Equity & Incentive Plan Services has been saved

Services

Equity & Incentive Plan Services

Global Employer Services

Equity & Incentives plan professionals partnering with you to deliver on your business and talent strategy.

How Deloitte can help

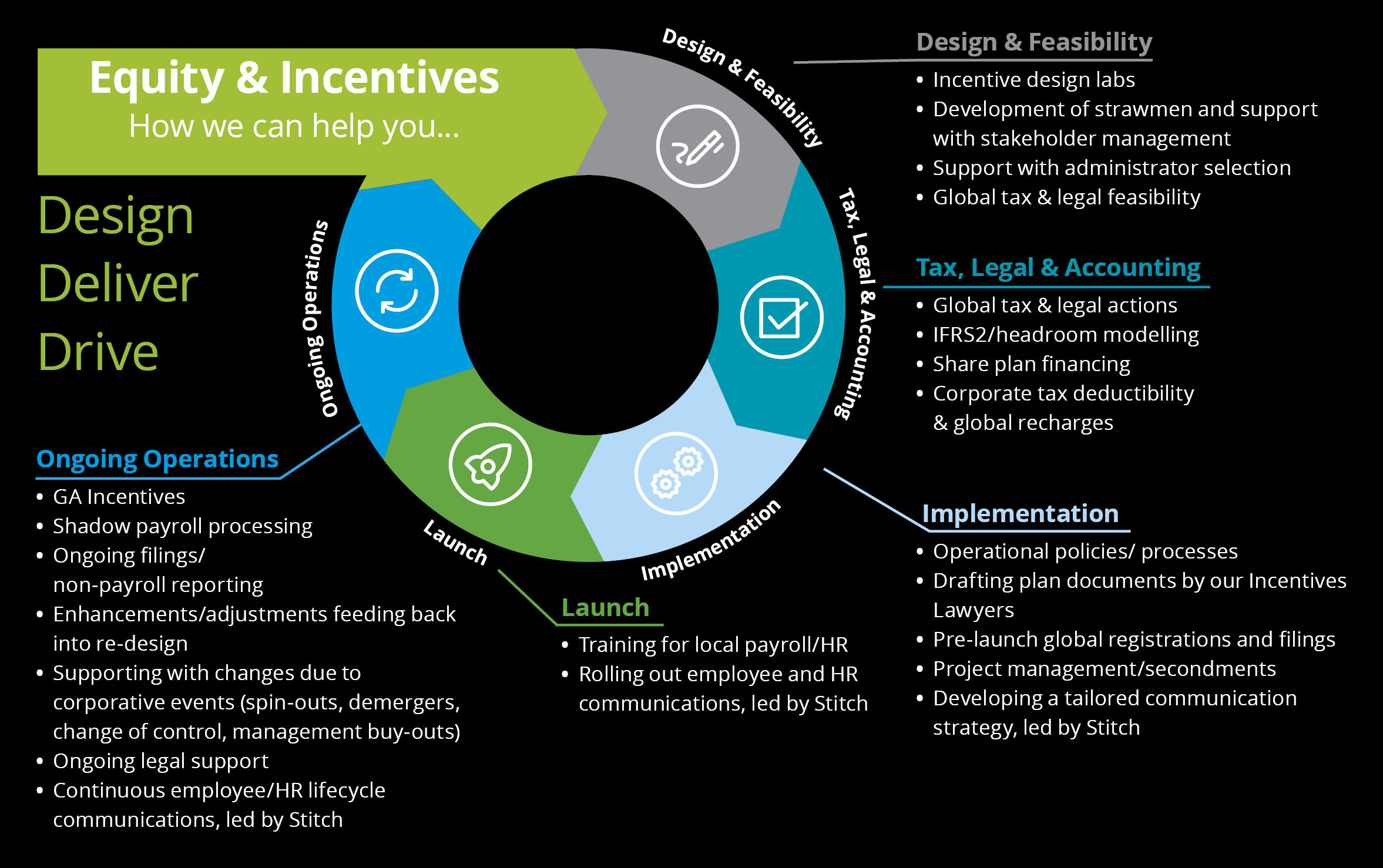

The success of a global incentive plan is rooted in the collaboration of a wide variety of stakeholders and subject matter experts. We partner with you in a flexible way to design, implement, communicate and operate incentives to help you meet your business aspirations.

The global Deloitte Incentives practice is made up of over 600 market leading experts across 100 countries in the key areas of: Plan Design, Governance & Compliance, Tax, Legal & Regulatory, Operations, Communications, Accounting and Finance.

We support a spectrum of companies with matters across the incentives lifecycle: from fast growth start-ups through to large multinational companies.

A multidisciplinary approach means that we can provide the full breadth and depth of support. We can help you navigate the field of incentives - working with you from inception / plan design through to implementation and ongoing operation. This includes understanding the costs of any new arrangements, delivering the legal drafting and employee communications that bring your incentives to life. To help you manage your global risk and compliance, it also includes partnering with multiple stakeholders across your legal, HR, finance, tax and payroll teams.

Our support helps you deliver on your strategic goals.

Visit the Deloitte Global Share Plans portal.