and ingest it into a platform for both real-time and historical analyses. Because much of the equipment used within the processes was decades old, none of the machines communicated with

one another or with operations personnel beyond the control panels. Project teams defined high-value use cases and then added secondary sensors across production lines to monitor and predict material flow

issues from the silos to the hopper train cars, as well as specific asset health including vibration, temperature, and amperage. The teams also harvested data from other sources—including downtime, quality,

and production—that, upon analysis, provided a holistic view of plant activity.

Pactiv Evergreen wanted to transition from reactive maintenance to condition-based monitoring, as a precursor to building

up sufficient data history to become predictive. By utilizing edge processing technologies to capture critical data points such as vibration, temperature, and pressure, leaders were able to predict downtime

and failures based on anomalies in real time. This information fed a library of proprietary condition-based monitoring applications, which were customized for different user groups. These apps pushed actionable

insights to the right people, who could then address potential problems before production disruptions occurred.

As part of the initial plant deployment, project teams also experimented with signal

analysis and video analytics to understand asset health throughout the production process. For example, the grinder is the most unintelligent asset on the production line, but if it goes down, the entire

production line goes down. Using acoustic signal analysis, Pactiv Evergreen developed an algorithm based on machine learning that would predict grinder blade wear and alert maintenance to replace the blades

during the next changeover, thus preventing unplanned downtime.

Finally, Pactiv Evergreen developed a factory control tower to allow plant leadership to monitor line asset performance as well as the OEE for each line and the entire plant. The control tower also

provides insights on raw material consumption (blend insights) to control quality and material usage variances, machine and human performance insights (activity insights), and overall production health (production

insights).

Pactiv Evergreen’s factory asset intelligence initiative has transformed the company’s entire approach to operational monitoring and maintenance, resulting in a 9% boost in OEE and a positive impact

on the bottom line. “The results so far have been excellent,” says CFO Mike Ragen. “We have seen a lift of about 19% in output, and that that equates on one line to about US$2 million of profitability. Extrapolating

that across the 18 lines, we should see a US$36 million lift.”11

Lessons from the front lines

Read insights from thought leaders and success stories from leading organizations.

Pactiv Evergreen gets proactive with factory asset intelligence

The factory floor is a critical component in a supply chain’s overall flow from materials to finished products.Pactiv Evergreen gets proactive with factory asset intelligence

The factory floor is a critical component in a supply chain’s overall flow from materials to finished products. Within this controlled environment, manufacturers not only create value but, to a degree, set the pace at which other supply network components

such as sourcing and distribution operate. When factory machines malfunction, the impact can ripple across the entire supply chain, which is why a growing number of companies deploy an array of digital technologies

on factory floors to generate the data they need to better understand machine efficiency and create a continuous machine optimization cycle.

Case in

point: Pactiv Evergreen, one of the world’s largest producers of food and beverage plastic, paper, and foam containers, wanted to explore opportunities to use digital capabilities including IoT, visualization

tools, and advanced analytics to increase overall equipment effectiveness (OEE) to drive increased revenues without a significant investment in additional factory equipment. Leaders also wanted to reduce

operating costs by making the company’s existing industrial assets more efficient.

The company embarked on a factory asset intelligence program to merge the physical and digital worlds by investing

in IoT technology, artificial intelligence, and advanced analytics to drive both asset and people performance improvements.

First, Pactiv Evergreen had to “light up” the dark data that already existed

within plant assets and ingest it into a platform for both real-time and historical analyses. Because much of the equipment used within the processes was decades old, none of the machines communicated with

one another or with operations personnel beyond the control panels. Project teams defined high-value use cases and then added secondary sensors across production lines to monitor and predict material flow

issues from the silos to the hopper train cars, as well as specific asset health including vibration, temperature, and amperage. The teams also harvested data from other sources—including downtime, quality,

and production—that, upon analysis, provided a holistic view of plant activity.

Pactiv Evergreen wanted to transition from reactive maintenance to condition-based monitoring, as a precursor to building

up sufficient data history to become predictive. By utilizing edge processing technologies to capture critical data points such as vibration, temperature, and pressure, leaders were able to predict downtime

and failures based on anomalies in real time. This information fed a library of proprietary condition-based monitoring applications, which were customized for different user groups. These apps pushed actionable

insights to the right people, who could then address potential problems before production disruptions occurred.

As part of the initial plant deployment, project teams also experimented with signal

analysis and video analytics to understand asset health throughout the production process. For example, the grinder is the most unintelligent asset on the production line, but if it goes down, the entire

production line goes down. Using acoustic signal analysis, Pactiv Evergreen developed an algorithm based on machine learning that would predict grinder blade wear and alert maintenance to replace the blades

during the next changeover, thus preventing unplanned downtime.

Finally, Pactiv Evergreen developed a factory control tower to allow plant leadership to monitor line asset performance as well as the OEE for each line and the entire plant. The control tower also

provides insights on raw material consumption (blend insights) to control quality and material usage variances, machine and human performance insights (activity insights), and overall production health (production

insights).

Pactiv Evergreen’s factory asset intelligence initiative has transformed the company’s entire approach to operational monitoring and maintenance, resulting in a 9% boost in OEE and a positive impact

on the bottom line. “The results so far have been excellent,” says CFO Mike Ragen. “We have seen a lift of about 19% in output, and that that equates on one line to about US$2 million of profitability. Extrapolating

that across the 18 lines, we should see a US$36 million lift.”11

Learn more

Download the trend to explore more insights, including the “Executive perspectives” where we illuminate the strategy, finance, and risk implications of each trend, and find thought-provoking “Are you ready?” questions to navigate the future boldly. And check out these links for related content on this trend:

- Supply chain collection: Explore the latest insights on disruptive changes in supply chain, and learn how your organization can respond.

- From one to many: Learn how to drive efficiencies by scaling smart factory manufacturing systems and responding to supply chain stress.

- Industry 4.0 collection: Delve into the research on how advanced manufacturing and IoT are connecting physical and digital.

Next Trend:

Senior contributors

Jennifer Brown, Rafael Calderon, Ramsey Hajj, Jim Kilpatrick, Bill Lam, Sarah Noble, Diogo Carneiro, and Paulo Souza

Endnotes