News

Deloitte x SAS Insurance Forum on Hong Kong Risk-Based Capital

Successfully held on 24 October at Deloitte Digital Studio in Hong Kong

Published date: 25 October 2023

|

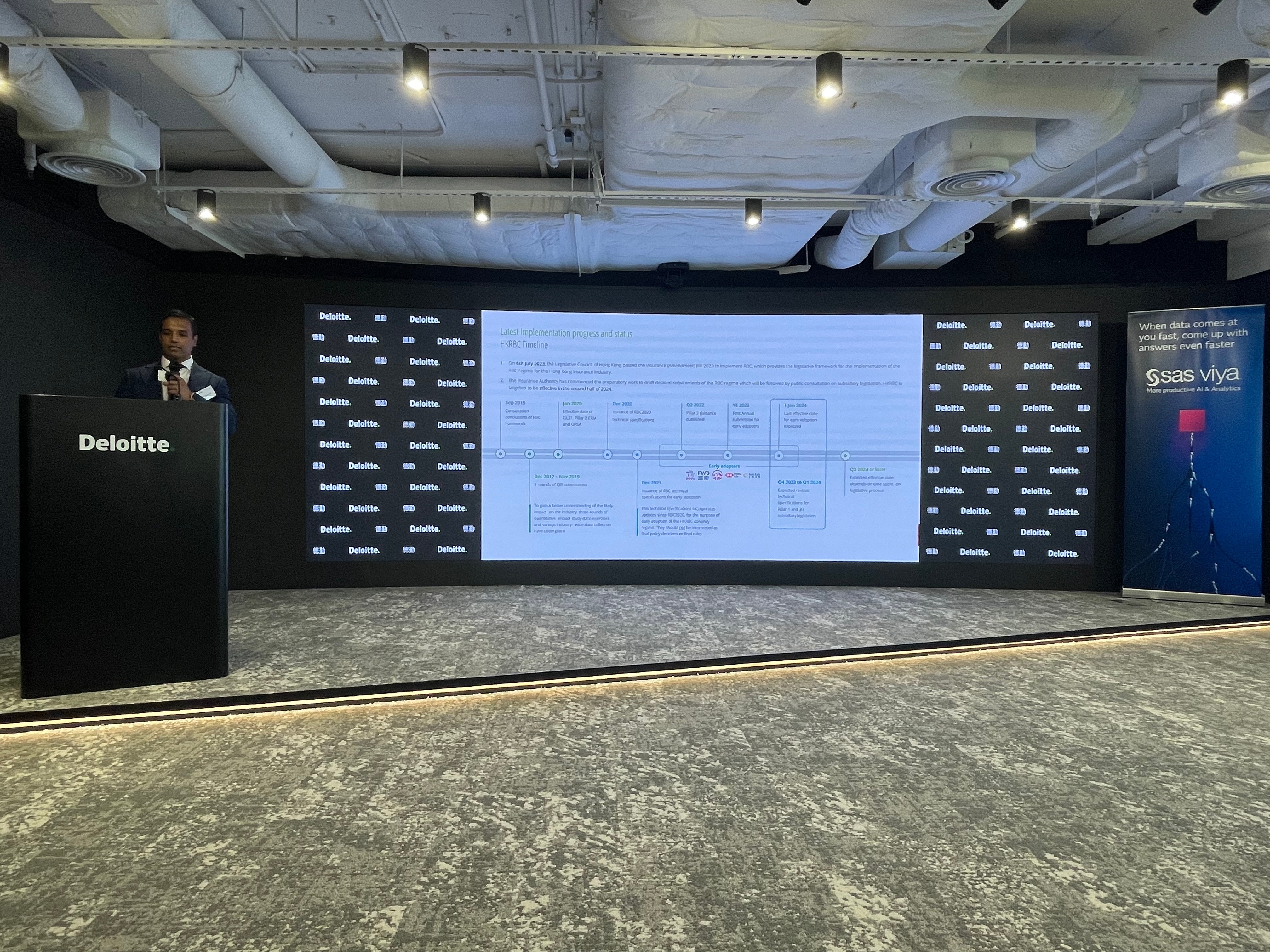

Hong Kong Risk-Based Capital or HKRBC, the new regulatory capital framework for the insurance industry in Hong Kong, is targeted to be effective in the second half of 2024.

Co-organized by Deloitte and SAS, the Insurance Forum on Hong Kong Risk-Based Capital ("The Forum") was successfully held on 24 October2023 (Tuesday) at Deloitte Digital Studio. The Forum provided a unique opportunity for insurance companies to keep abreast of latest developments and insights of HKRBC.

At the Forum, Deloitte presented our latest thought leadership titled HKRBC Implementation Guide which provides Deloitte’s insights on the HKRBC regime developments, the major HKRBC implementation challenges and solutions, and zoomed in on how insurers can materialize the business benefits of HKRBC beyond regulatory compliance through operationalization strategies.

Dhiran Dookhi, Actuarial Partner, Deloitte China

The Forum comprises of a mix of thought leadership sharing and panel discussions to cover various hot topics from actuarial, finance, technology, operations and tax.

During the Fireside Chat: The imminent coming of risk-based capital for insurance, Deloitte and SAS speakers stated that, different insurance companies are on different stages of preparing for HKRBC requirements. Technology can assist them in preparing for HKRBC requirements and help address the challenges in implementing the HKRBC requirements. As IFRS 17 and upcoming HKRBC requirements become effective, there will be short term and long term impacts to insurance companies, as well as potential benefits. Insurance companies can leverage on technology to minimise the hassles and maximise the benefits.

Jeffrey Li, Principal Industry Consultant, Risk and Finance Advisory, SAS Asia Pacific; and Alice So, Strategic Accounting Solutions Director, Deloitte China

Jeffrey Li, Principal Industry Consultant, Risk and Finance Advisory, SAS Asia Pacific; and Alice So, Strategic Accounting Solutions Director, Deloitte China

At the Panel Discussion: Experience Sharing on HKRBC Operationalisation, the panelists discussed common challenges in HKRBC operationalisation, the various dimensions people should consider and decide to implement HKRBC for their own company and how system and technology will play a key role.

From left to right: Jonathan Culver, Tax Partner, Deloitte China, Kenneth Yu, Deloitte Consulting Partner, Jeffrey Li, Principal Industry Consultant, Risk and Finance Advisory, SAS Asia Pacific, Mike Wong, Senior Actuarial Director, Prudential Hong Kong, Fei Xie, Deloitte Consulting Director

At the closing remarks by Dhiran Dookhi, he said, “While the industry and IA are in the final lap of preparing for RBC, there are key remaining items we need to work through before RBC can be implemented. However, the journey does not stop with implementation and there is so much more required around operationalizing RBC including leveraging the power of technology to materialize the business benefits and be competitive in this very challenging market environment.”