News

Hong Kong Tax Newsflash

Hong Kong removed from EU watchlist on tax cooperation

Published date: 21 February 2024

On 20 February 2024, the European Union (EU) announced updates to the list of non-cooperative tax jurisdictions and removed Hong Kong from the EU watchlist1 on tax cooperation.

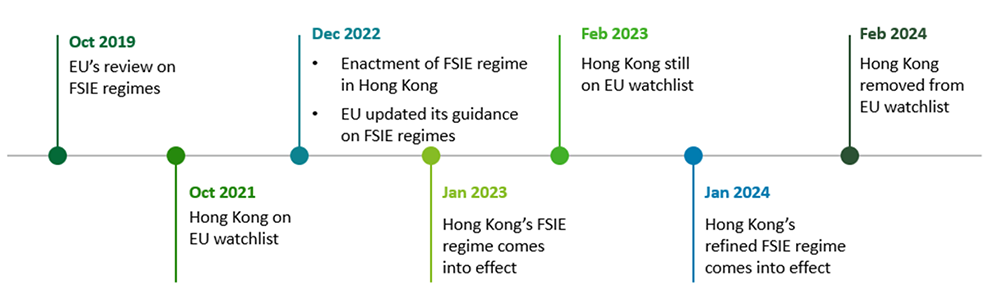

The Journey

The EU included Hong Kong in its watchlist of non-cooperative tax jurisdictions2 on 5 October 2021 as a result of the foreign-sourced income exemption (FSIE) regime review. In order to address the EU’s concern, Hong Kong enacted the legislation for a new FSIE regime3 in December 2022 and implemented it on 1 January 2023.

Coincidently in December 2022, the EU updated its guidance on FSIE regimes requiring all types of passive income (including dividends, interest, royalties4 and capital gains) to be subject to the economic substance requirement. As the scope of foreign-sourced disposal gain under Hong Kong’s FSIE regime covered only disposal gains on equity interests (which is not sufficiently wide), Hong Kong was still on the EU’s watchlist5 when it was updated on 14 February 2023.

In this regard, Hong Kong further refined the FSIE regime by expanding the scope of foreign-sourced disposal gains to cover all types of assets. The refined FSIE regime6 has come into effect on 1 January 2024. Upon review, EU considered that Hong Kong has fulfilled its commitment by amending the tax regime and moved it from the watchlist to the “white” list on 20 February 2024.

Our comments

Following Hong Kong's continued efforts, we are pleased to see that Hong Kong has been removed from the EU watchlist. As an international business and trade centre, Hong Kong has demonstrated its commitment to comply with international tax standards.

1 https://www.consilium.europa.eu/en/policies/eu-list-of-non-cooperative-jurisdictions/

2 Please refer to our Hong Kong Tax Newsflash Issue 145.

3 Please refer to our Hong Kong Tax Analysis Issue H110/2022 and Hong Kong Tax Newsflash (Issue 155, Issue 163, Issue 165 and Issue 168).

4 For royalties from intellectual property (IP) rights, nexus approach for IP regimes would apply.

5 Please refer to our Hong Kong Tax Newsflash Issue 174.

6 Please refer to our summary diagram and Hong Kong Tax Newsflash (Issue 177, Issue 192, Issue 195 and Issue 200).

Tax Newsflash is published for the clients and professionals of Deloitte Touche Tohmatsu. The contents are of a general nature only. Readers are advised to consult their tax advisors before acting on any information contained in this newsletter.

If you have any questions, please contact our professionals:

Authors |

|

Doris Chik Kiwi Fung |

Carmen Cheung |

Global Business Tax Services |

|

National Leader |

Hong Kong |

International and M&A Tax |

|

National Leader |

Hong Kong |

Recommendations

Hong Kong Tax Newsflash

Newly published advance ruling and updated guidance on single family office tax concession

Hong Kong Tax Newsflash

Passage of stamp duty adjustments for residential properties