Article

2024 banking and capital markets outlook

Banks’ strategic choices will be tested as they contend with multiple fundamental challenges to their business models. They must demonstrate conviction and agility to thrive.

Published date: 9 January 2024

Key messages

- A slowing global economy, coupled with a divergent economic landscape, will challenge the banking industry in 2024. Banks’ ability to generate income and manage costs will be tested in new ways.

- Multiple disruptive forces are reshaping the foundational architecture of the banking and capital markets industry. Higher interest rates, reduced money supply, more assertive regulations, climate change, and geopolitical tensions are key drivers behind this transformation.

- The exponential pace of new technologies, and the confluence of multiple trends, are influencing how banks operate and serve customer needs. The impact of generative AI, industry convergence, embedded finance, open data, digitization of money, decarbonization, digital identity, and fraud will grow in 2024.

- Banks, in general, are on sound footing, but revenue models will be tested. Organic growth will be modest, forcing institutions to pursue new sources of value in a capital-scarce environment.

- Investment banking and sales and trading businesses will need to adapt to new competitive dynamics. Forces like the growth of private capital will challenge this sector to offer more value to both corporate and buy-side clients.

- Early 2023 shocks to global banking have galvanized the industry to reassess their strategies. While bank leaders focus on proposed regulatory changes to capital, liquidity, and risk management for U.S. banks, there is much to be done to evolve business models.

Priorities for strategic planning

Retail banking |

|

Consumer payments |

|

Wealth management |

|

Corporate and transaction banking |

|

Investment banking and capital markets |

|

Market Infrastructure |

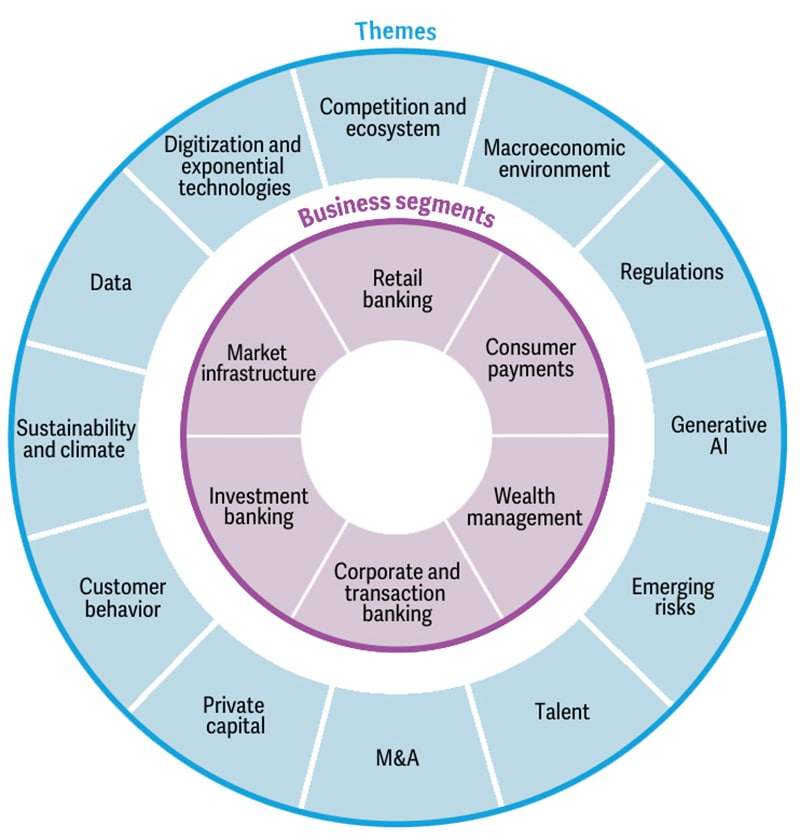

Themes highlighted in Deloitte’s 2024 banking and capital markets outlook

Recommendations

2024 investment management outlook

Winning in tomorrow’s world with the lessons of today