The future of work in oil, gas and chemicals

Opportunity in the time of change

The oil & gas industry is in a “great compression” where companies’ room to maneuver is restricted. Transformation and people will define the future of work.

Employment cyclicality plaguing the industry

THE US crude oil, natural gas, and chemicals (OG&C) industry employs close to 1.5 million people and hires a global cadre of engineers and scientists to unlock the earth's energy reserves.1 It was on the strength of this cadre that US energy companies were able to shift the discussion from energy scarcity to energy security. This talent tapped into new offshore and unconventional reservoirs, developed an integrated transportation network, and fueled the downstream renaissance in the United States. OG&C companies, in return, rewarded them handsomely via large paychecks and lucrative offshore jobs, thanks to high oil prices and margins.

Then came the shale boom a decade ago and the industry ramped up its hiring. But problems started appearing in 2014 when the boom triggered a collapse in oil prices to US$50/bbl, and the talent narrative shifted to mass layoffs.2 From July 2014 to June 2016, the industry laid off 200,000 people (figure 1).3 Additionally, the short-cycled nature of shales made hiring extremely cyclical. During 2014–2019, the sensitivity of OG&C employment to oil prices was at its highest, especially in upstream and oilfield services (OFS) sectors (see sidebar, “About 70% of jobs lost in 2020 may not come back by the end of 2021 in a business-as-usual scenario”).

The employment situation took a turn for the worse due to COVID-led slowdown of the economy and the resulting oil price crash, leading to the fastest layoffs in the industry—about 107,000 workers were laid off between March and August 2020, apart from widespread furloughs and pay cuts.4 Even the relatively stable sectors, such as refining and chemicals, reported up to 35,000 layoffs combined.5 Such large-scale layoffs, coupled with the heightening cyclicality in employment, are challenging the industry’s reputation as a reliable employer.

Although attracting new talent may not be an immediate priority—and understandably so given the slowdown in production and the pressure to reduce costs—retaining top employees and tackling the challenge of an aging workforce (median age of above 44 years) are of utmost concern for the industry.6 Existing OG&C employees having fungible digital skills are at the risk of migrating to other industries (e.g., technology and consulting firms, digital solution providers, etc.) where the prospects of career growth seem to be brighter.7

Employment cyclicality and downturn are also having a knock-on effect on a few fast-growing specialty chemicals businesses that compete with relatively stable businesses (such as pharmaceuticals) in sourcing talent in the growing material informatics and advanced materials sciences space. So, what does all of this mean for the future of the OG&C industry? Some might argue that this is what cyclicality looks like, and the industry and employment will both pick up as oil prices recover. We, however, take a different view.

This downturn is truly like no other … and a big opportunity for repositioning

The OG&C industry is in a “great compression” where companies’ room to maneuver is restricted by multidecade-long low prices, unforeseen demand destruction, and changes in end-use consumption due to mass telecommuting, mounting debt loads, and a renewed focus on health from COVID-19.8 The gravity of this compression is reflected in the shrinking valuation of the energy sector, which is now the second-smallest segment in the S&P 500, with a share of only 2.5% as of August 31, 2020.9

Our multivariate statistical analysis on employment and market data suggests that as much as 70% of jobs lost during the pandemic may not come back by the end of 2021 in a consensus business-as-usual scenario.

—Deloitte analysis

The compression is challenging the three deeply connected dimensions of an OG&C organization-the hydrocarbon business model itself (the work), who does the work (workforce), and where the work is done (the workplace)—making this downturn like no other. The cost of waiting the downturn out or playing for cyclical upswings in oil prices could be very high for the industry. In a business-as-usual scenario of oil prices staying at around US$45/bbl, as much as 70% of jobs lost by the industry in the pandemic may not come back by the end of 2021 (see sidebar, “About 70% of jobs lost in 2020 may not come back by end-2021 in a business-as-usual scenario”). How are the work, workforce, and workplace undergoing a change in the industry?

About 70% of jobs lost in 2020 may not come back by the end of 2021 in a business-as-usual scenario

The sensitivity of OG&C employment to changes in crude oil prices has risen significantly since 2014 due to the short-cycled investment and production profile of shales. A monthly correlation of oil prices and employment, for example, reveals that a dollar movement in oil prices affected 3,000 exploration and production and OFS jobs vs. 1,500 in the 1990s (figure 2). During 2002–2007, the sensitivity was high, but it was positive for employment as oil prices rallied one way from US$30/bbl to US$100/bbl.

Worryingly, the rate of recovery in employment will likely be slower over the next 15–18 months. In a linear business-as-usual scenario for 2021, where oil and natural gas prices are projected to recover to US$45/bbl and US$2.5/MMBtu, respectively, along with the associated uptick in industry fundamentals, 70% of OG&C jobs lost during the pandemic (107,000) may not come back by the end of 2021 (figure 3). The rate of recovery will likely be higher in the chemicals business but still below 100% as the pandemic has significantly dented consumers’ buying behavior. In a pessimistic scenario of US$35/bbl and US$2/MMBtu, the rate of recovery in jobs would be only 3%.

Work: COVID-19 is challenging the way work is done in the industry, including tracking of new manufacturing tasks and regulations (such as Occupational Safety and Health Administration recordables, bloodborne pathogen training, and new personal protective equipment requirements) and moving of roles, schedules, inspections, and practices from human-operated fields to digitally powered remote operations centers. A bigger question mark, however, is on the industry’s core hydrocarbon work itself. COVID-19 has abruptly fast-forwarded the specter of peak oil demand, degraded the investment climate and investors’ appetite for fossil fuels, and reminded organizations to take the energy transition seriously.10

The pandemic has also set forth new constraints in the operating work models of midstream, refining, and chemical companies. The wave of production shut-ins and rising bankruptcies of shale operators is prompting producers to exit pipeline contracts and avoid minimum volumetric commitments, leaving a large debt-funded asset base of midstream companies underutilized. Similarly, a steep fall in the US shale production has significantly reduced the feedstock advantage of US refining and chemical companies. This is hampering their expansion of secondary processing units and the retail portfolio and making them highly vulnerable to large upcoming capacity in the Middle East and Asia-Pacific.

Workforce: The pandemic has had a significant effect on people’s lives and livelihoods. According to a workforce survey by the University of Houston, about 53% of oil and gas workers highlighted job security as a concern.11 With more than 107,000 layoffs in 2020 YTD, such concerns are only natural.12 With COVID-19 renewing the emphasis on health and well-being, the flow of new talent that have an affinity for safe and flexible working conditions can drop to a trickle.

Additionally, limited career mobility for specialized roles, such as petroleum geologist and on-site requirements for a few specialized operators and technicians, put the OG&C workforce at a disadvantage, especially in the current economy that is embracing remote working. This poses a fundamental question: How can the industry avoid a talent gap and stop an organizational challenge from becoming a precarious business problem?

Workplace: As for workplace safety, OG&C has some ground to cover—its fatality rate is seven times greater than other industries, even though it has been focusing on workplace health and safety.13 While OG&C companies remain focused on making their operations safer and healthier, the pandemic has forced them to reduce their on-site staffing altogether and move the staff to safer locations, including home. With a majority of workforce off-field, mitigating risks (including regulatory compliance and cyber) and ensuring continuity of key tasks become challenging.14 One of the critical areas, for example, is regular inspection and maintenance of wells and plants, which typically require personnel and technicians on the site.

Similarly, operating from a 15.6-inch laptop with a less secure 100 Mbps connection at home isn’t easy for geoscientists who are used to analyzing petabytes of data on multiple big screens in a control room. So, is the industry ready to provide a secure remote working environment and open to flexible workplace and timing? An analysis of yearly job postings by OG&C companies reveals that less than 1% OG&C employers offered a flexible workplace arrangement before the pandemic.15 So how does reality conform to the expectation? The new trend of home-based workers shouldn’t be seen as transitory—as it impacts behavior and may become an expectation in the post-COVID-19 world.

The new trend of home-based workers shouldn’t be seen as transitory.

Are there any bright spots then? There are, in fact, four bright spots in particular—we call them levers of transformation for the industry and its workforce. Disruption and technology have a record of creating jobs, not destroying them; along the way, they transform the entire way of working for an organization. Companies and employees that look at the crisis through the lens of innovation and technology will likely be better prepared than others to take on new opportunities.

The four levers of transformation

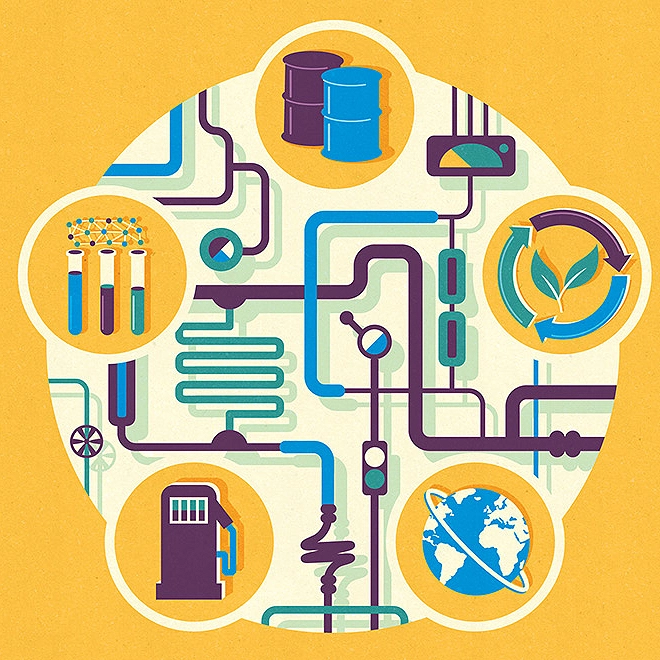

Today’s changed environment has given OG&C organizations the much-needed “why not” to transform themselves and find new ways to reclaim their earlier appeal. How? The four levers of transformation—energy transition, integrated human-machine collaboration, recoded careers, and organizational agility—could push OG&C organizations into the future (figure 4). They may seem a heavy lift at the start, as all initiatives to change an organization or its culture seem initially. Once the management engages with the transformation and empowers its employees to drive and shape the transformation, the pathway to transformation likely becomes embraced by the vast majority of employees.

Lever 1: Sustainability as a way of business (the new core “work”)

Combustion of fuels by the transportation sector (Scope 3 emissions) produces about 80% of full-cycle greenhouse gas (GHG) emissions for the OG&C industry.16 With unprecedented restrictions on travel, transportation-driven fuel demand fell 30% and global GHG emissions 17% in the first half of 2020.17 Now the big question is: Should the industry find comfort in these reduced emissions—and reduced pressure to invest in green businesses—or should it see the drop as a wake-up call to decarbonize their hydrocarbon “work” as the pandemic shines a light on the health and well-being of society. Our research suggests the latter and strongly so.

The consequences of the pandemic have reinforced the call for long-term decarbonization and a solid energy transition. OG&C strategists will need to take this into consideration.18 The current instability and volatility in oil and oil-based feedstocks, in fact, have already made the OG&C industry less attractive to some investors—the return on invested capital of oil and gas companies (6-8%, but highly variable) is largely on a par with that of top renewable companies.19 Put simply, the green energy business is now at a level playing field with the traditional OG&C model. And on average, the weighted average cost of capital of 8-10% for an oil and gas company is twice that of top renewable companies.20 With only 1-2% of oil and gas capex spent on new green energy projects, there is nearly unlimited scope for companies to transform their traditional hydrocarbon model.21 A few large companies have formalized and announced their net-zero carbon emission goal by 2050—in fact, BP plans to be a “different kind of energy company” by 2030 with an aim to reduce its oil and gas production by over 40% and increase its low-carbon investment tenfold.22 Considering the diverse reporting and strategies, a structured energy transition pathway—from adhering to the first steps (foundational health, safety, and environmental requirements) to laying building blocks (advanced electrification, emissions, and efficiency measures) to developing new blueprints (portfolio of low-carbon fuel mix, energy sources, green and service-oriented businesses like carbon capture) to finally winning the future (a license to operate and lead in a clean-energy economy, and influence net-zero paths of consumers)—can help OG&C companies plan their journey well (figure 5).

The green energy business is now at a level playing field with the traditional OG&C model.

Indeed, the transition won’t be easy, given that many OG&C companies are fighting for survival currently. For the transition to gain strength and support, it is thus important for OG&C executives to also highlight the transition’s crucial role in addressing three immediate challenges of the industry:

- Bolstering trust of employees and investors

- Bringing stability to margins and finding new ways to reduce costs

- Finding new avenues of scalable and sustainable growth

According to a Morgan Stanley survey, 85% of individual investors are interested in sustainable investing and as many as 95% of millennials polled in the survey expressed interest in investing in sustainable companies.23 Majors like Shell are, in fact, linking their credit facilities with their emissions-reduction targets, and they are reducing their cost of capital as well.24

While the industry has always prioritized the health and safety of its workers, now companies are focusing on other expectations as well, including improved land and water management. The building blocks of the pathway—electrification, energy efficiency, and emissions reduction—however, remain an ongoing focus area for companies across the OG&C value chain. Although most companies have electrified their operations and continue to advance energy efficiency, reducing leaks and routine flaring are still a big unfinished task for many, especially those in upstream and midstream sub-sectors. The prize is big. Even basic methane abatement measures, such as leak detection and repair, and device replacement, could bring net savings of US$2 ̶ 4/MMBtu.25 The other happy byproduct is more interest from investors (especially from environmental, social, and governance funds) and employees.

Even basic methane abatement measures could bring net savings of US$2 ̶ 4/MMBtu.

Creating a new blueprint with a portfolio of low-carbon products and services is the need of the hour as it can provide much-needed stability to the existing business. Although integrated oil companies (primarily European) have started taking the lead in investing in renewables or making natural gas a transition fuel, a sizable opportunity lies in centralizing emission sources and deploying carbon capture, utilization, and storage solutions. TOTAL, for example, is allocating 10% of its research and development budget to carbon capture, utilization, and storage (commonly called CCUS) technologies to capture 5 million tons of carbon dioxide by 2030, which it probably aims to offer as a service to its customers.26 OG&C companies that progress well toward this milestone may see market-share gains in the next decade.

The final milestone of winning the future (creating and leading the clean-energy system) is reducing emissions at end-use sectors and influencing paths to net-zero of the broader community. From converting refineries to manufacture renewable fuels, like bio-gasoline, to driving the adoption of hydrogen fuel cells in transportation or commercializing waste management and recycling, the opportunities are substantial for OG&C companies. Marathon Petroleum Corporation, for example, plans to convert its 166,000 bpd Martinez, California, refinery near San Francisco into a terminal facility and may add a renewable diesel plant to align with California’s Low Carbon Fuel Standards objectives.27 BASF is going one step further as it plans to share total GHG generated for each of its 45,000 products (product carbon footprints) with its customers by 2021 so as to help them achieve their climate targets and influence their buying behaviors.28 A net-zero pathway, with tangible medium-term targets, is essential for the industry’s current and future workforce to gain the social and economic license to work in this industry.

Lever 2: Digitalization transforming work

Advanced digital solutions including data analytics, cloud computing, robotics, automation, predictive maintenance, and machine learning have played a key role in bringing higher efficiency and productivity to the traditionally complex operations of the industry. However, many companies still struggle to ascertain a starting point for their digital transformation or how to break away from their old digital culture of “this is how we work.” In fact, many even find it difficult to select a technology from myriad available technologies and quantify the return on investment of their digital efforts.

While the COVID-19 pandemic has brought a greater urgency in accelerating OG&C companies’ digitization efforts to unlock new operational gains, it has given a new mandate-cum-challenge to put people at the core and prioritize their health and safety. Given that capital is the most constrained resource today, how should an OG&C company plan its digital transformation with this new mandate?

The power of digital transformation lies in a structured road map that extends structural changes from an individual asset level to the entire organization and creates a platform for innovation and collaboration. The human-machine collaboration model is one such road map—a journey of 10 milestones, where the leap from one stage to another marks the accomplishment of a specific business objective puts operations and now people at the center stage of this road map (figure 6).

The journey begins with mechanizing operations using hydraulic, pneumatic, or electric control systems and progresses from the physical to the digital realm by sensorizing equipment and transmitting data to a unified network. By doing this, companies can maintain integrity of their assets and gain visibility on their assets’ operating conditions. Although sectors such as petroleum refining and chemicals have established and intelligent process controls, a lot has yet to be digitized in geographically dispersed sectors like mid-stream.

The next leg of the journey brings together the data from on-field physical assets to off-field remote centers for real-time surveillance and optimization. By analyzing and augmenting the data using advanced-analytics libraries and machine learning, companies can detect anomalies, intimate predictive maintenance alerts, overcome new challenges in inspection and maintenance activities, and reengineer the interplay of offshore and onshore teams. National Oilwell Varco, for example, is using augmented reality to connect their in-field technicians wearing smart headsets with offsite experts via video/audio streaming, allowing the latter to view events as they are happening and address them in real time in today’s remote-working environment.29

Though virtual and remote projects were being implemented well before 2020, the pandemic has accelerated the urgency to mitigate health, safety, and environment exposure for both off- and on-field employees without disrupting operations. Employing cloud platforms to help experts working from home analyze and visualize operations, leveraging edge analytics to analyze the data at the place of data creation itself, and providing augmented wearables for the onsite workforce have become the bare minimums now, and will likely become a permanent fixture in the postpandemic world. Woodside Energy, in collaboration with an oilfield service major, is leveraging a cloud platform to provide real-time field data to its specialists working remotely.30 In fact, major oilfield service companies have observed a surge in remote-work technologies, including cloud analytics, since March. Completing the “remote” loop would mean an enterprisewide integration of workflows with enhanced cloud computing for tailored analytics and secured next-generation user and data security experience.

The final stage requires remote to cognitive transformation, which starts from educating the workforce through digital learning, training supply chain partners, and experimenting with an agile scrum team model. In BP’s “Shared VR” experience at its chemical plant in the United Kingdom, a virtual 3D chemical plant simulator projects images of any point within the factory in a 360-degree dome, allowing field technicians to practice safety-critical tasks.31 Similarly, ExxonMobil’s 3D immersive training platform mimics real-life scenarios, including unplanned shutdowns, abnormal operations, and emergency responses, in a safe environment.32

The last leg of journey involves bolstering the cognitive journey through streamlined remote operating centers run by a distributed workforce and, finally, virtualizing the entire business model through technology-enabled, human-driven decision-making using the technology-as-a-service model. By putting people at the center, and, most importantly, having a strong and conducive culture for digital execution, this new digital road map could open up new avenues of value creation and further burnish the industry’s reputation for engineering change.

Lever 3: Recoded careers to build workforce of the future

The great compression and COVID-19 have created a dichotomy for the industry: Big layoffs amid the great crew change. The main challenges aren’t complying with socialdistancing norms or working remotely, as people in the OG&C industry are used to following safety guidelines and have been operating from remote locations for years. The root cause of the talent challenge is still the “work” and many OG&C companies are yet to make the “workforce” a core business issue.

Over the past five years, for example, there has been no major change in the hiring strategy or job postings of OG&C companies (figure 7). Job postings are dishearteningly similar irrespective of the location or the skill set. About 90% of job postings are still for traditional energy cities, with less than 4% in nonconventional locations like Silicon Valley.33 Similarly, less than 15% of postings in 2019 had mathematical or data analytics as the primary skill.34

Although there is a minor trend toward hiring more graduates, the drop in the demand for specialists is a worrying sign as retirements cause accumulative loss of knowledge. Attaining the right balance between new and tenured workforce was never more challenging than today. So, can the OG&C industry attract more people across generations to want to work there again? Renewing the focus on the workforce lies at the very center of the talent puzzle, and the time has perhaps come to revisit the traditional talent life cycle.

Renewing the focus on the workforce lies at the very center of the talent puzzle, and the time has perhaps come to revisit the traditional talent life cycle.

The industry needs to initiate change right from a prehiring stage as its employment cyclicity and rising environmental concerns may be deterring millennials. In fact, the total number of US university graduates for technical courses like petroleum and geological engineering courses dropped by 15 ̶ 21% from 2015 to 2019.35 Digitalizing operations or announcing net-zero long-term plans could boost interest among new graduates. BASF, for example, is deploying social media campaigns focused on sustainability and digital ways of working for its younger workforce and is inviting women students to its campuses to network with women executives and leaders.36 Companies will need to build a new workforce architecture to attract new talent (figure 8). This includes, but is not restricted to, building career paths for new roles, such as agile coaches, data scientists, emissions officers, or user-experience designers, to attract young talent. These are necessary imperatives to move from an “only fuels-based” to a “solutions-based” business. Until organizations themselves undergo a fundamental change, including building a cohesion culture where employees have a sense of belonging and pride, their talent-acquisition landscape will not change.

The hiring strategy can win by challenging conventional workforce models of rigid work schedules or hiring from typical demographics and making flexibility/remote working a reality. Additionally, viewing "Talent-as-a-Service” by crowd-sourcing jobs, adding a more distributed workforce to the mix, or shared workforce models with value-chain partners could help OG&C organizations lower costs and tackle cyclical hiring requirements.

To avoid, or at least delay, career stagnation among employees, companies should develop the existing workforce. For example, a major transportation and pipeline company in North America recently enabled a “techlab,” where scrum teams of data engineers, data scientists, and technical experts together solved internal and customer problems. And such labs are increasingly becoming the norm.37 They can also transform typical hierarchical structures with cyber-physical collaboration—such reimagined collaborations or Super Teams (humans and intelligent machines working together fruitfully) could give transformative insights and solutions.38

Reimagined collaborations or Super Teams (humans and intelligent machines working together fruitfully) could give transformative insights and solutions.

Progressing into the maturity phase of the career, employees typically battle with excessive specialization or role-based silos, and companies building skill-interoperability would make a smoother transition toward agility. Companies can devise unique programs with a broader objective to grow the existing workforce so that they can add value to future business plans. In fact, Shell has enabled AI-based cross-skilling programs for employees, aiming to train them for futuristic roles in the company’s energy transition journey.39 Besides formal training, companies have been providing diversified exposure to business leaders by moving them to cross-functional roles every few years to enhance their value and competencies.

The final challenge is how to engage and retain a tenured workforce. The tenured crew comprises nearly 50% of the industry’s personnel and most are retiring within the next five to seven years.40 Could the looming brain drain from retiring employees be turned around by building a stronger perennial-millennial pairing or by leveraging the knowledge of the “over-55s”? How can companies leverage older workers to reinforce a strong sense of belonging in the younger generation by initiating experiential programs? Here, establishing unique programs, such as BP’s Reverse Mentoring, can drive discussions, culture change, and even two-way engagement between senior executives and young professionals.41

Unlocking the strength of a transformed workforce could not only bring back the best talent, but also trigger the much-needed change to the existing working models of the industry. Transformative work, well-defined career paths, and agile working models seem to be the only way forward for OG&C organizations to thrive.

Lever 4: Organizational agility for new business models

What helped OG&C companies navigate the last downturn of 2014–2016 and the new normal since then? Operational agility is driven by its four levers (portfolio, assets, processes, and commercial). During this period, the industry captured significant efficiencies—whether it is refining and chemical firms building asset and feedstock flexibility, upstream companies streamlining, midstream companies expanding their shale portfolio, OFS firms exploring new contractual terms to support upstream customers, or the general adoption of operational and digital technologies across the value chain. In fact, the industry’s operating costs were the lowest during the period, falling by 17% to 30%.42

But efficiencies seem to be plateauing with suppliers having limited room to reduce costs further. For example, operating margins of OFS companies in 2019 remained around their 2016 lows of 5%.43 With dwindling gains from the usual performance levers in the near term, it is time for organizations to now challenge their traditional way of functioning, including how they have set up their core and support functions, and how they manage resources and work with partners. Simply put, organizational agility is the way forward. It can be achieved in four steps (figure 9).

Redraft the future ways of working for the entire organization: Instead of developing a piecemeal digital and automation road map for a business unit, organizations need to redraft the operational vision and ascertain the future ways of working for the entire organization. All costs that are not aligned to this vision or future ways of working—facilities, personnel, and administrative costs that don’t enable remote operations or are not in line with customers’ new workflows—should be driven down. An oilfield service major, for example, aims to reduce its costs by US$1.5 billion annually by combining its many product lines into four divisions, structuring its geographic footprint around key basins of activity, and streamlining its management structure.44

“Variabilize” fixed costs of support functions: In general, support functions are the prime cost-cutting targets in a downturn. Considering high fixed technology (hardware including data centers and software licensing) and personnel (about 15–20% of total personnel expense) costs associated with support functions, significant opportunity lies before companies to make these fixed costs highly variable through outsourcing intelligent process automation, and cloud-based technology solutions. Companies, however, have to cut these costs deliberately as about 90% of back-office reductions return to previous levels in 3-4 years.45 The transition of support functions to an “as-a-service” model or moving them to the cloud can bring a structural change in the industry’s annual SG&A costs and mitigate workforce cyclicality.

Explore flexible and scalable resource models: OG&C largely follows a permanent “on-balance sheet” workforce model, which it scales up or down by incurring significant hiring, training, overhead, and separation costs. Given that production of resources or utilization of plants will likely become more variable, could leading OG&C organizations continue with this traditional model? For baseload capacity, probably yes. But for task-based, on-demand, or transactional roles, leading organizations should consider exploiting new and off-balance sheet resource models that lower fixed cost and minimize business disruption.

Move toward open energy platforms: The OG&C industry is often held to ransom by brutal price cycles and painful successions of over- and under-capacity periods. Appallingly, these periods come in the way of the industry’s progressive efforts toward sustainability, operational agility, and workforce improvement. For example, overinvestment in petrochemicals has led to a crash in the prices of virgin polyethylene terephthalate (PET), which is now US$200/tonne lower than recycled PET, squeezing economic opportunities to switch to recycled plastics.46 Similarly, the lack of visibility into demand and the shortage of raw material and even suppliers lead to idling of resources, nonproductive time, disruption in supply chain, and significant project delays.

Industry participants across the value chain could forge an open energy system—a multisided platform of operators, suppliers, and even potential talent that reduces costs and delays in the “ecosystem” through timely hiring, contracting, procurement, scheduling, and management of material and services. Furthermore, the open energy system can be expanded to change customer interactions. Online B2B marketplace platforms such as Knowde, CheMondis, and OneTwoChem are targeting the US$5 trillion chemicals space by providing e-commerce-like web catalogs for buying and selling chemicals and enhancing customer experience by offering samples and providing technical literature on a product.47 The future is wide open for e-commerce platformers to predict supply and demand shifts, integrate with enterprise resource planning platforms of their customers, and reduce delays in shipment and contracting, among others.

Expecting blanket transformation across the industry or even an organization is unwise. But piecemeal transformation and solutions (tweaking the existing processes and throwing in a few cyclical solutions) could yield suboptimal results in the post-COVID-19 environment. Successful organizations of the future will make sustainable energy their core “work,” elevate human-machine interactions, and reimagine their traditional “workforce” model and “workplace” culture. Can this happen? Why not? The industry has transformed itself in the past and it will do it again in the next decade. We take a positive view after hearing the plans of a few organizations in their 2Q20 results.

Turning the layoff tide, skillfully

Like organizations, employees, too, have to do their bit by upskilling themselves for the future. A combination of business transformation and skill development can turn the “business-as-usual” layoff tide and lead to a much higher recovery in the employment rate than 30% (as mentioned in previous sidebar). Which skills can help employees lead the change for their organizations? What can separated employees do to become more employable in the marketplace?

An analysis of recent job postings by OG&C companies reveals that fast-growing occupations need skills that are different from those needed for slow-growing occupations (figure 10). A right mix of the professional, technical, and IT skills and capabilities can re-equip the workforce of today to do the work of tomorrow.

Building the organization of the future

The coming years are pivotal in determining the path of the OG&C industry at large. Naysayers may call the new normal part of the industry’s cyclicality. However, organizations that see the coming decade as an opportunity for transformation will likely not just outlive this compression but may even lead the industry into the future of work. But for that, fundamental changes will be needed across each element of the income statement and balance sheet—from traditional on-balance sheet budgeted expenses to off-balance sheet outsourcing, and even shifting to pay-as-you-go models.

Organizations that see the coming decade as an opportunity for transformation will likely not just outlive this compression but may even lead the industry into the future of work.

The ultimate expectation is to move from a traditional oil, gas, chemical business model to a solution-driven, customer-centric energy company. That mandate must come from the top. The CEO/chairman should bring this vision to the board and ask each member of the executive committee to align their businesses to the new vision and, most importantly, to live the new purpose (figure 11).

Implementing a new strategy would mean extensive changes in the very foundation of the business. While tackling these questions won’t be an easy exercise, it is vital in kick-starting aggressive efforts to bring organizational change from the long-term focus to the “medium term.” And the current environment will only accelerate these efforts.

On the way to transforming the organization, the leaders will have to constantly probe their plans and course correct to deliver added value.

On the way to transforming the organization, the leaders will have to constantly probe their plans and course correct to deliver added value. They have to continually assess hard or even unfavorable business decisions. Such continual self-assessment will go a long way in generating a resilient company. After all, the end goal in tackling these questions is simple: building an OG&C organization of the future by making bold choices today for the work of tomorrow, expanding job canvases of the workforce by creating redesigned, cyber-physical teams, and fungible roles, and embracing a digital workplace culture that remains open to future innovations.48

Oil, Gas and Chemicals

With its breadth of experience working across the value chain, Deloitte’s Oil, Gas & Chemicals (OG&C) practice offers rich insights and services to help its clients evolve their businesses with technology transformations, workforce reorganization, supply chain remodeling, M&A, globalization, the energy transition, and more. Through audit and assurance, tax, consulting, and risk and financial advisory, Deloitte’s OG&C practice offers the expertise companies need to thrive in today’s marketplace.