2023 Fair Valuation Pricing Survey has been saved

Analysis

2023 Fair Valuation Pricing Survey

Answering the bell: Responding to new requirements

The journey towards compliance will always require people who are dedicated to making compliance a reality. With the adoption of Rule 2a-5, interest in valuation polices, practices, and the valuation operating model has never been higher. Learn more in the 21st edition of our Fair Value Pricing Survey.

Rule 2a-5 and the adequacy of resources

Regardless of the specific rule, the journey towards compliance always has one thing in common; it takes people to make compliance a reality. A strong valuation operating model is supported by the collective experiences and judgment of the people who drive the day-to-day activities within it, and Rule 2a-5 recognizes that by requiring valuation designees to annually report to their respective Boards on the adequacy of valuation risk management resources.

It isn’t easy to define how many valuation-focused FTEs that a fund group should have or where they should reside, and given the lack of published data to aid in analysis, it’s even more difficult for Board members to assess the accuracy and adequacy of a valuation designee’s report using only their own instincts, experience, and educated judgment. As noted in Figure 1, 86% of fund groups with less than $10 billion in assets under management (“AUM”) reported that they had less than five valuation-focused FTEs, whereas the majority (70%) of fund groups with greater than $500 billion in assets under management had more than ten valuation-focused FTEs.

Figure 1. Full-time equivalents ("FTEs") based on size of fund group

Formalized Board reporting under Rule 2a-5

In general, Rule 2a-5’s more noticeable impact on Board oversight appears to be regarding reporting. It is both prescriptive and not prescriptive in that it offers flexibility to each Board in determining other reporting necessary to carry out oversight duties. As a result, Boards may be redefining what valuation oversight really means, especially as it relates to their involvement in certain activities and the level of detail they receive. Compared to 10% in 2022, 34% of Fair Value Pricing Survey participants indicated that over the last year, the Board had delegated more responsibilities to management. And on top of that, Boards more commonly are focusing on oversight of the process, while 100% of respondents reported providing their Boards with summarized reporting, often in the form of a dashboard. Additionally, just over half of survey participants noted that certain aspects of Board reporting were changed over the last year, at the request of the Board itself, while 27% of that group indicated there was a change in format or materials utilized for reporting.

Valuation risk management practices evolving under Rule 2a-5

The adopting rule release of Rule 2a-5 suggested that subsequent consequences of the rule could lead to more accurate fair value pricing determinations, and it’s worth noting that appropriate oversight of the fair value pricing process is that fair value determinations will be more likely to reflect a price that could be obtained in arm’s-length transactions with less bias. Whether the goal of achieving the most accurate fair valuations is achievable as a result of Rule 2a-5—or even measurable—is hard to say.

Pushing for enhanced oversight via a focus on risk assessment could potentially intersect with scarcity of information, complexity of calculation, or even a conflict of interest, all of which could compromise the accuracy and integrity of the process. Nothing happens overnight, and 65% of Fair Value Pricing Survey participants indicated that the implementation of Rule 2a-5 required a moderate level of time, expense, and resources to adjust to.

Testing fair value methodologies trends

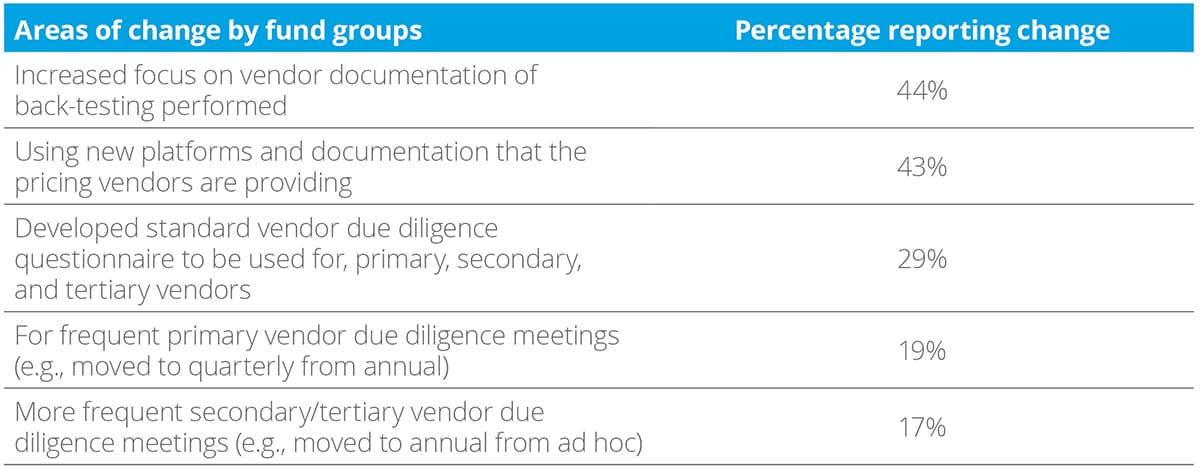

The big story in valuation risk management practices from the FV survey relates to the due diligence process relating to pricing vendors. Due diligence of pricing vendors has certainly changed as a result of Rule 2a-5, as illustrated in Figure 4. In fact, more than half of respondents indicated a reporting change related to focus on vendor documentation of back-testing and the use of new platforms and documentation that pricing vendors are providing.

Figure 4. Areas in which pricing vendor due diligence has changed

Technology investments aimed at strengthening valuation operations

This year’s FV survey once again reveals that fund groups remain zealous about enhancing the valuation operating model through technological advancements: Nearly 70% of survey participants reported that they had begun to use or increased their usage of different forms of technology for valuation purposes. Last year, 65% reported that they had begun to use or increased their usage. Another interesting insight from the survey was that two participants indicated that they are using cognitive automation, natural language processing, machine learning, or artificial intelligence in their valuation operating model. While no FV survey participants had acknowledged successful use of such technology for valuation purposes during the previous five editions of the FV survey, perhaps these and other advanced technology are on the brink disrupting today’s valuation operating models.

Beyond these highlights, the FV survey contained questions on a number of other critical valuation topics including virtual and in-person team arrangements, foreign investments and equities, fixed income and private equity investments, SEC exams, and digital assets and cryptocurrencies.

Looking ahead

30+ years of Fair Value Pricing Surveys have taught us that many fund groups make changes to their valuation risk management policies, procedures, and valuation operating model each year, and 2023 is no different. In the most recent survey, 54% of Fair Value Pricing Survey participants indicated that they changed their valuation policies and procedures subsequent to the adoption of Rule 2a-5.

Benefits stemming from Rule 2a-5 will likely emerge after the first year, when compliance is still in its infancy and teams are still settling in to newly implemented processes. Given that the valuation process is evergreen, any gains will likely come later, which is why it’s important to continue to look for ways to improve upon the valuation operating model.

While the three decades of Fair Value Pricing Surveys have shown constant attention, improvement, time, and governance over valuation policies and procedures, it’s worth keeping an eye on how Rule 2a-5 could dampen the collaborative and innovative relationship between fund groups and the Board. Additionally, the real curiosity is whether there can be any measurable value derived from the Rule. That being said, the benefits may start simply: 15% of Fair Value Pricing Survey participants indicated that there were a few areas in which they were saving time, mainly relating to a reduction of materials being provided to the board, while others reported that technology enhancements have also made a difference.

About the 2023 Fair Valuation survey

We conducted the Fair Value Pricing Survey in summer 2023, and participants representing 104 registered investment company fund groups completed it. Fair Value Pricing Survey participants included small, midsize, and large fund groups. Thirty-one percent of them have more than 100 funds within the fund group, and 29% have less than 15 funds. Approximately 15% of them managed mainly equities, 6% manage mainly fixed-income securities, and the remainder manage a balanced array of strategies. Percentages reported are generally based on the number of survey participants responding to the specific question, unless otherwise noted.

Past Surveys

While each year's survey report highlights significant year-to-year changes, readers can make their own comparisons by reviewing past surveys in full.

Recommendations

Fair value measurements and disclosures

On the Radar: Financial reporting impacts of ASC 820

Advancing social and economic goals with global financial inclusion

Bridging the gap through access and opportunity